DEPARTMENT OF DEFENSE

DEFENSE HEALTH AGENCY

CONTRACT RESOURCE MANAGEMENT

FISCAL YEAR 2018

AUDITED FINANCIAL STATEMENTS

Table of Contents

Agency Head Message ..................................................................................... 1

Management’s Discussion and Analysis .......................................................... 2

Principal Statements ....................................................................................... 20

Notes to the Principal Statements ................................................................... 25

Other Information ........................................................................................... 41

Independent Auditor’s Reports ....................................................................... 59

1

Agency Head Message

The Military Health System (MHS) serves as the Department of

Defense’s singular health care delivery entity responsible and

accountable for effectively and efficiently maintaining and advancing

our dual missions of readiness and health-care delivery for our 9.5

million service member, retiree, and family member beneficiaries.

The MHS prides itself on its commitment to service and its corporate

culture which includes a strong obligation to transparency, especially

as we plan for a more integrated, higher-performing enterprise in light

of our significant Congressionally mandated transitions required by

the 2017 and 2019 National Defense Authorization Acts. The mission

of the MHS remains to support the warfighter, care for our warfighter

families and care for our patient. As in the past, our priority remains

readiness in support of the warfighting mission of the Department of

Defense, and we provide that through our high quality health care

system. The ultimate goal of this transition is a more integrated,

efficient and effective system of readiness and health that best

supports the lethality of the force. In order to achieve that lofty goal,

the MHS must ensure proper controls are in place, that they are

functioning as intended, and that we are maximizing our value to our

beneficiaries and to the Department.

The ongoing auditability of the MHS is a priority for each and every member of our team as each of us directly

contributes to our mission, regardless of rank or level, and the entire enterprise is committed to achieving an unmodified

opinion. We understand it will take everyone’s support to improve the reliability and accuracy of our data to enable us

to make informed decisions both now and in the future and make the best use of our available resources in order to

achieve our strategic goals and objectives. In order to continue our progress towards this goal, we have undertaken

corrective actions based on deficiencies and internal control weaknesses that our team has identified. More information

regarding the status of the internal control environment within the DHP Enterprise and the steps we are taking to

address these issues can be found in the Management Assurance section of this report.

I welcome and encourage all of our stakeholders to read this report. I am confident that in doing so, it will be clear that

the MHS is committed to transparency, efficiency, and effectiveness as we ensure mission alignment with Secretary

Mattis’ Department priorities to increase lethality, leverage strategic partnerships, and improve our business processes. I

thank the staff of the MHS for their tireless dedication and perseverance in delivering these strategic priorities every

day, our beneficiaries for their service and being the most deserving customers in the world, and all our stakeholders for

their incredible support as we engage in this endeavor.

Tom McCaffery

Principle Deputy Assistant Secretary of Defense for Health Affairs

2

DEPARTMENT OF DEFENSE

DEFENSE HEALTH AGENCY

CONTRACT RESOURCE MANAGEMENT

MANAGEMENT’S DISCUSSION AND

ANALYSIS

Management’s Discussion and Analysis

3

DEPARTMENT OF DEFENSE

DEFENSE HEALTH AGENCY

CONTRACT RESOURCE MANAGEMENT

MANAGEMENT’S DISCUSSION AND ANALYSIS

YEARS ENDED SEPTEMBER 30, 2018 AND 2017

I Description of the Reporting Entity

The reporting entity is the Contract Resource Management (CRM) division of the Defense Health Agency (DHA) of

the Department of Defense (DoD). Within DoD, the Office of the Under Secretary of Defense (OUSD) for

Personnel and Readiness (P&R), through the Office of the Assistant Secretary of Defense (OASD) for Health Affairs

(HA), has as one of its missions, operational oversight of the Military Health System (MHS), including the direct

care system (military hospitals), the private sector care system, and the Medicare-Eligible Retiree Health Care Fund

(MERHCF) for those beneficiaries dual-eligible for both Medicare and TRICARE. The Defense Finance and

Accounting Service-Indianapolis (DFAS-IN) provides accounting and financing activities for DHA.

The primary mission of the DHA, a Combat Support Agency, is to enhance the DoD and our nation’s security by

providing health care support for the full range of military operations and sustaining the health of all those entrusted

to our care, including active duty personnel, military retirees, certain members of the Reserve Component, family

members, widows, survivors, ex-spouses, and other eligible members. These beneficiaries receive direct care

through Military Treatment Facilities (MTFs), private sector care through TRICARE's civilian provider network,

prescription and mail order coverage through the TRICARE Pharmacy Program (TPHARM). Care is also provided

to members of the Coast Guard, the National Oceanic and Atmospheric Administration (NOAA), the Public Health

Service (PHS) and their families on a reimbursable basis.

The DHA supports the delivery of integrated, affordable, and high quality health services to beneficiaries of the

MHS, and executes responsibility for shared services, functions and activities of the MHS and other common clinical

and business processes in support of the Military Services. The DHA serves as the program manager of the

TRICARE health plan, medical resources, and the market manager for the National Capital Region (NCR) enhanced

Multi-Service Market. The DHA manages the execution of policy as issued by the OASD(HA) and exercises

authority, direction, and control over the inpatient facilities and their subordinate clinics assigned to the DHA in the

NCR Directorate.

The senior medical leadership, the Surgeons General, and DHA staff over the past several years have reexamined

DHA’s fundamental purpose, vision for the future and strategies to achieve that vision. The DHA is refocusing

efforts on the core business in which it is engaged: creating an integrated medical team that provides optimal health

services in support of our nation’s military mission—anytime, anywhere. The DHA has taken bold steps to redefine

how we work collaboratively with the Department of Veterans Affairs (VA) and our civilian partners to improve

coordinated care for wounded warriors and all whom we have the honor to serve. More will be discussed on this

topic in Section V, Other Management Information, Initiatives, and Issues.

The DHA has developed four strategic goals:

Empower and Care for Our People

Optimize Operations across the Military Health System

Co-create Optional Outcomes for Health, Well-being and Readiness

Deliver solutions to Combatant Commands

The DHA leads the MHS integrated system of readiness and health to deliver the Quadruple Aim:

Increased Readiness – ensuring that the total military force is medically ready to deploy and that

the medical force is ready to deliver supportive health services anytime and anywhere in support

of the full range of military operations, including on the battlefield or disaster response and

humanitarian aid missions.

Better Care – continuing to advance health care that is safe, timely, effective, efficient, equitable,

Management’s Discussion and Analysis

4

and patient- and family-centered.

Better Health – improving the health of a population, making the transformation from health care

to health by reducing the generators of disease and injury, encouraging healthy behaviors,

increasing health resilience, and decreasing the likelihood of illness through focused prevention.

Lower Costs – increasing value by focusing on quality, eliminating waste, and reducing

unwarranted variation. In the move toward value-based health care, we begin to consider the total

cost of care over time, not just the cost of care at a single point in time. There are both near-term

opportunities to become more agile in our decision making and longer-term opportunities to

change the trajectory of cost growth by building value and improving the health of all we serve.

In fulfillment of Section 701 of the 2017 National Defense Authorization Act (NDAA), the DoD implemented the

most sweeping changes to the TRICARE benefit structure since TRICARE was established in 1995. Contract

management adjusted to synchronize these changes with the DoD’s transition to the TRICARE 2017 contracts and

regional oversight. The TRICARE changes expand beneficiary choice, improve access to network providers,

modernize beneficiary cost-sharing, and enhance administrative efficiency.

The TRICARE program provides healthcare services to 9.4 million beneficiaries. The most current generation of the

TRICARE Managed Care Support Contracts went into effect January 1, 2018, which established two TRICARE

regions in the United States, East and West, with a single contract for each region. Before January 1, 2018, the

private sector care contracts were organized into three geographical regions –North, South, and West. The current

generation merged the North and the South regions, now called the East region.

Contractors are responsible for managing the delivery of health care to TRICARE's beneficiaries by developing and

maintaining a civilian provider network consisting of both primary care and specialist providers. The contractors are

also responsible for ensuring adequate access to health care, referring and authorizing beneficiaries for health care,

educating providers and beneficiaries about TRICARE benefits, credentialing providers, and processing claims.

The DHA is the administrative agency for TRICARE. The Agency provides oversight, payment to and management

of claims processors, monitoring/management of the Improper Payments Information Act, and preparation of

consolidated financial statements and footnotes. It is responsible for the management of the dental program,

Uniformed Services Family Health Plans and pharmacy programs, both retail and mail order, and MERHCF.

Contract Resource Management

The CRM in Aurora, Colorado, under the leadership of J8, Deputy Assistant Director, Financial Operations, Mr.

Jeffrey Zottola, Chief Financial Officer, is responsible for the accounting, financial support, and financial reporting

for TRICARE's centrally funded private sector health care programs and the TRICARE Retail Pharmacy Refunds

Program. The CRM provides budget formulation input, carries out budget execution and prepares component

financial statements and footnotes.

In addition, CRM is responsible for processing invoices received electronically from its contractors, and through the

TRICARE Encounter Data Set (TEDS), and reporting these transactions through accessible electronic media. The

CRM provides funding availability certification and financial program tracking for the centrally funded private

sector care programs. The CRM monitors budget execution through analysis of current year and prior years spending

and program developments. It also assists the Contract Management division, Program Integrity (fraud), and Case

Recoupment activities related to private sector care.

CRM uses Defense Health Program (DHP) funds provided by annual appropriations from the Congress of the United

States to reimburse private sector health care providers for services rendered to TRICARE beneficiaries and funding

from MERHCF for the health care provided through TRICARE for Life (TFL) programs.

During the last two years of CRM’s operation, funding was received from the following sources:

Management’s Discussion and Analysis

5

CRM Funding Sources

Fiscal Year (FY) MERHCF Funding (Billions) Annual Appropriations (Billions) *

2018 $8.2 $14.4

2017 $8.4 $15.0

* CRM received Funding Authorization Documents (FADs) for FY17/1889 of $15.0 billion through September 30, 2017. CRM

received FADs for FY18/1889 of $14.4 billion through September 30, 2018.

