DRAFT – NOT FOR CIRCULATION OR CITATION

Authors

Sarah Anderson directs the Global Economy Project at the Institute for Policy Studies and

is the lead author of the annual IPS Executive Excess report. She is also a co-editor of the

IPS web site Inequality.org.

Scott Klinger is the Senior Equitable Development Specialist at Jobs With Justice. He has

worked in the arenas of corporate social responsibility, executive compensation, and

corporate taxes for three decades. He crafted the first shareholder proposals on executive

pay while working as a social investment portfolio manager. Scott is a CFA charterholder.

Research Assistance: Bella DeVaan, Program Associate and Inequality.org co-editor at

the Institute for Policy Studies.

Cover design: Sarah Gertler, Institute for Policy Studies.

Acknowledgements: Thanks to Monique Morrissey, Economic Policy Institute, for expert

comments on this report.

The Institute for Policy Studies (www.IPS-

dc.org) is a multi-issue research center that has

conducted path-breaking research on executive

compensation for more than 20 years. The IPS

Inequality.org website provides an online portal

into all things related to the income and wealth

gaps that so divide us, in the United States and

throughout the world. Sign up for our weekly

newsletter at: inequality.org/subscribe/ Twitter:

@inequalityorg

Institute for Policy Studies

1301 Connecticut Ave. NW, Suite 600

Washington, DC 20036

202 234-9382, www.ips-dc.org, Twitter: @IPS_DC

Facebook:

www.facebook.com/InstituteforPolicyStudies

Email: sarah@ips-dc.org

Jobs With Justice (www.jwj.org) believes that all

workers should have collective bargaining rights,

employment security and a decent standard of

living within an economy that works for

everyone. We bring together labor, community,

student, and faith voices at the national and local

levels to win improvements in people’s lives and

shape the public discourse on workers’ rights and

the economy.

Jobs With Justice

1150 Connecticut Ave. NW, Suite 200

Washington, DC 20036

202-393-1044, Twitter @jwjnational

Facebook: www.facebook.com/jobswithjustice

Email: [email protected]

Contents

Key Findings…………………………………………………………………………….…… 1

The Double Standard in Government Retirement Subsidies ..……….………….…….. 3

Company Examples……………………….……………………………..………...………… 7

Low-wage employers

Real estate executives

Health care executives

Narrowing the Retirement Divide…………………………………………………….…… 12

Methodology and Sources…………………………..……………..……….………………. 14

1

Key Findings

A double standard in our tax code for government retirement subsidies gives preferential

treatment to those who need it least — wealthy corporate executives. Ordinary employees with

access to 401(k) plans face strict limits on the amounts they can set aside, tax-free, for their

golden years. Most senior executives of large corporations, on the other hand, have unlimited

tax-deferred compensation accounts. Often called “top hat” plans, these special perks for

executives are growing rapidly.

“Top hat” plans offer the rich one more way to avoid paying their fair share of taxes

• The top five executives at S&P 500 firms held a combined $8.9 billion in special tax-deferred

accounts at the end of 2021 and such perks became even more common over the past year.

Executives owe income taxes on this compensation when they withdraw the funds. But in

the meantime, they benefit from the tax-free compounding of investment returns.

• An executive who sets aside $1 million in a deferred account every year for seven years and

earns average returns would wind up with an estimated $1.3 million more in after-tax

earnings and $1 million less in tax liabilities than an executive who pays annual income

taxes on that compensation and capital gains taxes on investment assets purchased with that

compensation income.

Low-wage employers have among the largest deferred compensation accounts while

many of their workers can’t afford to contribute to 401(k) plans

• At more than 20 low-wage employers, executives have sufficient deferred compensation

funds to generate monthly retirement checks larger than their workers’ median annual pay.

• Walmart CEO Doug McMillon held more than $169 million in his deferred compensation

account at the end of 2022 — enough to generate a monthly retirement check worth more

than $1 million. The retail giant offers employees 401(k) plans with matching funds, but 46

percent of eligible participants have zero balances. Median pay at Walmart: $27,136 (half of

their 2.1 million employees make less).

• Hyatt Hotels Board Chair and billionaire Thomas Pritzker is sheltering $91 million from

taxes in his deferred pot, while 36 percent of the hotel chain’s employees have not been able

to set aside any funds in their 401(k) accounts. Half of Hyatt employees make less than

$40,395.

• A majority (53 percent) of eligible participants in Home Depot’s 401(k) plan have zero

balances. Meanwhile, former CEO and current Board Chair Craig Menear is sitting on $14.8

million in deferred compensation — enough to generate a monthly retirement check three

times larger than the company’s median worker pay of just $30,100.

2

As ordinary families struggle with rising housing costs, real estate executives are sitting

on massive tax-sheltered funds

• Paul Saville, Executive Chairman of NVR, the owner of Ryan Homes, has the fattest

“top hat” account in the S&P 500. The $488 million in his account at the end of 2022 is

enough to generate a $3 million retirement check every month for the rest of his life.

That’s 1,514 times as much as a typical American retiree could expect to receive every

month, based on the average U.S. Social Security benefit and median 401(k) accounts.

