2016-2017 Financial Report

2

1

Cornell University 2016-2017 Financial Report

CONTENTS

Highlights 3

Message from the Executive Vice President and Chief Financial Offi cer 4

Financial Review by the University Controller 5

Report of Independent Auditors 8

Notes to the Consolidated Financial Statements 13

University Administration 40

Board of Trustees and Trustees At Large 41

2

The audited Financial Report is available online at: http://www.dfa.cornell.edu/about-us/reports

3

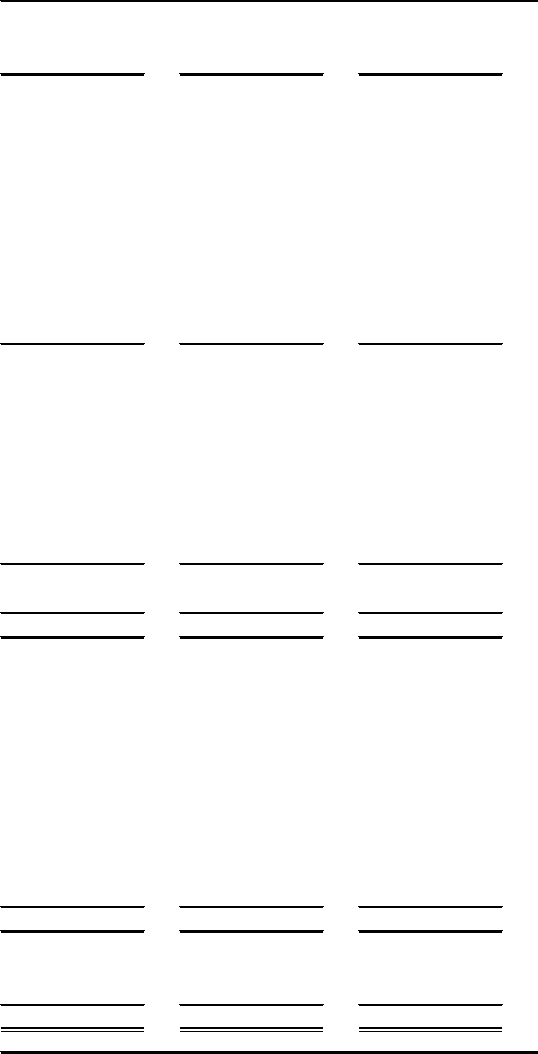

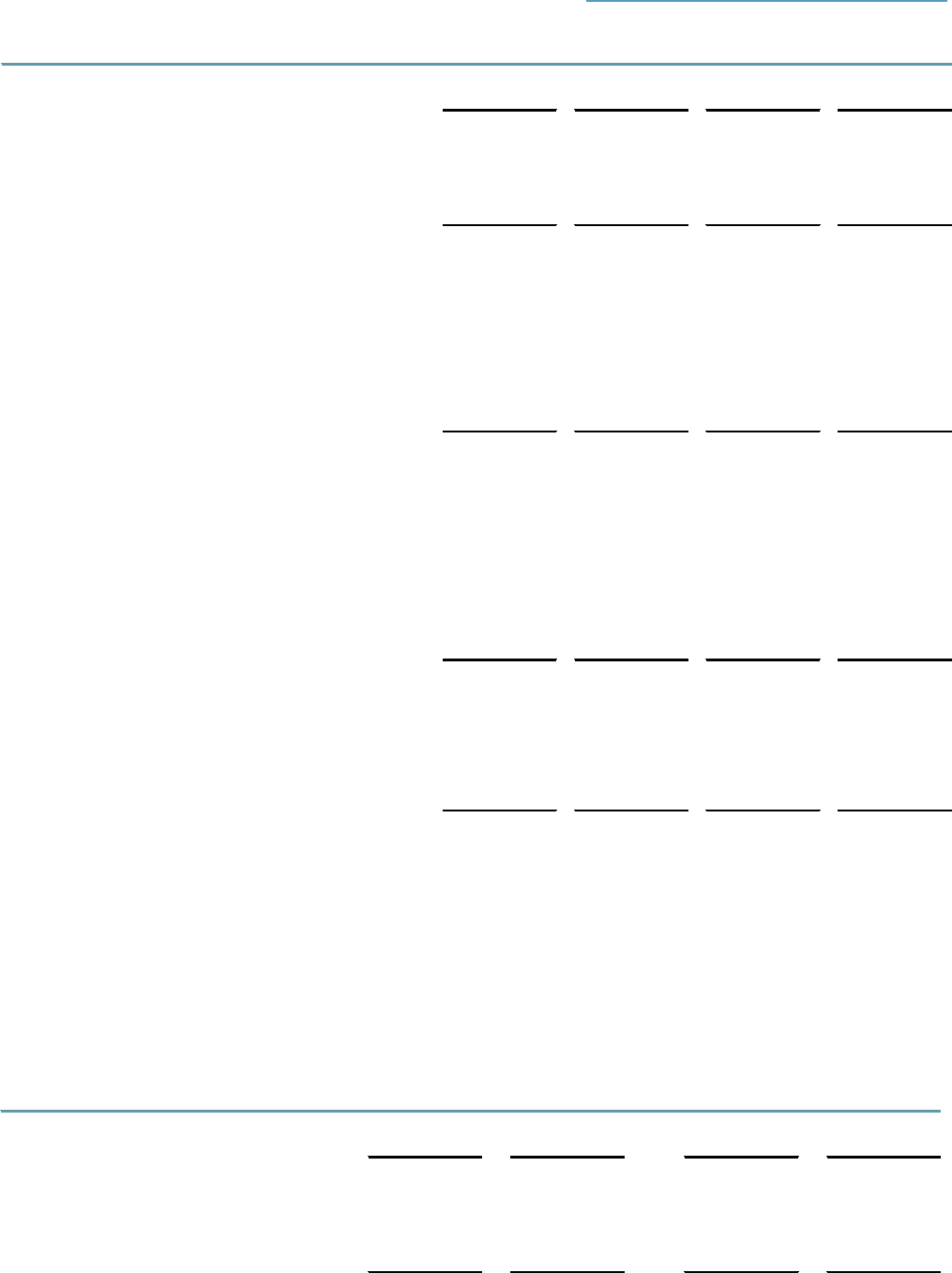

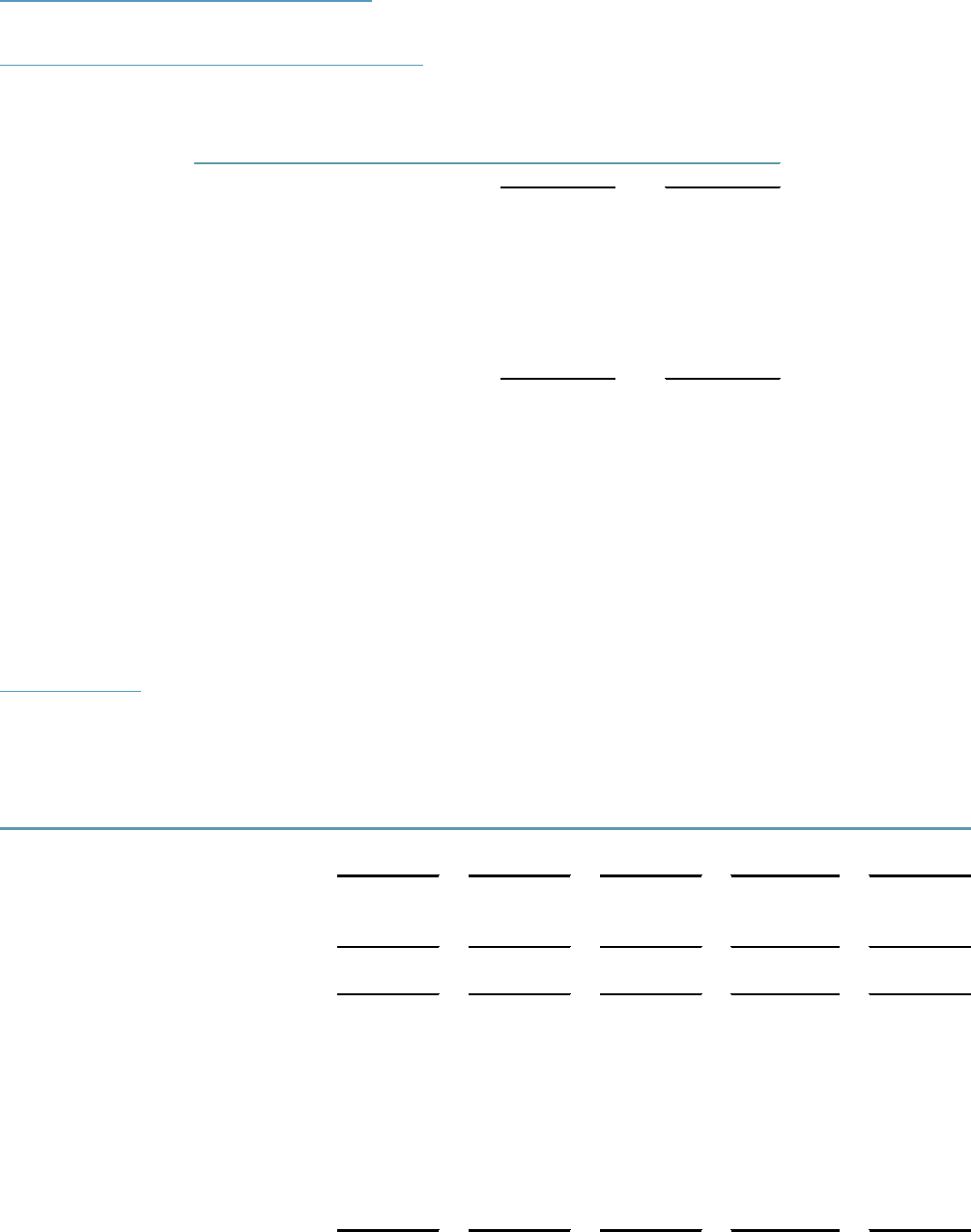

CORNELL UNIVERSITY HIGHLIGHTS

2016-17

2015-16 2014-15

Fall enrollment (excluding in absentia)

Undergraduate 14,566 14,315 14,453

Graduate 5,965 5,879 5,757

Professional 2,857 2,746 2,663

Total fall enrollment 23,388 22,940 22,873

Degrees granted

Baccalaureate degrees 3,646 3,758 3,674

Masters degrees 2,792 2,598 2,502

Ph.D. degrees 555 555 555

Other doctoral degrees (J.D., M.D., D.V.M.) 403 386

374

Total degrees granted 7,396 7,297 7,105

Tuition rates

Endowed Ithaca 50,712$ 48,880$ 47,060$

Contract Colleges

Resident 33,968$ 32,740$ 30,910$

Nonresident 50,712$ 48,880$ 47,050$

Medical Campus 52,500$ 50,950$ 49,500$

Business 61,584

$

59,532$

58,192

$

Law 61,400$ 59,950$ 59,360$

Veterinary Medicine 33,732$ 32,750$ 31,800$

Volumes in library (in thousands) 8,184 8,087 8,046

Academic workforce

Full-time employees

Faculty 3,964 3,842 3,705

Nonfaculty 881

882

888

Part-time employees

Faculty 299 285 281

Nonfaculty 153 192 145

Total academic workforce 5,297 5,201 5,019

Nonacademic workforce

Full-time employees 11,225 10,866 10,475

Part-time employees 611 575 579

Total nonacademic workforce 11,836 11,441 11,054

University Endowment

Market value of total university endowment (in millions) 6,516.4$ 5,757.7$ 6,037.5$

Unit value of Long Term Investment Pool 55.51$ 52.32$ 57.31

$

Gifts received, excluding pledges (in millions) 535.9$ 512.0$ 540.3$

New York State appropriations through SUNY (in millions) 132.0$ 131.5$ 131.4$

Medical Physician Organization fees (in millions) 1,050.4$ 982.4$ * 927.6$

Sponsored research volume (in millions)

Direct expenditures 493.4$ 496.3$ 497.4$

Indirect-cost recovery 131.5$ 138.0$ 138.6$

Selected land, buildings, and equipment items & related debt (in millions)

Additions to land, buildings, and equipment 545.0$ 471.4$ 335.8$ *

Cost of land, buildings, and equipment 7,613.6$ 7,115.0$ 6,662.0$

Outstanding bonds, mortgages, notes payable and capital leases 1,356.7$ 1,519.5$ * 1,542.8$

* Certain prior-year amounts have been reclassified to conform to the current year presentation.