Defense Health Program

The TRICARE program consists of a combination of MTFs and regional networks of civilian providers that work

together to provide care to 9.4 million eligible beneficiaries. The MTFs include 51 inpatient facilities and 628

medical and dental clinics, staffed by 144,217 MHS personnel, in the United States and overseas that, in conjunction

with the Uniformed Services University of the Health Sciences (USUHS), serve as premier training grounds for

military medical personnel. If care is not available in MTFs, beneficiaries seek care from civilian providers paid

through the TRICARE program via the Managed Care Support Contracts and the TFL program.

For FY 2017, the Consolidated Appropriations Act, 2017, Public Law No. 115-31, became law May 5, 2017,

providing DoD funding for FY 2017, replacing the Continuing Resolution in effect since the beginning of the fiscal

year.

For FY 2018, the Consolidated Appropriations Act, 2018, Public Law No. 115-141, became law March 23, 2018,

providing DoD funding for FY 2018, replacing the Continuing Resolution in effect since the beginning of the fiscal

year.

Covered beneficiaries include but are not limited to:

Active Duty Service Members and Families

National Guard/Reserve Members and Families

Retired Service Members and Families

Retired Reserve Members and Families

Survivors

Former Spouses

Medal of Honor Recipients and Families

Private Sector Health Care Plans

Individuals have access to different levels and types of benefits depending on their beneficiary status. Active Duty

Service Members (ADSM) generally obtain care from MTFs. When necessary, active duty personnel may obtain

care from civilian providers at government expense. Active Duty Family Members (ADFM) as well as military

retirees and dependents who are not eligible for Medicare can choose from one of two main options:

TRICARE Prime, a managed care option, is comparable to health maintenance organization

(HMO) benefits offered in many areas. Each enrollee chooses or is assigned a primary care

manager (PCM), a health care professional who is responsible for helping the patient manage his

or her care, promoting preventive health services (e.g., routine exams and immunizations), and

arranging for specialty provider services as indicated. TRICARE Prime access standards apply to

the travel time to reach a primary care or specialty care provider, waiting times to get an

appointment, and waiting times in doctors’ offices. TRICARE Prime’s point-of-service (POS)

option permits enrollees to obtain care from TRICARE-authorized providers other than the

assigned PCM without a referral, but with deductibles and cost shares significantly higher than

those under TRICARE Select (Formerly TRICARE Standard and TRICARE Extra). All

beneficiaries who are not ADSM or ADFM pay annual enrollment fees and network copayments.

TRICARE Prime offers fewer out-of-pocket costs than TRICARE Select, but less freedom of

Management’s Discussion and Analysis

6

choice in selecting providers.

TRICARE Select, .a self-managed, preferred-provider option for eligible beneficiaries (except

ADSMs and TFL beneficiaries) not enrolled in TRICARE Prime. Beneficiaries pay lower out-of-

pocket costs if care is provided by a TRICARE-authorized network provider. A fixed fee is paid

for care for most services from a TRICARE network provider instead of paying a percentage of

the allowable charge. Certain services can also be received from non-network, TRICARE-

authorized providers, but will result in paying higher cost sharing amounts for out-of-network

care. Effective January 1, 2018, TRICARE Select replaced TRICARE Standard and TRICARE

Extra.

In addition, the following plans are among those available:

TRICARE Prime Remote (TPR) is a managed care option for active duty service members and

their families who live and work in remote locations.

TRICARE Prime Overseas (Remote/Non-Remote) is a TRICARE Prime option offered in

remote and non-remote overseas locations for permanently-assigned active duty service

members or Guard/Reserve members and their dependents to receive care from a network of

licensed, qualified physicians. Beneficiaries enrolled in Prime Overseas will be assigned an MTF

PCM. There are no out-of-pocket costs as long as care is received from the PCM or with a

referral. Care received without a referral is subject to POS fees.

TRICARE Select Overseas provides comprehensive coverage in all overseas areas. This plan

allows beneficiaries to seek care from any civilian provider although prior authorization may be

needed from the overseas contractor. Costs vary based on the sponsor’s military status.

Beneficiaries will be reimbursed for a portion of the costs after paying co-payments and meeting

deductibles. Effective January 1, 2018, TRICARE Select Overseas replaced TRICARE Standard

Overseas.

TRICARE For Life (TFL) was created as wraparound coverage to Medicare-eligible military

retirees by Section 712 of the Floyd D. Spence National Defense Authorization Act for FY 2001

(P.L. 106-398). TFL functions as a secondary payer to Medicare, paying out-of-pocket costs for

medical services covered under Medicare for beneficiaries who are entitled to Medicare Part A

based on age, disability, or end-stage renal disease (ESRD). TFL serves as the final payer for

Medicare Covered Benefits, and first payer for TRICARE benefits that are not covered in the

Medicare, or other health care insurance programs.

TRICARE Reserve Select is a premium-based health plan that qualified Selected Reserve

members may select with benefits similar to TRICARE Select.

TRICARE Retired Reserves is a premium-based health plan that qualified Retired Reserve

members may select with benefits similar to TRICARE Select.

TRICARE Young Adult Program (TYA) is a premium-based health plan that implements the

NDAA of FY 2011, allowing coverage for adult children until age 26 in response to the Patient

Protection and Affordable Care Act of 2010 requiring civilian health plans to offer such coverage.

TRICARE Pharmacy Program is a program that provides low cost pharmaceutical drugs to

TRICARE beneficiaries in MTFs, via TRICARE retail network pharmacies and through the

TRICARE Pharmacy Home Delivery Program (for CRM, this program may also be called

TRICARE Mail Order Pharmacy (TMOP)).

TRICARE Active Duty Dental Program (ADDP) is a program offered to TRICARE Active Duty

beneficiaries at military dental treatment facilities or civilian dental services. There are also two

premium-based programs: TRICARE Dental Program (TDP), which includes ADFMs, and

TRICARE Retiree Dental Program (TRDP).

Health Care Purchased From Civilian Providers

Claims for care provided by civilian providers are submitted to claims processors who work for the private sector,

managed care contractors. Claims are adjudicated to ensure that the patients are eligible, that care was provided by

authorized healthcare providers, for covered benefits and for the right price. A record of the transaction is submitted

to DHA in the form of a TEDS file. The TEDS records are run through a series of automated edits to ensure that the

Management’s Discussion and Analysis

7

data is accurate and that data standards are met. If the TEDS records pass these edits, the records are accepted, and

payment to the contractor is authorized.

In addition to payments made to contractors through the TEDS record process, TRICARE contractors are paid based

upon invoices that are submitted to CRM. The invoices are for administrative services provided for the management

of the healthcare benefit, such as the operation of TRICARE Service Centers, network development operations,

provider education services and other services that are non-healthcare in nature.

In addition to the direct healthcare/MTF systems and the private sector healthcare systems, DoD beneficiaries may

enroll in capitation rate plans in specific locations where Uniformed Services Family Health Plan (USFHP) facilities

are available. These plans include inpatient and outpatient services and a pharmacy benefit. The capitation rate is

paid by DoD. Beneficiaries who choose enrollment in these plans are ineligible for care in MTFs as well as benefits

under the TFL programs.

Medicare Eligible Retiree Health Care Plans

The FY 2001 NDAA significantly expanded the DoD health care benefits for Medicare-eligible military retirees,

their dependents and survivors. The NDAA established the TRICARE Pharmacy Program that began on April 1,

2001, and the TFL benefits that became effective on October 1, 2001.

The TRICARE Pharmacy Program authorizes eligible beneficiaries to obtain low-cost prescription medications from

TMOP and TRICARE network and non-network civilian pharmacies. Beneficiaries may also continue to use

military hospital and clinic pharmacies, at no charge.

Beneficiaries who are eligible for the Medicare program (over 65, End-Stage Renal Disease, survivors, etc.) can

receive care from Medicare participating providers through the TFL program. With this program TRICARE serves

as the final payer to Medicare and other health insurance for Medicare covered benefits, and first payer for

TRICARE benefits that are not covered by Medicare or other health insurance programs.

In accordance with DoD 7000.14-R, Financial Management Regulation, Volume 12, Chapter 16, CRM reports daily

obligations to MERHCF for healthcare purchased from civilian providers or “purchased care”. Daily claims are

validated by the voucher edit procedures required by the TRICARE/Civilian Health and Medical Program of the

Uniformed Services (CHAMPUS) Automated Data Processing Manual 6010.50-M, dated May 1999, to ensure that

only costs attributable to Medicare-eligible beneficiaries are included in payments drawn from MERHCF.

II Performance Measures

The Evaluation of the TRICARE Program: Fiscal Year 2018 Report to Congress Access, Cost, and Quality Data

through Fiscal Year 2017, reflects DHA’s mission and vision statements, updates and refines descriptions of core

values, and presents key results of the metrics supporting DHA’s Strategic Plan that focuses on how DHA defines and

measures mission success, and how DHA plans to continuously improve performance.

Stakeholder Perspective*

The $53.64 billion Unified Medical Program (UMP) presented in the FY 2018 President’s Budget,

including estimated outlays from MERHCF, is 3% higher that the FY 2017 actual expenditures, and

is 9% of total estimated DoD outlays.

The number of beneficiaries eligible for Department of Defense (DoD) medical care remained at

approximately 9.4 million between FY 2015 and FY 2017. The number of Prime-enrolled

beneficiaries has decreased annually since 2011, falling to 4.8 million in FY 2017, consistent with

the decrease in Active Duty and their family members.

TYA enrollment increased to just under 40,000 beneficiaries under age 26 enrolled in FY 2017, from

just over 38,000 in FY 2016. Prime enrollment was 43% of the total.

TRICARE Reserve Select (TRS) enrollment increased in FY 2017 to over 145,000 plans and almost

386,000 covered lives, while retired Reservists and their families in TRICARE Retired Reserve

(TRR) reached just over 3,000 plans and 8,100 covered lives.