• Two leading rental apartment corporations, Camden Property Trust and AvalonBay

Communities, are also near the top of the “top hat” list. At Camden, two executives

have more than $80 million each in their deferred accounts while the Executive Chair of

AvalonBay has $23 million.

Health care executives have amassed huge deferred compensation accounts, buoyed by

taxpayer investments

• The CEO of Centene, the nation’s largest Medicaid provider, had the second-largest

“top hat” plan in the S&P 500 in 2022, valued at $328 million.

• Fueled by Covid vaccine profits, Pfizer CEO Albert Bourla enjoyed a 37 percent increase

in the value of his deferred compensation account over the past year, from $29.5 million

to $44.4 million at the end of 2022.

The deferred compensation double standard is widening the retirement divide

• Among S&P 500 CEOs with tax-deferred accounts, the average balance at the end of

2021 was $14.6 million. By contrast, the median 401(k) balance at Vanguard, a major

provider of such plans, was just $33,472. The current annual contribution limit for 401(k)

plans: $22,500, or $30,000 for employees over age 50.

• Nationwide, just 35 percent of working-age adults have tax-deferred 401(k)-type defined

contribution plans through their employer and another 13 percent have defined benefit

or cash balance plans. Some 42 percent of Americans age 56-64 have zero retirement

account savings, according to the U.S. Census Bureau. Americans who are unable to

save for retirement need to rely on Social Security, which pays an average monthly

benefit of $1,784, as of March 2023.

• Among S&P 500 CEOs with company-provided retirement assets (either or both a “top

hat” plan and a pension) the average balance at the end of 2021 was $19.4 million.

3

The Double Standard in Government

Retirement Subsidies

In the eight years we’ve been analyzing the retirement divide, we’ve seen ordinary workers

struggle with rising insecurity while corporate executives enjoy ever larger gilded nest eggs.

One largely overlooked factor in this disparity: the double standard in government retirement

subsidies.

The sections of the U.S. tax code related to employer-provided, tax-deferred retirement accounts

impose one set of strict rules on ordinary workers and another set of far more flexible rules for

corporate top brass. Employees with 401(k) plans face hard caps on the amounts they can set

aside in these accounts every year. By contrast, Section 409A of the tax code allows top

corporate executives to place unlimited amounts in special “non-qualified tax deferred

compensation” accounts, often called “top hat” plans.

From a policy point of view, no rational argument exists for allowing certain members of

society to shelter unlimited amounts of compensation from taxes simply because of the kind of

work they perform. This double standard reflects corporate leaders’ power to rig rules in their

favor.

A Tale of Two Retirements: The Worker Story

Some 42 percent of Americans age 56-64 have zero retirement account savings, according to the

U.S. Census Bureau. For decades now, large U.S. corporations have been making workers’

retirement futures less secure by abandoning traditional pensions in favor of 401(k) plans.

In 1984, more than 30 million Americans had defined benefit pensions through which

employers bore the financial risks for their workers’ retirement security. By 2020, that number

had declined to just 12 million, and private sector workers were approximately 3.5 times as

likely to have a defined contribution plan as a traditional pension.

The current annual limit on 401(k) contributions: $22,500, or $30,000 for employees over age 50.

Under these plans, the amount employees will receive after retirement depends on how much

they contribute, the whims of financial markets, and the size of often hidden administrative

costs and fees.

Last year’s bear market was a painful reminder of the unpredictability of such funds. Fidelity,

the largest manager of 401(k) plans, reported a 20 percent drop in average balances between the

last quarters of 2021 and 2022.

4

Companies often match a portion of employee 401(k) contributions, but this benefit is

meaningless for the many low-wage workers who cannot afford to set aside any of their wages,

as we detail in the next section of this report.

In 2022, Congress passed the SECURE 2.0 bill, which requires companies with new 401(k) plans

to automatically enroll eligible employees, starting in 2025. While well-intentioned, this reform

will have limited impact because the new rules don’t apply to businesses with existing plans

and workers who cannot afford to contribute will still need to opt out of the benefit.

A Tale of Two Retirements: The Executive Story

By shifting investment risk onto employees through defined contribution plans, corporations

have slashed their overall retirement costs, boosting earnings and stock prices and in turn

pumping up executives’ stock-based pay.

The unlimited tax-deferred accounts most big company top executives hold also provide huge

tax savings. Executives owe income taxes on their deferred compensation when they withdraw

the funds. But in the meantime, they benefit from the tax-free compounding of investment

returns.

An executive who sets aside $1 million every year for seven years and earns average returns

would wind up with an estimated $1.3 million more in after-tax earnings and $1 million less in

tax liabilities than an executive who pays annual income taxes on that compensation and capital

gains taxes on investments purchased with that compensation.

