Financial

Report

FISCAL YEAR 2022

Message from the President

I am pleased to submit Harvard University’s nancial

results for scal year 2022.

Guided by health and safety protocols, our community

saw the safe return of students, faculty, and sta to

campus last year. Emerging variants and subvariants

were navigated with discipline and prudence, and

improved health conditions allowed us to ease

restrictions and increase our on-campus activities in

the latter half of the spring semester. In May, we held

our usual Commencement for the Class of 2022 and,

two days later, welcomed back to campus the Classes

of 2020 and 2021 for a long-awaited celebration. The

preponderance of joy and excitement at these events

was a spectacular armation of our community’s

enduring strength and spirit.

Across Harvard, faculty, students, and sta continue

to advance scholarship and teaching on the world’s

most signicant challenges. This fall ushers in the

launch of two groundbreaking research entities:

the Salata Institute for Climate and Sustainability

and the Kempner Institute for the Study of Natural

and Articial Intelligence. Building on the report

and recommendations released in the spring, the

Presidential Initiative on Harvard and the Legacy of

Slavery has begun its implementation work supported

by a $100 million commitment by the University,

most of it endowed. We are making further progress

in Allston with the approval for the rst phase of the

University’s Enterprise Research Campus (ERC),

which will serve as an inclusive center for invention,

collaboration, and entrepreneurship, as well as with

the creation of additional aordable housing and the

new home of the American Repertory Theater. These

next steps will bring together partners from Greater

Boston and beyond, expanding our community to

increase vibrancy along and around Western Avenue.

As we grow opportunities, we work to ensure that

those opportunities are within reach for talented

individuals regardless of their circumstances. We are

deeply grateful to our alums and donors—past and

present—whose contributions are improving access

to Harvard. Their support has enabled us to expand

the Harvard Financial Aid Initiative (HFAI) for low-

and middle-income families. Starting with the class

of 2026, the cost to attend Harvard College is free

for families with annual incomes below $75,000,

an increase from the $65,000 annual income

threshold in previous years. Making it possible for

more people to realize their potential is an act of

outstandinggenerosity.

Though we nd ourselves in a better public

health situation today, there remains instability

in the global economy and markets, which will

continue to inuence the University’s nancial

resources. Fortunately, prudent planning and sound

management have put us in a strong nancial position

that, along with the generous support of alums

and friends, enables us to fulll our mission. It is

impossible to anticipate the challenges the University

will face in the future, but I know our community

is prepared to embrace opportunities that move

Harvard—and the world—forward.

Lawrence S. Bacow

October 2022

HARVARD UNIVERSITY

MESSAGE FROM THE PRESIDENT

Financial Overview

From the Vice President for Finance and the Treasurer

Harvard’s operations were reinvigorated in scal year

20

22 with both revenues and expenses exceeding,

for the rst time, pre-pandemic levels. This occurred

amidst steeply rising ination, changes in how and

where work is accomplished, volatility in the capital

markets and economic uncertainty—all which

demand vigilance and innovative, future-oriented

shifts in the way the University operates. Over the past

year, rather than returning to “business as usual,”

leaders across Harvard have been focused on how we

can incorporate the collective learnings from the past

two and half years with respect to digital pedagogy,

student access, dynamic approaches to work, the use

of space and travel, and research aimed at solving the

world’schallenges.

We want to thank Harvard’s faculty and sta for

enabling outstanding teaching that benets our

students and ground-breaking research that benets

the world. We also want to thank all members of

the Harvard community for carefully managing our

nancial resources as we strive to steward every dollar

in support of the mission of the University.

Revenues this past year rebounded with an 11%

increase to $5.8 billion, following two years of

sequential declines with fewer students on campus

during the pandemic. The revenue increases this

past year reect a return of students to campus with

resulting increases in tuition, room and board, and

other related service revenues, such as parking,

rent and health fees. Harvard had more students on

campus this past year than at any point in its history

as the number of entering rst-year students returned

to normal levels, and the number of returning

students was boosted by those who took deferrals

during thepandemic.

As the University’s single largest contributor to

r

evenue, 45% of this year’s income arose from

philanthropy—9% from current use gifts, which have

an immediate impact on operations, and 36% from the

ongoing support of distributions from the endowment.

We want to thank all the alumni and donors who gave

to the University—past and present—as Harvard’s

excellence in teaching, scholarship, research, and

generous nancial aid is made possible through

philanthropy. We are deeply appreciative of this

extraordinarysupport.

Expenses rebounded as well with a 9% increase,

although rising less than revenues due to

comparatively high vacancy rates in stang as well

as sourcing challenges with goods and services.

The diculty in hiring people and underlying

supply-chain issues were common problems across

the country this past year. The combination of the

temporary boost in revenues along with temporarily

suppressed spending drove a signicant portion of the

$406 million surplus. Peer universities experienced

this same phenomenon.

A surplus at Harvard is a consolidation of the

u

nderlying results of each of the schools and units

within the University. Surpluses, and for that matter,

losses, are earned and controlled locally at Harvard,

and it is our schools and units who decide how to

allocate any surplus funds either by reinvesting into

their respective missions, or setting aside funds for

rainy day reserves or future programmatic expansion.

Harvard is actively investing across the campus—

please see a few examples in priority areas including

education, nancial aid, student accessibility,

research, and climate sustainability detailed later

in this report. Building reserves is also wise at this

time as ination increases our operating and capital

costs, and recession fears mount. Recessions put

pressure on all sources of revenues and rapidly aect

donations and research grants, as well as the need for

increased nancial aid. Remaining adroit and attentive

is essential as history shows that planning ahead,

including building reserves, can help buer negative

impacts during times of economicadversity.

HARVARD UNIVERSITY

FINANCIAL OVERVIEW

The endowment experienced a negative return of

1.8% for the year. This is a very good result given

the signicant declines in both the equity and bond

markets in the past year. We wrote a year ago that

“history teaches that capital markets give and take

away,” so we remain cautious in our administration

of the endowment as we endeavor to spend as much

as possible from the endowment annually to support

current academic and research activities, while

keeping an eye on the intent of our alumni and

donors to utilize their endowed gifts as an ongoing

source of income, often with specic restrictions, for

generations of future students. The positive impact of

a 34% return a year ago has been muted by this year’s

market reversals, but Harvard Management Company

(HMC) continues to wisely manage the endowment

so that it can best provide steady and increasing

distributions to the University’s budget into the future.

We thank Narv Narvekar and his HMC colleagues for

their excellent stewardship, and encourage you to read

Narv’s letter on page 13 of the annual report.

Amidst these challenges, the University’s overall

nancial condition remains very strong with ample

levels of liquidity, comparatively low levels of debt,

and ready access to borrowings as needed. This past

spring, as the window was closing on many years of a

low interest rate environment, we issued $750 million

of both new taxable and tax-exempt long-term debt,

including a Green Bond issuance, reecting Harvard’s

commitment to climate sustainability. The all-in xed

interest rate on this spring’s indebtedness is lower

than similar duration US Treasury borrowing rates

are today, and reduces our overall cost of the total debt

portfolio to just below 4%.

As we emerge from the pandemic that left our campus

empty for so long, we recognize that—incredibly and

admirably—it did not impede our community from

carrying on in the fulllment of the University’s

mission. Instead, the experience has unleashed

new energy, new approaches, and new paths to

help chart the roadmap to Harvard’s future. With a

strong nancial foundation and agile planning, the

University is well positioned to manage through both

future opportunities and challenges.

Thomas J. Hollister

Paul J. Finnegan

October 2022

HARVARD UNIVERSITY

FINANCIAL OVERVIEW

The University ended scal year 2022 with an

operating surplus of $406 million compared to

$283million in scal year 2021. The result marks the

rst time that revenue and expenses have exceeded

pre-pandemic levels. While on-campus activities

and programming revitalized revenue with more

students enrolled than any year prior, expenses were

constrained by evolving pandemic restrictions, high

vacancy rates in stang, and sourcing challenges for

goods and services.