4

MESSAGE FROM THE EXECUTIVE VICE PRESIDENT AND

CHIEF FINANCIAL OFFICER

Cornell’s fi scal position strengthened in a number of ways in fi scal year 2017. Our operating margins improved, invest-

ment return was 12.5 percent, and post-retirement benefi t and swap liabilities decreased by $50 million and $81 mil-

lion, respectively. There continues to be an extraordinary demand for a Cornell education, and we are well-positioned

under the leadership of our new President, Martha E. Pollack, to remain one of the preeminent research institutions

in the world.

Over 47,000 prospective students applied for 3,375 undergraduate places in the Class of 2021, and we remain selective

in our admissions process, with a 12.7 percent acceptance rate for fall 2017 freshman applicants, compared with 14.1

percent a year ago. Cornell also maintains a steady matriculation yield rate, which has consistently averaged more than

50 percent. And, with 11.5 percent of our undergraduate students from outside the United States, our geographical

profi le remains diverse and global. We achieve this level of selectivity and diversity while honoring our commitment

to our land-grant mission, with 31 percent of the Class of 2021 hailing from New York state.

University operating revenues have grown by 25 percent over the past fi ve years, from $3.2 billion to $4.0 billion. The

largest growth area has been the Medical Physician Organization at Weill Cornell Medicine, which now makes up over

26 percent of the University’s total operating revenue (compared to 22 percent in fi scal year 2012).

Cornell remains a leader in research, a critical factor in attracting outstanding faculty members and enhancing the

educational experience for both undergraduate and graduate students. The University generated almost $600 million

in grant and contract revenues in fi scal year 2017, comprising 15 percent of the University’s total operating revenues.

Operating costs at Cornell are less dependent on endowment payout than other highly endowed institutions, mostly

due to the University’s revenue diversity. Less than 9 percent of the University’s operating costs was funded from its

endowment in fi scal year 2017. University operating expenses increased over $160 million, or 4 percent, from over $3.8

billion to $4.0 billion, this past year. This is mainly the result of the almost 7 percent increase in the Medical Physician

Organization over the same period. The University experienced an operating loss of $7.5 million this year.

As of June 30, 2017, Cornell had $1.3 billion of bonds and notes outstanding, including $137 million of outstanding

commercial paper. The University has a notional amount of $785 million in interest rate swaps, whose fair value is de-

termined by an external swap consultant. Change in valuation between June 30, 2016 and June 30, 2017, decreased the

mark-to-market liability by $81 million, due to the change in interest rates over this period. In February, the University

redeemed its Series 2009 taxable bonds with a maturity date in January 2019.

Over the past fi scal year, there has been no shortage of uncertainties. We have, however, managed through these chal-

lenges to place Cornell on a fi rmer fi scal footing. I am certain that the coming year will continue to present chal-

lenges for higher education, which we are committed to facing head-on, while focusing on our commitment to “One

Cornell” and mission-critical priorities set forth by President Pollack. With this in mind, I am confi dent that our cher-

ished institution will continue to forge a path as a leader among its peers, and remain a preeminent research university

with a global impact.

Joanne M. DeStefano

Executive Vice President and Chief Financial Offi cer

5

year ended June 30, 2017. More information about these

and other recent standards impacting the University can

be found in Note 1P.

FINANCIAL YEAR IN REVIEW

Statement of Financial Position

The University’s overall net assets increased by $985.6 mil-

lion. Because of this performance in the current year, the

statement of fi nancial position, or balance sheet, has been

strengthened, with over of $10.0 billion in net assets, includ-

ing $3.1 billion in unrestricted net assets.

Assets

Cash is subject to variation from year to year because of the

University’s holdings as of June 30 in cash equivalents, i.e.,

securities with an initial maturity term of ninety days or less.

At the end of fi scal year 2017, cash was $.8 million lower

than the prior year, which represents a decrease of .5 percent.

Receivables from all sources, more fully disclosed in Note 2

of the consolidated fi nancial statements, decreased by $96.8

million, or 11.3 percent.

Investments as of June 30, 2017 were $7.1 billion, an 8.2

percent increase from the prior year. The increase in the

fair value is primarily the result of unrealized net gains as

of the end of this fi scal year in addition to an increase of 6.1

percent in participation in the LTIP. Fair-value adjustments

are often related to the asset allocations in the portfolio, with

some sectors outperforming others.

The University continues to enhance its physical plant with

new buildings, improvements to older buildings, and infra-

structure projects. The $247.5 million or 6.2 percent increase

in land, buildings, and equipment in fi scal year 2017 consists

of projects placed in service as well as construction in prog-

ress (“CIP”). During the fi scal year, the University placed

into service renovations to Upson Hall, Cornell Health,

and Kimball Hall. CIP at fi scal year-end includes several

major projects, such as the College of Veterinary Medicine

expansion and the Ag Quad Utility Infrastructure Upgrade

and Landscape Revitalization. Cornell Tech also recorded

a capital lease for a co-location building (now named “The

Bridge”) at a value of $64.2 million.

Liabilities

In total, accounts payable and accrued expenses decreased

by $75.8 million for the year.

Of the deferred benefi ts of $610.5 million, $395.2 million

relates to pension and other postretirement benefi ts, which

decreased 11.3 percent over the prior year due to factors

OVERVIEW

The University ended the fi scal year with over $10.0 billion

in net assets, up from $9.0 billion the previous year. Total

unrestricted net assets are $3.1 billion. Total assets increased

by $668.9 million, while total liabilities decreased by $316.8

million. The change in net assets from operating activities

increased from the prior year, with a $7.5 million net op-

erating loss for the year, and the change in net assets from

non-operating activities swung from a decrease of $391.9

million in the prior year to an increase of $993.1 million in

the current year. Market conditions were responsible for a

large part of the change in net assets.

NEW STANDARDS, EMERGING ISSUES,

AND INITIATIVES

The Financial Accounting Standards Board (FASB), which

establishes fi nancial accounting and reporting standards

for public and private companies and not-for-profi t or-

ganizations, continues to be very active. Since January of

2014, the FASB has issued sixty-seven new updates, some

of which could have signifi cant changes for accounting and

reporting. The University monitors closely the FASB’s Ac-

counting Standard Updates (“ASUs”), and evaluates each

for relevance and impact.

Three recent updates are of particular importance to the

University. ASU 2014-09—Revenue from Contracts with

Customers (Topic 606) is intended to provide a compre-

hensive, industry-neutral revenue recognition model to

increase fi nancial statement comparability across companies

and industries, and signifi cantly reduce the complexity in-

herent in today’s revenue recognition guidance. ASU 2016-

02—Leases (Topic 842) addresses the criticism that current

accounting standards do not adequately inform fi nancial

statement users of the full nature and implications of leasing

transactions. The new standard will require operating leases

to be recognized as right-to-use assets and lease liabilities

on the balance sheet. Finally, ASU 2016-14—Not-for-Profi t

Entities (Topic 958): Presentation of Financial Statements

for Not-for-Profi t Entities is intended to improve the infor-

mation presented in fi nancial statements and notes about

a not-for-profi t entity’s liquidity, fi nancial performance,

and cash fl ows. The revenue recognition and not-for-profi t

reporting standards are effective for fi scal year 2019, and the

new lease standard for fi scal year 2020.

ASU 2017-07—Compensation—Retirement Benefi ts (Topic

715) allows only the service costs to be presented as operat-

ing expenses; the other elements of the net periodic costs

must be considered non-operating. The effective date of this

change is the fi scal year ending June 30, 2019; however, the

University has elected to adopt this standard for the fi scal

FINANCIAL REVIEW BY THE UNIVERSITY CONTROLLER

6

described below. These liabilities are further disclosed in

Note 6.

Funds held in trust for others represent resources that are

invested by the University as a custodian for other closely

related parties. Independent trustees are responsible for

investing the funds and for the designation of income

distribution. The decrease of $16 million was the result of

a combination of withdrawals amounting to $35 million,

and an increase in market value.

The bonds and notes payable decline of $235.1 million was

due primarily to the 2009 bond debt defeasance of $250 mil-

lion and $29 million in principal payments, offset by $52.7

million additional debt for the Hudson JV building and

project loans. These bonds and notes payable are further

disclosed in Note 8.