Management’s Discussion and Analysis

8

MHS Workload and Cost Trends*

The percentage of beneficiaries using MHS services remained about the same between FY 2015 and

FY 2017, at between 85-86%.

Excluding TFL, total MHS workload (direct and purchased care combined) fell from FY 2015 to FY

2017 for inpatient care (-3%) and prescription drugs (-2%). Total outpatient workload increased by

1%.

From FY 2015 to FY 2017, direct care workload decreased for inpatient care (-6%) and prescription

drugs (-1%), but increased by 2% for outpatient care. Over the same period, direct care costs rose by

5%.

Excluding TFL, purchased care workload fell for inpatient care (-2%), outpatient care (less than 1%),

and prescription drugs (-4%). Overall, purchased care costs decreased by 8%, due largely to the

resolution of fraudulent compound drug prices at the end of FY 2015.

The purchased care portion of total MHS health care expenditures decreased from 55% in FY 2015

to 52% in FY 2017.

In FY 2017, out-of-pocket costs for MHS beneficiary families under age 65 were between $5,700

and $7,200 lower than those for their civilian counterparts, while out-of-pocket costs for MHS senior

families were $3,100 lower.

Lower Cost*

MHS estimated savings include nearly $850 million in retail pharmacy refunds in FY 2017 and $105

million in Program Integrity (PI) activities in calendar year 2016.

Increased Readiness*

Force Health Protection: At the end of FY 2017, the overall medical readiness of the total force

was at 87%, with the Active Component at 88% and the Reserve Component at 85%, all equaling or

exceeding the strategic goal of 85%. Dental readiness, at 96%, exceeded the MHS goal of 95%. The

MHS surgical community is leading the way in identifying and enumerating critical clinical

readiness skill sets.

Better Care*

Access to Care: In FY 2017, about 84% of Prime enrollees reported at least one outpatient visit,

comparable to the civilian HMO benchmark, while administrative data reflect 82% of non-Active

Duty enrollees had at least one recorded primary care visit and 40% had five or more visits. Patient-

Centered Medical Home (PCMH) primary care administrative measures indicate MTF enrollees saw

their primary care provider 59% of the time, and a PCMH team member 92% of the time; days to

their next 24-hour or acute appointments declined to 0.93 days [less than one day], and continued to

meet the seven-day standard for future appointments. Beneficiary enrollment in and usage of secure

messaging continued to increase in FY 2017. Dispositions and bed-days per 1,000 enrollees

continued to improve, decreasing 26% and 27%, respectively, from FY 2012. The new standardized

DHA/Service survey of beneficiary outpatient experience shows strong and stable ratings of access

to care at 83%.

Hospital Quality of Care: MTFs and MHS-supporting civilian hospitals report results are

comparable to many Joint Commission national hospital quality measures and consistent with the

national Joint Commission benchmarks in the perinatal care measures.

Outpatient Care: MHS Healthcare Effectiveness Data and Information Set (HEDIS

®

) rates exceed

the national standards at the 90

th

percentile for colorectal cancer screening, mental health follow-up

visits post hospitalization, and treatment of children with upper respiratory infection, and surpass the

national 75

th

percentile for cervical cancer screenings, low back pain, well-child visits, and treating

children for pharyngitis.

Beneficiary Ratings of Inpatient Care:

o Overall Hospital Rating: Direct care has shown improved patient hospital ratings from FY

2015–2017, with Service meeting or exceeding the national Hospital Consumer Assessment

of Healthcare Providers and Systems (HCAHPS) benchmark in the medical and surgical

product lines. While ratings continue to improve in the obstetric product line for all

Services and purchased care, they remain below the HCAHPS benchmark.

Management’s Discussion and Analysis

9

o Beneficiary Recommendation of Hospital: MHS beneficiary ratings for both direct and

purchased care are above the HCAHPS benchmark in the medical and surgical product line,

while Service and purchased care ratings are close to or above the national HCAHPS

benchmark in FY 2017 for the obstetric product line.

Patient Safety: The MHS direct care system has been focusing on reducing Wrong-Site Surgery

Sentinel Events (WSS SEs) through the development and dissemination of prevention tool kits,

educational webinars, leadership engagement and direct MTF coaching. Compared to FY 2016, FY

2017 saw a 32% reduction in WSS SEs.

MHS Provider Trends: The number of TRICARE network providers increased by 21% from FY

2013 to FY 2017. The total number of participating providers increased by 9% over the same time

period.

Access for TRICARE Standard/Extra Users: Results from the first year of the congressionally

mandated four-year survey (2017–2020) of civilian providers and MHS non-enrolled beneficiaries

shows 8 of 10 physicians accept new TRICARE Standard patients, a higher acceptance rate than

reported for behavioral health providers.

*Note: Source of all metrics presented above is the Evaluation of the TRICARE Program: Fiscal Year

2018 Report to Congress Access, Cost, and Quality Data through Fiscal Year 2017.

III Analysis of Financial Statements

Comparative Financial Data

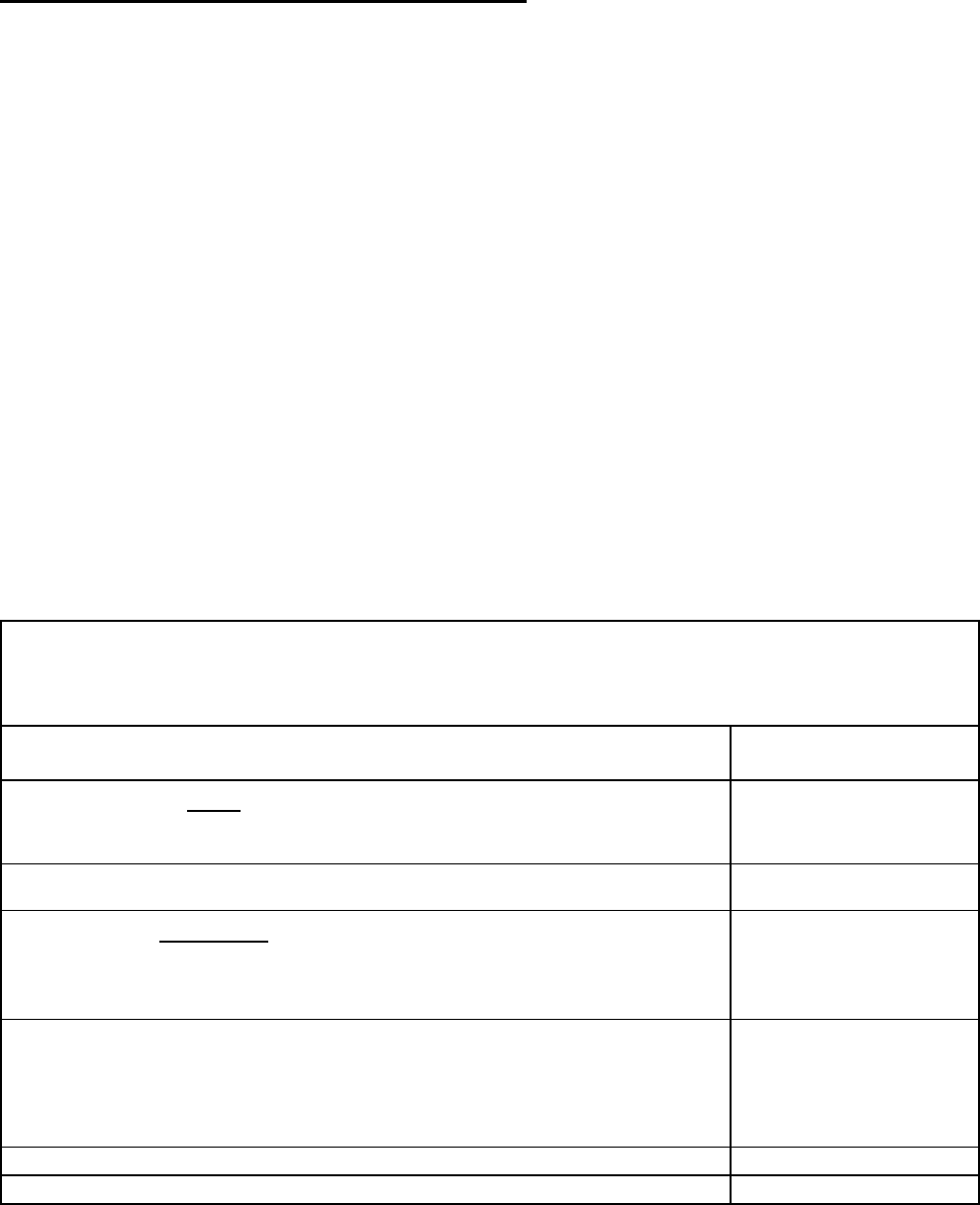

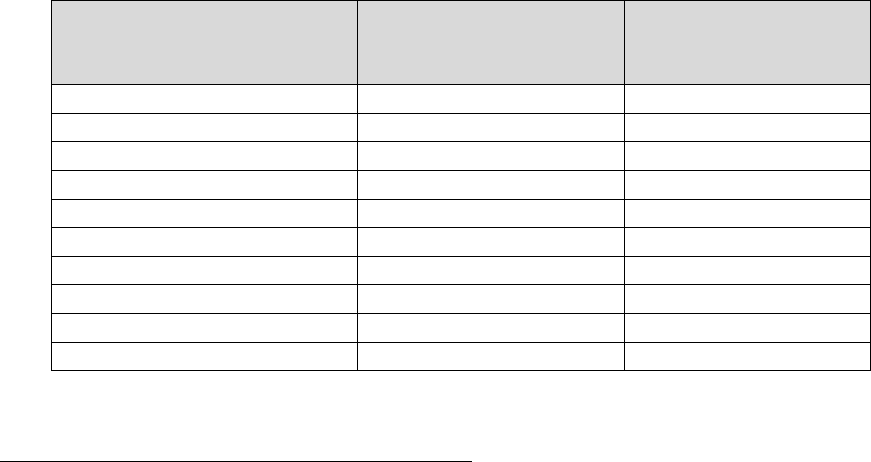

The following table presents comparative financial statement information for CRM.