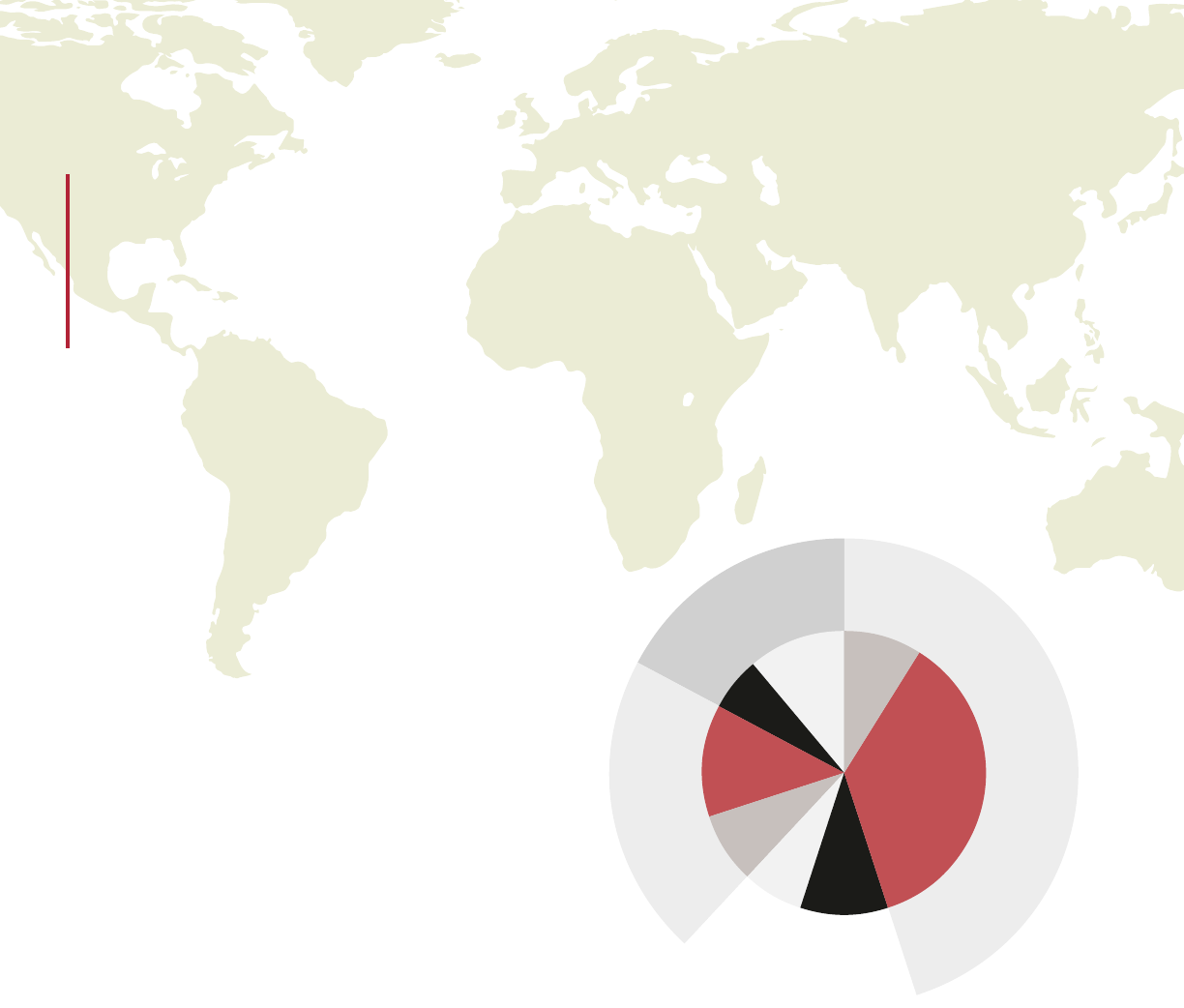

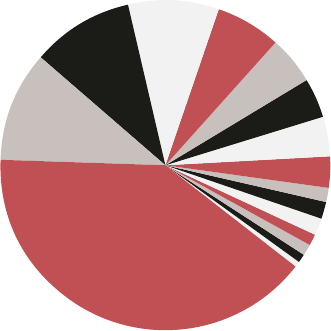

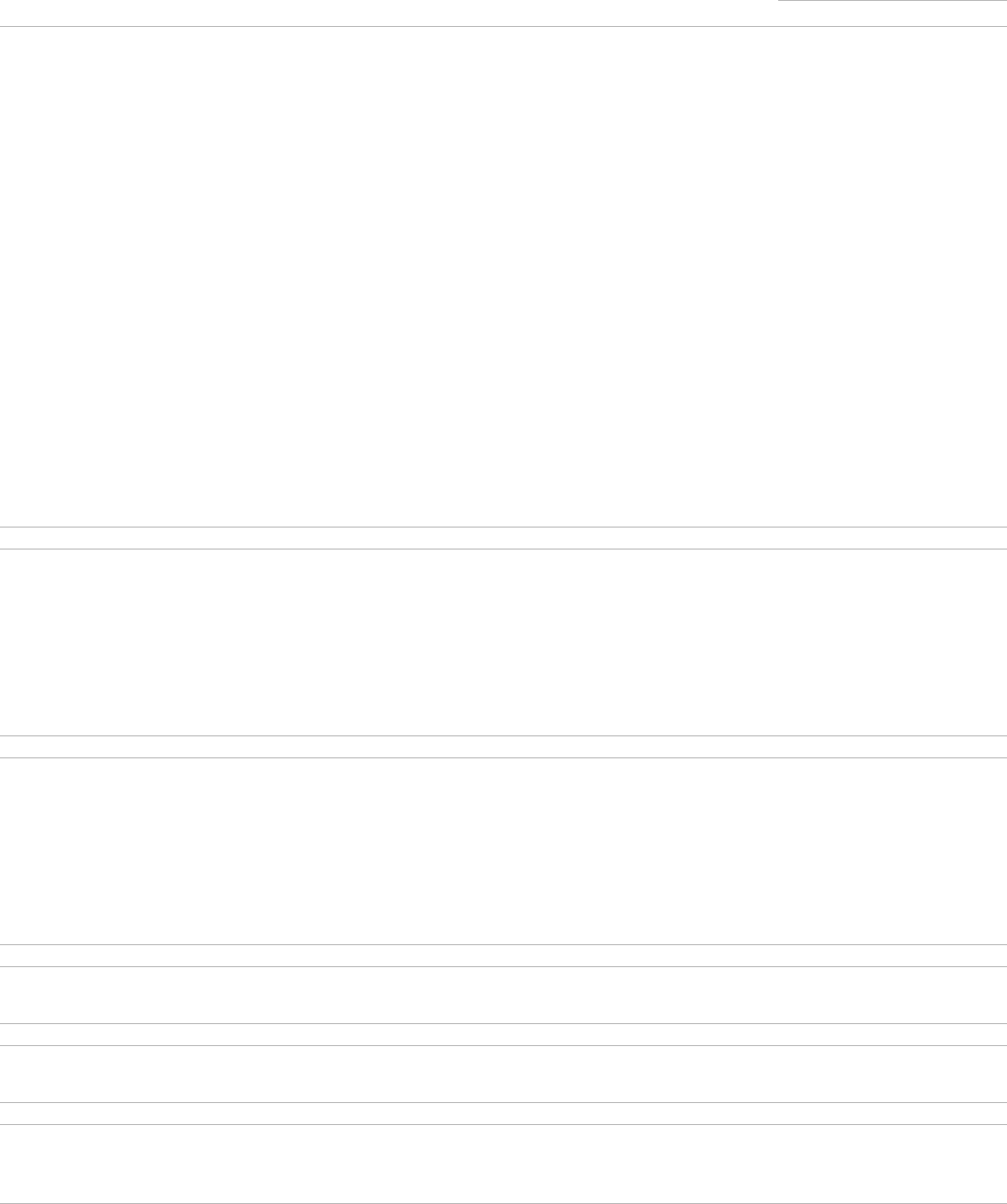

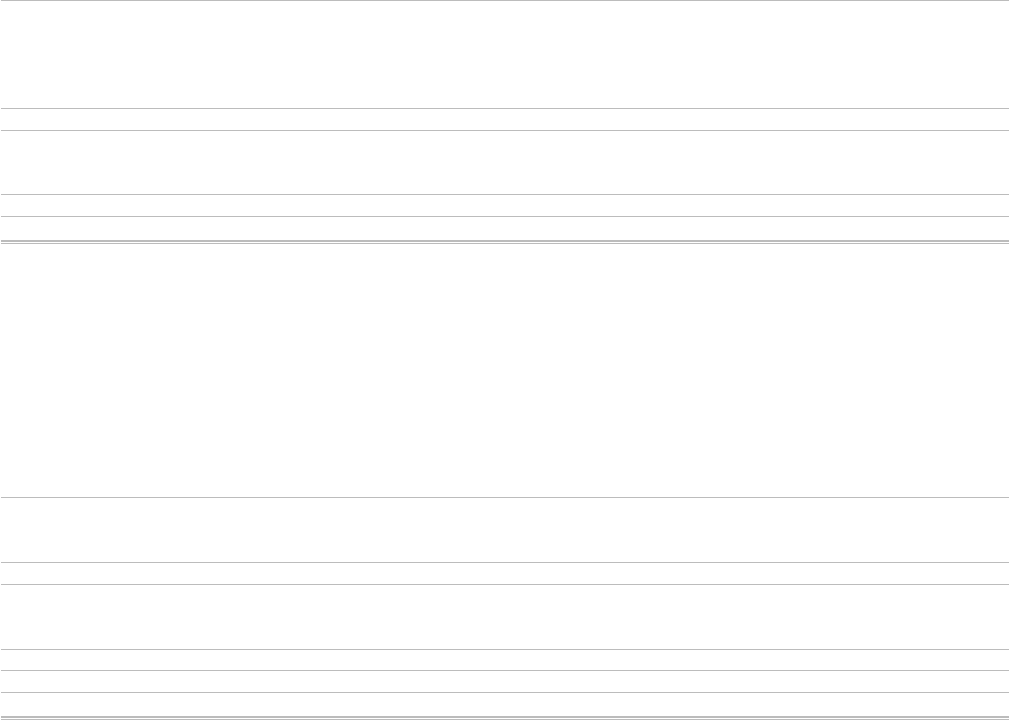

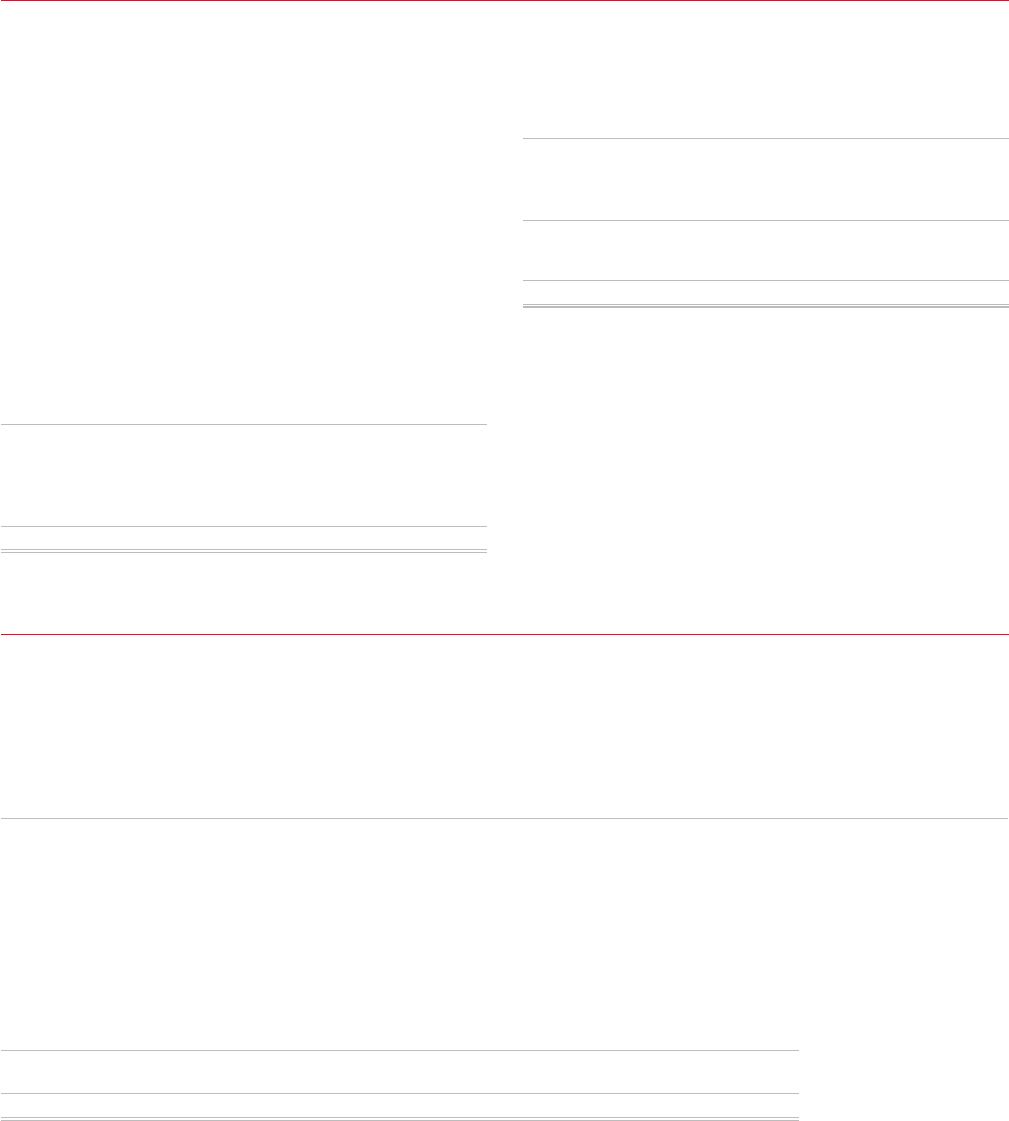

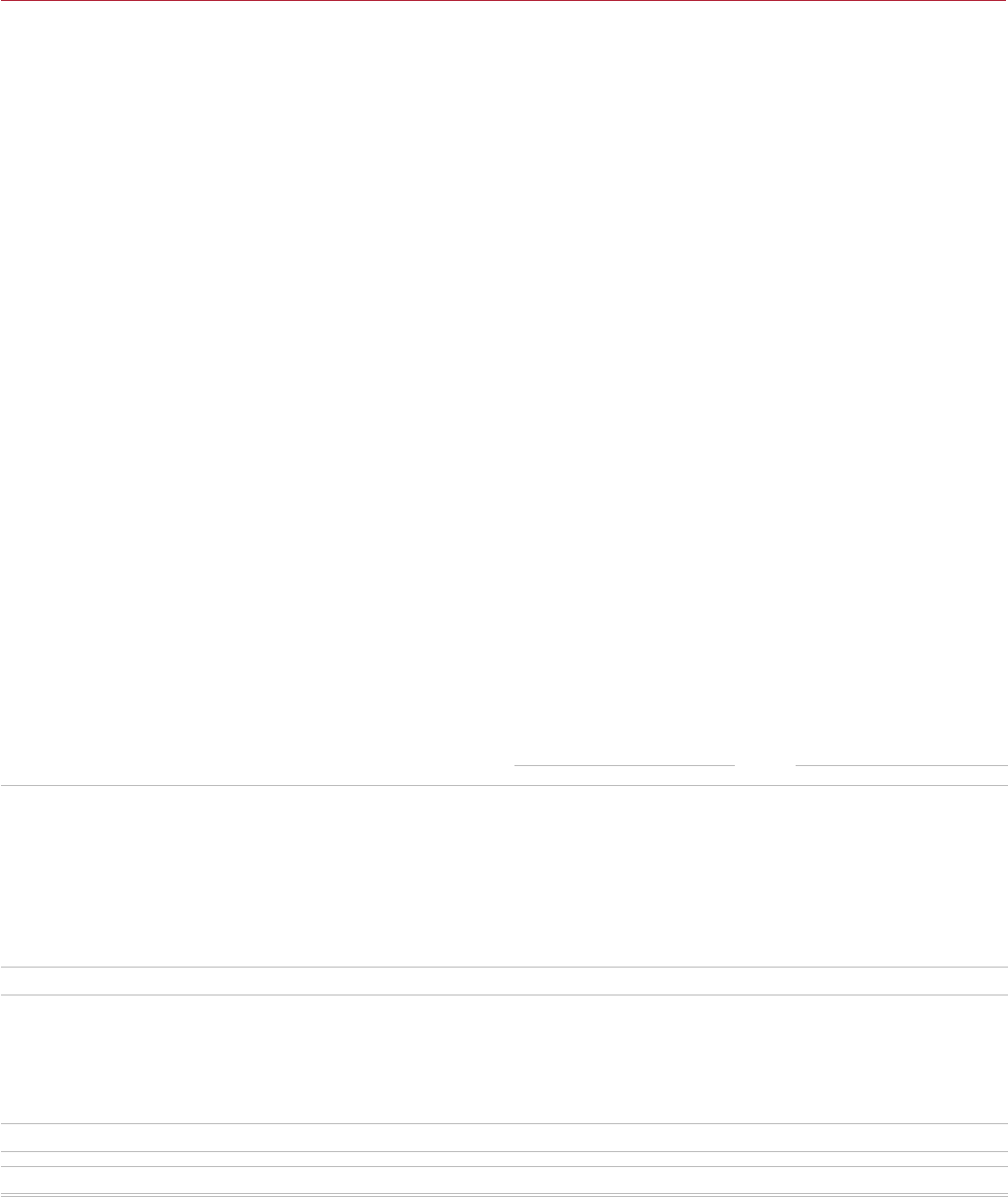

In scal year 2022, total operating revenue increased

11% or $587 million to $5.8 billion. Harvard’s

diversied revenue portfolio relies on three main

sources of revenue: education or tuition, sponsored

research, and philanthropy.

Total education revenue comprises 21% of revenue

and includes tuition and board and lodging payments

from both traditional degree seeking students

(undergraduate, graduate, and professional), as well

as executive and continuing education learners. In

support of research, our talented faculty are awarded

external grants to further global and research

priorities and this sponsored funding makes up

17% of revenue. Revenue generated each year from

our education program and research endeavors is

not sucient to fund operations and as such, the

University relies on phil anthropy to ll in the gap. In

scal year 2022, our current and previous donors

supported 45% of revenue through their generosity

and belief in the broad impact of education and

research at Harvard.

For Harvard’s many schools and units, revenue

proles vary widely, with each drawing a dierent

proportion of its budget from its endowment and

othersources.

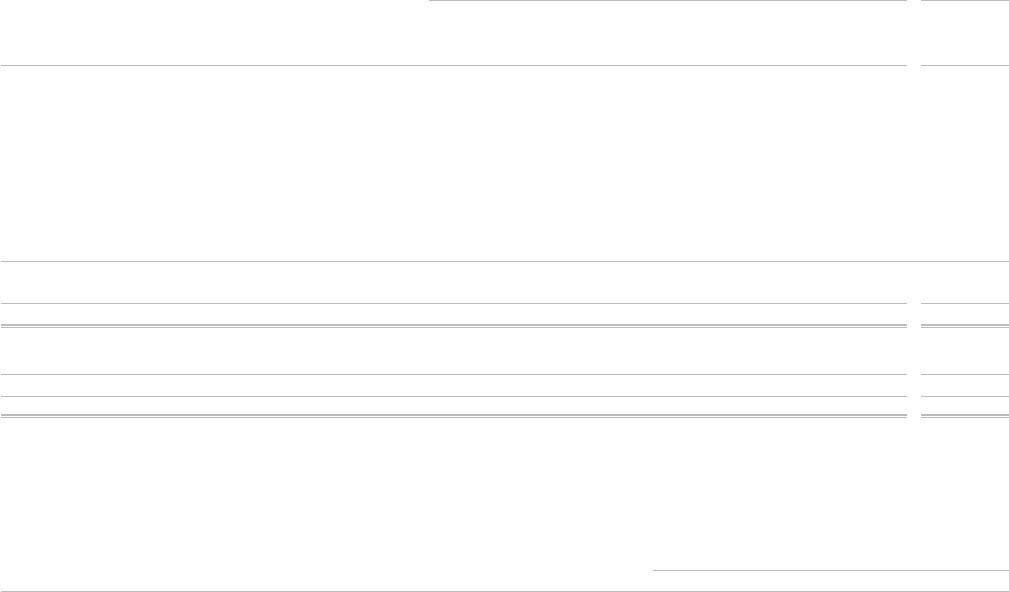

7%

10%

Other

17%

Current

Use Gifts

9%

Net

Endowment

Distribution

36%

13%

Degree

Seeking

Education

Publications

and Royalties

Services

and Other

8%

Continuing &

Executive

Education

Non-Federal

Sponsored

6%

11%

Federal

Sponsored

Education

21%

Research

17%

Philanthropy

45%

2022

Harvard University’s stewardship of its nancial resources is aimed at advancing teaching, learning, and

research priorities to make a positive impact in the world. This includes expanding access to education

across the globe, supporting students with our strong nancial aid program, fullling ourongoing

dedication to public service, and transforming how problems are understood and addressed through

research. The key nancial highlights for scal year 2022 included in this report demonstrate the

University’s continued commitment to advancing these priorities.