Operating Revenues

For fi scal year 2017, operating expenses exceeded operating

revenue by .19 percent, resulting in a $7.5 million net oper-

ating loss. The Medical Physician Organization continues

to grow, with revenues up 6.9 percent, reaching almost $1.1

billion, driven by the maturation of the Lower Manhat-

tan practices and network physicians. All other operating

revenue, excluding the Medical Physician Organization,

had a net increase of $136.6 million, or 4.8 percent, while

operating expenses increased by $161.6 million, or 4.2 per-

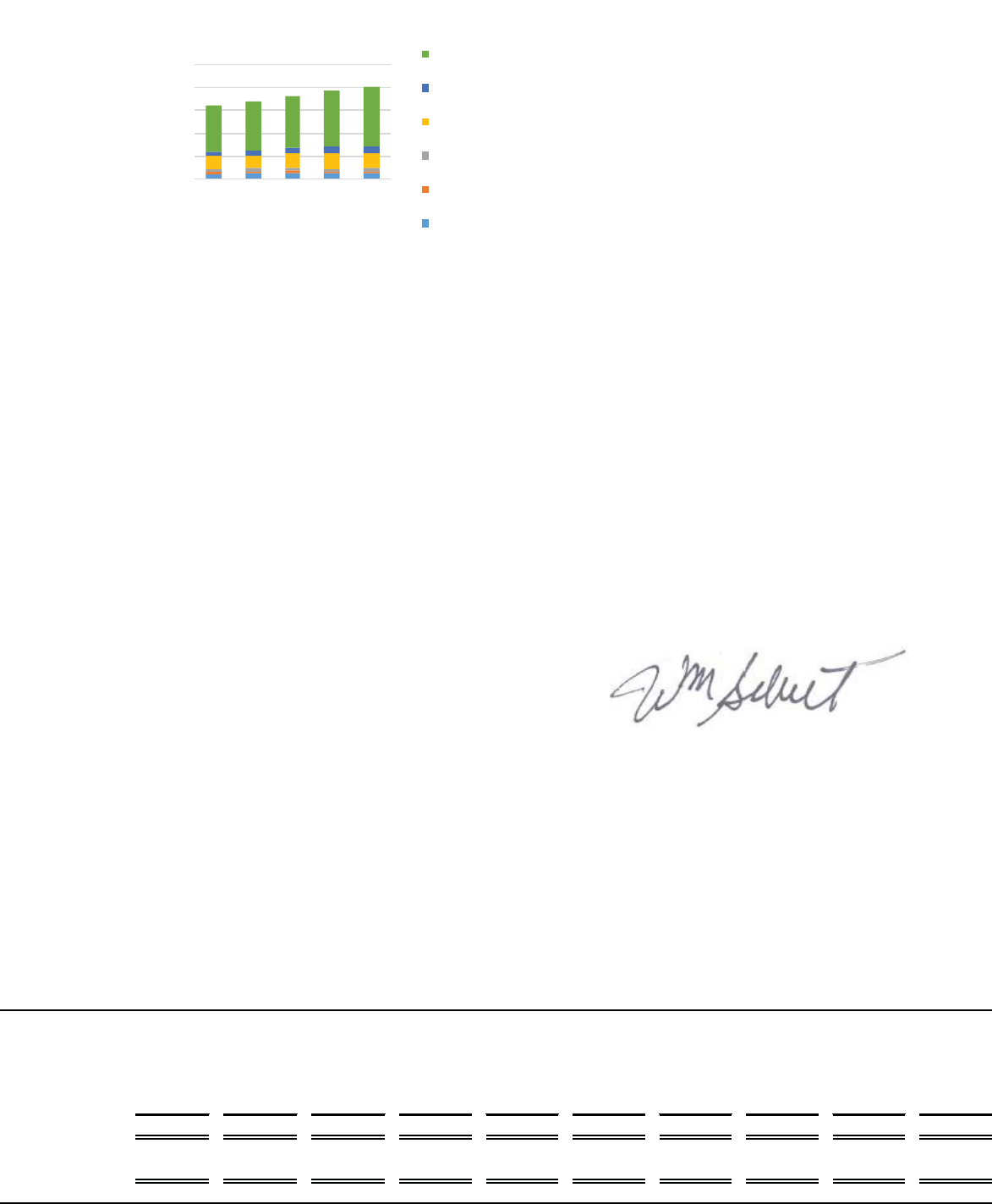

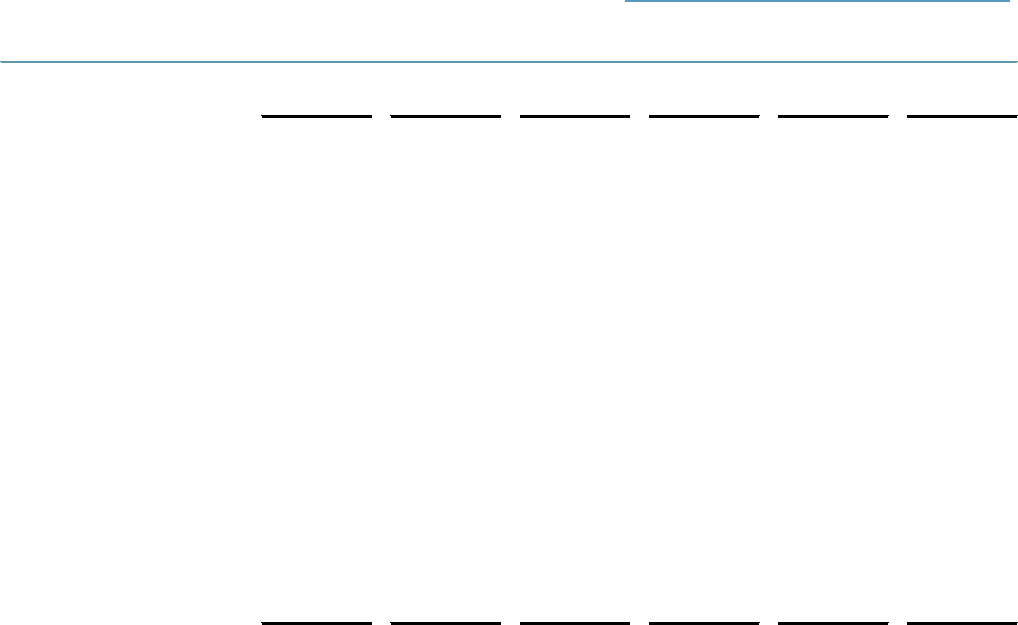

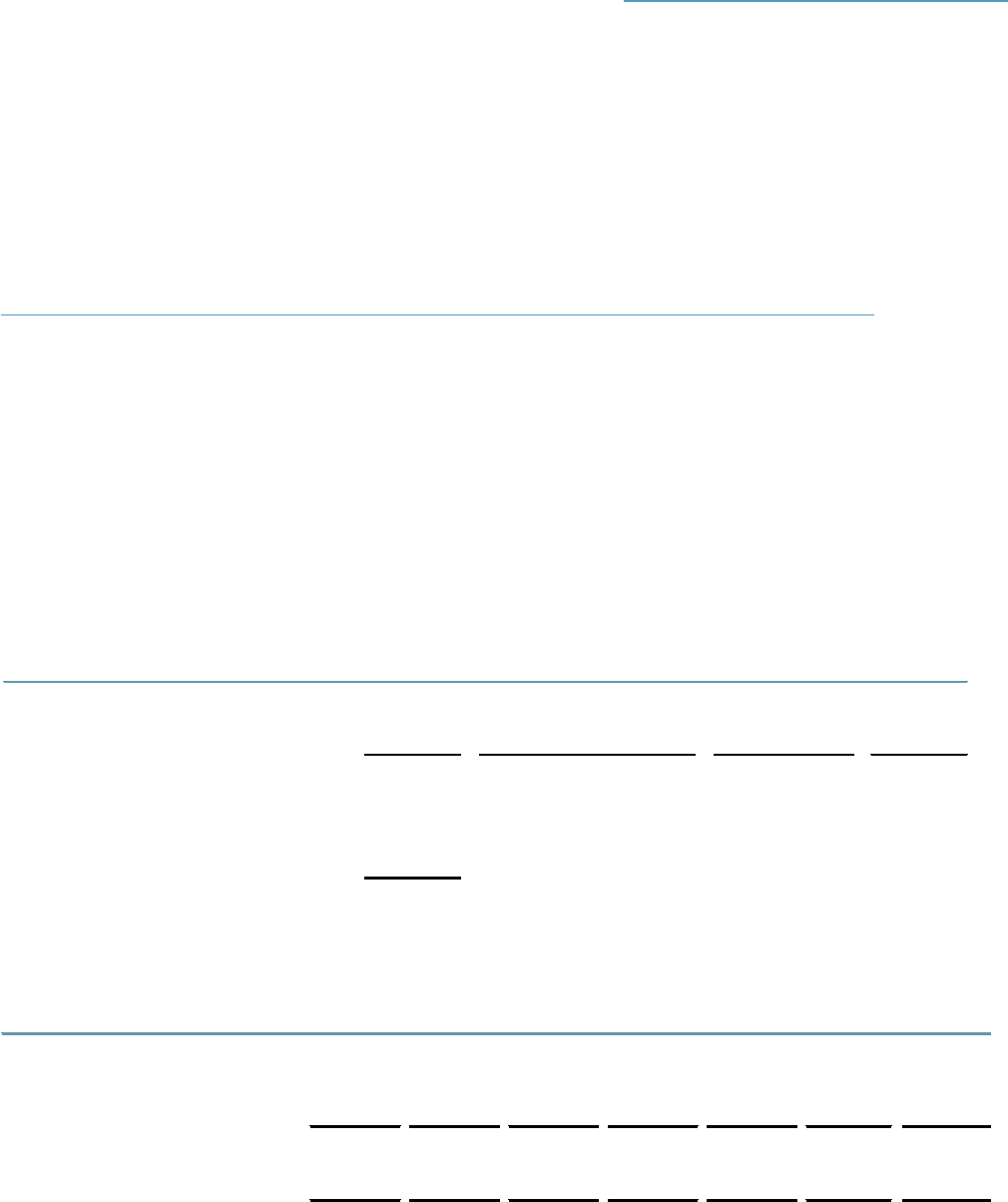

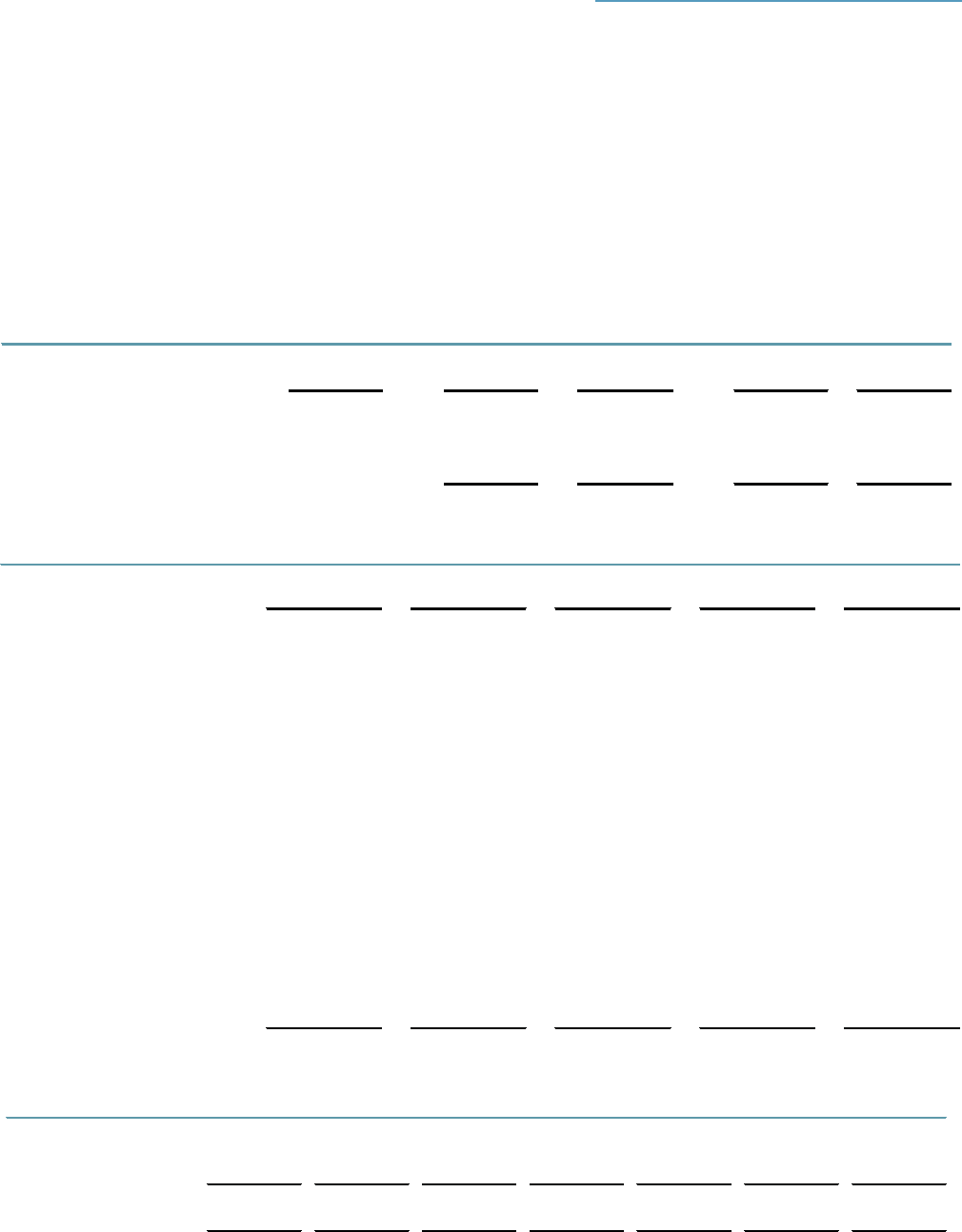

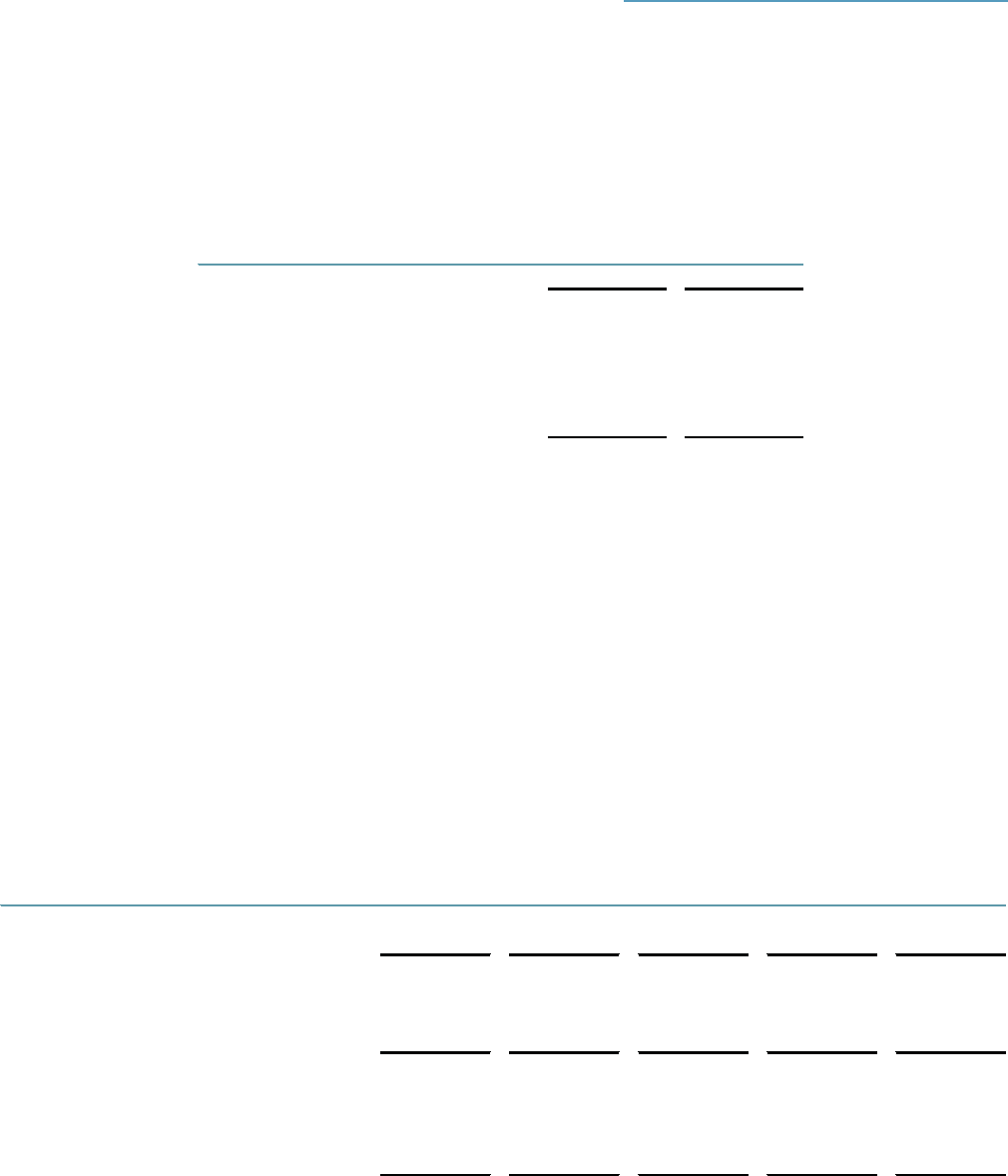

cent. The following graph shows University consolidated

revenues for the past fi ve years.