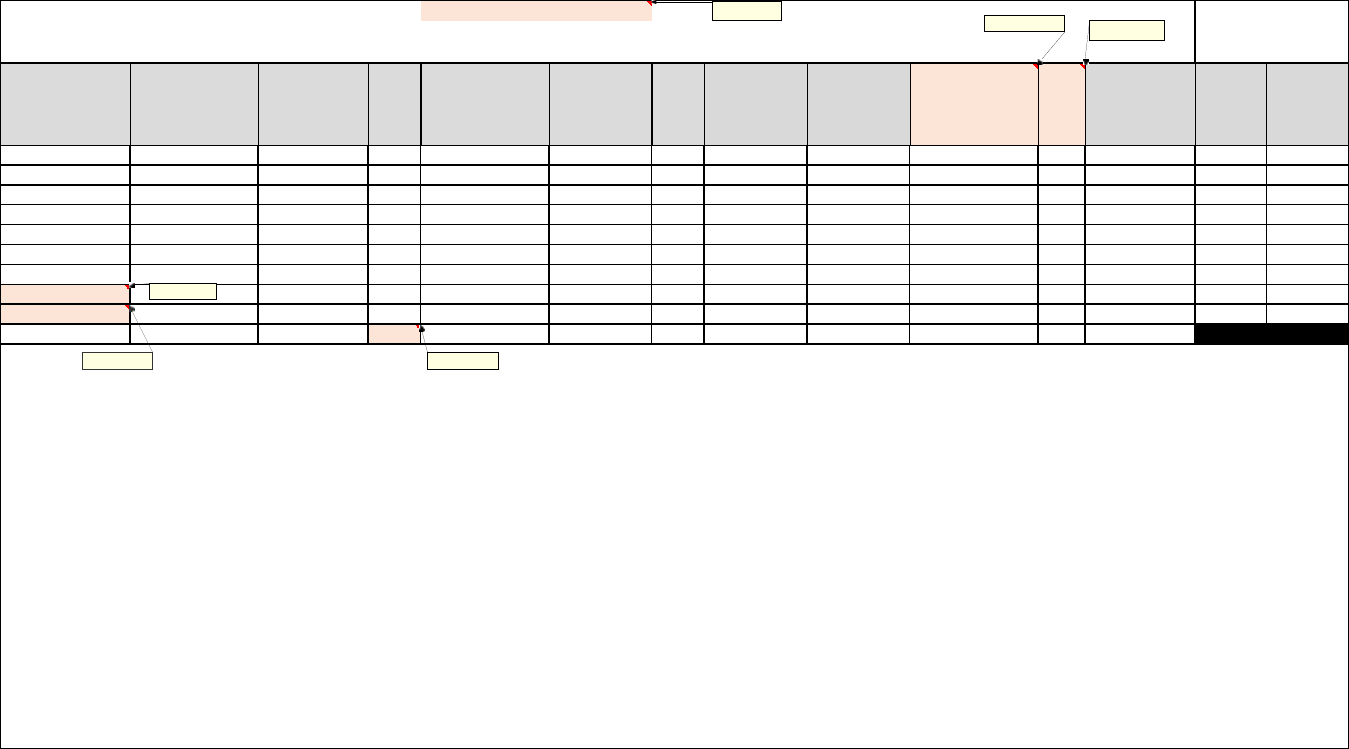

Contract Resource Management

Table of Key Measures

for the years ended September 30, 2018 and 2017

($ in Thousands) Current FY Prior FY Increase/ (Decrease)

$ %

Costs

1

Total Financing Sources

$14,729,933 $14,589,443

$140,490 1.0%

Less: Net Cost

$9,274,571 $22,931,861

($13,657,290) -59.6%

Net Change of Cumulative Results of

Operation $5,455,362 (8,342,418) $13,797,780 165.4%

Net Position

2

Assets:

Fund Balance with Treasury $1,393,187 $1,675,116 ($281,929) -16.8%

Accounts Receivable $448,729 $340,194 $108,535 31.9%

Total Assets $1,844,152 $2,015,329 ($171,177) -8.5%

Liabilities:

Accounts Payable ($492,098) ($340,280) $151,818 44.6%

Military Retirement & Other Federal

Employment Benefits ($179,548,375) ($184,901,446) ($5,353,071) -2.9%

Total Liabilities ($180,042,709) ($185,241,745) ($5,199,036) -2.8%

Net Position (178,198,557) (183,226,416) $5,027,859 2.7%

1

Source: Statement of Net Cost and Statement of Changes in Net Position

2

Source: Balance Sheet

Management’s Discussion and Analysis

10

Total Financing Sources

Total Financing Sources increased by $140.5 million (1%) because of an increase in residual payments for FY17

disbursed in FY18, along with cost increases for Phase In/Out costs and incentives under the Managed Care Support

contracts.

Net Cost

Total Net Cost of Operations decreased $13.7 billion (60%) for the reasons noted below.

Total Costs

Intragovernmental costs decreased $87.2 million (11%) due to decreases in the TMOP benefit program of $87.0 million

and Air Force collection costs of $1.5 million, offset by an increase in Department of Justice (DoJ) - Case Recoupments

of $0.4 million accounting for 101% of the decrease.

Public costs, other than losses/gains from actuarial assumption changes, decreased $2.5 billion (18%) due to a net

decrease in expenses before losses/(gains) from actuarial assumption changes of $2.7 billion, 108% of the decrease.

Losses/(gains) from actuarial assumption changes decreased $10.8 billion (120%) (see below).

The actuarial liability for Military Pre Medicare-Eligible Retiree Health Benefits has three components that affect net

cost. The first, Costs Other than Losses/Gains from Actuarial Assumption Changes, mentioned above, decreased $2.5

billion. The second, Losses/(Gains) from Actuarial Assumption Changes decreased $10.8 billion and the third, Benefit

Outlays, increased $0.2 billion, netting to a decrease in actuarial expenses of $13.5 billion. The actuarial liability is

discussed in detail in Note 9.

Total Revenue

Total earned revenue increased $256.5 million (26%). Intragovernmental revenue increased $7.1 million (1%)

attributable to an increase in revenue from the Coast Guard of $5.1 million, PHS of $1.5 million, and NOAA of $0.4,

accounting for 99% of the increase.

Public revenue increased $249.4 million (58%) attributable to an increase in revenue from TRS of $8.3 million and

Prime Enrollment Fees of $241.3 million, accounting for 100% of the increase.

Net Change in Cumulative Results of Operation

Net Change in Cumulative Results of Operation increased $13.8 billion (165%) due to an increase in financing sources

and a decrease in net costs as discussed above.

Funds Balance with Treasury (FBWT)

FBWT decreased $281.9 million (17%). The decrease is attributable to obligations not yet disbursed of $395.8 million

and programmatic FAD decreases of $626.4 million, offset by a decrease in obligations of $550.7 million, net

appropriation exchanges of $37.1 million, and FAD returns and deobligations of $141.6 million, accounting for 104%

of the decrease.

Accounts Receivable

Accounts Receivable increased $108.5 million (32%).

Federal Accounts Receivable increased $6.2 million (14%) attributable to increases in billings to the Coast Guard of

$5.6 million and to the PHS of $0.7 million, accounting for 100% of the increase.

Management’s Discussion and Analysis

11

Non-Federal Accounts Receivable increased $102.3 million (35%), attributable to an increase in Other Receivables of

$116.8 million offset by a decrease of $14.5 million in the TRICARE Retail Pharmacy Refunds Program.

The decrease in the TRICARE Retail Pharmacy Refunds Program is due to decreases in routine billings and pharmacy

collections. The accounts receivable balance at year end is also affected by the timing of billings and collections as well

as the calculated accrual.

The increase in Other Receivables of $116.8 million, mentioned above, was primarily due to net increases in Office of

General Counsel (OGC) cases of $62.3 million, contractor held debt of $19.5 million, and TEDS claims/TRICARE

Claims Management (TCM) and other of $37.4 million, accounting for 102% of the increase.

Total Assets

Total Assets decreased $171.2 million (9%), primarily due to the decrease in Funds Balance with Treasury of $281.9

million offset by an increase in Accounts Receivable of $108.5 million.

Accounts Payable

Accounts payable increased $151.8 million (45%), primarily attributable to increases in the Managed Care Support

contract of $72.2 million, MTF Enrollees of $12.8 million, Supplemental Health Care of $12.2 million, Active Duty

Dental of $9.4 million, and Capital and Direct Medical Education Costs of $38.4 million, totaling $145.0 million, 96%

of the increase.

Military Retirement and Other Federal Employment Benefits

Annually, the DoD Office of the Actuary (OACT) calculates this actuarial liability at the end of each fiscal year using

the current active and retired population plus assumptions about future demographic and economic conditions.

Note 9 of the financial statements reflects two distinct types of liabilities related to Military Retirement and Other

Federal Employment Benefits. The line entitled “Military Pre Medicare–Eligible Retiree Health Benefits” represents

the actuarial (or accrued) liability for future health care benefits that are not yet incurred. The line entitled “Other”

represents the incurred-but-not-reported reserve amount which is an estimate of benefits already incurred but not yet

reported to DoD for all DHP beneficiaries excluding those from the retiree population.

The DHA actuarial liability is adjusted at the end of each fiscal year. The 4

th

Quarter, FY 2018 balance represents the

September 30, 2018 amount.

Total Liabilities

Total Liabilities decreased $5.2 billion (3%), primarily due to the decrease in Military Retirement and Other Federal

Employment Benefits, the actuarial (or accrued) liability for future health care benefits that are not yet incurred

discussed above.

Net Position

Net Position decreased $5.0 billion (3%), due to the net decreases discussed above.

IV Analysis of Systems, Controls and Legal Compliance

Systems

CRM is positioned to achieve positive audit results due to exceptions granted to the program by the U.S. Treasury; the

U.S. Treasury prepares disbursements from data directly submitted by CRM. The Purchased Care Program managed by

CRM includes an immense volume of claims processed by two regional Health Care contractors, the TRICARE Dual

Eligible Fiscal Intermediary (TDEFIC) contractor, a foreign claims contractor, and a pharmaceutical contractor to

Management’s Discussion and Analysis

12

process retail and mail order prescriptions. Contract amendments are made to incorporate policy or administrative

changes, as needed.