HARVARD UNIVERSITY

FINANCIAL OVERVIEW

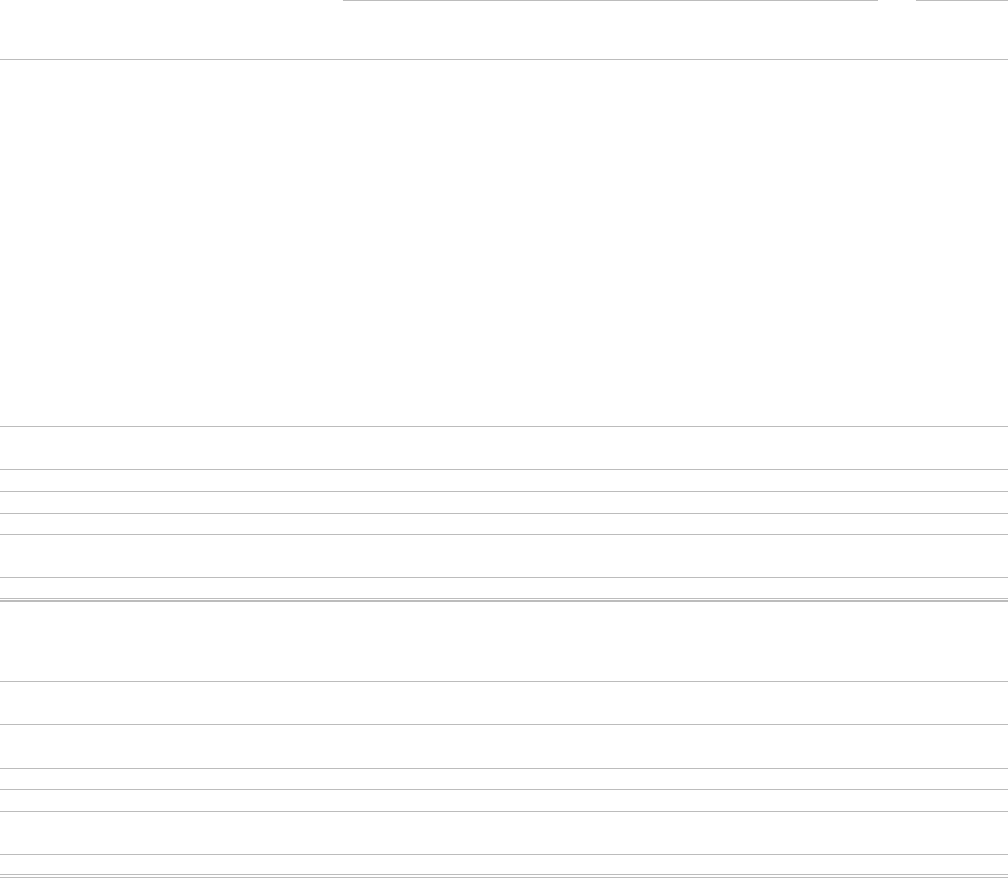

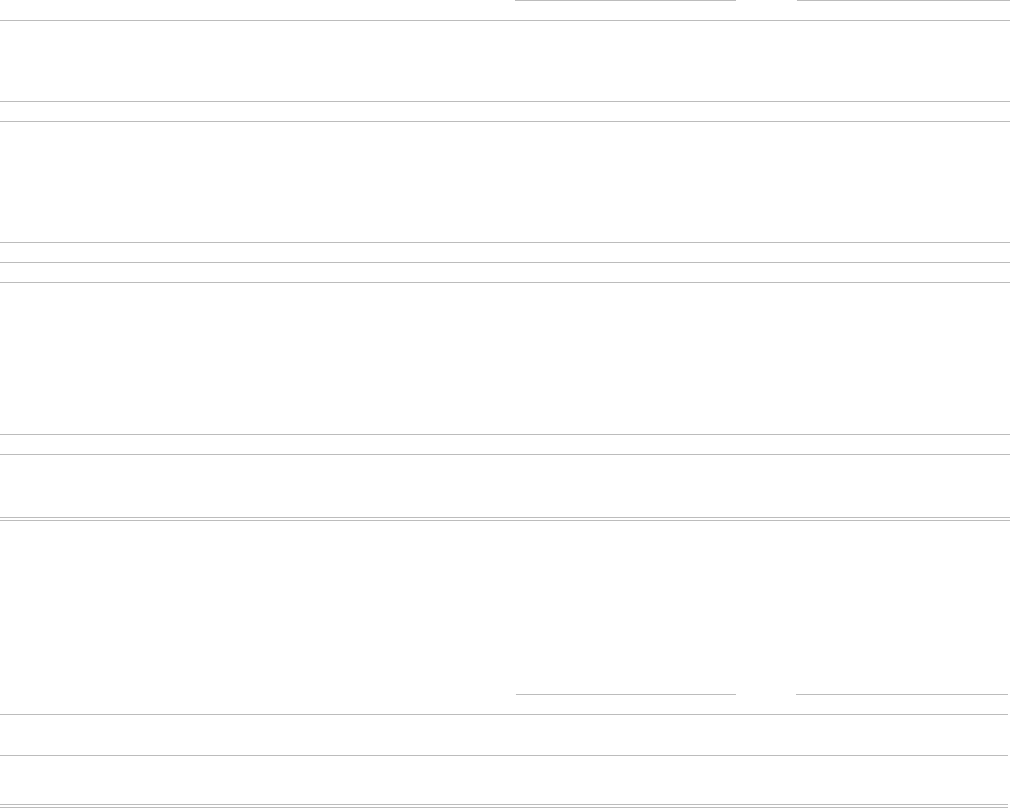

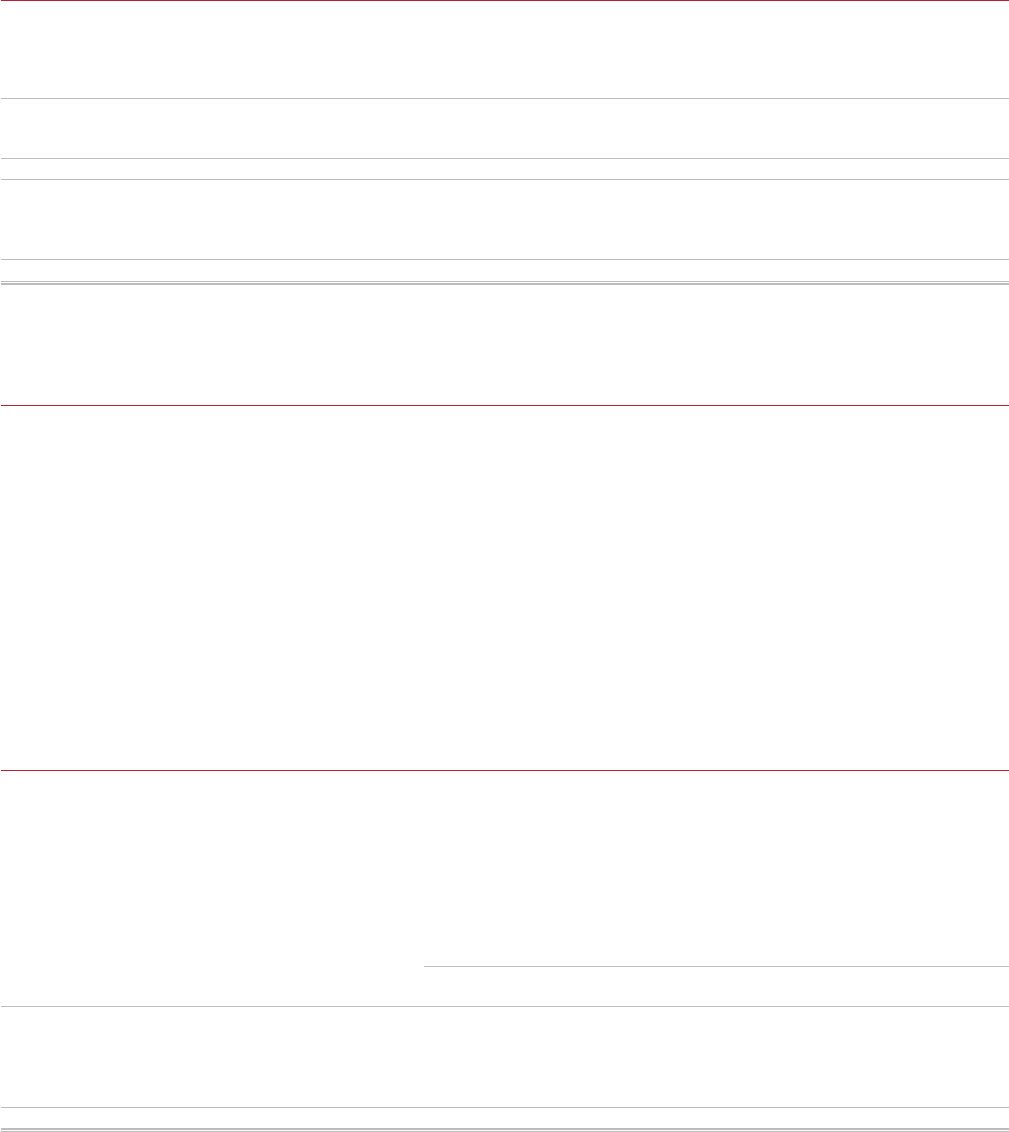

OtherGifts for current useSponsored supportEducation revenueEndowment income made available for operations/endowment distribution

Education

13%

22%

13%

21%

31%

13%

5%

44%

36%

2%

Design

Law

45%

5%

3%

10%

37%

Engineering &

Applied

Sciences

Business

39%

3%

12%

22%

24%

35%

7%

20%

38%

Dental

20%

24%

24%

30%

6%

26%

Medical

Kennedy

School

15%

13%

36%

25%

11%

4%

21%

3%

38%

34%

University

17%

17%

36%

21%

Public

Health

Divinity

Faculty

of Arts &

Sciences

3%

4%

61%

20%

12%

Radclie

12%

10%

6%

71%

1%

12%

81%

7%

9%

FISCAL YEAR 2022 SOURCES OF OPERATING REVENUE

6%

7%

13%

22%

52%

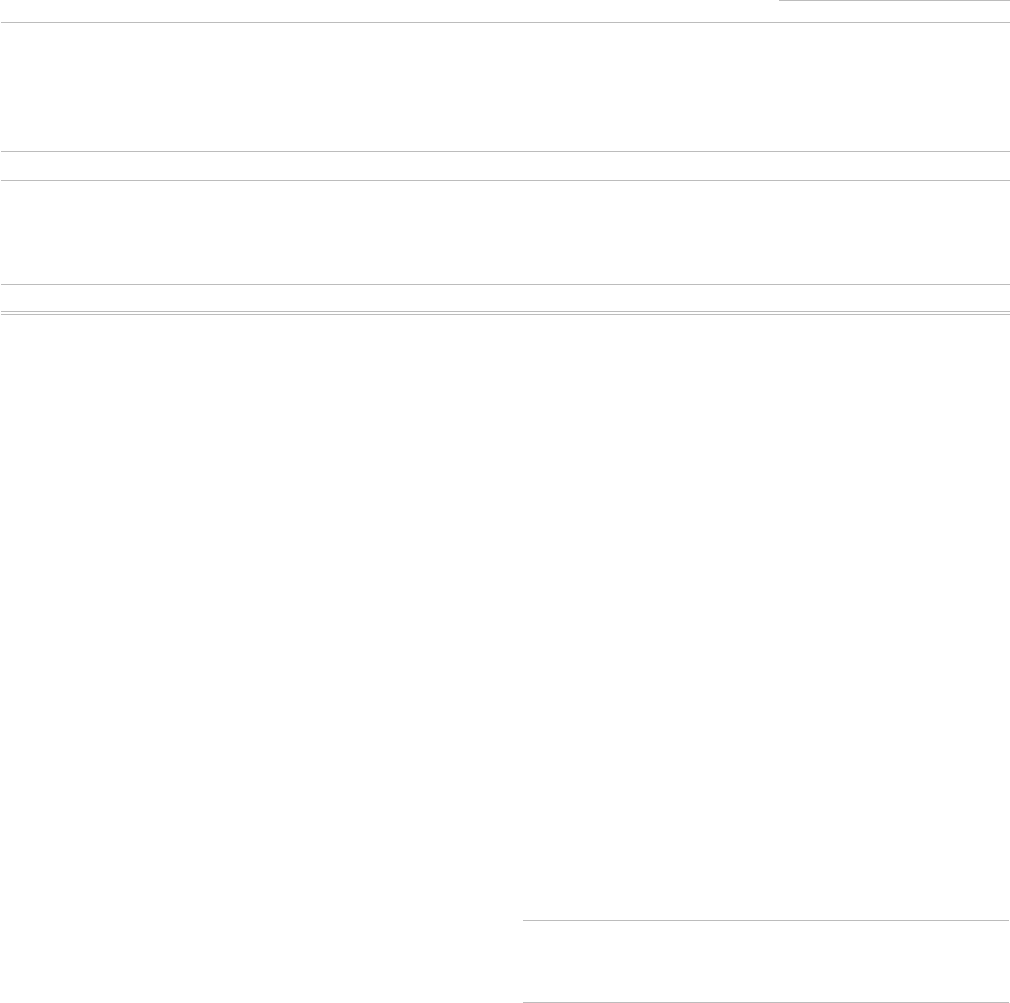

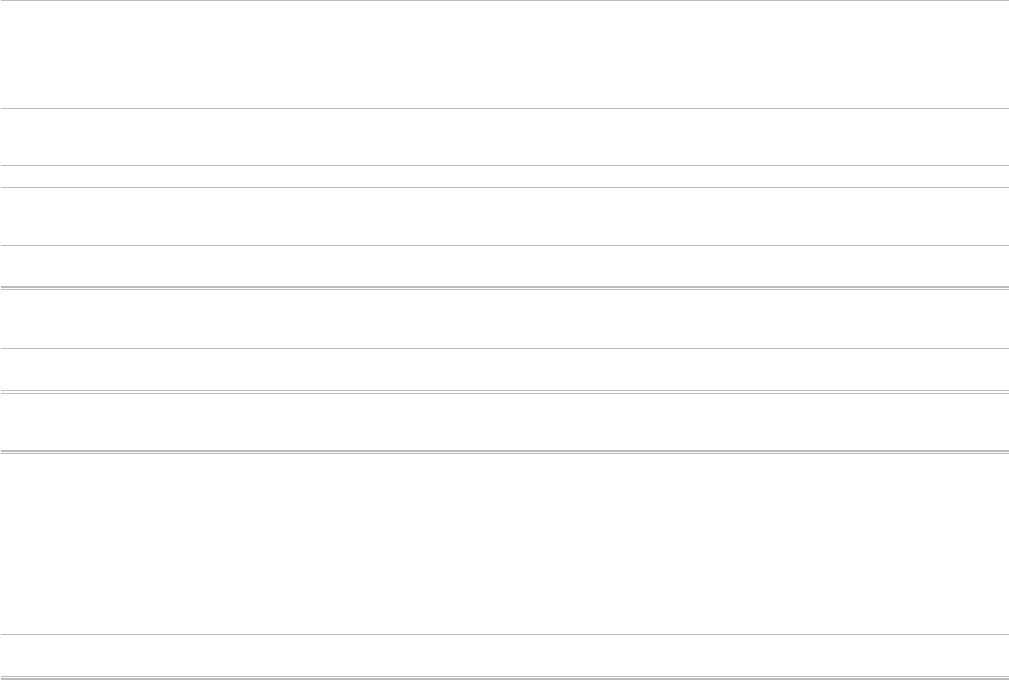

The University’s operating expenses increased by

$464 million or 9%, to $5.4 billion for scal year 2022.

While spending has rebounded in many areas across

the University, overall expense growth lagged revenue

growth due to continued pandemic and external

marketconditions.