In fi scal year 2017, gross tuition revenue increased by 4.6

percent, as a result of Board-authorized tuition increases

and a slight increase of 448 students, for an overall enroll-

ment of 23,388. The scholarship allowance represents the

amount of institutional grant aid for the cost of attendance;

this allowance remained relatively consistent with the prior

year. Additionally, the University provides fi nancial aid to

students to defray the cost of living expenses; this aid is

reported in supplies and general expense, and is disclosed

in Note 10.

Combined direct and indirect revenues from grants and

contracts increased slightly, by 1.7 percent.

Contribution revenue for operations was $297.6 million,

or an 11.6 percent increase from the prior year.

Distributed investment return increased by 8.5 percent in this

fi scal year. Investment payout on the long-term investment

pool (“LTIP”) shares is the major component of this revenue.

The LTIP is a mutual-fund-like vehicle used for investing

the University’s true endowment funds, funds functioning

as endowment, and other funds that are not expected to be

expended for at least fi ve years. Investment return included in

operating revenues consists of amounts appropriated by the

Board of Trustees from the pooled endowment, and income

and realized gains and losses on investments from working

capital and non-pooled endowments and similar funds.

Revenue for educational activities and other sales and ser-

vices increased by $33.9 million, or 4.9 percent. Of this

increase, $24.4 million resulted from additional support

from New York Presbyterian Hospital.

Net assets released from restrictions represents the transfer of

funds from temporarily restricted net assets to unrestricted

net assets as a result of the satisfaction of donor-imposed

contribution stipulations with respect to timing or purpose.

In fi scal year 2017, this amount was $356.9 million.

Operating Expenses

Expenses for compensation and benefi ts are the major

component of operating expenses for a research university,

and Cornell is no exception. Consistent with the prior year,

salary and benefi t expense is 64.3 percent of overall operat-

ing expenses. This expense increased by $142.8 million, or

5.9 percent. Beyond the overall salary improvement plan,

averaging 2.3 percent in Ithaca, compensation at WCM

was a major component of this increase, due to increased

headcount related to strategic initiatives and expansion of

the Medical Physician Organization.

Supplies and general expense decreased in fi scal year 2017

by $10.6 million, or 1.6 percent.

Other operating expenses remained relatively fl at. The Uni-

versity is committed to managing overall costs without

jeopardizing its ability to carry out its missions and strategic

initiatives, and continues to focus efforts on streamlining,

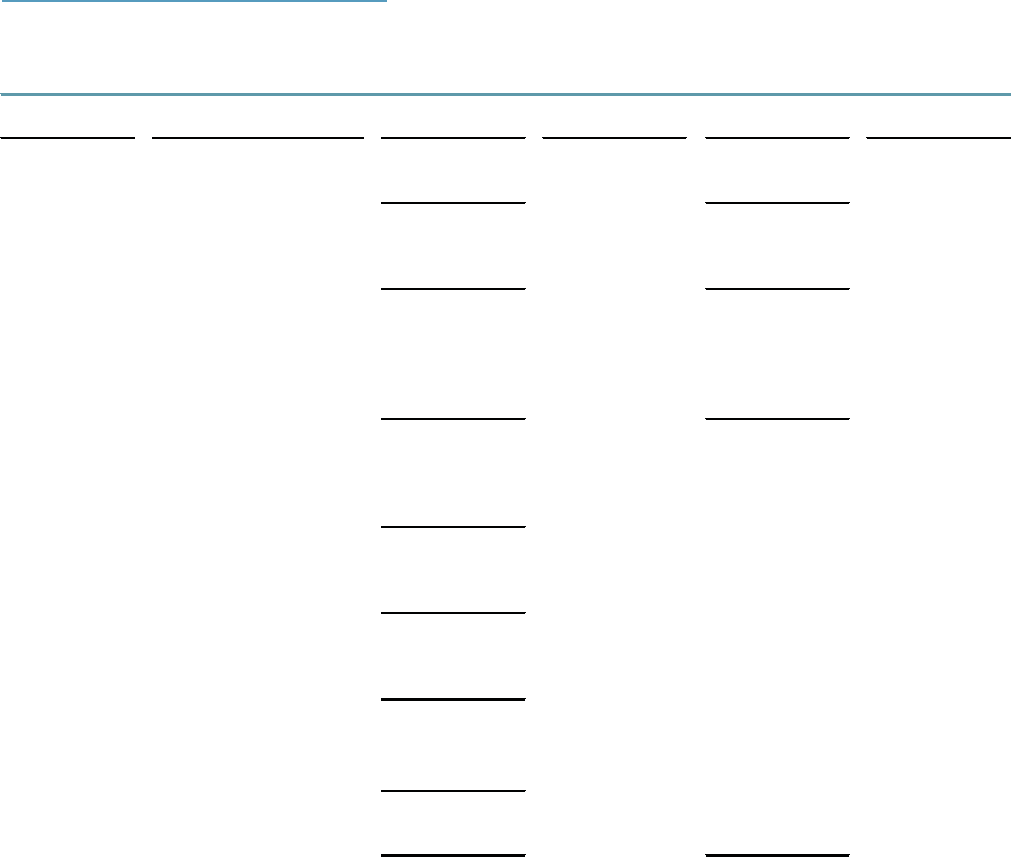

effi ciencies, and reducing administrative burden. The fol-

lowing graph shows University consolidated expenses for

the past fi ve years.

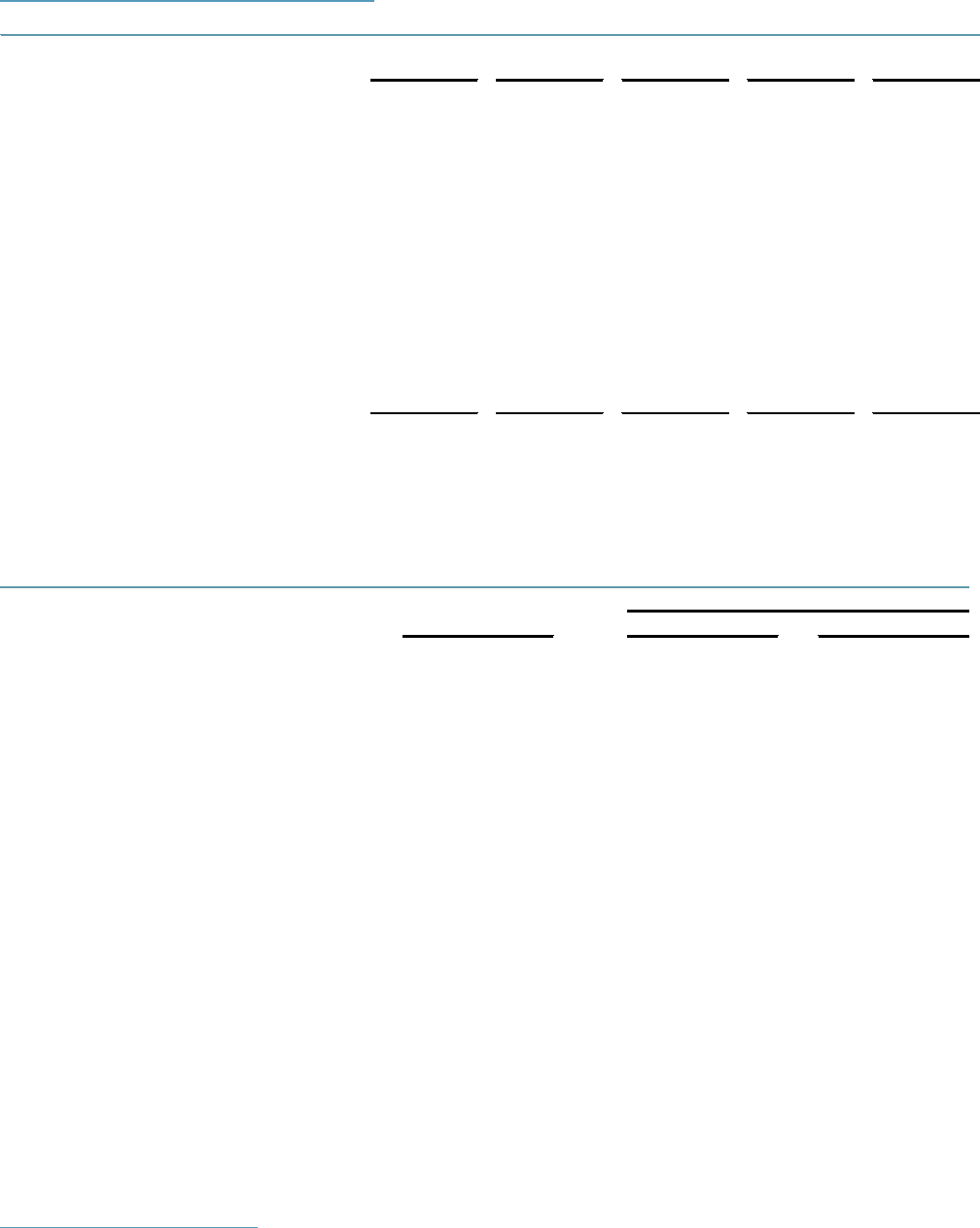

LONG-TERM INVESTMENT POOL

Source and applications (in millions)

Beginning market value

Gifts and other additions

Withdrawals

Realized and unrealized gain/(loss)

Ending market value

Unit value at year-end (in dollars)

$0

$1,000

$2,000

$3,000

$4,000

$5,000

2013 2014 2015 2016 2017

Fi s cal year ended June 30

Operating Revenues

(in millions)

Net tu ition

Grants and contracts

Contribut ion s

Medical physicians

organization

Educational acti vities,

sales and services

All oth er operating

revenue

7

Non-Operating Revenues and Expenses

Non-operating activities represent those in support of the

University but not directly related to its core activities. These

would include funding from New York State for buildings;

funding from donors restricted to capital projects, trusts, or

endowments; investment returns, net of amounts distrib-

uted; and non-operating income and expense affected by

fair-value adjustments at fi scal year-end.

New York State has provided signifi cant appropriations, over

$212.8 million in the past fi ve years, to allow the University

to build and improve the facilities for the contract colleges.

The current year revenues increased by $3.5 million from

the prior year.

In 2016, funding was received from the New York City

Economic Development Corporation and used for the con-

struction of the new campus on Roosevelt Island. Grants and

contracts for capital acquisitions decreased by $8.4 million

in the current year because this project is near completion.

Non-operating contributions for buildings, trusts, and

permanent endowment were $390.5 million, resulting in a

59.0 percent increase from the prior year.

The $175.0 million year-over-year increase in value of in-

terest rate swaps is based on the fair value of the debt swap

portfolio at June 30.

The overall non-operating gain of $993.1 million for fi scal

year 2017 is driven by the remaining income and expense

items that are signifi cantly affected by market factors. The

$405.0 million gain refl ected as investment return in the

non-operating section is net of the amount distributed of

$355.9 million refl ected in the operating section of the state-

ment of activities. The total operating and non-operating

return for fi scal year 2017 is a $760.9 million gain, which

includes $361.0 million of unrealized gains. The investment

return for long-term investments was 12.5 percent for the

year, as compared with -3.3 percent in the prior year. Over

the last three years, the annualized return of the long-term

investments is 4.0 percent.

The $195.4 million year-over-year increase, refl ected as

the change in pension and postretirement costs in the

non-operating section, is affected by numerous factors.

This fi gure includes gains, losses, and other changes in the

actuarially determined benefi t obligations arising in the

current period but not yet refl ected within net periodic

benefi t cost. The actuarial gains were driven primarily by

increases in the discount rates used and by favorable actual

vs. expected investment returns.