To track these programs, CRM uses the TEDS, a financial feeder system, through which all claims are processed to

Oracle Federal Financials (OFF). OFF contains TCM, Accounts Receivable, Accounts Payable, Purchase Orders and

the General Ledger modules. CRM sends OFF trial balances to the Defense Finance and Account Services-Indianapolis

(DFAS-IN), through the Defense Department Reporting System-Budgetary (DDRS-B), who reviews the balances for

proprietary to budgetary adjustments, prepares journal vouchers in DDRS and compiles the financial statements.

The initiative to improve controls, increase efficiency, and documentation are contributing factors in the reduction of

the risks and misstatements that can occur within FBWT. The risk areas are monitored ensuring prompt action if

fluctuation occurs. Many processes are automated, so it is important to consider information systems and the effects on

inherent risk. The asserted inherent risk revealed from the test samples indicated the risk components are susceptible to

a material misstatement in the area of:

Improper payments

Inaccurate claims paid

Unauthorized reimbursed claims

Inaccurate electronic postings

Incorrect number or amount of claims transmitted

Discrepancies between the U.S. Treasury and CRM

Intragovernmental Payment and Collection (IPAC) amounts not accurately reported to the U.S.

Treasury

The CRM has established consistent business rules for management control impacting disbursing and collection

activities, and the related banking and U.S. Treasury reconciliations.

With processes and procedures in place and the continued risk monitoring, monthly reconciliations are performed to

ensure balances reconcile to the U.S. Treasury on a monthly, quarterly, and fiscal year basis.

The CRM uses OFF to track commitments and obligations for its purchases. These transactions flow through the CRM

Unadjusted Trial Balance that is submitted to DFAS-IN and becomes the primary source into the financial statements.

The DoD recognizes the significance and impact of Financial Management Systems (FMS) in obtaining unmodified

audit opinions, as evidenced by implementation of the Standard Financial Information Structure (SFIS) and Assertion

Package Tabs that focus on FMS and key feeder systems. CRM continues to improve financial management and feeder

system processing and eliminate weaknesses.

The CRM is responsible for implementing and maintaining FMS that substantially comply with Federal financial

management system requirements, Federal accounting standards, and the United States Standard General Ledger

(USSGL) at the transaction level. The CRM determined that the FMS substantially complied with the Federal financial

management systems requirements, Federal accounting standards, and application of the USSGL at the transaction level

as of September 30, 2018.

The September 2007 Defense Business Systems Management Committee (DBSMC) resulted in the Investment Review

Board (IRB) directing the DHA E-Commerce System (DHA ECS) program, as a Target Accounting System, to

“comply with the OUSD (C) memorandum, ‘SFIS Implementation Policy’ dated August 4, 2005.” The DHA achieved

SFIS compliance during FY 2011. The DHA continued to maintain SFIS compliance through FY 2018. In addition, the

IT management and technical staff prepared for an SFIS compliance assessment conducted by the DoD Joint

Interoperability Test Center during FY 2017 and FY 2018. Corrective actions for all findings were implemented by

October 1, 2018.

Management’s Discussion and Analysis

13

TEDS

TEDS is the entry point from the Health Care Support Contactors. The data includes various categories of records that

include Institutional, Non Institutional, and Provider health plan information. TEDS is primarily required by DHA to

account for the expenditure of government funds and to develop statistical information used for analysis by DHA for

reporting to the Congress of the United States, the Executive Branch, for developing trends and budget projections and

for determining the loss to the government when DoJ institutes criminal or civil action against a provider who has been

under investigation. During FY 2018, the TED Production environment was hosted at two different locations:

October 1, 2017 - June 22, 2018 Defense Information System Agency Oklahoma City (DISA-OKC)

June 23, 2018 - Present - Defense Information System Agency San Antonio (DISA-SATX).

Statement on Standards for Attestation Engagements (SSAE) No. 18, Service Organization Control (SOC) reports are

available for the TRICARE Manage Care regional contracts – West (Health Net Federal Services) and East (Humana

Military Healthcare), along with their subcontractors’ claims processing organizations, West (Palmetto Government

Benefit Administrators (PGBA)) and East (Wisconsin Physicians Services (WPS)). SOC reports are also available for

the Mail Order and Retail Pharmacy (TPharm-Express Scripts), TDEFIC (WPS), Pharmacy Data Transaction Services

(PDTS) (Change Healthcare), and the TRICARE Overseas Program (International SOS Government Services, Inc.

(ISOS)) as well as its subservice organization (WPS).

Once claims enter the claims processing systems at the various contractors, they are subjected to various edits including

patient eligibility (verified via the Defense Enrollment Eligibility Reporting System (DEERS)), regional or TDEFIC

eligibility, and provider eligibility. If the claims pass those edits, the benefit calculations occur based on programmed

payment rules and reimbursement methods determined by TRICARE. The claims processing systems are able to

determine the appropriate reimbursement methodology based on information included in the claims such as type of

service, provider record, claim form type, etc.

On a daily basis, the contractors submit the claims that successfully pass their edits as TEDS records to DHA. The

incoming TEDS are required to pass another set of edits in-house at DHA before they are accepted and paid.

As reported during previous fiscal years, the TED application, which is a major claims-based feeder system for the

CRM financial statements, did not have a continuity of operations recovery site (COOP). DHA however, had been

working on a substantial project to migrate this application to DISA managed platforms to resolve these technical and

COOP related issues. Phase 1 of this effort was completed on August 22, 2017 when the TED system was migrated

from ageing outdated technology to a newer internal cloud-based hosting service platform at DISA-OKC.

The second phase of the migration was initiated on June 22, 2018, wherein the Production environment for TED was

copied from DISA-OKC to DISA-SATX. Upon completion of this effort, the environment hosted at DISA-OKC

became the COOP Platform supporting any Disaster Recovery requirements. Since this phase is complete TED has an

operational COOP site and DHA-CRM closed this associated risk.

E-Commerce

The DHA ECS is an integrated, centralized major system that improves DHA’s core financial, contracting and business

processes by providing a seamless integrated financial and contracting system. It uses commercial off-the-shelf

(COTS) software and hardware to provide a network-based, multi-user system with the essential tools to manage and

administer the TRICARE financial and contracting activities. The core financial solution embedded in the DHA ECS,

OFF, is a Financial Systems Integration Office (FSIO) (formerly known as the Joint Financial Management

Improvement Program [JFMIP]) certified financial system. This component is integrated with a contract management

component and a management control component. The management control component enables Web-based queries of

TRICARE contracting and financing information directly against a single database and permits direct reporting of

program status and tracking information to management.

Management’s Discussion and Analysis

14

OFF

OFF is the financial subsystem of the DHA ECS. It supports budget and accounting/finance functions and healthcare

(TEDS) claims processing. Since 2009, the OFF financial subsystem has employed DISA hardware at the OKC data

center.

The accounting/finance function provides support for activities associated with establishing and administering the

accounting classification structure, the standard general ledger and subsidiary account structure. The accounting

function interfaces with the contracting functions to obtain contract data for issuing payments and maintaining financial

records. OFF is used by CRM and OGC for debt management. It uses external and internal interfaces to provide

financial reports, make payments and to provide management information to other federal government agencies,

financial agencies and institutions.

The healthcare (TEDS) claims processing function is performed by the OFF-TCM extension. TCM is a custom built

extension to OFF which converts healthcare (TEDS) data into financial data that can then be processed by standard

(COTS) OFF. The TCM conversion of healthcare data is of critical importance to the accuracy of the financial

information presented in the CRM financial statements. TRICARE processed about 186 million claims (invoices)

valued at approximately $18.4 billion during FY 2018. The financial conversion, processing and posting of TEDS data

from commitment/obligation through payable/receivable is 100% automated. In addition to creating budgetary and

accounting transactions, TCM supports the TEDS system by providing daily financial data to TEDS. Without the data

received from the OFF-TCM extension the TEDS system would be unable to process and properly edit the contractor’s

daily data submissions. TEDS functions supported by the OFF-TCM data provided include:

header and detail data editing used for government acceptance of services

funds control at both the commitment and obligation level

prevention of duplicate billings at the header level

The Organizational Execution Plan (OEP) and investment certification process resulted in the Weapon System Life

Cycle Management/Materiel Supply and Services Management (WSLM/MSSM) Investment Review Board (IRB)

recommending a conditional approval. The IRB required DHA to submit an assessment as to whether the system

performs acceptance activities for unclassified Federal Acquisition Regulation (FAR) based contract/orders, and

provides a plan for receiving associated invoice/shipment data from the Invoicing, Receipt, Acceptance and Property

Transfer (iRAPT) system (formerly known as Wide Area Workflow [WAWF]) and posting acceptance data.

During Q3 FY 2017, the DHA ECS program technical staff deployed all OFF application software interface and

configuration changes associated with the iRAPT interface project. Activation of the Global Exchange (GEX) support

of the interface is fully functional.

The OFF application is a current; fully supported Version of R-12. The DHA ECS program successfully deployed the

Version R-12 technical upgrade in January 2016. The CRM remains compliant through FY 2018.

As main participants of the TRICARE Retail Pharmacy Refund Program, MERHCF/DHA-CRM, along with the Health

Care Data Analysis (HCDA) Group, receive and use pharmacy files as a basis for demand letters, billing and invoicing,

the calculation of penalties, interest and administrative costs, and dispute tracking. Using existing E-Commerce

toolsets, the Pharmacy Modernization Project was deployed in FY 2015 to streamline billings, collections,

reconciliations, dispute resolutions, and pricing changes. Since deployment of the Pharmacy Modernization Project

collections have increased significantly to an average of 98% p

er bill quarter.

During FY 2018, the DHA ECS Program continued to sustain and enhance all deployed phases through Phase IV of the

Pharmacy Modernization Project. Development efforts for Phase V, which is expected to further streamline the dispute

resolution process, is planned for FY 2019.