Compensation, or people, expenses (i.e., salaries,

wages and benets) represented approximately half

of the University’s total operating expenses in scal

year 2022. Salaries and wages increased by 6%, or

$130million, to $2.2 billion, resulting from wage

increases oset by higher than average levels of

position vacancies. Employee benet expense grew at

a muted pace of 1% due to medical costs increasing at

a lower rate than before the pandemic, combined with

reductions in the long-term cost of our post-retirement

health and pension programs.

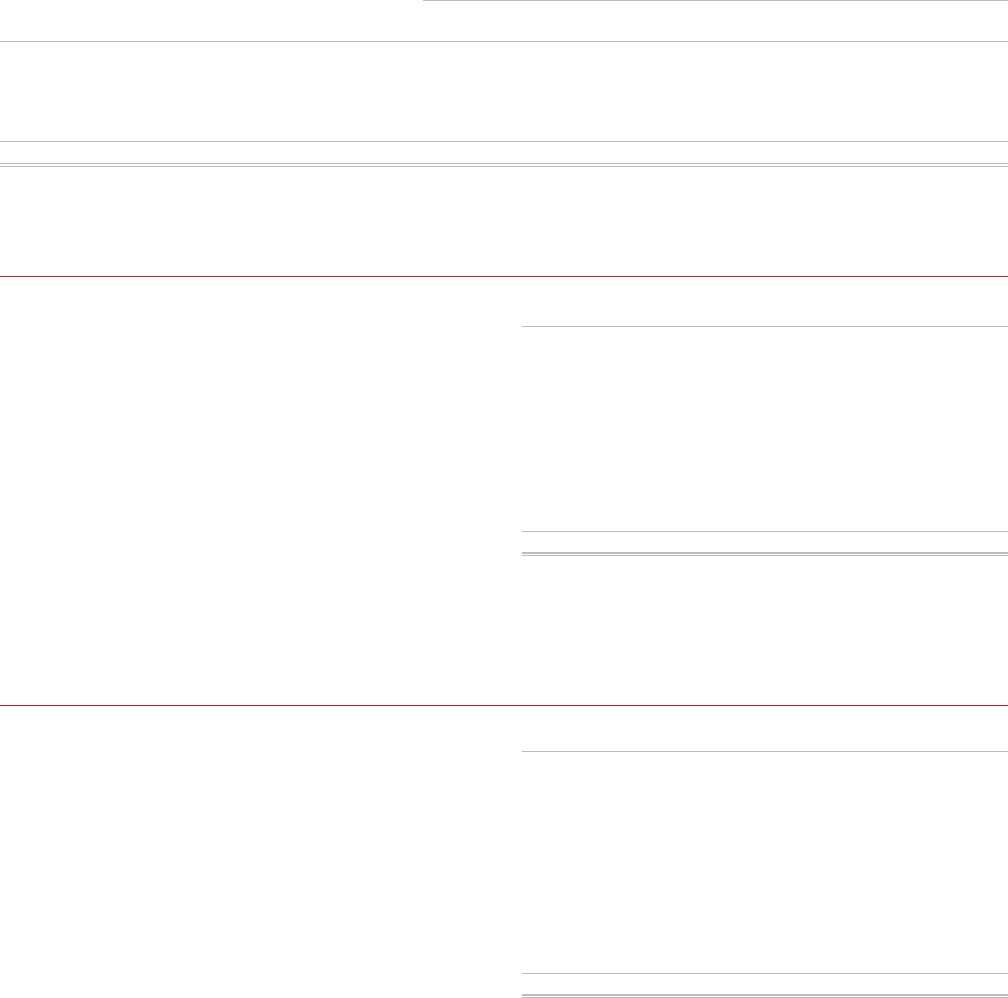

11%

12%

41%

5%

13%

7%

3%

8%

Salaries &

Wages

Benets

Depreciation

Interest

Space &

Occupancy

Space 18%

People

52%

Supplies &

Equipment

Services

Purchased

Other

2022

HARVARD UNIVERSITY

FINANCIAL OVERVIEW

While non-compensation expense began to rebound,

responsible cost management and continued

pandemic impacts to programming and purchasing

suppressed this growth, keeping some expenses

below pre-pandemic levels. Costs for space and

occupancy, travel, and supplies and equipment were

equal to or below pre-pandemic levels. COVID-related

expenditures were down from $83million in scal

year 2021 to $53million in scal year 2022.

Investments and endowment

In scal year 2022, the return on investments

was -1.8% and its value (after the net impact of

distributions from the endowment for operations, and

the addition of new gifts to the endowment during the

year) decreased from $53.2 billion at the end of scal

year 2021 to $50.9 billion at the end of scal year 2022.

More information can be found in the Message from

the CEO of Harvard Management Company, found

later in this report.

The University has a policy of maintaining liquidity

outside of the General Investment Account (GIA).

These liquid, short-term investments totaled

$2.2billion at June 30, 2022 compared to $1.5billion

at June 30, 2021 (see Note 2), well above our minimum

policy requirement.

Debt

Bonds and notes payable increased from $5.5 billion at

June 30, 2021 to $6.1 billion at June 30, 2022, driven

by a $750 million bond issuance during the scal

year, consisting of $500 million of taxable bonds

and $250 million of tax-exempt Green Bonds. The

tax-exempt borrowing marked the rst time the

University issued bonds with a Green designation,

reecting the University’s long-standing sustainable

building principles in alignment with the Climate

Bond Initiative. The University maintained its AAA

rating by S&P Global Ratings and Aaa by Moody’s

InvestorServices.

Fixed assets

The University resumed capital projects that had

been curtailed as a result of the COVID-19 pandemic

however, though supply chain and construction labor

shortages have continued to delay schedules and

spending. The University invested $356 million in

capital for scal 2022 compared to $410million in

scal year 2021. The current challenges facing the

construction industry are expected to continue into

scalyear 2023.

Signicant progress was made on major projects

including the completion of Swartz Hall, a donor

funded renewal of Harvard Divinity School’s main

campus building which utilized the University’s

Healthier Building Materials Academy to build a new

multifaith space and modernized classrooms to help

facilitate a sense of community as students return

to campus. In addition, the Reginald F. Lewis Law

Center, a newly renovated space, will serve as a living

laboratory for world-class research, learning, and

innovation, opened its doors on Harvard Law School’s

campus in January 2022.

HARVARD UNIVERSITY

FINANCIAL OVERVIEW

The challenge of climate change demands a bold

response and clear action from organizations and

individuals. Harvard is committed to transitioning

away from fossil fuel use by accelerating solutions that

enhance public health and equity, improve building

eciency, and promote new renewable energy. Our

entire community of students, faculty, and sta are

taking critical action on climate change by advancing

cutting-edge research and translating research into

action on campus.

Fossil Fuel-Free by 2050 and Fossil Fuel-Neutral

by2026

Harvard was one of the rst organizations to

announce in February 2018 a goal to eliminate the

useof all fossil fuels to heat, cool, and power buildings

and vehicles on our campus by 2050 along with a

short-term goal to be fossil fuel-neutral by 2026 as

a bridging strategy. The University’s climate action

plan, including its roadmap to achieve the interim

2026 goal, uniquely addresses both greenhouse

gas emissions (GHG) and health impacts from air

pollution caused by fossil fuels.

Endowment Net Zero by 2050

Harvard has pledged to make its endowment net zero

of greenhouse gases by 2050. This commitment was

a rst among university endowments and adheres to

the timeline set by the Paris Agreement. In scal year

2022, Harvard Management Company’s operations

became carbon neutral.

In spring 2022, Harvard issued $250 million

of greenbonds to fund sustainable capital

projects, including the recently constructed

Science and Engineering Complex, renewal of

Adams House, and renovation of the Soldiers

Field Park housing complex.

More than 30 percent of Harvard’s bus eet

is now electric after the University purchased

four 100 percent electric buses and electric

infrastructure to replace four, similarly sized

bio-diesel powered vehicles. The transition to

electric power is expected to lower greenhouse

gas emissions by more than 220,000 pounds

annually while reducing air and noise pollution.

The new groundbreaking Salata Institute

for Climate and Sustainability, launched in

fall 2022, will advance and catalyze research

programs across all of Harvard’s Schools

and enable comprehensive cross-University

education in climate and the environment.

Theinstitute is made possible by a $200 million

gift to Harvard from Melanie and Jean Salata.

The Science and Engineering Complex(SEC)

opened in fall 2020 and is home to the Harvard

John A. Paulson School of Engineering and

Applied Sciences (SEAS). The 544,000-square-

foot building is certied Leadership in Energy

and Environmental Design (LEED) Platinum

and is the largest building and rst research

laboratory globally to receive Living Building

Challenge Materials, Equity, and Beauty

Petalcertication.

James H. Stock, the Harold Hitchings

Burbank Professor of Political Economy with

the Faculty of Arts and Sciences and member

of the faculty at Harvard Kennedy School, was

named the inaugural Vice Provost for Climate

and Sustainability in fall 2021 to advance

the University’s climate research and its

globalimpact.

The 2022 Climate Change Solutions Fund

awarded $1.3 million in research grants

to Harvard faculty and students who are

advancing solutions to reduce the risks of

climate change, diminish its impacts on the

environment, and hasten innovation that will

support cleaner energy and a greenerworld.

PHOTO: BRAD FEINKNOPF

HARVARD UNIVERSITY

FINANCIAL OVERVIEW

In scal year 2022, across its 12 schools, Harvard

enrolled 25,110 students from around the globe,

including 7,095 at Harvard College.

Total education revenue

Student income increased $335 million or 38%

to $1.2billion in scal year 2022. Revenue from

traditional student programs (undergraduate and

graduate) grew by $113 million or 26% as students

returned to campus for the 2021-2022 school

year after taking advantage of prior year deferral

policies, allowing them to pause their course of

study during the pandemic. Board and lodging

revenue of $200 million grew 187% as students

fully returned to campus for the academic year.

Financial aid applied to student income increased

$70 million or 16% to $506 million in scal year

2022. Net executive and continuing education totaled

$469million, rebounding $91 million or 24% after

the substantial impact of the COVID-19 pandemic on

the prior two years with program cancellations and

enrollmentdeclines.

Undergraduate and graduate programs and

nancialaid

Harvard is committed to cultivating a diverse

community of bright and talented students regardless

of their ability to pay. Thanks to our robust nancial

aid program, approximately 55% of Harvard College

students receive need-based scholarships and pay an

average of $16,100. Additionally, over 20% of these

Harvard College students pay nothing to attend.

Since launching the Harvard Financial Aid Initiative

in 2004, the College has awarded over $2.8 billion

in grant aid, and the undergraduate nancial aid

budget has nearly tripled from $80 million in 2005

to $225million in 2022. The average net cost of

attendance for all Harvard College students is $41,148.

Approximately 94% of dollars supporting student

nancial aid at Harvard come from institutional

sources, including gifts, the endowment and

unrestricted funds. The other 6% comes from

the federal government aid initiatives and other

outsidesponsors.

Expanding access

In recent years, Harvard College signicantly expanded

nancial aid, rst, by eliminating the expectation that

students contribute from their summer earnings, and

in 2022-23 by expecting a ‘$0 parent contribution’

from all families making under $75,000. In addition to

the aid described above, Harvard also provides funding

for low-income students to pay for health insurance,

emergency expenses, event fees, and other activities

in order to ensure that students can participate fully

in the Harvard experience. First-year students from

families making under $75,000 also receive a $2,000

start-up grant.

Over the past decade, the University has continuously

worked to extend a Harvard education to audiences

beyond the traditional on-campus undergraduate and

graduate student. In 2021, Harvard Online enrolled

over 7.6 million unique learners worldwide in courses

created by Harvard faculty, and nine of our twelve

schools oer professional education programs for both

individuals and organizations. These programs reach

learners in every corner of the globe, helping them

achieve their personal and professional potential.

In Fall 2021, Harvard and MIT created a new nonprot

that focuses on closing the learning and opportunity

gap for millions of learners through the development

of new educational partnerships, digital tools, and

learning strategies. The nonprot was created using

the proceeds of the sale of the online course provider

edX to U, a leader in education technology. The

new nonprot plans to devote signicant resources

to forging partnerships with institutions of higher

education, particularly community colleges and

other educational institutions that serve under-

resourced communities. It also seeks to partner with

other nonprot organizations to tackle longstanding

inequities in education, and with enterprises and

governments to address workforce reskilling needs,

while advancing learning experience platforms and

research in all theseareas.

HARVARD UNIVERSITY

FINANCIAL OVERVIEW

Harvard scholars conduct research in almost every

eld, seeking to expand human knowledge through

analysis, innovation, and insight. In 2022, research

was supported by $976 million of sponsored research

funds. In addition, the University funded $384million

in University funds, as submitted in the 2021 National

Science Foundation Higher Education and Research

Development (HERD) Survey. Research is carried out

both in the departments of the schools and at more

than 100 research centers, on campus and around

the world. Researchers include faculty members,

visiting scholars, post-doctoral fellows, and graduate

and undergraduate students, and they collaborate

with colleagues across the University, at aliated

institutions, and at other researchinstitutions.

During scal year 2022, the University saw continued

growth in research funding. In aggregate, revenue

from federal and non-federal sponsored sources

increased by $49 million or 5%. Federal funding,

which accounted for approximately 66% of total

sponsored revenue in scal year 2022, increased

$17 million or 3% to $642 million. The University’s

relationships with corporations, foundations and

other non-federal sponsors expanded in scal year

2022, resulting in a $32 million or 11% increase

in non-federal sponsored revenues, which totaled

$334million. Nonfederal funding continues to be an

area of growth, as researchers diversify their research

funding support. In addition, Harvard devotes

signicant institutional resources to leverage these

federal and non-federal investments. This funding

is crucial to support the initial development or early-

stage research which enables the researchers to

develop an idea to a state in which it can be presented

to sponsors for additional funding, as well as other

uses including seed funding large new initiatives,

subsidizing projects with external funding, and

supporting faculty to venture into new areas of

scientic inquiry.