Summary

As we celebrate the inauguration of Cornell University’s

President Martha E. Pollack and the offi cial opening of our

exciting new Cornell Tech campus on New York City’s Roos-

evelt Island, we are buoyed by the prospects for an incredible

future. The current year’s fi nancial results are indicative of

the University’s commitment to manage operating expenses,

enhance new and existing revenue streams, and improve pro-

cesses and procedures. I am confi dent that we will continue

to strengthen our business model and our commitment to

“One Cornell” through focus and connectivity, and remain

dedicated to our stewardship responsibilities.

William Sibert

University Controller

2007-08 2008-09 2009-10 2010-11 2011-12 2012-13 2013-14 2014-15 2015-16 2016-17

5,197.5$

5,378.1$ 3,794.3$ 4,223.2$ 4,921.8$ 4,786.9$ 5,188.6$ 5,896.3$ 5,973.7$ 5,629.0$

236.8 190.5 573.9 210.6 155.3 287.4 349.7 378.2 337.0 479.2

(130.1) (340.9) (578.7) (286.9) (233.0) (354.1) (422.2) (440.8) (439.2) (414.0)

73.9 (1433.4) 433.7

774.9 (57.2) 468.4 780.2 140.0 (242.5) 669.1

5,378.1$ 3,794.3$ 4,223.2$ 4,921.8$

4,786.9$ 5,188.6$ 5,896.3$ 5,973.7$ 5,629.0$ 6,363.3$

65.37$ 45.12$

47.38$ 53.58$ 50.67$ 53.30$ 58.45$ 57.31$ 52.32$ 55.51$

$0

$1,000

$2,000

$3,000

$4,000

$5,000

2013 2014 2015 2016 2017

Fi s cal year ended June 30

Operating Expenses

(in millions)

Compensatio n and

Ben efits

Purchased Servic es

Suppl ies and General

Expense

Maintenance and

Facilities C osts

Interest Expense

Depreciation Expense

8

FINANCIAL

STATEMENTS

Report of Independent Auditors

CONSOLIDATED

To The Board of Trustees of Cornell University

We have audited the accompanying consolidated fi nancial statements of Cornell University (the “Uni-

versity”), which comprise the consolidated statement of fi nancial position as of June 30, 2017 and the

related consolidated statements of activities and of cash fl ows for the year then ended.

Management’s Responsibility for the Consolidated Financial Statements

Management is responsible for the preparation and fair presentation of the consolidated fi nancial

statements in accordance with accounting principles generally accepted in the United States of Ameri-

ca; this includes the design, implementation and maintenance of internal control relevant to the prep-

aration and fair presentation of consolidated fi nancial statements that are free from material misstate-

ment, whether due to fraud or error.

Auditors’ Responsibility

Our responsibility is to express an opinion on the consolidated fi nancial statements based on our au-

dit. We conducted our audit in accordance with auditing standards generally accepted in the United

States of America. Those standards require that we plan and perform the audit to obtain reasonable

assurance about whether the consolidated fi nancial statements are free from material misstatement.

An audit involves performing procedures to obtain audit evidence about the amounts and disclosures

in the consolidated fi nancial statements. The procedures selected depend on our judgment, including

the assessment of the risks of material misstatement of the consolidated fi nancial statements, whether

due to fraud or error. In making those risk assessments, we consider internal control relevant to the

University’s preparation and fair presentation of the consolidated fi nancial statements in order to de-

sign audit procedures that are appropriate in the circumstances, but not for the purpose of expressing

an opinion on the effectiveness of the University’s internal control. Accordingly, we express no such

opinion. An audit also includes evaluating the appropriateness of accounting policies used and the

reasonableness of signifi cant accounting estimates made by management, as well as evaluating the

overall presentation of the consolidated fi nancial statements. We believe that the audit evidence we

have obtained is suffi cient and appropriate to provide a basis for our audit opinion.

Opinion

In our opinion, the consolidated fi nancial statements referred to above present fairly, in all material

respects, the fi nancial position of Cornell University at June 30, 2017, and the changes in its net assets

and its cash fl ows for the year then ended in accordance with accounting principles generally accepted

in the United States of America.

Other Matter

We have previously audited the consolidated balance sheet as of June 30, 2016, and the related consoli-

dated statements of activities and cash fl ows for the year then ended (not presented herein), and in our

report dated October 27, 2016, we expressed an unmodifi ed opinion on those consolidated fi nancial

statements. In our opinion, the information set forth in the accompanying summarized fi nancial in-

formation as of June 30, 2016 and for the year then ended is consistent, in all material respects, with

the audited consolidated fi nancial statements from which it has been derived.

October 25, 2017

PricewaterhouseCoopers LLP, 1200 Bausch & Lomb Place, Rochester, NY 14604

9

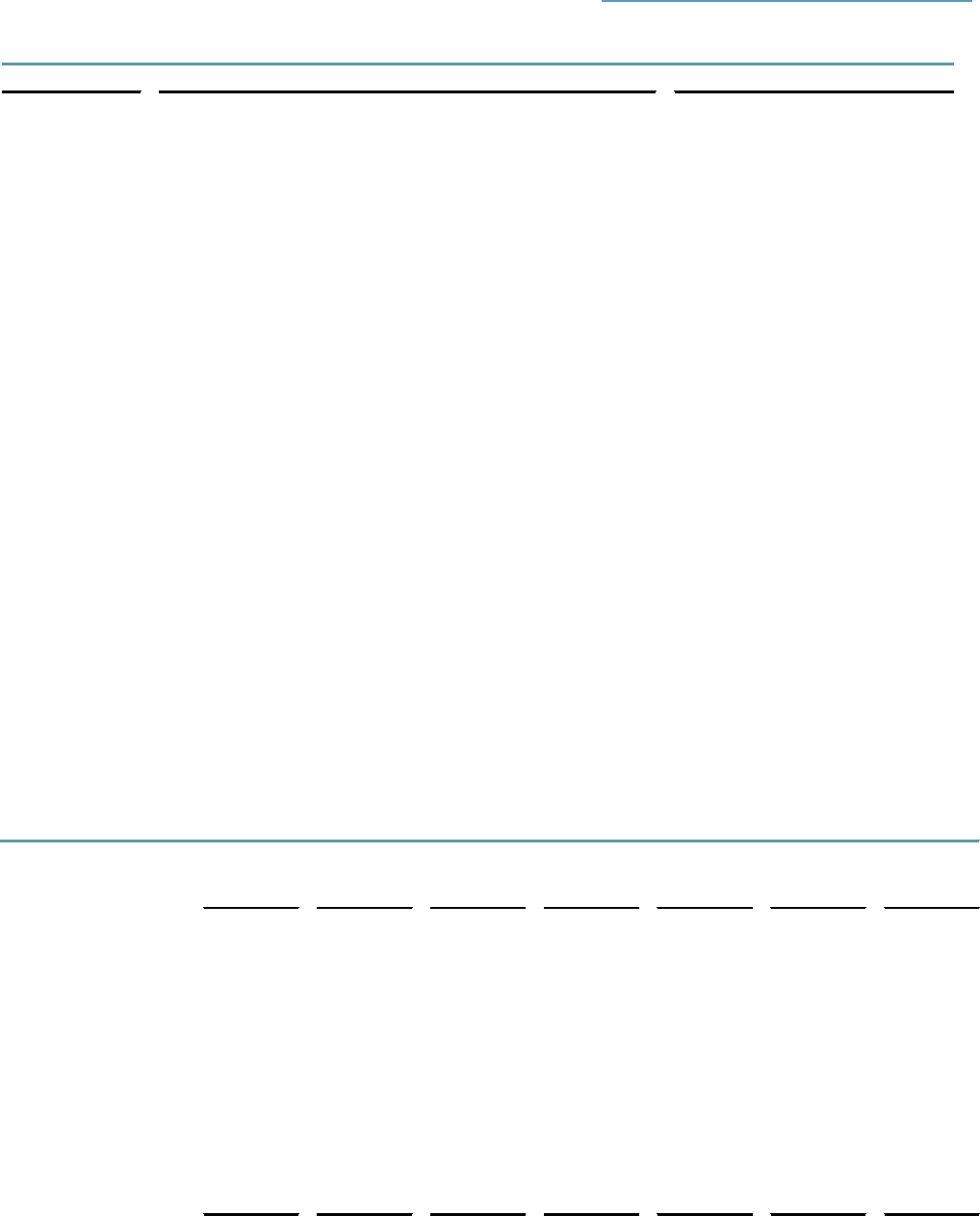

CONSOLIDATED STATEMENTS OF FINANCIAL POSITION

AS OF JUNE 30, 2017 AND JUNE 30, 2016 (in thousands)

2017 2016

Assets

1 Cash and cash equivalents 181,265$ 182,096$

2 Accounts receivable, net (note 2-A) 392,435 404,061

3 Contributions receivable, net (note 2-B) 902,846 986,322

4 Prepaid expenses and other assets 136,032 140,377

5 Student loans receivable, net (note 2-C) 79,211 80,956

6 Investments (note 3) 7,124,578 6,587,175

7 Land, buildings, and equipment, net (note 4) 4,256,807 4,009,285

8 Funds held in trust by others (note 5) 110,917 124,960

9 Total assets 13,184,091$ 12,515,232$

Liabilities

10 Accounts payable and accrued expenses 637,597$ 713,414$

11 Deferred revenue and other liabilities 190,025 195,448

12 Obligations under split interest agreements (note 5) 133,459 135,444

13 Deferred benefits (note 6) 610,516 656,410

14 Funds held for others (note 7) 137,093 153,065

15 Obligations under capital leases (note 9) 67,842 4,359

16 Bonds and notes payable (note 8) 1,332,261 1,567,368

17 Government advances for student loans 50,679 50,730

18 Total liabilities 3,159,472 3,476,238

Net assets (note 11)

19 Unrestricted 3,120,525 2,698,090

20 Temporarily restricted 3,329,946 3,204,004

21 Permanently restricted 3,574,148 3,136,900

22 Total net assets 10,024,619 9,038,994

23 Total liabilities and net assets 13,184,091$ 12,515,232$

The accompanying notes are an integral part of the consolidated financial statements.

10

CONSOLIDATED STATEMENT OF ACTIVITIES FOR THE YEAR-ENDED JUNE 30, 2017 (in thousands)

(WITH SUMMARIZED INFORMATION FOR THE YEAR-ENDED JUNE 30, 2016)

Temporarily

Unrestricted Restricted

Operating revenues

1

Tuition and fees 1,044,627$ -$

2 Scholarship allowance (367,731) -

3

Net tuition and fees 676,896 -

4 State and federal appropriations 150,912 -

5 Grants, contracts and similar agreements

6 Direct 451,023 -

7 Indirect cost recoveries 146,037 -

8 Contributions 88,777 208,851

9

Investment return, distributed 213,667

142,237

10 Medical Physician Organization 1,050,433 -

11

Auxiliary enterprises 162,433

-

12 Educational activities and other sales and services 722,590 -

13 Net assets released from restrictions 356,928

(356,928)

14 Total operating revenues 4,019,696 (5,840)

Operating expenses (note 10)

15 Compensation and benefits 2,585,582 -

16 Purchased services 315,228 -

17 Supplies and general 655,409 -

18 Maintenance and facilities costs 132,302 -

19 Interest expense (note 8) 52,635 -

20 Depreciation 280,176 -

21 Total operating expenses 4,021,332 -

22 Change in net assets from operating activities (1,636) (5,840)

Nonoperating revenues and (expenses)

23

State appropriations for capital acquisitions

45,096 -

24

Grants, contracts and similar agreements for capital acquisitions

31,168 -

25

Contributions for capital acquisitions, trusts and endowments

10,258 69,391

26

Investment return, net of amount distributed

147,906 237,496

27

Change in value of split interest agreements

19,979 (16,111)

28 Pension and postretirement changes 64,213 -

29 Swap interest and change in value of interest rate swaps 55,560

-

30 Other (8,659) -

31 Net asset released for capital acquisitions and reclassifications 58,550

(158,994)

32 Change in net assets from nonoperating activities 424,071 131,782

33 Change in net assets 422,435 125,942

34 Net assets, beginning of the year 2,698,090 3,204,004

35

Net assets, end of the year 3,120,525$ 3,329,946$

The accompanying notes are an integral part of the consolidated financial statements.