Controls & Legal Compliance

The CRM is responsible for understanding and complying with applicable provisions of laws, regulations, and

contracts, including those that affect the financial statements. The CRM is not aware of any undisclosed pending or

Management’s Discussion and Analysis

15

threatened litigation, claims, and assessments, the effects of which should be considered when preparing the financial

statements. There are no known:

Violations or possible violations of laws or regulations, the effects of which should be disclosed in the

financial statements or as a basis for recording a loss contingency.

Material liabilities or gain or loss contingencies that are required to be accrued or disclosed that have

not been accrued or disclosed.

Unasserted claims or assessments that are probable of assertion and must be disclosed that have not

been disclosed.

Anti-Deficiency Act, 31 U.S.C. §§ 1341, 1342, 1350, 1351, 1517: ANTI-DEFICIENCY ACT

The Anti-deficiency Act (ADA) prohibits federal employees from obligating in excess of an appropriation, before funds

are available or from accepting voluntary services. As required by the ADA, DHA-CRM notifies all appropriate

authorities of any ADA violations. The DHA-CRM management has taken and continues to take necessary steps to

prevent ADA violations. Investigations of any violations will be completed in a thorough and expedient manner. The

DHA-CRM remains fully committed to resolving ADA violations appropriately and in compliance with all aspects of

the law. The CRM is not aware of any violations of the Anti-deficiency Act that must be reported to the Comptroller

General, Congress, and the President for the year ended September 30, 2018.

Prompt Payment Act, 31 U.S.C. §§ 3901-3907; Prompt Payment Act

In 1982, Congress enacted the Prompt Payment Act (PPA) to require federal agencies to pay their bills on a timely

basis, to pay interest penalties when payments are made late, and to take discounts only when payments are made by the

discount date. DHA-CRM uses iRAPT (formerly WAWF) system to ensure compliance with this statutory requirement.

Provisions Governing Claims of the United States Government as provided in 31 U.S.C. §§ 3711-3720E (including

provisions of the Debt Collection Improvement Act of 1996, (DCIA), as amended by the Digital Accountability and

Transparency Act of 2014); Debt Collection Improvement Act of 1996

The Debt Collection Improvement Act of 1996 (DCIA), as amended by the DATA Act, requires that Federal agencies

refer delinquent debts to Treasury within 120 days and take all appropriate steps prior to discharging debts. DHA-CRM

follows applicable requirements for establishing and collecting validated debts, ensuring compliance with Debt

Collection statutes and regulations.

Digital Accountability and Transparency Act of 2014 (DATA Act), 31 U.S.C. § 6101 note. The DATA Act amended the

Federal Funding Accountability and Transparency Act of 2006 (FFATA). DIGITAL ACCOUNTABILITY AND

TRANSPARENCY ACT OF 2014

The Digital Accountability and Transparency Act of 2014 (DATA Act) expands the Federal Funding Accountability

and Transparency Act of 2006 to increase accountability and transparency in federal spending, making federal

expenditure information more accessible to the public. It directs the Federal Government to use government-wide data

standards for developing and publishing reports and to make more information, including award-related data, available

on the USASpending.gov Web site. The standards and Web site allow stakeholders to track federal spending more

effectively. Among other goals, the DATA Act aims to improve the quality of the information on USASpending.gov, as

verified through regular audits of the posted data, and to streamline and simplify reporting requirements through clear

data standards. DHP Enterprise complies with the DATA Act; making its expenditures accessible to the public on

USASpending.gov.

Management Assurances

The Federal Managers’ Financial Integrity Act (FMFIA) requires agencies to assess the effectiveness of internal control

and provide an annual statement of assurance regarding internal accounting and administrative controls, including

controls in program, operational, and administrative areas as well as accounting and financial reporting. The DHA-

CRM conducted its assessment of risk and internal control in accordance with the Office of Management and Budget

(OMB) Circular No. A-123, Management’s Responsibility for Enterprise Risk Management and Internal Control

and

Management’s Discussion and Analysis

16

the Green Book, Government Accountability Office (GAO)-14-704G, Standards for Internal Control in the Federal

Government. Based on the results of its assessment, DHA-CRM can provide reasonable assurance that internal controls

over operations, reporting, and compliance were operating effectively as of September 30, 2018.

The DHA-CRM conducted its assessment of the effectiveness of internal controls over operations in accordance with

OMB Circular No. A-123, the GAO Green Book, and the FMFIA. Based on the results of this assessment, the DHA-

CRM can provide reasonable assurance that internal controls over operations, reporting, and compliance were operating

effectively as of September 30, 2018.

The DHA-CRM conducted its assessment of the effectiveness of internal controls over reporting (including internal and

external financial reporting) in accordance with OMB Circular No. A-123, Appendix A. Based on the results of this

assessment, the DHA-CRM can provide reasonable assurance that the internal controls over operations, reporting

(including internal and external financial reporting as of September 30, 2018), and compliance were operating

effectively as of September 30, 2018.

The DHA-CRM also conducted an internal review of the effectiveness of the internal controls over the integrated

financial management systems in accordance with Federal Financial Management Improvement Act (FFMIA) of 1996

(Public Law 104-208) and OMB Circular No. A-123, Appendix D. Based on the results of this assessment, the DHA-

CRM can provide reasonable assurance that the internal controls over the financial systems are in compliance with the

FFMIA and OMB Circular No. A-123, Appendix D, as of September 30, 2018.

Status of Audit Findings

Consistent with government-wide financial reform and the President’s Management Agenda, one of the goals of DoD is

to improve operational, day-to-day accounting and financial management, and achieve an unmodified audit opinion on

each DoD component’s financial statements. This requires Military Departments, Defense Agencies, and other DoD

Components that are required to prepare financial statements, to develop and implement broad improvement plans and

take appropriate actions to achieve and maintain unmodified audit opinions.

The CRM received unmodified opinions for FY 2010 through FY 2018. FY 2017 and FY 2018 had no reportable

conditions and, as such, there are no status updates for reportable conditions.

DHA Program Integrity Office

The DHA Office of Program Integrity (PI) manages anti-fraud and abuse activities for the DHA to safeguard

beneficiaries and protect benefit dollars. The PI responsibilities include:

Central coordinating office for allegations of fraud and abuse within the TRICARE Program.

Develops and executes anti-fraud and abuse policies and procedures.

Provides oversight of contractor program integrity activities.

Develops cases for criminal prosecutions and civil litigations.

Coordinates investigative activities with Military Criminal Investigative Offices, as well as other

federal, state, and local agencies.

Initiates administrative measures

DHA PI had another active year in supporting ongoing investigative actions. During calendar year 2017, 690 active

investigations were managed, 304 new cases were opened, and 1,086 leads/requests for assistance were responded to.

DHA PI received and evaluated 451 new qui tams. A qui tam is a provision of the Federal Civil False Claims Act

(FCA) that allows private citizens, known as relators, to file lawsuits in the name of the U.S. Government alleging that

private companies—usually their employer—have submitted fraudulent claims for government payment. The private

whistleblowers who file these qui tam lawsuits receive a percentage of the settlement or judgment amount if a

settlement or judgment is reached. For more information, please refer to DHA’s “Program Integrity Operational

Report” dated January 1, 2017 through December 31, 2017. The FY 2018 data will not be available until published in

April 2019, due to the time required to compile 4th Quarter, FY 2018 data.

Management’s Discussion and Analysis

17

V Other Management Information, Initiatives, and Issues

TRICARE Standard Discount Program (SDP) formerly known as Mandatory Agreements Retail Refunds (MARR)

The SDP (Program 006) is a Standard or Minimum Refund, formerly known as MARR, on a Section 703 Covered

Drug. It is by law equal to the difference between Non-Federal Average Manufacturer Price (Non-FAMP) and Federal

Ceiling Price (FCP) (FCP = 76% x Non-FAMP).

The NDAA for FY 2008, §703 enacted 10 U.S.C. 1074g(f) which mandated all covered TRICARE Retail Pharmacy

Network prescriptions filled after January 28, 2008, be subject to FCP.

The initial rule, published in the Code of Federal Regulations at 32 C.F.R. 199.21(q), subjected the TRICARE retail

pharmacy program to pricing standards known as FCP by prohibiting pharmaceutical manufacturers from receiving

more than the FCPs for pharmaceuticals purchased by DoD for the TRICARE retail pharmacy program.

The OGC requested waiver/compromise authority from DoJ, received it, and has resolved all pending

waiver/compromise requests applicable to the “Retro Period” (January 2008 through June 2009) based upon the

provisions of 32 C.F.R. §199.11.

TRICARE Additional Discount Program (ADP) formerly known as Voluntary Agreements Retail Rebates (VARR)

The DHA initiated a new retail pharmacy rebate program during FY 2007, ADP, formerly known as VARR.

Manufacturers may offer rebates to the DoD for pharmaceutical agents dispensed through the TRICARE Retail

pharmacy network. The Uniform Formulary VARR (UF-VARR) is contingent upon pharmaceutical agents being

included on the 1

st

(generic drugs) or 2

nd

(formulary brand drugs) tiers of the DoD Uniform Formulary. There are two

types of additional discounts:

ADP #1 (Program 009) - WAC (% of Wholesale Acquisition Cost): The manufacturer’s list price for

the drug to wholesalers or direct purchasers in the United States, not including prompt pay or other

discounts, rebates or reductions in price, as reported in wholesale price guides or other publications

of drug pricing data.

ADP #2 (Program 010) – (FCP - additional discount): The maximum price the manufacturer can

charge for a Federal Supply Schedule (FSS) listed drug to the Big 4 - VA, DoD, PHS, and the Coast

Guard; calculated annually by VA using Non-FAMP and other data submitted by the manufacturer.