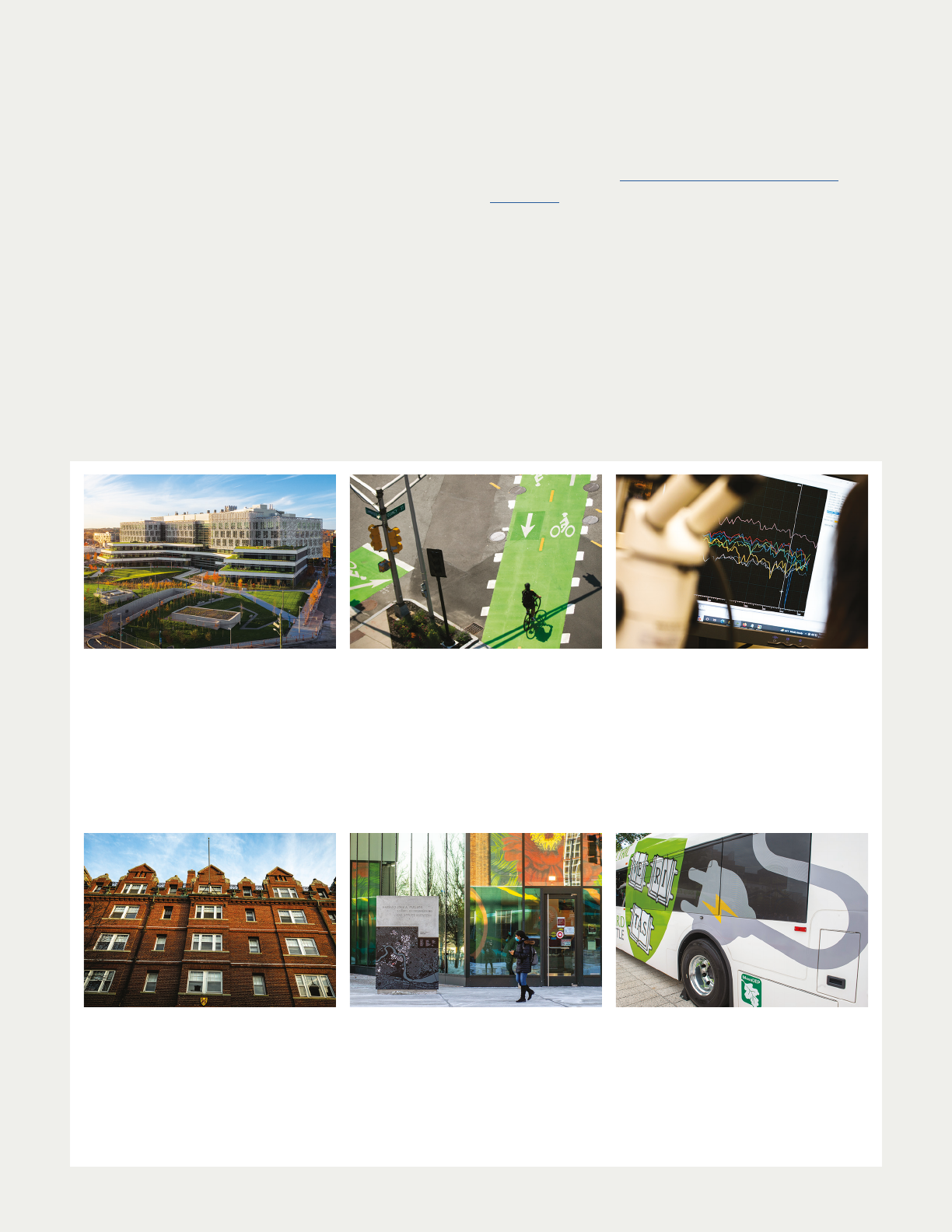

DEPLOYING ARTIFICIAL INTELLIGENCE

AGAINST CANCER

Gastroenterologists at Harvard Medical School and

Beth Israel Deaconess Medical Center used an AI-based

computer-vision algorithm to backstop physicians looking

at colonoscopy scans and found they lessened the chance

a doctor would miss a potentially cancerous polyp by

30 percent. Across the University, researchers, faculty,

and students are working to improve algorithms, boost

computing power, and push the boundaries of what AI can

do. The newly launched Kempner Institute for the Study

of Natural and Articial Intelligence is one University-

wide initiative in this space, bringing together the elds of

neuroscience and AI to enhance our understanding of how

humans think.

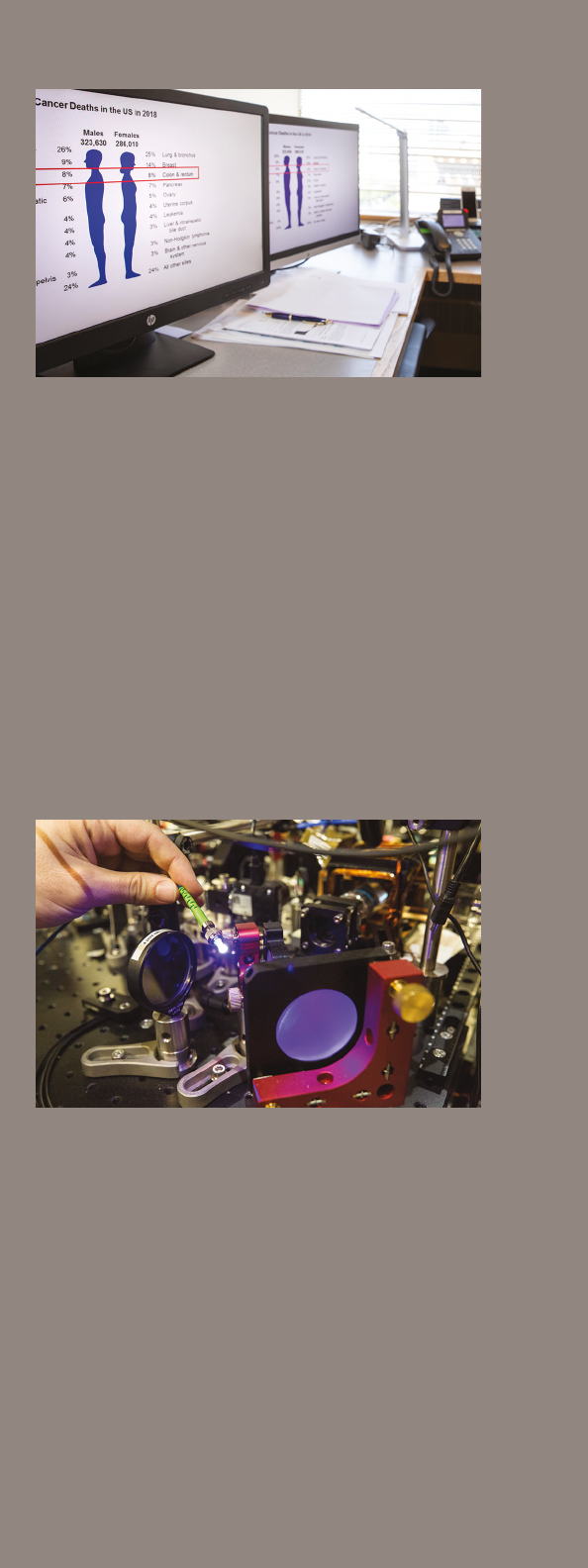

NEW APPROACH MAY HELP CLEAR HURDLE

TO LARGESCALE QUANTUM COMPUTING

A team of Harvard-led physicists, which includes

collaborators from QuEra Computing, MIT, and the

University of Innsbruck, has developed a new approach

for processing quantum information that shues atoms

in mid-computation, allowing for the self-correction of

errors. This approach marks a major step toward the goal

of building large-scale machines that leverage the unique

characteristics of quantum mechanics to bring about real-

world breakthroughs in material science, communication

technologies, nance, and many otherelds.

HARVARD UNIVERSITY

FINANCIAL OVERVIEW

Combining gifts for current use and Harvard’s

endowment distribution, philanthropy accounts

for 45% of scal year 2022 revenue. Every gift helps

Harvard continue to be a leading force for progress

in the world, enabling excellence in our teaching

and research mission, recruiting and retaining

our worldclass faculty, helping students thrive, and

providing greater access through nancial aid.

Gifts for current use

In scal year 2022, Harvard received current use

gifts from alumni, foundations, and others totaling

$505million, representing approximately 9% of

operating revenues. Support for the University comes

from donations of all sizes; more than 75% of gifts in

scal year 2022 averaged $155 per donor.

The Harvard endowment

Harvard’s endowment has existed for nearly

four centuries and belongs to current and future

generations of Harvard students, faculty, and

researchers. The aggregate endowment is made

up of more than 14,000 individual endowments

that support nearly every aspect of the University’s

work, from student nancial aid to neighborhood

programs, from museum and library preservation to

campus activities, from faculty and fellow positions to

scientic advancement.

Donor contributions to the endowment have enabled

leading nancial aid programs, groundbreaking

discoveries in scientic research, and hundreds of

professorships across a wide range of academic elds.

Each year, a portion of the endowment is paid out as

an annual distribution to support the University’s

annual operations. In any given year, the University

aims to maximize what we can responsibly draw,

while balancing both current and future needs.

Guided by this principle of intergenerational equity,

Harvard’s endowment is carefully managed in order to

ensure that future generations will enjoy its benets

just as much as the current one.

Cash gifts to the endowment were $584 million in

scal year 2022 compared to $465 million in scal

year2021.

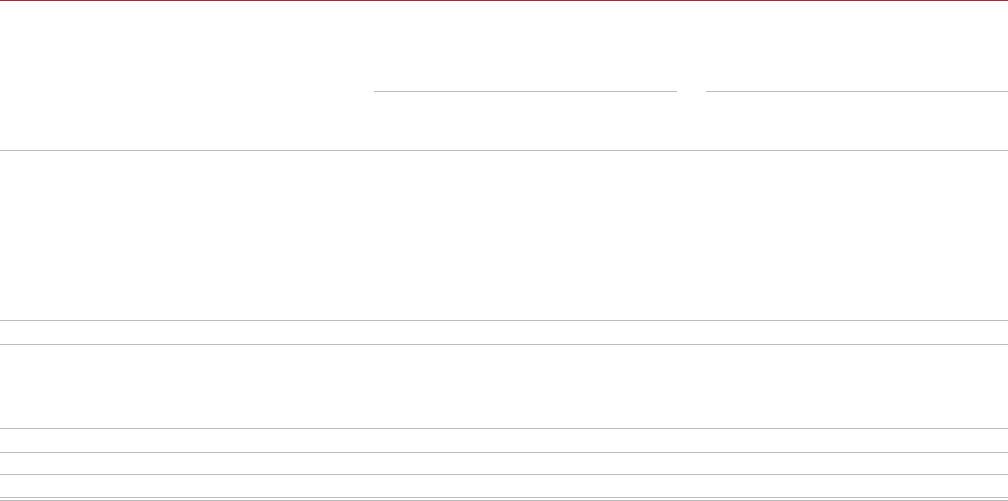

Endowment returns made available for operations

The University’s endowment spending practice has

to balance two competing goals: the need to fund

the operating budget with a stable and predictable

distribution, and the obligation to maintain the long-

term value of the endowment. There is a common

misconception that endowments, including Harvard’s,

can be accessed like bank accounts, used for anything

at any time as long as funds are available. In reality,

Harvard’s exibility in spending from the endowment

is limited by the fact that it is designed to last forever,

which is crucial for an institution intended to serve

generations of students and pursue research on

questions that cannot be answered in onelifetime.

Law $2,504

Public Health $2,009

Engineering & Applied

Sciences $1,848

Kennedy School $1,559

Radclie $805

Education $804

Divinity $796

Design $657

University professorship $416

Dental $267

President’s funds $3,127

Business

$5,086

Other

Departs.