11

Permanently 2017 2016

Restricted Total Total

-$ 1,044,627$ 998,942$

1

- (367,731) (352,179) 2

- 676,896 646,763 3

- 150,912 149,138 4

5

- 451,023 444,818 6

- 146,037 142,010 7

- 297,628 266,629 8

- 355,904 327,906

9

- 1,050,433 982,430 10

- 162,433

160,853

11

- 722,590 688,667

12

- - - 13

- 4,013,856 3,809,214

14

- 2,585,582 2,442,735 15

- 315,228 313,165 16

- 655,409 666,041 17

- 132,302 122,324 18

- 52,635 56,803 19

- 280,176 258,698 20

- 4,021,332 3,859,766 21

- (7,476) (50,552) 22

- 45,096 41,604 23

- 31,168 39,592

24

310,886 390,535 245,669 25

19,612 405,014 (467,085)

26

6,703 10,571 (4,236) 27

- 64,213 (131,152)

28

- 55,560 (119,020) 29

(397) (9,056) 2,763 30

100,444 -

-

31

437,248 993,101 (391,865) 32

437,248 985,625 (442,417) 33

3,136,900 9,038,994 9,481,411 34

3,574,148$ 10,024,619$ 9,038,994$

35

12

CONSOLIDATED STATEMENTS OF CASH FLOWS

2017 2016

1 985,625$ (442,417)$

2 Proceeds from contributions for capital acquisitions, trusts and endowments (464,383) (293,552)

3 Depreciation and amortization 271,339 253,481

4 Net realized and unrealized (gain)/loss on investments (672,248) 202,286

5 Pension and postretirement changes (64,213)

131,152

6 Change in value of interest rate swaps (81,451) 89,965

7 Bond call premium 18,973 -

8 Loss on disposals of land, building, and equipment 7,470 4,181

9 Other adjustments (10,825) (22,101)

Change in assets and liabilities

10 Accounts receivable, net 11,626 10,546

11 Contributions receivable, net 83,476

107,521

12 Prepaid expenses and other assets (4,703) (5,751)

13 Accounts payable and accrued expenses (1,700) 19,757

14 Deferred revenue and other liabilities (5,423) 4,489

15 Obligations under split interest agreements 12,058 (10,992)

16 Deferred benefits 18,319 (2,316)

17 Net cash provided/(used) by operating activities 103,940 46,249

18 Proceeds from the sale and maturities of investments 17,338,583 9,900,735

19 Purchase of investments (17,181,628) (9,723,130)

20 Acquisition of land, buildings, and equipment (net) (453,370) (450,016)

21 Student loans granted (12,655)

(17,273)

22 Student loans repaid 14,974 13,090

23 Change in funds held for others, net of unrealized (gain)/loss on investments (29,034) (28,102)

24 Net cash used by investing activities (323,130) (304,696)

Proceeds from contributions for capital acquisitions, trusts and endowments

25 Investment in endowments 395,753 207,687

26 Investment in physical plant 65,202

81,219

27 Investment subject to living trust agreements 3,428 4,646

28 Principal payments of bonds, notes payable and capital leases (279,731) (181,860)

29 Proceeds from issuance of bonds and notes payable 52,731 154,068

30 Bond call premium, bond premium and issuance costs (18,973) 27,292

31

Government advances for student loans (51) (2,262)

32 Net cash provided by financing activities 218,359 290,790

33 Net change in cash and cash equivalents (831)

32,343

34 Cash and cash equivalents, beginning of year 182,096 149,753

35 Cash and cash equivalents, end of year 181,265

$

182,096$

36 Cash paid for interest 61,497$ 61,725$

37 Increase/(decrease) in construction payables, non-cash activity 7,334$ 9,895$

38 Assets acquired under capital leases 64,267$ 1,561$

39 Gifts-in-kind 10,250$

16,562

$

Cash flows from financing activities

Supplemental disclosure of cash flow information

The accompanying notes are an integral part of the consolidated financial statements.

FOR THE YEARS-ENDED JUNE 30, 2017 AND JUNE 30, 2016 (in thousands)

Cash flows from operating activities

Change in net assets

Adjustments to reconcile change in net assets

to net cash provided/(used) by operating activities

Cash flows from investing activities

13

NOTES TO THE

CONSOLIDATED

FINANCIAL

STATEMENTS

1. SIGNIFICANT ACCOUNTING POLICIES

A. Description of the Organization

Founded in 1865, Cornell University (“the University”) is dedicated to a mission of learning, discovery, and

engagement. Cornell is a private university, the federal land-grant institution of New York State, and a member

of the Ivy League. Cornell administers four contract colleges, which are also units of the State University of New

York. Described as the fi rst truly American university because of its founders’ revolutionary egalitarian and

practical vision of higher education, the University is dedicated to its land-grant mission of outreach and public

engagement. Cornell’s community includes almost 23,400 students, nearly 4,000 faculty, and approximately

278,000 alumni who live and work across the globe.

The University comprises colleges and schools in Ithaca, New York (seven undergraduate units and four graduate

and professional units), New York City (two medical graduate and professional units, together with its physician

organization referred to collectively as “Weill Cornell Medicine”), and Doha, Qatar (the “Weill Cornell Medical

College in Qatar”). Also in New York City, the Cornell Tech campus offers graduate programs in applied sciences,

including two programs offered jointly with the Technion - Israel Institute of Technology under the auspices of

the Joan and Irwin Jacobs Technion-Cornell Institute (“Jacobs Institute”).

The University is subject to the common administrative authority and control of the Cornell University Board of

Trustees. The University is prohibited from using funds attributable to the contract colleges (i.e., those colleges

operated by the University on behalf of New York State) for other units of the University. Except as specifi cally

required by law, the contract and endowed colleges at Ithaca, Cornell Tech in New York City, and Weill Cornell

Medicine (“WCM”) are, to the extent practicable, governed by common management principles and policies

determined at the private discretion of the University. In addition to the activities of the endowed and contract

colleges, the University’s subsidiaries and certain affi liated organizations are included in the consolidated fi -

nancial statements. All signifi cant intercompany transactions and balances are eliminated in the accompanying

consolidated fi nancial statements.

B. Basis of Presentation

The accompanying consolidated fi nancial statements are prepared in accordance with U.S. generally accepted

accounting principles (“GAAP”). Net assets, revenues, gains, and losses are categorized based on the existence

or absence of donor-imposed restrictions.

The University’s Board of Trustees, with consideration to the actions, reports, information, advice, and counsel

provided by its duly constituted committees and appointed offi cers of the University, including University Counsel,

has instructed the University to preserve the historical dollar value of donor-restricted (true) endowment funds,

absent explicit donor direction to the contrary. As a result, the University classifi es as permanently restricted net

assets the original gift value of true endowments, plus any subsequent gifts and accumulations made in accordance

with the directions of the applicable gift instruments. In accordance with accounting standards, the portion of

the true endowment fund not classifi ed as permanently restricted net assets is classifi ed as temporarily restricted

net assets except when the fair value of the endowment fund is less than its historical dollar value. For these “un-

derwater” funds, the difference between historic dollar value and fair value is refl ected in unrestricted net assets.

Temporarily restricted net assets also include gifts and appropriations from the endowment that can be expended,

but for which the donors’ purpose restrictions have not yet been met, as well as net assets with explicit or implied

time restrictions, such as pledges and split interest agreements. Expiration of donor restrictions is reported in

the consolidated statement of activities as a reclassifi cation from temporarily restricted net assets to unrestricted

net assets on the net assets released from restriction lines.

Unrestricted net assets are the remaining net assets of the University.

14

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(dollars in thousands)

C. Cash and Cash Equivalents

Cash and cash equivalents include cash on hand and in bank accounts, money market funds, and other temporary in-

vestments held for working capital purposes with an original maturity term of ninety days or less. The carrying amount

of cash equivalents approximates fair value because of their short terms of maturity. Cash that is part of the University’s

investment portfolio is reported as investments and included in Note 3.

D. Contributions

Contributions, including unconditional promises to give (pledges), are recognized as revenues in the appropriate categories

of net assets in the periods received. A pledge is recorded at the present value of estimated future cash fl ows, based on an

appropriate discount rate determined by management at the time of the contribution. Amortization of this discount in

subsequent years is included in contribution revenue. A contribution of assets other than cash is recorded at its estimated

fair value on the date of the contribution. Contributions for capital projects, endowments, and similar funds are reported

as non-operating revenues. Conditional promises to donate to the University are not recognized until the conditions are

substantially met.

Temporarily restricted net assets include contributions to the University and to the Cornell University Foundation (the

Foundation), an affi liated entity that is included in the consolidated fi nancial statements. The Foundation maintains a

donor-advised fund for which the donors can make recommendations to the fund’s trustees regarding distributions to the

University or other charitable organizations. Distributions from the Foundation to external charitable organizations are

recorded as non-operating expenses.

E. Investments

The University values certain fi nancial and non-fi nancial assets and liabilities, on a recurring basis, in accordance with a

hierarchy that categorizes and prioritizes the sources used to measure and disclose fair value. Fair value is defi ned as the

price associated with an orderly transaction between market participants at the measurement date. This fair-value hier-

archy is broken down into three levels based on inputs that market participants would use in valuing the fi nancial instru-

ments, which is based on market data obtained from sources independent of the University. The hierarchy of inputs used

to measure fair value, and the primary valuation methodologies used by the University for assets and liabilities measured

at fair value, are disclosed below.

Investment income is recorded on an accrual basis, and purchases and sales of investment securities are refl ected on a

trade-date basis. Realized gains and losses are calculated using average cost for securities sold.

Investment return included in operating revenues consists of amounts appropriated by the Board of Trustees from the

pooled endowment, as well as income and realized gains and losses on investments from working capital and non-pooled

endowments and similar funds. Unrealized gains and losses on investments, any difference between total return and

amounts appropriated from the pooled endowment, and income and realized gains reinvested per donor restrictions are

reported as non-operating activities.

F. Fair-Value Hierarchy

The University values certain fi nancial and non-fi nancial assets and liabilities, on a recurring basis, in accordance with a

hierarchy that categorizes and prioritizes the sources used to measure and disclose fair value. Fair value is defi ned as the

price associated with an orderly transaction between market participants at the measurement date. This fair-value hier-

archy is broken down into three levels based on inputs that market participants would use in valuing the fi nancial instru-

ments, which is based on market data obtained from sources independent of the University. The hierarchy of inputs used

to measure fair value, and the primary valuation methodologies used by the University for assets and liabilities measured

at fair value, are disclosed below.

The fair value of Level 1 securities is based upon quoted prices in accessible active markets for identical assets. Market price

data is generally obtained from exchange or dealer markets. The University does not adjust the quoted price for such assets.

The fair value of Level 2 securities is based upon quoted prices for similar instruments in active markets, quoted prices for

identical or similar instruments in markets that are not active, and model-based valuation techniques for which all signifi -

cant assumptions are observable in the market or can be corroborated by observable market data. Inputs are obtained from

various sources, including market participants, dealers, and brokers. In determining fair value of fi nancial instruments,

the University considers factors such as interest-rate yield curves, duration of the instrument, and counterparty credit

15

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(dollars in thousands)

risk. The fair value of Level 2 securities is determined using multiple valuation techniques including the market approach,

income approach, or cost approach.

The fair value of Level 3 securities is based upon valuation techniques that use signifi cant unobservable inputs.

Inputs used in applying the various valuation techniques refer to the assumptions that are used to make valuation deci-

sions. Inputs may include price information, credit data, liquidity statistics, and other factors. A fi nancial instrument’s level

within the fair-value hierarchy is based on the lowest level of any input that is signifi cant to the fair-value measurement. The

University considers observable data to be market data that is readily available and reliable and provided by independent

sources. The categorization of a fi nancial instrument within the fair-value hierarchy is, therefore, based upon the pricing

transparency of the instrument, and does not correspond to the University’s perceived risk of that instrument.

G. Derivative Instruments

The University has approved the use of derivatives by outside investment managers, based on investment guidelines ne-

gotiated at the time of a manager’s appointment. The derivatives are used to adjust fi xed income durations and rates, to

create “synthetic exposures” to certain types of investments, and to hedge foreign currency fl uctuations. The University

records the fair value of a derivative instrument within the applicable portfolio. The change in the fair value of a derivative

instrument held for investment is included in non-operating investment return in the consolidated statement of activities.

In addition, the University holds other derivatives to manage its current and/or future long-term debt. These instruments

are recorded at fair value as either prepaid or accrued expenses in the consolidated statement of fi nancial position, and

the swap interest and change in fair value is recorded as non-operating activity in the consolidated statement of activities.

Derivatives involve counterparty credit exposure. To minimize this exposure, the University manages counterparty risk

by limiting swap exposure for each counterparty and monitoring the fi nancial health of swap counterparties, and has

structured swap documents to limit maximum loss in the event of counterparty default.