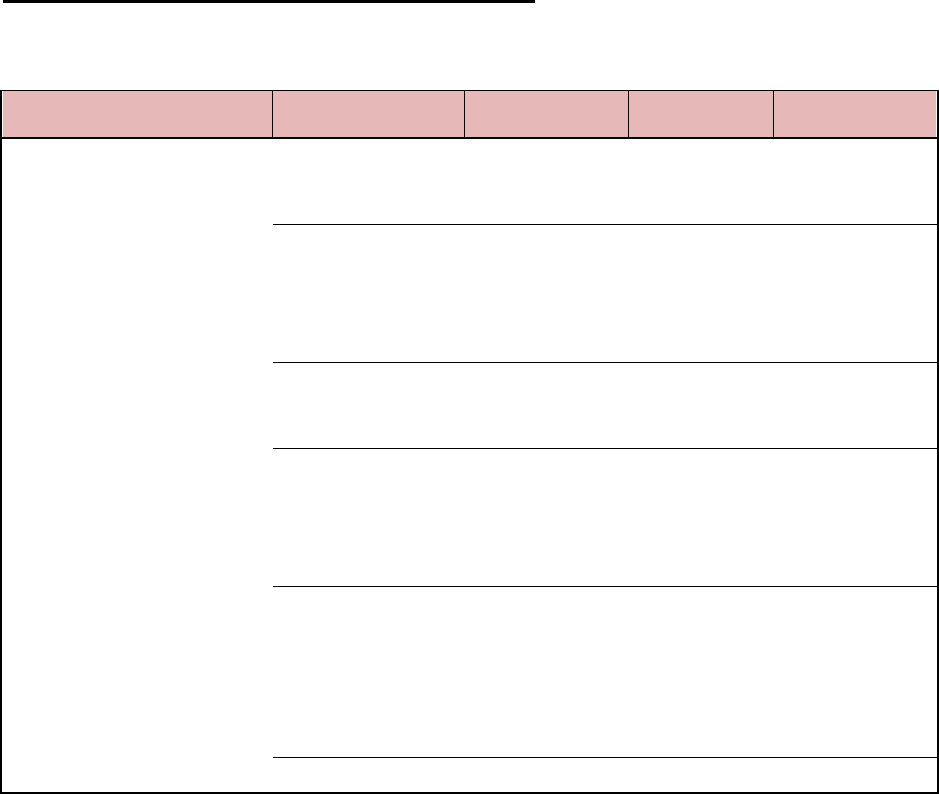

The table on the following page highlights DoD activity since the inception of the Program. DoD has collected $12.0

billion to date and continues rigorous collection efforts for both programs.

Management’s Discussion and Analysis

18

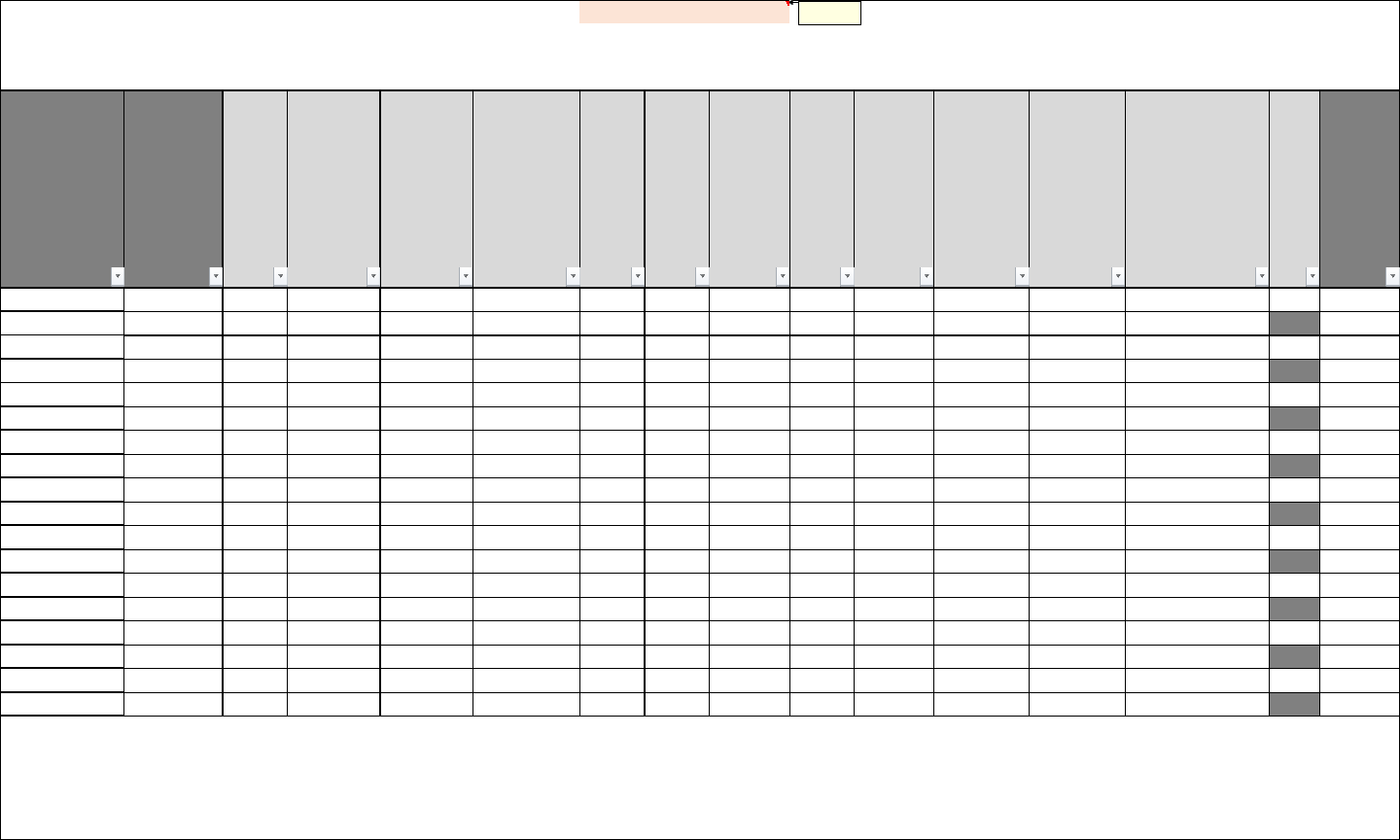

TRICARE Retail Pharmacy Refunds Program

Program To Date (CY 2008-

3rd Quarter, CY 2018 Total DHP Non-DoD MERHCF

SDP -

Billed $7,767,316,589 $3,533,064,654 $119,650,058 4,114,601,877

Collected (7,468,113,084) (3,403,791,255) (114,168,670) (3,950,153,159)

Net 299,203,505 129,273,399 5,481,388 164,448,718

ADP -

Billed 4,745,537,027 2,151,949,586 73,985,370 2,519,602,071

Collected (4,543,283,635) (2,063,943,291) (70,563,736) (2,408,776,608)

Net 202,253,392 88,006,295 3,421,634 110,825,463

UDC

1

(349,828) (151,345) (6,076) (192,407)

Total -

Billed $12,512,853,616 $5,685,014,240 $193,635,428 $6,634,203,948

Collected (12,011,396,719) (5,467,734,546) (184,732,406) (6,358,929,767)

UDC (349,828) (151,345) (6,076) (192,407)

Net

$501,107,069 $217,128,349 $8,896,946 $275,081,774

Aging -

Current $418,112,159 $180,888,729 $7,262,643 $229,960,787

61 Days to 2 Years

2

15,592,652 6,445,418 632,190 8,515,044

Over 2 Years 67,402,257 29,794,201 1,002,112 36,605,944

Total

3

$501,107,068 $217,128,348 $8,896,945 $275,081,775

1. UDC applied to CY18.

2. Pharmacy debt not delinquent until 70 days. 70-day A/R aging bucket not available; 61-day aging used instead.

3. 3QCY2018 Estimate added to Billings to reconcile with A/R: $117,137,000 MERHCF; $95,841,000 DHP & Non-DoD.

TRICARE has a waiver dated September 23, 1996, 10 USC 1079a, Champus: Treatment of Refunds and Other

Amounts Collected that states:

“All refunds and other amounts collected in the administration of the Civilian Health and Medical Program of the

Uniformed Services shall be credited to the appropriation available for that program for the fiscal year in which the

refund or amount is collected.”

Thus TRICARE records all Collections/Refunds into the current year and decreases budgetary disbursements for the

current year. The refunds collected are not treated as offsetting collections.

The DHA in FY 2018 continued to aggressively collect pharmacy refunds for both the Standard and Additional

Discount Programs. Through the concerted efforts of CRM, POD, HCDA, and OGC, DHA collected 98.9% of the

delinquent debt from 1st Quarter Calendar Year (CY) 2008 through 2nd Quarter CY 2017. All unpaid debts for these

quarters have been referred to the OGC’s Claims Collections Section and/or to the Department of the Treasury for

further collection activity.

The percent collected for 3rd Quarter CY 2017 through 1st Quarter CY 2018 is 97.8% with payments due for 2nd

Quarter CY 2018 in November 2018.

Management’s Discussion and Analysis

19

(Sources: PDW Reconned Cases Status 9.30.18 for 1QCY2015 to 2QCY2018 & DHA AR Activity 30-SEP-2018 for

1QCY2008 to 4QCY2014)

Forward Plans

The MHS Quadruple Aim is to increase readiness through better health, better care, and lower costs. The Quadruple

Aim serves as the strategic framework of the MHS, and in achieving this strategic framework, the DHA has adopted the

following three key goals:

Fortify our relationship with the Services

Strengthen our role as a Combat Support Agency

Optimize DHA operations

In response to the NDAA of FY 2017, the DHA continues to find efficiencies through consolidation of health care

plans, and integration of the direct health care facilities into the organization. The DHA has developed an

implementation plan based on the direction from Congress that will significantly alter the organizational structure of the

direct care facilities, enhancing coordination or healthcare activities for better patient care and improved cost

efficiencies. This plan will be effective 1 October 2018, and be fully implemented in FY 2020.

The majority of the impact of the changes will occur in the Military Treatment Facilities. As the centerpiece of the

Military Health System, the Private Sector Care contracts will continue to support those facilities as this transition

occurs. The changes directed by NDAA 2017, Section 702 are not expected to have a significant impact on the Private

Sector Care program.