$4,561

Medical

$5,562

Faculty of

Arts & Sciences

$20,390

30, 2022

In millions of dollars

$50,878

Interfaculty initiatives $487

HARVARD UNIVERSITY

FINANCIAL OVERVIEW

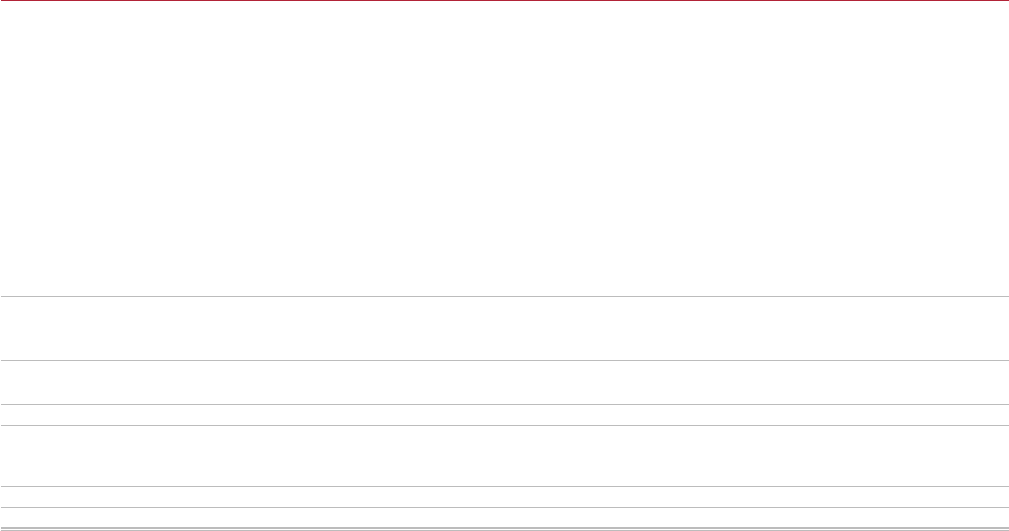

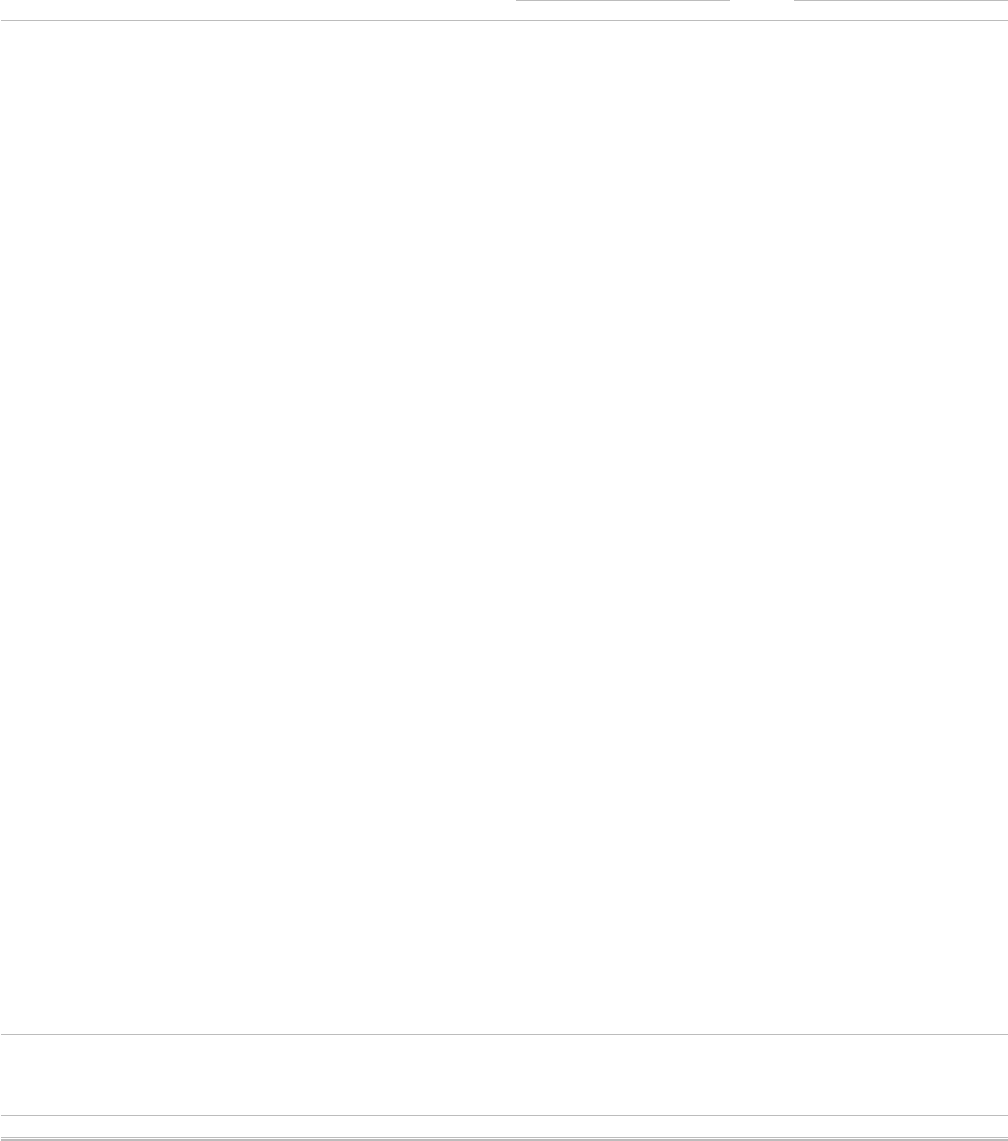

Harvard is obligated to preserve the purchasing power

of the endowment by spending only a small fraction of

its value each year. Spending signicantly more than

that over time, for whatever reason, would privilege the

present over the future in a manner inconsistent with

an endowment’s fundamental purpose of maintaining

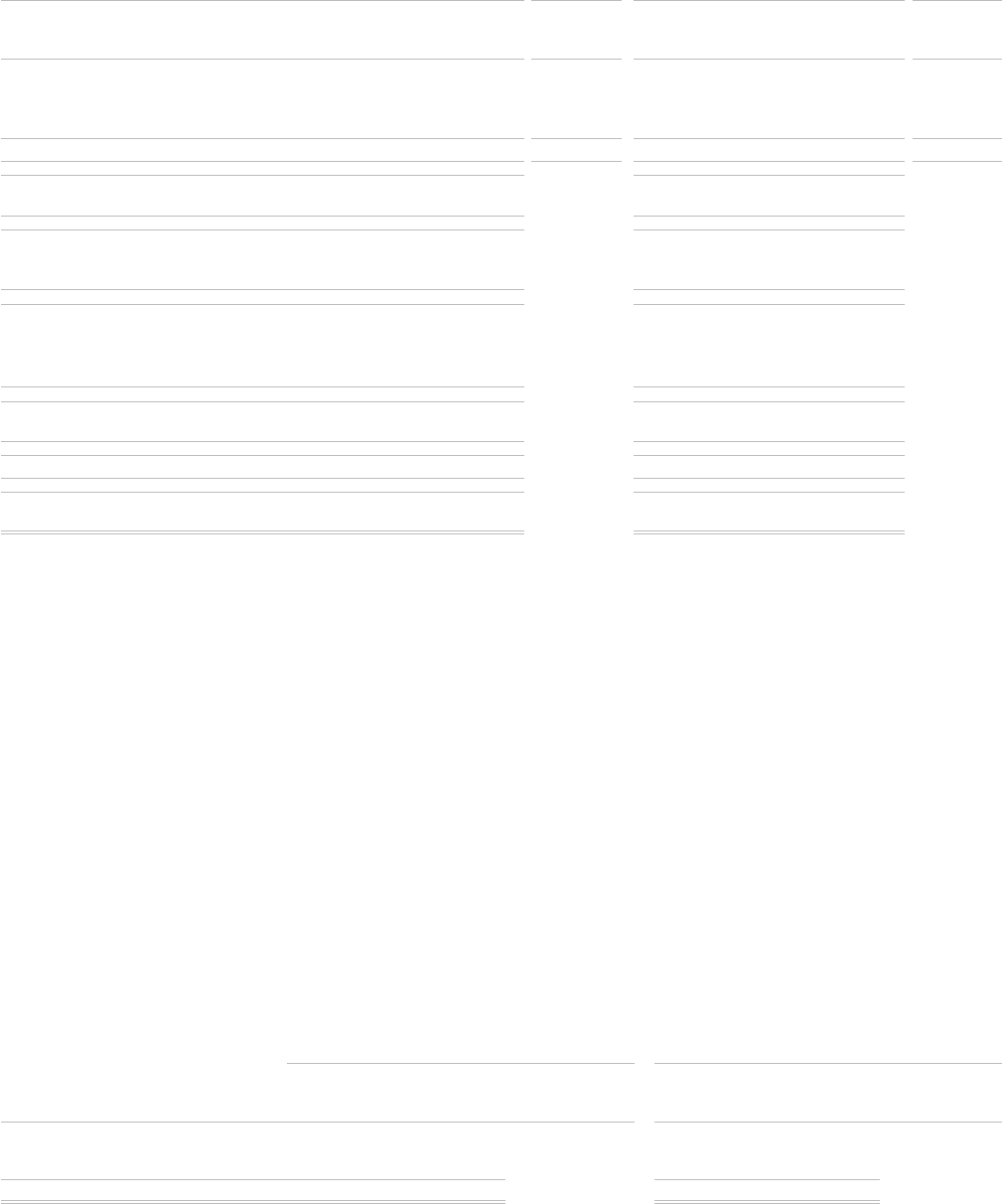

intergenerational equity. As a general rule, Harvard

targets an annual endowment payout rate of 5.0 to

5.5% of market value. The actual payout rate varies

each year based on endowment returns. For example,

following extraordinary endowment returns in FY21

of 33.6% that served to boost the endowment’s market

value, the payout rate (i.e., the annual distribution as

a percent of market value) fell, despite the fact that

the annual distribution increased. This critical source

of funding distributed $2.1 billion in the scal year

ending June 30, 2022—representing 36% of Harvard’s

total operating revenue—and is the single largest

source of revenue supporting theUniversity.

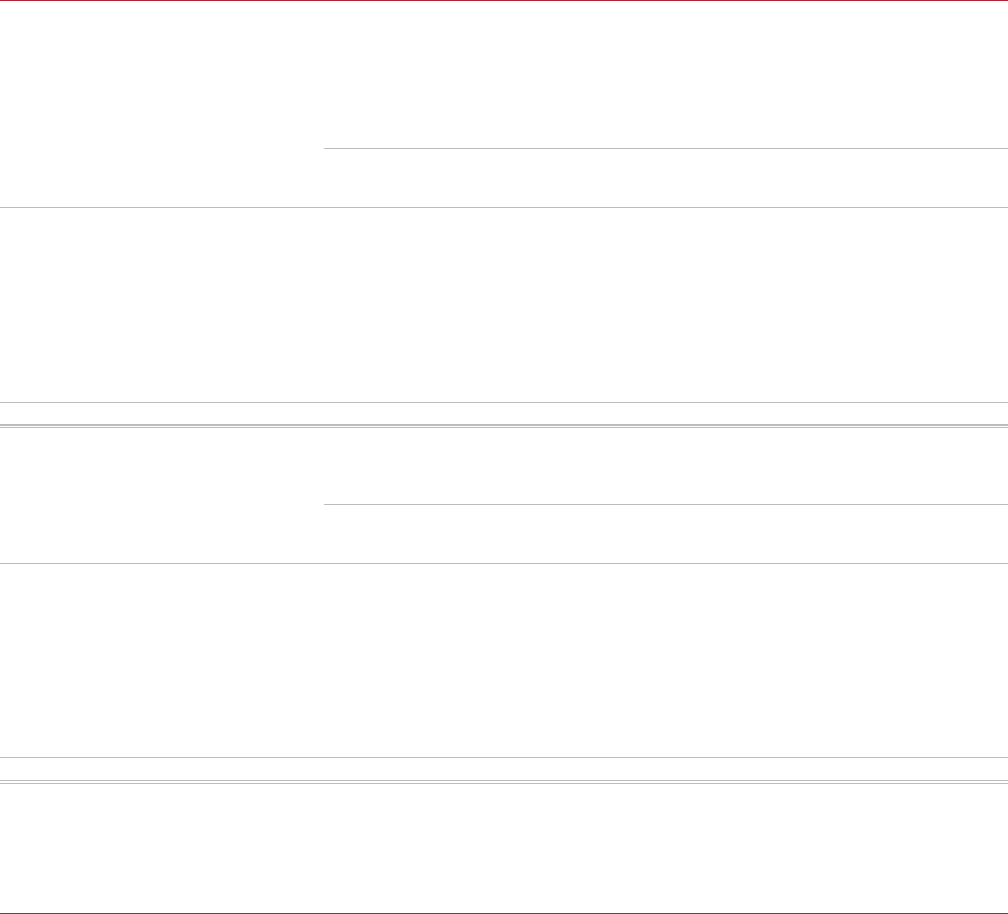

Donor directed

Capital/Construction (1%)

Flexible

Faculty & Teaching (2%)

Library & Museums (3%)

Other

Professorships

Program support

Research

Scholarships &

Student Support

24%

6%

5%

20%

30%

9%

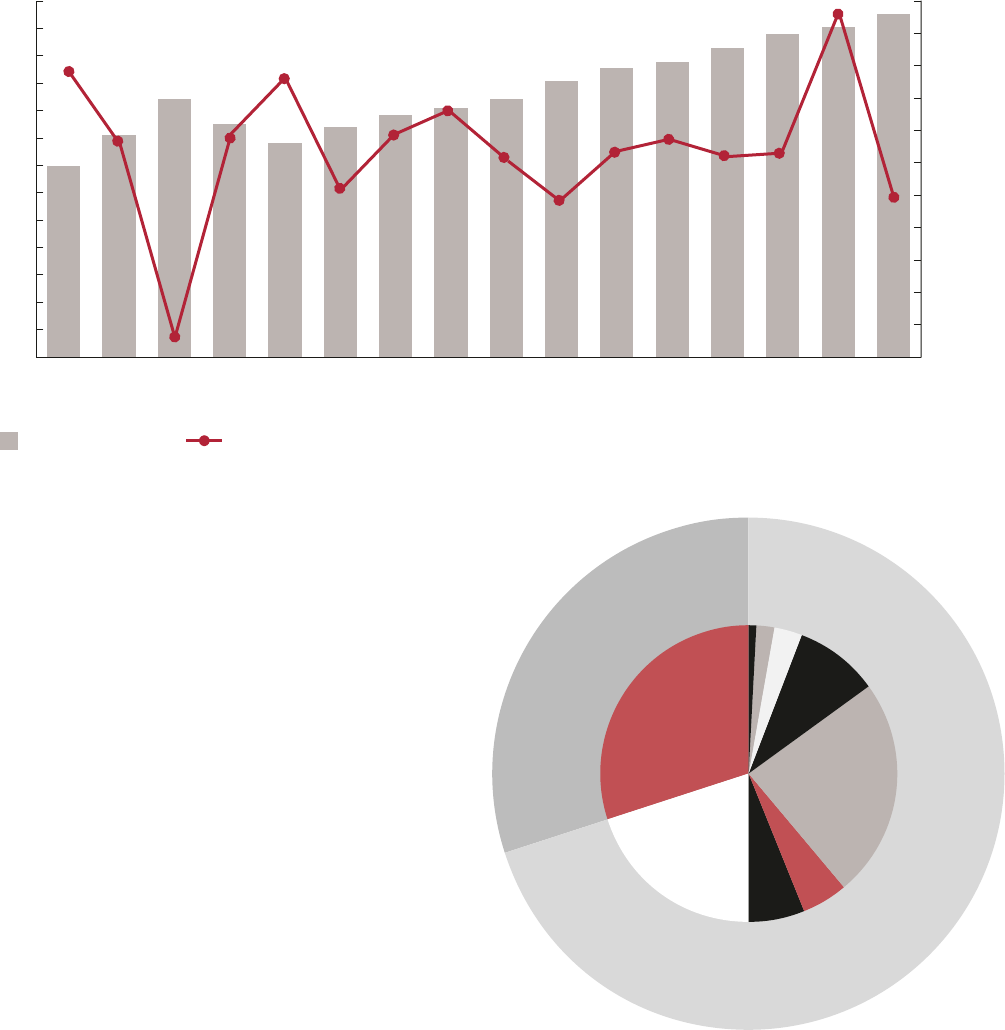

ENDOWMENT RETURNS MADE AVAILABLE FOR OPERATIONS BY YEAR

0

200

400

600

800

1,000

1,200

1,400

1,600

1,800

2,000

$2,200

-30%

-25%

-20%

-15%

-10%

-5%

0%

5%

10%

15%

20%

25%

30%

35%

2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022

4.6%

Endowment Distribution

Payout

Rate

Endowment Return

4.8% 4.6% 6.1% 5.3% 4.7% 5.1% 4.9% 4.6% 4.9% 5.4% 5.3% 5.3% 5.3% 5.2% 4.2%

Endowment Distribution (in millions of dollars)

Endowment Return

Endowment payout

While the endowment is a critical source of funding,

70% of the annual distribution is directed to specic

programs, departments, or purposes and must be

spent in accordance with the terms set forth by the

donor. Funds without donor restriction are more

exible in nature and are critical in supporting

structural operating expenses and transformative,

strategic initiatives. In this way, the endowment

bridges the gap between revenue that is brought in

from tuition and research grants, and the critical

costs associated with the University’s teaching and

researchactivities.

HARVARD UNIVERSITY

FINANCIAL OVERVIEW

OCTOBER 2022

1

R I

TAS

R I

TAS

Dear Members of the Harvard Community,

For the most recent fiscal year, which ended on June 30, 2022, the return on the Harvard endowment

was -1.8% and the value stood at $50.9 billion. The endowment also distributed more than $2.1 billion

toward the University’s operating budget, which continues to represent more than one-third of annual

operating revenue.

The disparity between fiscal year 2021 (FY21) and fiscal year 2022 (FY22) returns was stark and reinforces

the necessity of focusing on long-term, risk adjusted returns. Among the headwinds we faced this past

year, several market factors weighed negatively on performance.

• By far the most significant impact was the poor performance of global equity markets over

the course of the year. The S&P 500, Nasdaq Composite, Nasdaq Small Cap, and the ACWI —

benchmarks for domestic and global equities — declined by 11%, 23%, 27% and 16%, respectively.

In addition, two other less significant factors weighed upon performance:

• While our benchmark relative performance with respect to public equities, hedge funds, and

private equities had been unusually strong over the past four fiscal years, FY22 was not a strong

benchmark relative year. Notably, however, HMC’s five-year benchmark relative performance — a far

more important metric — remains very strong and reinforces the eective turnaround HMC has made.

• A number of institutional investors leaned into the conventional energy sector, through

either equities or commodity futures, adding materially to their total return. HMC did not

participate in these returns given the University’s commitment to tackling the impacts of

climate change, supporting sustainable solutions, and achieving our stated net Zero goals.

Notably, the highest risk asset classes — i.e., the private portfolios of venture capital, buyout, and real

estate — were the strongest performers. In fact, the more private assets an investor had in its portfolio

in FY22, the stronger their performance. This is somewhat counterintuitive and may indicate that private

managers have not yet marked their portfolios to reflect general market conditions. This phenomenon

does make us cautious about forward-looking returns in private portfolios.

For example, the venture capital portion of HMC’s private equity portfolio returned high single digits

despite the deeply negative performance of relevant public equity indices. On the other hand, some

venture managers have meaningful exposure to public companies, which declined with public markets.