H. Land, Buildings, and Equipment

Land, buildings, and equipment are stated in the consolidated statement of fi nancial position at cost on the date of ac-

quisition or at fair value on the date of donation, net of accumulated depreciation. Depreciation is computed using the

straight-line method over the estimated useful life of the asset, and is refl ected as an operating expense. Expenditures as-

sociated with the construction of new facilities are recorded as construction in progress until the projects are completed.

The University’s collections of art, rare books, and other property have been acquired through purchases and contributions

since the University’s inception. They are recognized as capital assets and are refl ected, net of accumulated depreciation,

in the consolidated statement of fi nancial position. A collection received as a gift is recorded at fair value as an increase in

net assets in the year in which it is received.

I. Split Interest Agreements

The University’s split interest agreements with donors consist primarily of charitable gift annuities, pooled income funds,

and charitable trusts for which the University serves as trustee. Assets held in trust are either separately invested or included

in the University’s investment pools in accordance with the agreements. Contributions of split interest agreements, net of

related liabilities, increase temporarily restricted net assets or permanently restricted net assets. Liabilities associated with

charitable gift annuities and charitable trusts represent the present value of the expected payments to the benefi ciaries based

on the terms of the agreements. Pooled income funds are recognized at the net present value of the net assets expected at

a future date. Gains or losses resulting from changes in fair value, changes in assumptions, and amortization of discount

are recorded as changes in value of split interest agreements in the appropriate restriction categories in the non-operating

section of the consolidated statement of activities.

J. Funds Held in Trust by Others

Funds held in trust by others represent resources that are not in the possession or under the control of the University. These

funds are administered by outside trustees, with the University receiving income or residual interest. Funds held in trust

by others are recognized at the estimated fair value of assets or the present value of future cash fl ows due to the University

when the irrevocable trust is established or the University is notifi ed of its existence. Gains or losses resulting from changes

in fair value are recorded as non-operating activities in the consolidated statement of activities.

16

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(dollars in thousands)

K. Endowments

The responsibility for accepting, preserving, and managing those funds entrusted to the University rests, by law, with the

Board of Trustees; however, the Trustees have delegated authority for investment decisions to the Investment Committee

of the Board of Trustees. The Investment Committee determines investment policy, objectives, and guidelines, including

allocation of assets between classes of investments.

The University’s investment objective for its endowment assets is to maximize total return within reasonable risk param-

eters, specifi cally to achieve a total return, net of expenses, of at least fi ve percent in excess of infl ation, as measured by

the Consumer Price Index over rolling fi ve-year periods. The achievement of favorable investment returns enables the

University to distribute over time increasing amounts from the endowment so that present and future needs can be treated

equitably in infl ation-adjusted terms. Diversifi cation is a key component of the University’s standard for managing and

investing endowment funds, and asset allocation targets are subject to ongoing reviews by the Investment Committee of

the Board of Trustees.

The University applies the “prudent person” standard when deciding whether to appropriate or accumulate endowment

funds, and considers the following factors: the duration and preservation of the endowment fund, the purposes of the

institution and the endowment fund, the general economic conditions including the potential effect of infl ation or defl a-

tion, the expected total return of the fund, other resources of the University, the needs of the University and the fund to

make distributions and preserve capital, and the University’s investment policy.

The Board authorizes an annual distribution from endowment funds that is within a target range of 4.4 percent to 5.9

percent of a 12-quarter rolling average of the unit fair value. The Trustees may occasionally make step adjustments, either

incremental or decremental, based on prior investment performance, current market conditions, and/or any of the factors

for prudent judgment described above. Total distributions, or spending, are presented as investment return, distributed,

on the consolidated statement of activities, and includes endowment payout and an administrative fee that supports the

investment and stewardship costs of the University endowment.

The New York Prudent Management of Institutional Funds Act (“NYPMIFA”) established a requirement related to appro-

priations from endowments for which the fair value falls below the historic dollar value (“underwater”). The University,

in compliance with NYPMIFA, notifi ed available donors who had established endowments prior to September 17, 2010

of the new law, and offered these donors the option of requiring the University to maintain historical dollar value for their

endowment funds. A minority of donors requested this option; for those who did, the University has designed procedures

to ensure that the University maintains historical dollar value by not expending the payout on any underwater fund.

L. Sponsored Agreements

Revenues under grants, contracts, and similar agreements are recognized at the time expenditures are incurred. These

revenues include the recovery of facilities and administrative costs, which are recognized according to negotiated prede-

termined rates. Amounts received in advance and in excess of incurred expenditures are recorded as deferred revenues.

M. Medical Physician Organization

The Medical Physician Organization (“MPO”) provides the management structure for the practice of medicine at the WCM

academic medical center and the Physician Organization Network. In addition to conducting instructional and research

activities, physician members generate clinical practice income from their professional services to patients. MPO revenue

represents patient care and management service agreement fees. Expenses of the clinical practice, including physician

compensation, administrative operations, and provision for uncollectible accounts, are refl ected as University expenses.

N. Use of Estimates

The preparation of fi nancial statements in conformity with U.S. GAAP requires management to make estimates and

assumptions that affect the reported amounts of assets, liabilities, revenues, and expenses during the reporting period.

Management’s assumptions are primarily related to the appropriate discount rate for the purposes of fair-value calcula-

tions, to allowances for doubtful accounts and contractual allowances, and to self-insured risks. Actual results may differ

from those estimates.

17

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(dollars in thousands)

O. Comparative Financial Information

The consolidated statement of activities includes prior-year information in summary form rather than by restriction class.

Such information does not include suffi cient detail to constitute a presentation of prior-year data in conformity with U.S.

GAAP. Accordingly, such information should be read in conjunction with the University’s consolidated fi nancial statements

for the prior fi scal year from which the summarized information was derived.

P. Accounting Pronouncements

In April 2015, the Financial Accounting Standards Board (“FASB”) issued ASU 2015-03–Imputation of Interest (Subtopic

835-30): Simplifying the Presentation of Debt Issuance Costs, to reduce the cost and complexity in presentation of debt

issuance cost by aligning its presentation with the debt discount or premium. This update requires all costs incurred to

issue debt to be presented in the balance sheet as a direct deduction from the carrying value of the associated debt liability.

The effective date of this change for the University was the fi scal year ended June 30, 2017. Implementation of this stan-

dard update resulted in the reclassifi cation of $7.5 million and $10.7 million from the prepaid expenses and other assets

line to the bonds and notes payable line for the fi scal years ended June 30, 2017 and 2016, respectively. The unamortized

issuance costs have been added to the unamortized premium and issuance costs line in the Summary of Bonds and Notes

Payable table in Note 8.

In April 2015, the FASB also issued ASU 2015-05–Intangibles - Goodwill and Other Internal-Use Software (Subtopic 350-

40): Customer’s Accounting for Fees Paid in a Cloud Computing Arrangement, which provides guidance to help entities

evaluate whether a cloud computing arrangement includes a software license. If there is contractual right to take possession

of software at any time during its hosting period without signifi cant penalty, and it is feasible to either run the software on

the University’s hardware or contract with another party unrelated to the vendor to host the software, then the contract

(or portion thereof) is accounted for as an acquisition of software. Otherwise, the contract is accounted for as a service

contract (i.e., expensed). The effective date of this change for the University was the fi scal year ended June 30, 2017. The

University performed an analysis of its cloud computing arrangements and determined that no contracts met the criteria

as software acquisition under this new standard.

In March 2017, the FASB issued ASU 2017-07—Compensation—Retirement Benefi ts (Topic 715): Improving the Presenta-

tion of Net Periodic Pension Cost and Net Periodic Postretirement Benefi t Cost. Currently, net periodic costs are recorded

as operating expenses and are comprised of: service costs, interest costs, expected return on assets, and amortized net loss/

(gain). This accounting standard allows only the service costs to be presented as operating expenses; the other elements

of the net periodic costs must be considered non-operating. The effective date of this change is the fi scal year ending June

30, 2019; however, the University has elected to adopt this standard for the fi scal year ended June 30, 2017. The impact of

this presentation change is a reclassifi cation of $17.6 million and $7.8 million, from operating to non-operating expense,

for the years ended June 30, 2017 and 2016, respectively. The pension and postretirement changes line on the consolidated

statement of activities includes both the change in funded status and the other components of net periodic costs. These

two amounts are separately disclosed in the Summary of Obligations and Funded Status table in Note 6C.

In May 2014, the FASB issued ASU 2014-09–Revenue from Contracts with Customers (Topic 606) at the conclusion of a

joint effort with the International Accounting Standards Board to create common revenue recognition guidance for U.S.

GAAP and international accounting standards. This framework ensures that entities appropriately refl ect the consideration

to which they expect to be entitled in exchange for goods and services, by allocating transaction price to identifi ed per-

formance obligations, and recognizing that revenue as performance obligations are satisfi ed. Qualitative and quantitative

disclosures will be required to enable users of fi nancial statements to understand the nature, amount, timing, and uncertainty

of revenue and cash fl ows arising from contracts with customers. In August of 2015, FASB issued ASU 2015-14–Revenue

from Contracts with Customers (Topic 606): Deferral of the Effective Date, which makes ASU 2014-09 effective for the

fi scal year ending June 30, 2019. The University is planning for the implementation of this new standard.

In February 2016, the FASB issued ASU 2016-02–Leases (Topic 842) which provides accounting guidance for leases from

both the lessor’s and lessee’s perspective. The main difference between previous GAAP and Topic 842 is the recognition of

lease assets and lease liabilities by lessees for those leases classifi ed as operating leases; however, the University will evaluate

other impacts of the new guidance. The new standard will be effective in the fi scal year ending June 30, 2020. The University

has begun its planning for implementation of this new standard.

In August 2016, the FASB issued ASU 2016-14–Not-for-Profi t Entities (Topic 958): Presentation of Financial Statements

for Not-for-Profi t Entities to improve the information presented in fi nancial statements and notes about a not-for-profi t

entity’s liquidity, fi nancial performance, and cash fl ows. The signifi cant changes under the new guidance include the

reduction of net asset classifi cations to two categories based on the existence or absence of donor restrictions, and addi-

18

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(dollars in thousands)

tional disclosure requirements related to board designation of net assets, and related to the liquidity and availability of the

entity’s fi nancial assets. ASU 2016-14 is effective for the fi scal year ending June 30, 2019. The University is planning for the

implementation of this new standard.

Q. Reclassifi cations

The University reclassifi ed certain lines in the consolidated statement of fi nancial position to conform to the current year

presentation. These changes impacted the prepaid expenses and other assets, deferred revenue and other liabilities, and

bonds and notes payable lines. In addition, changes impacting the consolidated statement of activities were made on the

compensation and benefi ts and the pension and postretirement changes lines due to the early adoption of ASU 2017-07,

and certain prior year expenses within the purchased services and supplies and general lines to conform to the current

year presentation. Also, the impact of net settlements of the interest rate swaps was reclassifi ed from interest expense to

the swap interest and change in value of interest rate swaps line. Finally, revenue from WCM’s agreement with New York-

Presbyterian Hospital was reclassifi ed from MPO revenue to the educational activities and other sales and services line.

R. Income Taxes

The University is a not-for-profi t organization as described in Section 501(c)(3) of the Internal Revenue Code and is gen-

erally exempt from income taxes on related income pursuant to the appropriate sections of the Internal Revenue Code. In

accordance with the accounting standards, the University evaluates its income tax position each fi scal year to determine

whether the position is more likely than not to be sustained if examined by the applicable taxing authority. This review

had no material impact on the University’s consolidated fi nancial statements.

2. RECEIVABLES

A. Accounts Receivable

The University’s receivables from the sources identifi ed in the table below are reviewed and monitored for aging and

other factors that affect collectability.

Accounts receivable from the following sources were outstanding as of June 30:

The patient accounts receivable for medical services was comprised of the following at June 30, 2017 and 2016, respectively:

commercial third parties 67.3 percent and 64.4 percent; federal/state government 16.7 percent and 15.3 percent; and patients

16.0 percent and 20.2 percent. Note 12 provides additional information related to the reinsurance receivable.

Other accounts receivable include receivables from other government agencies, matured bequests, and receivables from

other operating activities.