The DHA Mission Statement is as follows:

The DHA, a Combat Support Agency, lead the MHS integrated system of readiness and health to deliver the Quadruple

Aim: increased readiness, better health, better care, and lower cost. DHA Director Priorities to align with the DHA

Mission are:

Empower and Care for Our People

Optimize Operations across the Military Health System

Co-create Optional Outcomes for Health, Well-being and Readiness

Deliver solutions to Combatant Commands

The DHA plan to accomplish the changes associated with NDAA 2017, Section 701, includes the key elements of the

mission statement above.

VI Limitations of the Financial Statements

The principal financial statements are prepared to report the financial position and results of operations of CRM,

pursuant to the requirements of 31 U.S.C. 3515(b). The statements are prepared from the books and records of Federal

entities in accordance with Federal Generally Accepted Accounting Principles (GAAP) and the formats prescribed by

OMB. Reports used to monitor and control budgetary resources are prepared from the same books and records. The

financial statements should be read with the realization they are for a component of the U.S. Government.

20

DEPARTMENT OF DEFENSE

DEFENSE HEALTH AGENCY

CONTRACT RESOURCE MANAGEMENT

PRINCIPAL STATEMENTS

___________________________________________________Principal Statements

The accompanying notes are an integral part of these statements

21

Department of Defense

Defense Health Agency

Contract Resource Management

BALANCE SHEETS

As of September 30, 2018 and 2017

($ In Thousands)

2018 2017

Assets

Intragovernmental:

Fund Balance with Treasury (Note 2) $ 1,393,187 $ 1,675,116

Accounts Receivable (Note 3) 49,816 43,572

Total Intragovernmental 1,443,003 1,718,688

Cash and Other Monetary Assets (Note 4) 2,236 19

Accounts Receivable, Net 398,913 296,622

Total Assets

$ 1,844,152 $ 2,015,329

Liabilities

Intragovernmental:

Accounts Payable (Notes 5 and 6) $ 66,337 $ 74,194

Total Intragovernmental 66,337 74,194

Accounts Payable (Notes 5 and 6) 425,761 266,086

Military Retirement and Other Federal

Employment Benefits (Notes 5 and 9) 179,548,375 184,901,446

Other (Notes 5 and 7) 2,236 19

Total Liabilities

$ 180,042,709 $ 185,241,745

Commitments and Contingencies (Note 8)

Net Position

Unexpended Appropriations - Other Funds $ 950,905 $ 1,378,408

Cumulative Results of Operations - Other Funds (179,149,462) (184,604,824)

Total Net Position $ (178,198,557) $ (183,226,416)

Total Liabilities and Net Position

$ 1,844,152 $ 2,015,329

___________________________________________________Principal Statements

The accompanying notes are an integral part of these statements

22

Department of Defense

Defense Health Agency

Contract Resource Management

STATEMENTS OF NET COST

For the Years Ended September 30, 2018 and 2017

($ In Thousands)

2018 2017

Program Costs

Gross Costs (Note 10)

Operations, Readiness & Support $ 15,740,129 $ 15,651,278

Actuarial Non Assumption Costs (3,381,259) (689,143)

Less: Earned Revenue (1,253,893) (997,367)

Net Program Costs $ 11,104,977 $ 13,964,768

Gain/(Loss) from Actuarial Assumption Changes

for Military Retirement Benefits (Note 9) (1,830,406) 8,967,093

Net Program Costs Including Assumption Changes $ 9,274,571 $ 22,931,861

Net Cost of Operations

$ 9,274,571 $ 22,931,861

___________________________________________________Principal Statements

The accompanying notes are an integral part of these statements

23

Department of Defense

Defense Health Agency

Contract Resource Management

STATEMENTS OF CHANGES IN NET POSITION

For the Years Ended September 30, 2018 and 2017

($ In Thousands)

2018 2017

Unexpended Appropriations:

Beginning Balance $ 1,378,408 $ 1,136,900

Budgetary Financing Sources:

Appropriations received 14,380,099 15,006,527

Appropriations transferred-in/out (4,409) (55,000)

Other adjustments (rescissions, etc) (73,260) (120,576)

Appropriations used (14,729,933) (14,589,443)

Total Budgetary Financing Sources (427,503) 241,508

Total Unexpended Appropriations 950,905 1,378,408

Cumulative Results of Operations:

Beginning Balance (184,604,824) (176,262,406)

Budgetary Financing Sources:

Appropriations used 14,729,933 14,589,443

Transfers-in/out without reimbursement 0 0

Other 0 0

Total Financing Sources 14,729,933 14,589,443

Net Cost of Operations 9,274,571 22,931,861

Net Change 5,455,362 (8,342,418)

Cumulative Results of Operations

(179,149,462) (184,604,824)

Net Position

$ (178,198,557) $ (183,226,416)

___________________________________________________Principal Statements

The accompanying notes are an integral part of these statements

24

Department of Defense

Defense Health Agency

Contract Resource Management

STATEMENTS OF BUDGETARY RESOURCES

For the Years Ended September 30, 2018 and 2017

($ In Thousands)

2018 2017

Budgetary Resources

Unobligated balance from prior year budget authority, net $ 888,255 $ 395,340

Appropriations (discretionary and mandatory) 14,380,099 15,006,527

Spending authority from offsetting collections (discretionary

and mandatory) 1,236,715 1,003,632

Total Budgetary Resources

$ 16,505,069 $ 16,405,499

Status of Budgetary Resources

New obligations and upward adjustments (total) $ 16,035,766 $ 16,039,124

Unobligated balance, end of year

Unexpired unobligated balance, end of year 35,398 111,113

Expired unobligated balance, end of year 433,905 255,262

Unobligated balance, end of year (total) 469,303 366,375

Total Budgetary Resources

$ 16,505,069 $ 16,405,499

Outlays, Net

Outlays, net (total) (discretionary and mandatory) $ 14,584,358 $ 14,543,036

Agency Outlays, Net (discretionary and mandatory)

$ 14,584,358 $ 14,543,036

25

DEPARTMENT OF DEFENSE

DEFENSE HEALTH AGENCY

CONTRACT RESOURCE MANAGEMENT

NOTES TO THE PRINCIPAL STATEMENTS

__________________________________________Notes to the Principal Statements

26

DEPARTMENT OF DEFENSE

DEFENSE HEALTH AGENCY

CONTRACT RESOURCE MANAGEMENT

NOTES TO THE PRINCIPAL STATEMENTS

FOR THE YEARS ENDED SEPTEMBER 30, 2018 AND 2017

NOTE 1. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

A. Mission of the Reporting Entity. The DHA is a DoD agency of the Under Secretary of Defense for Personnel and

Readiness and operates under the authority, direction, and control of the Assistant Secretary of Defense for Health

Affairs. The DHA has as one of its missions operational oversight of the MHS, including the direct care system

(military hospitals), the private sector care system, and management of MERHCF for those beneficiaries dual-

eligible for both Medicare and TRICARE.

TRICARE's primary mission is to enhance the DoD and our nation’s security by providing health care support for

the full range of military operations and sustaining the health of all those entrusted to our care, including active duty

personnel, military retirees, certain members of the Reserve Component, family members, widows, survivors, ex-

spouses, and other eligible members.

TRICARE’s vision is to be a world-class health care system that supports the military mission by fostering,

protecting, sustaining and restoring health. TRICARE’s vision:

To be the provider of premier care for our warriors and their families

To be an integrated team ready to go in harm’s way to meet our nation’s challenges at home or

abroad

To be a leader in health education training, research, and technology

To be a bridge to peace through humanitarian support

To be a nationally recognized leader in prevention and health promotion

The CRM office is responsible for the accounting and financial support and financial reporting for TRICARE’s

centrally funded private sector care programs. It draws funds from MERHCF to pay TRICARE for Life and

TRICARE Pharmacy private sector costs. The CRM is also responsible for reimbursable financial transactions

involving non-DoD services to the National Guard and Reserve Forces for private sector health care and for

reimbursable financial transactions involving medical services such as those provided by the Centers for Medicare &

Medicaid Services, related to private sector health care.

B. Basis of Presentation. These financial statements have been prepared to report the financial position and results

of operations of CRM, as required by the Chief Financial Officers Act of 1990, expanded by the Government

Management Reform Act of 1994, and other appropriate legislation. The financial statements have been prepared

from the books and records of CRM in accordance with, and to the extent possible, U.S. generally accepted

accounting principles (U.S. GAAP) promulgated by the Federal Accounting Standards Advisory Board; the OMB

Circular No. A-136, “Financial Reporting Requirements”; and the DoD, Financial Management Regulation (FMR).

The accompanying financial statements account for all resources for which CRM is responsible unless otherwise

noted.

On September 30, 2013, DoD Directive Number 5136.13 disestablished the TRICARE Management Activity

(TMA) and all TMA functions were transferred to DHA. TMA is now DHA with components including CRM,

USUHS and DHA-Comptroller (DHA-C) (formerly Financial Operations Division (FOD)). Any reference in law,

rule, regulation, or issuance to TMA will be deemed to be a reference to DHA, unless otherwise specified by the

Secretary of Defense.

The CRM is able to fully implement all elements of U.S. GAAP and the OMB Circular No. A-136. The CRM has

implemented an Oracle Based Federal Financial system.

__________________________________________Notes to the Principal Statements

27

C. Use of Estimates. The CRM’s management makes assumptions and reasonable estimates in the preparations of

financial statements based on current conditions which may affect the reported amounts. Actual results could differ

materially from the estimated amounts. Significant estimates include such items as accounts receivable, incurred but

not reported (IBNR) liabilities, and unfunded actuarial liabilities.

D. Appropriations and Funds. The CRM receives appropriations and funds as general, working capital (revolving),

trust, special funds, and deposit funds. The CRM uses these appropriations and funds to execute its missions and

subsequently report on resource usage.

General funds are used for financial transactions funded by congressional appropriations, including personnel,