Accordingly, the performance of venture portfolios during FY22 was largely a function of the proportion

of public companies held in those portfolios.

We expect that the end of the current calendar year might present meaningful adjustments to these

valuations, as investment managers audit their portfolios. Under existing accounting conventions for

venture portfolios, investment managers generally use the most recent round of financing to mark

investments. This convention may slow the process of moving existing valuations to fair value. This

circumstance is not unique to Harvard — other institutional investors with large private portfolios will

almost certainly face the same dynamic.

Message from the CEO

OCTOBER

2022

HMC FY22 Endowment Report.indd 1HMC FY22 Endowment Report.indd 1 2022-10-05 1:52 PM2022-10-05 1:52 PM

HARVARD UNIVERSITY

HARVARD MANAGEMENT COMPANY

OCTOBER 2022 2

Given this environment, we are particularly pleased that we were able to sell close to $1 billion

of private equity funds in the secondary market during the summer of 2021 — a time of significant

ebullience — avoiding the discounts these funds would likely face today.

Harvard’s Risk Tolerance

Harvard engaged in a years-long analysis of its risk tolerance to balance the desire for continued growth

in the endowment with the University’s steady reliance on annual distributions. In November 2021, the

Corporation approved a proposal of the Harvard Finance Committee and the HMC Board to moderately

increase the risk level of the portfolio. Noting how expensive the overall market was at the time, HMC

decided to increase the portfolio risk level slowly over a multi-year period to avoid investing heavily

at prevailing valuations. This increase will eventually make our risk level more consistent with that of

various peers, although it will still be lower than some.

Net Zero Eorts

HMC is proud to be deeply engaged in the issue of sustainability. We are particularly excited about

two eorts. First, HMC became the first U.S. endowment to make its own operations carbon neutral

for FY22. Working with a third-party vendor, we measured our greenhouse gas emissions, sought

opportunities to reduce future emissions, and secured osets through carbon dioxide removal (CDR).

Our goal continues to be mitigation of emissions wherever possible. For the emissions we cannot abate,

our guiding principles for CDR are durability, additionality, quality carbon accounting and monitoring,

and they may not result in harm to surrounding ecosystems and communities. Second, HMC has been

an active investor in technology-driven climate transition investments. A more detailed report on our

eorts for these important initiatives will be available in the 2023 Climate Report.

Diversity, Equity & Inclusion

For many years, HMC has worked to address the lack of gender and racial diversity in the financial

industry — among our team, our universe of external managers, and portfolio investments.

We last reported on the diversity of our external managers in 2020. Since then, the percentage of

diverse, active U.S.-based managers has grown. While we are pleased with our eorts to date, there is

certainly more work to be done. HMC continues to actively seek out opportunities to invest with diverse

managers and to maintain a sta that reflects those same principles.

In Closing

The disparity in performance between FY21 and FY22 serves to highlight both the value of the endowment

to Harvard University during times of economic adversity, as well as the need to focus on long-term

returns. We remain confident that the steps we have taken — and those still in process — to construct a

portfolio that serves the University’s long-term interests will allow Harvard to maintain and increase its

critical support of students, faculty, and research for generations to come.

Best regards,

N.P. “Narv” Narvekar

Chief Executive Ocer

HMC FY22 Endowment Report.indd 2HMC FY22 Endowment Report.indd 2 2022-10-05 1:52 PM2022-10-05 1:52 PM

HARVARD UNIVERSITY

HARVARD MANAGEMENT COMPANY

PricewaterhouseCoopers LLP, 101 Seaport Boulevard, Boston, MA 02210

T: (617) 530 5000, F: (617) 530 5001, www.pwc.com/us

Report of Independent Auditors

To the Joint Committee on Inspection of the Governing Boards of Harvard University

Opinion

We have audited the accompanying consolidated financial statements of Harvard University and its

subsidiaries (the “University”), which comprise the consolidated balance sheet as of June 30, 2022, and

the related consolidated statements of changes in net assets with general operating account detail and of

changes in net assets of the endowment for the year ended June 30, 2022, and of cash flows for the years

ended June 30, 2022 and 2021, including the related notes (collectively referred to as the “consolidated

financial statements”).

In our opinion, the accompanying consolidated financial statements present fairly, in all material respects,

the financial position of the University as of June 30, 2022, the changes in its net assets for the year ended

June 30, 2022, and its cash flows for the years ended June 30, 2022 and 2021 in accordance with

accounting principles generally accepted in the United States of America.

Basis for Opinion

We conducted our audit in accordance with auditing standards generally accepted in the United States of

America (US GAAS). Our responsibilities under those standards are further described in the Auditors’

Responsibilities for the Audit of the Consolidated Financial Statements section of our report. We are

required to be independent of the University and to meet our other ethical responsibilities, in accordance

with the relevant ethical requirements relating to our audit. We believe that the audit evidence we have

obtained is sufficient and appropriate to provide a basis for our audit opinion.

Other Matter

We previously audited the consolidated balance sheet as of June 30, 2021, and the related consolidated

statements of changes in net assets with general operating account detail, of changes in net assets of the

endowment and of cash flows for the year then ended (the balance sheet and the statements of changes in

net assets with general operating account detail and of changes in net assets of the endowment are not

presented herein), and in our report dated October 13, 2021, we expressed an unmodified opinion on those

consolidated financial statements. In our opinion, the information set forth in the accompanying

summarized financial information as of June 30, 2021 and for the year then ended is consistent, in all

material respects, with the audited consolidated financial statements from which it has been derived.

Responsibilities of Management for the Consolidated Financial Statements

Management is responsible for the preparation and fair presentation of the consolidated financial

statements in accordance with accounting principles generally accepted in the United States of America,

and for the design, implementation, and maintenance of internal control relevant to the preparation and

fair presentation of consolidated financial statements that are free from material misstatement, whether

due to fraud or error.

In preparing the consolidated financial statements, management is required to evaluate whether there are

conditions or events, considered in the aggregate, that raise substantial doubt about the University’s

ability to continue as a going concern for one year after the date the consolidated financial statements are

issued.

HARVARD UNIVERSITY

INDEPENDENT AUDITOR’S REPORT

2

Auditors’ Responsibilities for the Audit of the Consolidated Financial Statements

Our objectives are to obtain reasonable assurance about whether the consolidated financial statements as

a whole are free from material misstatement, whether due to fraud or error, and to issue an auditors’

report that includes our opinion. Reasonable assurance is a high level of assurance but is not absolute

assurance and therefore is not a guarantee that an audit conducted in accordance with US GAAS will

always detect a material misstatement when it exists. The risk of not detecting a material misstatement

resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery,

intentional omissions, misrepresentations, or the override of internal control. Misstatements are

considered material if there is a substantial likelihood that, individually or in the aggregate, they would

influence the judgment made by a reasonable user based on the consolidated financial statements.

In performing an audit in accordance with US GAAS, we:

●

●

●

●

●

Exercise professional judgment and maintain professional skepticism throughout the audit.

Identify and assess the risks of material misstatement of the consolidated financial statements,

whether due to fraud or error, and design and perform audit procedures responsive to those risks.

Such procedures include examining, on a test basis, evidence regarding the amounts and

disclosures in the consolidated financial statements.

Obtain an understanding of internal control relevant to the University audit in order to design

audit procedures that are appropriate in the circumstances, but not for the purpose of expressing

an opinion on the effectiveness of the University’s internal control. Accordingly, no such opinion is

expressed.

Evaluate the appropriateness of accounting policies used and the reasonableness of significant

accounting estimates made by management, as well as evaluating the overall presentation of the

consolidated financial statements.

Conclude whether, in our judgment, there are conditions or events, considered in the aggregate,

that raise substantial doubt about the University’s ability to continue as a going concern for a

reasonable period of time.

We are required to communicate with those charged with governance regarding, among other matters, the

planned scope and timing of the audit, significant audit findings, and certain internal control-related

matters that we identified during the audit.

Other Information

Management is responsible for the other information included in the annual report. The other information

comprises the Harvard University Financial Report Fiscal Year 2022, but does not include the

consolidated financial statements and our auditor’s report thereon. Our opinion on the consolidated

financial statements does not cover the other information, and we do not express an opinion or any form

of assurance thereon.

In connection with our audit of the consolidated financial statements, our responsibility is to read the

other information and consider whether a material inconsistency exists between the other information and

the consolidated financial statements or the other information otherwise appears to be materially

misstated. If, based on the work performed, we conclude that an uncorrected material misstatement of the

other information exists, we are required to describe it in our report.

Boston, Massachusetts

October 12, 2022

HARVARD UNIVERSITY

INDEPENDENT AUDITOR’S REPORT

with summarized nancial information as of June 30, 2021

June 30

In thousands of dollars 2022 2021

ASSETS:

Cash and cash equivalents , ,

Receivables, net (Note 4) , ,

Prepayments and deferred charges , ,

Operating leases — right of use assets (Note 18) , ,

Notes receivable, net (Note 5) , ,

Pledges receivable, net (Note 6) ,, ,,

Fixed assets, net (Note 7) ,, ,,

Interests in trusts held by others (Note 3) , ,

Securities pledged to counterparties, at fair value (Note 3) , ,

Investment portfolio, at fair value (Note 3) ,, ,,

TOTAL ASSETS ,, ,,

LIABILITIES:

Accounts payable , ,

Deferred revenue and other liabilities ,, ,,

Operating lease liabilities (Note 18) , ,

Other liabilities associated with the investment portfolio (Notes 3 and 10) , ,

Liabilities due under split interest agreements (Note 9) , ,,

Bonds and notes payable (Note 10) ,, ,,

Accrued retirement obligations (Note 11) , ,,

Government loan advances (Note 5) , ,

TOTAL LIABILITIES ,, ,,

NET ASSETS ,, ,,

TOTAL LIABILITIES AND NET ASSETS ,, ,,

Without donor

restrictions

With donor

restrictions

June 30

2022 2021

NET ASSETS:

General Operating Account (GOA) (Note 8) ,, ,, ,, ,,

Endowment (Note 8) ,, ,, ,, ,,

Split interest agreements (Note 9) , , ,

TOTAL NET ASSETS ,, ,, ,, ,,

The accompanying notes are an integral part of the consolidated nancial statements.

HARVARD UNIVERSITY

CONSOLIDATED FINANCIAL STATEMENTS

with summarized nancial information for the year ended June 30, 2021

For the year ended

Without Donor With Donor June 30

In thousands of dollars Restrictions Restrictions 2022 2021

OPERATING REVENUE:

Net student income (Notes 2 and 12) ,, ,, ,

Sponsored support (Note 13)

Federal government – direct costs , , ,

Federal government – indirect costs , , ,

Non-federal sponsors – direct costs , , , ,

Non-federal sponsors – indirect costs , , , ,

Total sponsored support , , , ,

Gifts for current use (Note 14) , , , ,

Investment income:

Endowment returns made available for operations (Note 8) , ,, ,, ,,

GOA returns made available for operations , , ,

Other investment income , , , ,

Total investment income , ,, ,, ,,

Other revenue (Note 15) , , ,

Net assets released from restriction ,, (,,)

TOTAL OPERATING REVENUE ,, , ,, ,,

OPERATING EXPENSES:

Salaries and wages ,, ,, ,,

Employee benets (Note 11) , , ,

Services purchased , , ,

Depreciation (Note 7) , , ,

Space and occupancy , , ,

Supplies and equipment , , ,

Interest (Note 10) , , ,

Scholarships and other student awards (Note 12) , , ,

Other expenses (Note 16) , , ,

TOTAL OPERATING EXPENSES ,, ,, ,,

NET OPERATING SURPLUS , , , ,

NONOPERATING ACTIVITIES:

Income from GOA investments , , ,

GOA realized and change in unrealized (depreciation)/appreciation, net (Note 3) (,) (,) ,,

GOA returns made available for operations (,) (,) (,)

Change in pledge balances (Note 6) , , (,)

Change in interests in trusts held by others (,) (,)

Gifts for facilities and loan funds (Note 14) , , ,

Change in retirement obligations (Note 11) , , ,

Other changes (,) (,) (,)

Transfers between GOA and endowment (Note 8) (,) , (,) ()

Transfers between GOA and split interest agreements (Note 9) , , ,

Non-operating net assets released from restrictions , (,)

TOTAL NONOPERATING ACTIVITIES (,) , (,) ,,

GENERAL OPERATING ACCOUNT NET CHANGE DURING THE YEAR (,) , , ,,

Endowment net change during the year (,) (,,) (,,) ,,

Split interest agreements net change during the year (Note 9) (,) (,) ,

NET CHANGE DURING THE YEAR (,) (,,) (,,) ,,

Net assets, beginning of year ,, ,, ,, ,,

NET ASSETS, END OF YEAR ,, ,, ,, ,,

The accompanying notes are an integral part of the consolidated nancial statements.

HARVARD UNIVERSITY

CONSOLIDATED FINANCIAL STATEMENTS

with summarized nancial information for the year ended June 30, 2021

For the year ended

June 30

Without Donor

Restrictions

With Donor

Restrictions In thousands of dollars 2022 2021

Investment return (Note 3):

Income from general investments , , , ,

Realized and change in unrealized (depreciation)/appreciation, net (,) (,) (,,) ,,

Total investment return (,) (,) (,) ,,

Endowment returns made available for operations (,) (,,) (,,) (,,)

Net investment return (,) (,,) (,,) ,,

Gifts for endowment (Note 14) , , , ,

Transfers between endowment and the GOA (Note 8) , (,) ,

Capitalization of split interest agreements (Note 9) , , ,

Change in pledge balances (Note 6) , , (,)

Change in interests in trusts held by others (Note 8) (,) (,) ,

Other changes (,) (,) (,) (,)

Net assets released from restrictions , (,)

NET CHANGE DURING THE YEAR (,) (,,) (,,) ,,

Net assets of the endowment, beginning of year ,, ,, ,, ,,

NET ASSETS OF THE ENDOWMENT, END OF YEAR ,, ,, ,, ,,

The accompanying notes are an integral part of the consolidated nancial statements.