B. Contributions Receivable

Unconditional promises to give, or pledges, are recorded in the consolidated fi nancial statements at present value using

discount rates ranging from 1.0 percent to 7.0 percent. The methodology for estimating uncollectible amounts is based on

an analysis of the historical collectability of contributions receivable. Contributions are expected to be realized as follows:

2017 2016

Grants and contracts 95,361$ 85,386$

New York Presbyterian Hospital and other affiliates 40,484 44,603

Patients (net of contractual allowances) 118,608 131,669

Reinsurance receivable 103,726 102,891

Student accounts 13,659 16,095

Other 60,339 59,329

Gross accounts receivable 432,177$ 439,973$

Less: allowance for doubtful accounts (39,742) (35,912)

Net accounts receivable 392,435

$ 404,061$

SUMMARY OF ACCOUNTS RECEIVABLE

19

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(dollars in thousands)

Contributions receivable as of June 30 are intended for the following purposes:

At June 30, 2017, conditional promises not refl ected in the consolidated fi nancial statements, which consist primarily of

bequest intentions and conditional promises with signifi cant requirements, were $460,329.

C. Student Loans Receivable

In keeping with Ezra Cornell’s vision, the University has a “need-blind” policy of admission. Many students receive fi nancial

aid that consists of scholarship/fellowship grants, work-study opportunities and, when appropriate, student loans.

Student loan programs are funded by donor contributions, other institutional sources, and governmental programs,

primarily the Federal Perkins Loan Program. The amounts received from the federal government’s portion of the Perkins

program are ultimately refundable to the federal government and are reported as a liability on the University’s consolidated

statement of fi nancial position as government advances for student loans.

Credit worthiness is not a factor when granting a student a loan from institutional or federal resources; the loan is based

on fi nancial need. However, once the loan is in repayment status, the University monitors, no less than quarterly, the ag-

ing of the student loans receivable. If a loan is 75 days past due, the University generally will not release a transcript and/

or diploma. If the loan is 180 days past due, the University evaluates whether to assign the account to an external agency

for collection.

The Cornell University Bursar authorizes any write-off of a student loan receivable; such write-offs are based primarily

on the aging report and an evaluation of any recent activity in the account. Overall default rates and general economic

conditions are evaluated at least annually. The University, because of its close and continuing relationship with its students

and graduates, seeks to work closely with the students to help ensure repayment. At June 30, 2017, the average default rate

approximated 9.1 percent, with a rate of approximately 2.2 percent on the federal revolving loan portfolio. Student loans

are considered to be in default status when over 150 days past due. The average rate includes both the federal loans and

the institutional loans.

Student loans are often subject to unique restrictions and conditions and, therefore, it is not practical to determine their

fair values. The allowance for doubtful accounts is for all loans, whether in repayment status or not.

The two tables below provide additional information about the student loan receivables and the allowances associated with

federal and institutional loan programs.

2017 2016

Less than one year 372,009$ 366,885$

Between one and five years 413,276 561,661

More than five years 242,001 155,652

Gross contributions receivable 1,027,286$ 1,084,198$

Less: unamortized discount (96,517) (67,371)

Less: allowance for uncollectible amounts (27,923) (30,505)

Net contributions receivable 902,846$ 986,322$

SUMMARY OF CONTRIBUTIONS RECEIVABLE

2017 2016

Program support 469,049$ 521,273$

Capital purposes 184,457 289,949

Long-term support 249,340 175,100

Net contributions receivable 902,846$ 986,322$

EXPECTED PURPOSE OF CONTRIBUTIONS RECEIVABLE

20

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(dollars in thousands)

3. INVESTMENTS

A. General Information

The University’s investments are overseen by the Investment Committee of the Board of Trustees. The University’s invest-

ment strategy incorporates a diversifi ed asset allocation approach and maintains, within defined limits, exposure to the

movements of the world equity, fixed income, commodities, real estate, and private equity markets. Based on guidelines

established by the Investment Committee, the University’s Investment Office directs the investment of endowment and

trust assets, certain working capital, and temporarily invested expendable funds.

The University maintains a number of investment pools or categories for specifi c purposes as follows:

Total earnings on the University’s investment portfolio for the fi scal years ended June 30 is presented in the following

table:

B. Fair Value

The University’s investment holdings as of June 30, categorized in accordance with the fair-value hierarchy, are summarized

in the following table:

2016

Federal

revolving

Institutional Total allowance Total allowance

Allowance at beginning of year (2,360)$ (2,501)$ (4,861)$ (4,647)$

Current year provisions 964 (138) 826 34

Current year write-offs - (252) (252) (248)

Allowance at end of year (1,396)$ (2,891)$ (4,287)$ (4,861)$

CHANGE IN STUDENT LOAN ALLOWANCE

2017

2017 2016

Long-term investments (LTI)

Long-term investment pool (LTIP) 6,363,271$ 5,629,008$

Other LTI 394,477 343,333

Total LTI 6,757,748$ 5,972,341$

Intermediate-term 62 277,263

Separately invested and other assets 366,768 337,571

Total investments 7,124,578$ 6,587,175$

INVESTMENT POOLS/CATEGORIES AT FAIR VALUE

2017 2016

Interest and dividends, net of investment fees 75,608$ 77,473$

Net realized gain/(loss) 324,262 210,733

Net unrealized gain/(loss) 361,048 (427,385)

Total investment return 760,918$ (139,179)$

SUMMARY OF INVESTMENT RETURN

SUMMARY OF STUDENT LOANS RECEIVABLE

2016

Receivable Allowance Net receivable Net receivable

Federal revolving loans 49,365$

(1,396)$ 47,969$ 51,714$

Institutional loans 34,133 (2,891) 31,242 29,242

Total student loans receivable 83,498$ (4,287)$ 79,211$ 80,956$

2017

21

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(dollars in thousands)

Level 1 investments consist of cash and cash equivalents, equity, and fi xed-income securities with observable market prices.

Fair value is readily determinable based on quoted prices in active markets. Unsettled trade receivable and payable valua-

tions are refl ective of cash settlements subsequent to the fi scal year-end and are also categorized as Level 1. The University

does not adjust the quoted price for such instruments, even in situations where the University holds a large position and

a sale of all its holdings could reasonably impact the quoted price.

Investments that are classifi ed as Level 2 include domestic and foreign equities, as well as fi xed income securities that trade

in markets that are not considered to be active. Fair value is based on observable inputs for similar instruments in the mar-

ket, and obtained by various sources including market participants, dealers, and brokers; the University’s custodian secures

pricing for these assets. The fair value of derivative investments is based on market prices from the fi nancial institution

that is the counterparty to the derivative.

Level 3 investments have signifi cant unobservable inputs, as they trade infrequently or not at all. The inputs into the deter-

mination of fair value are based upon the best information in the circumstance and may require signifi cant management

judgment. Investments included in Level 3 consist primarily of the University’s ownership in real estate, oil and mineral

rights, limited partnerships, and equity positions in private companies.

C. Investments Using Net Asset Value

The net asset value (“NAV”) column above represents the University’s ownership interest in certain alternative investments.

As a practical expedient, the University uses its ownership interest in the NAV to determine the fair value of all alternative

investments that do not have a readily determinable fair value, and have fi nancial statements consistent with the measure-

ment principles of an investment company or have the attributes of an investment company. The NAV of these invest-

ments is determined by the general partner and is based upon appraisal or other estimates that require varying degrees of

judgment. If no public market exists for the investment securities, the general partner will take into consideration, among

other things, the cost of the securities, prices of recent significant placements of securities of the same issuer, and subse-

quent developments concerning the companies to which the securities relate. The University has performed significant due

diligence around these investments to ensure that NAV is an appropriate measure of fair value as of June 30.

Securities not included in investment portfolio

Cash and cash equivalents 69,963$ -$ -$ -$ 69,963$ 84,714$

Level 1

fair value

Level 2

fair value

Level 3

fair value

Net

asset value

2017

Total

2016

Total

Cash and cash equivalents 332,132$ 16,566$ -$

-$ 348,698

$ 323,766$

Derivatives (342) (1,918) - - (2,260) (3,527)

Equity

Domestic equity 419,412 61,390 1,656 207,434 689,892 646,613

Foreign equity 697,320 33,534 6,744 506,785 1,244,383 886,137

Hedged equity - - 4,945 430,809 435,754 629,455

Private equity - - 47,822 1,332,736 1,380,558 1,173,988

Fixed income

Asset backed fixed income - 26,646 929 - 27,575 29,604

Corporate bonds - 213,805 2,888 - 216,693 446,485

Equity partnership -

74 -

459,107

459,181

478,517

International 15,585

76,629

- -

92,214

110,355

Municipals - 11,005 - -

11,005

12,998

Mutual funds (non-equity) - 19,921 - -

19,921

22,603

Preferred/convertible - 15,103 5,014 - 20,117 28,929

Other fixed income - 105 - - 105 5,737

US government 42,897 87,886 - - 130,783 156,155

Marketable alternatives - 152 - 878,830 878,982 722,079

Real assets - 1,350 23,953 1,160,483 1,185,786 936,496

Receivable for investments sold 19,842 - - - 19,842 39,336

Payable for investments purchased (58,727) - - - (58,727) (83,011)

Other - - 24,076 - 24,076 24,460

Total investments 1,468,119$ 562,248$ 118,027$ 4,976,184$ 7,124,578$ 6,587,175$

INVESTMENTS AT FAIR VALUE

22

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(dollars in thousands)

The following tables provide additional information about alternative investments measured at NAV:

Asset class Strategy NAV in funds Remaining life

Unfunded

commitments

Timing to draw

commitments

Buyout $ 337,326 $ 329,677

Growth 327,515 204,258

Venture capital 667,895 162,660

Total private equity $ 1,332,736

1 to 10 years

$ 696,595

1 to 10 years

Real estate 574,092 308,893

Natural resource 586,391 282,761

Total real assets $ 1,160,483

1 to 10 years

$ 591,654

1 to 10 years

Distressed 214,158 76,194

Leveraged loans 48,215 6,250

Mezzanine 96,757 132,593

Multi-strategy 99,977 93,167

Total fixed income $ 459,107

1 to 10 years

$ 308,204

1 to 10 years

Emerging markets 123,757

Global equity 163,420

Foreign index 219,608

Total foreign equity $ 506,785

Global equity long/short 250,006

U.S. equity long/short 180,803

Total hedged equity $ 430,809

Marketable Event driven 153,223

alternatives Global macro 725,607

Total marketable

alternatives

$ 878,830

Domestic equity

Indexed

207,434

Total domestic equity $ 207,434

Total for alternative investments using NAV

$ 4,976,184 $ 1,596,453

Hedged equity

SUMMARY OF ALTERNATIVE INVESTMENTS MEASURED USING NET ASSET VALUE

Private equity

Real assets

Fixed income

Foreign equity

23

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(dollars in thousands)

D. Level 3 Investments

The table below presents a summary of Level 3 investment activity. All net realized and unrealized gains/(losses) in the

table are refl ected in the accompanying consolidated statement of activities. Net unrealized gains/(losses) relate to those

fi nancial instruments held by the University at June 30, 2017. There were no signifi cant transfers into or out of Level 3

during the fi scal year ended June 30, 2017.

Level 3 equities not priced by qualifi ed third parties (e.g., brokers, pricing services, etc.) are valued using discounted cash

fl ow, taking into account various factors including nonperformance risk, counterparty risk, and marketability. Investment

value is also derived using a market approach through comparison to recent and relevant market multiples of comparable

companies. Start-up assets, held by the University’s student-run venture fund or other similar programs, are maintained

at or near initial investment amounts due to the nature of the activity.

Fair value at

June 30,

2016

Realized

gain/(loss)

Unrealized

gain/(loss)

Purchases Sales

Transfers

in/(out) of

Level 3

Fair value at

June 30,

2017

Equity

Domestic equity 3,416$ -$ (1,664)$ -$ (96)$ -$ 1,656$

Foreign equity 17,857 (1,495) 2,337 2,485 (14,440) - 6,744

Hedged equity 1,949 (6) (256) 3,448 (190) - 4,945

Private equity 42,058 - 5,418 500 (154) - 47,822

Fixed income

Asset backed fixed income 1,006 - - - (77) - 929

Corporate bonds 127 5 (239) 3,209 (214) - 2,888

Preferred/convertible 4,959 - 55 - - - 5,014

Real assets 27,383 (172) (1,648) 397 (2,007) - 23,953

Other 24,460 297 (3,080) 2,399 - - 24,076

Total level 3 investments 123,215$ (1,371)$ 923$ 12,438$ (17,178)$ -$ 118,027$

SUMMARY OF LEVEL 3 INVESTMENT ACTIVITY

Asset class Redemption terms Redemption restrictions*

Private equity n/a** n/a

Real assets n/a** n/a

Fixed income Rolling 2 year redemptions with 90 days notice***

50% of each new contribution has 2 year