HARVARD UNIVERSITY

CONSOLIDATED FINANCIAL STATEMENTS

In thousands of dollars

For the year ended

June 30

2022 2021

CASH FLOWS FROM OPERATING ACTIVITIES:

Change in net assets (,,) ,,

Adjustments to reconcile change in net assets to net cash (used in) operating activities:

Depreciation , ,

Amortization of premium and discount related to bonds and notes payable (,) (,)

Realized and change in unrealized depreciation/(appreciation), net ,, (,,)

Change in fair value of interest rate exchange agreements (,) (,)

Change in interests in trusts held by others , (,)

Change in liabilities due under split interest agreements (,) ,

Gifts of donated securities (,) (,)

Proceeds from the sales of gifts of unrestricted securities , ,

Gifts for restricted purposes (,) (,)

Cost of issuance of debt

Loss on disposal of assets , ,

Change in accrued retirement obligations (,) (,)

Non-cash operating lease costs , ,

Changes in operating assets and liabilities:

Receivables, net (,) (,)

Prepayments and deferred charges (,) (,)

Pledges receivable, net (,) ,

Accounts payable (,) ,

Deferred revenue and other liabilities (,) ,

Operating lease liability (,) (,)

NET CASH USED IN OPERATING ACTIVITIES (,,) (,,)

CASH FLOWS FROM INVESTING ACTIVITIES:

Loans made to students, faculty, and sta (,) (,)

Payments received on student, faculty, and sta loans , ,

Change in other notes receivable , (,)

Proceeds from the sales and maturities of investments ,, ,,

Purchase of investments (,,) (,,)

Change associated with repurchase agreements (,) ,

Additions to xed assets (,) (,)

NET CASH PROVIDED BY INVESTING ACTIVITIES , ,,

CASH FLOWS FROM FINANCING ACTIVITIES:

Change in overdrafts included in accounts payable () ,

Change in split interest agreements from new contributions, income and payments to annuitants (,) (,)

Proceeds from issuance of debt ,

Debt repayments (,) (,)

Proceeds from the sales of gifts of restricted securities , ,

Gifts for restricted purposes , ,

Change in government loan advances (,) (,)

NET CASH PROVIDED BY FINANCING ACTIVITIES ,, ,

NET CHANGE IN CASH , ,

Cash, beginning of year ,, ,,

CASH, END OF YEAR ,, ,,

Cash and cash equivalents (per Consolidated Balance Sheets)

, ,

Cash and cash equivalents held in investments (Note 3) ,, ,,

TOTAL CASH AND CASH EQUIVALENTS ,, ,,

Supplemental disclosure of cash ow information:

Accounts payable related to xed asset additions , ,

Cash paid for interest , ,

The accompanying notes are an integral part of the consolidated nancial statements.

HARVARD UNIVERSITY

CONSOLIDATED FINANCIAL STATEMENTS

Basis of presentation

The accompanying consolidated nancial statements

have been prepared on the accrual basis of accounting

and include the accounts of the University and aliated

organizations controlled by the University. Signicant inter-

aliate accounts and transactions have been eliminated.

Funds transferred to the University on behalf of specic

beneciaries (agency funds) are recorded as assets and

liabilities in the Consolidated Balance Sheets and are not

included in the Consolidated Statements of Changes in

NetAssets with General Operating Account Detail.

The consolidated nancial statements include certain prior

year summarized comparative information in total, not by

net asset classication. This information is not presented in

sucient detail to conform to generally accepted accounting

principles (GAAP). Accordingly, such information should

be read in conjunction with the University’s nancial

statements for the year ended June 30, 2021, from which

the summarized information is derived. Certain prior

year amounts have been reclassied to conform to current

yearpresentation.

Net asset classications

For the purposes of nancial reporting, the University

classies resources into two net asset categories pursuant

to any donor-imposed restrictions and applicable law.

Accordingly, the net assets of the University are classied in

the accompanying consolidated nancial statements in the

categories that follow:

— Net assets not subject to

donor-imposed restrictions. Funds invested in xed assets

and unrestricted endowment funds comprise 81% of the

University’s net assets without donor-imposed restrictions

as of June 30, 2022. In addition, this category includes

gifts and endowment income balances where the donor

restriction has been met, University-designated loan funds,

and other current funds.

—Net assets subject to legal

or donor-imposed restrictions that will be satised

either by actions of the University, the passage of time,

or both. These net assets include net assets subject to

donor-imposed restrictions that are invested to provide a

perpetualsource of income to the University. Generally,

donors of these assets require the University to maintain

and invest the original contribution in perpetuity but

permit the use of some or all investment returns for general

or specic purposes. The appreciation on these perpetual

contributions must be reported as net assets with donor

restrictions until appropriated for spending in accordance

with Massachusetts law. Also included in this category

are gifts donated for a particular purpose and amounts

subject to time restrictions such as funds pledged for

futurepayment.

Revenues from sources other than contributions are

generally reported as increases in net assets without

donor restrictions. Expenses are reported as decreases in

net assets without donor restrictions. Gains and losses

on investments are reported as increases or decreases in

net assets without donor restrictions, unless their use

is restricted by donor stipulations or by law. Investment

returns earned by restricted donor funds are initially

classied as net assets with donor restrictions and then

reclassied to net assets without donor restrictions when

expenses are appropriated or incurred for their intended

purpose. Expirations of donor restrictions on net assets

1.

Harvard University (the “University”) is a private, not-for-

prot institution of higher education with approximately

7,100 undergraduate and 14,100 graduate students in

scal year 2022, as compared to 5,200 undergraduate and

13,400 graduate students in scal year 2021. Established

in 1636, the University includes the Faculty of Arts and

Sciences, the John A. Paulson School of Engineering and

Applied Sciences, the Division of Continuing Education, ten

graduate and professional Schools, the Radclie Institute

for Advanced Study, a variety of research museums and

institutes, and an extensive library system to support the

teaching and research activities of the Harvard community.

The President and Fellows of Harvard College (the

“Corporation”), a governing board of the University, has

oversight responsibility for all of the University’s nancial

aairs. The Corporation delegates substantial authority to

the Schools and departments for the management of their

resources and operations.

The University includes Harvard Management Company

(HMC), a wholly owned subsidiary founded in 1974 to

manage the University’s investment assets. HMC is

governed by a Board of Directors that is appointed by

theCorporation.

2.

HARVARD UNIVERSITY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Endowment and GOA returns liquidated from investments

and made available for operations over the course of the

scal year are distributed to University department and

program budgets to spend, subject to donor restrictions

where applicable.

While the University has no intention of doing so, there

are additional investments held by the University and the

endowment that could be liquidated in the event of an

unexpected disruption. While a portion of the endowment

is subject to donor restrictions, there is $9.1 billion and

$9.4 billion in endowment funds without donor restrictions

at June 30, 2022 and 2021, respectively and $4.7 billion

and $4.8 billion of General Operating Account investments

(GOA) at June 30, 2022 and 2021, respectively, that could be

accessed with the approval of the Corporation and subject to

the redemption provisions described in Note 3.

Revenue recognition

Revenue is recognized when control of promised goods

or services is transferred to customers, in an amount that

reects the consideration the University expects to be

entitled to in exchange for those goods or services.

Student income is derived from degree programs as well

as executive and continuing education programs and

includes tuition, fees, and board and lodging. Student

income is recognized ratably over the academic period of

the course or program oered based on time elapsed, and

scholarships awarded to students reduce the amount of

revenue recognized. The University’s individual schools

have various billing and academic cycles and the majority of

our programs are completed within the scal year. Student

income received in advance of services to be rendered is

recorded as deferred revenue which totaled $209.1 million

and $226.0 million, respectively, at June 30, 2022 and 2021,

which are primarily recognized in the subsequent scalyear.

Total student income of $1.2 billion and $888.3 million

was recorded during the years ended June 30, 2022 and

2021, respectively. Student tuition, fees, board and lodging

at published rates is summarized as follows for the years

ended June 30, 2022 and 2021 (in thousands of dollars):

2022 2021

Undergraduate program , ,

Graduate and professional degree programs , ,

Continuing education and executive programs , ,

Board and lodging , ,

Scholarships applied to student charges were $505,904 and $435,959 for the

years ended June 20, 2022 and 2021, respectively.

are reported as reclassications from net assets with

donor restrictions to net assets without donor restrictions

and appear as “Net assets released from restrictions” and

“Non-operating net assets released from restrictions” in the

Consolidated Statements of Changes in Net Assets.

Liquidity and availability

As part of the University’s liquidity management, it has

a policy to structure its nancial assets to be available as

its general expenditures, liabilities and other obligations

come due. A signicant portion of the University’s annual

expenditures are funded by operating revenues in the

current year including student income, sponsored support,

endowment returns made available for operations, gifts for

current use and other revenues.

The University’s nancial assets available within one year

of the balance sheet date for general expenditure, such as

operating expenses, scheduled principal payments on debt,

and capital construction costs not nanced with debt, are as

follows (in thousands):

June 30,

2022 2021

FINANCIAL ASSETS

Cash and cash equivalents , ,

Receivables, net , ,

Pledge receivables due in one year , ,

Cash equivalents and short-term investments held separately by General Operating Account (GOA)

1

,, ,,

Endowment returns made available for operations in the following year ,, ,,

TOTAL FINANCIAL ASSETS AVAILABLE WITHIN ONE YEAR ,, ,,

LIQUIDITY RESOURCES

Credit facility, undrawn balance ,, ,,

Tax-exempt commercial paper, undrawn balance ,, ,,

Taxable commercial paper, undrawn balance ,, ,,

TOTAL FINANCIAL ASSETS AND RESOURCES AVAILABLE WITHIN ONE YEAR ,, ,,

1

The University has a policy of maintaining liquidity outside of the General Investment Accounting (GIA) through a combination of cash equivalents and

short-term investments, as referenced on page 7 in the Financial Overview.

HARVARD UNIVERSITY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Unconditional contributions including pledges are

recognized immediately and classied as either net

assets with donor restrictions or net assets without

donor restrictions. Conditional contributions for which

cash is received are accounted for as a liability within

deferredrevenue.

Sponsored support of $975.8 million includes support

from governmental and private sources. Certain sponsored

arrangements are considered exchange arrangements,

and revenue under these agreements is recognized based

on the University’s fulllment of the contract, which

is typically based on costs incurred or the achievement

of milestones. Other sponsored support is considered

contribution revenue, which is recognized when any

donor-imposed conditions have been met, if applicable.

Sponsored conditional contributions received, where the

barrier to entitlement is not yet overcome, are recorded

as deferred revenues of $61.1 million and $68.2 million

as of June 30, 2022 and 2021, respectively. As of June 30,

2022, the University also had $1.5 billion awarded but not

yet expended contributions related to sponsored programs

where the condition had not yet been met. This is subject

to federal appropriations. Funding received in advance of

recognition is recorded as deferred revenue.

Other revenue of $838.3 million in scal 2022

and $693.9million in scal 2021 includes several

revenue streams considered exchange contracts with

customers totaling $728.1 million for scal year 2022

and $605.3million in scal 2021. These revenues are

recognized at the point in time goods or services are

provided. Deferred revenues related to other revenue of

$104.7 million and $102.1 million were recorded as of

June30, 2022 and 2021, which are primarily recognized

inthe subsequent scal year.

Measure of operations

Revenues earned, expenses incurred, and returns made

available for operations for the purpose of teaching,

conducting research, and the other programs and services

of the University are the components of “Net operating

surplus” in the Consolidated Statements of Changes in

Net Assets with General Operating Account Detail. The

University’s non-operating activity within the Consolidated

Statements of Changes in Net Assets with General Operating

Account Detail includes contributions to the University’s

building construction and renovation funds, investment

returns (net of amounts made available for operations),

change in pledge balances, long-term benet plan obligation

funding changes, and other infrequent transactions.

Collections

The University’s vast array of museums and libraries

contains priceless works of art, historical treasures, literary

works, and artifacts. These collections are protected and

preserved for public exhibition, education, research, and

the furtherance of public service. They are neither disposed

of for nancial gain nor encumbered in any manner.

Accordingly, such collections are not recorded for nancial

statement purposes. Proceeds on deaccessioned collections

are used to fund new collections or the direct care of

existing collections. Direct care is dened as general care

for the preservation of a collection.

Insurance programs

The University, together with the Harvard-aliated

teaching hospitals, has formed a captive insurance

company, Controlled Risk Insurance Company (CRICO), to

provide limited professional liability, general liability, and

medical malpractice insurance for its shareholders. The

University self-insures a portion of its professional liability

and general liability programs and maintains a reserve for

incurred claims, including those related to Harvard Medical

School activities not occurring in the aliated teaching

hospitals. CRICO provided malpractice coverage applies

with no deductible for medical professionals practicing

within Harvard’s University Health Services department,

the School of Dental Medicine, and the T.H. Chan School

of Public Health. The University also maintains reserves

for the self-insured portion of claims related to automobile

liability, property damage, and workers’ compensation;

these programs are supplemented with commercial excess

insurance above the University’s self-insured retention. In

addition, the University is self-insured for unemployment,

the primary retiree health plan, and all health and dental

plans for active employees. The University’s claims

liabilities are recognized as incurred, including claims that

have been incurred but not reported, and are included in

operating expenses.

Tax

The University is a tax-exempt organization under

Section501(c)(3) of the Internal Revenue Code.

On December 22, 2017, the Tax Cuts and Jobs Act (the

“Act”) was enacted. The Act impacts the University in

several ways, including the addition of excise taxes on

executive compensation and net investment income, as

well as new rules for calculating unrelated business taxable

income. The University records an estimate for related tax

expense based on currently available regulatory guidance of

the Act and continues to evaluate the impact of the Act on

current and future tax positions.

HARVARD UNIVERSITY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Use of estimates

The preparation of nancial statements in accordance with

U.S. GAAP requires management to make estimates and

assumptions that aect reported amounts and disclosures.

Actual results could dier from those estimates.

New accounting pronouncements

Eective July 1, 2021, the University adopted ASU

2018-15, Intangibles — Goodwill and Other — Internal-

Use Software (Subtopic 350-40): Customer’s Accounting

for Implementation Costs Incurred in a Cloud Computing

Arrangement That is a Service Contract. This guidance

aligns the requirements for capitalizing implementation

costs incurred in a hosting arrangement that is a

service contract with the requirements for capitalizing

implementation costs incurred to develop or obtain

internal-use software or software licenses. The University

adopted ASU 2018-15 prospectively. This guidance did not

have a signicant impact on the University’s consolidated

nancialstatements.

Eective July 1, 2021, the University adopted ASU 2020-07,

Presentation and Disclosures by Not-for-Prot Entities for

Contributed Nonnancial Assets. This guidance is intended

to increase transparency on how contributed nonnancial

assets are to be used and valued. The University adopted

ASU 2020-07 prospectively. This guidance did not have

a signicant impact on the University’s consolidated

nancialstatements.

Eective July 1, 2021, the University adopted ASU

2018-14, Disclosure Framework — Changes to the Disclosure

Requirements for Dened Benet Plans, which amends

ASC715, Compensation — Retirement Benets. This

accounting pronouncement modies the disclosure

requirements for employers that sponsor dened benet

pension or other postretirement plans. The University

adopted ASU 2018-14 on a retrospective basis. The eects

ofadopting this amendment are addressed in Note 11.

Eective July 1, 2020, the University adopted ASU 2019-03,

Not-for-Prot Entities (Topic 958): Updating the Denition

of Collections. The accounting pronouncements updates

the denition of “collections” to align with the denition

used by the American Alliance of Museums. The change

in the denition requires proceeds from sales of collections

to be used for acquisition of additional collections or

direct care of existing collections. The University adopted

ASU 2019-03 prospectively. The guidance did not have

a signicant impact on the University’s consolidated

nancialstatements.

3.

Investments are presented at fair value in accordance with

GAAP and under the guidelines prescribed by the HMC

investment valuation policy, which is reviewed and approved

by the HMC Board of Directors on an annual basis.

The majority of the University’s investments are managed

by HMC in the GIA, a pooled investment account that

consists primarily of endowment assets. Certain other

investments such as cash, short-term investments, split

interest agreements and other assets, are managed

separately from the GIA.