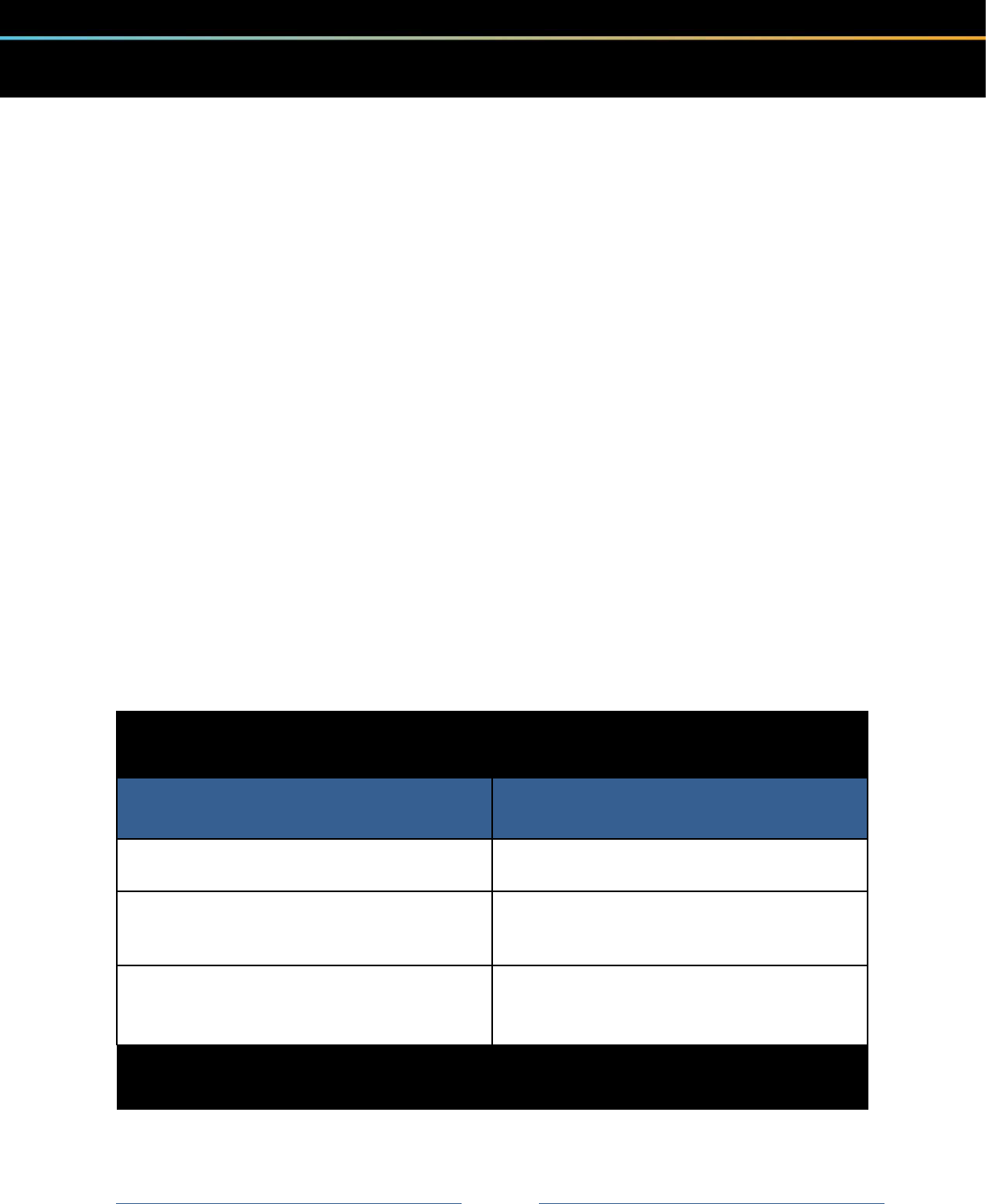

The Tax Benefits from Deferring Compensation

A hypothetical based on two corporate executives in the top income tax bracket

Corporate executive who can defer

compensation

Corporate executive who cannot defer

compensation

1. Receives and defers $1 million in compensation

every year for 7 years (average CEO tenure)

1. Receives $1 million in compensation every year for 7

years

2. Earns 10 percent return each year (the long-term

average annual return) and pays no taxes, for a total of

$10.4 million over 7 years.

2. Pays 37% income tax on each annual payment of $1

million, leaving $630,000 to invest in financial markets.

Pays an annual 23.8% tax on long-term capital gains.

3. Income tax owed when the executive withdraws the

compensation after 7 years: $3.9 million. After-tax

earnings: $6.6 million.

3. Total taxes owed over 7 years: $4.9 million. After tax

earnings total: $5.3 million.

After 7 years, the executive who defers would wind up with an estimated:

$1.3 million more in after-tax earnings

$1 million less in tax liabilities

Note: Estimates based on statutory tax rates. The executive who does not defer may exploit other tax breaks that would reduce the actual rates paid.

5

Executives can also get lucky with the timing of their deferred compensation withdrawals. The

top marginal tax rate was 39.6 percent from 2013 to 2017. A company bigwig who deferred pay

during that period and withdraws the funds under the current 37 percent top rate will reap

even bigger windfalls. This gives executives a personal incentive to throw their political power

behind efforts to further reduce taxes on the wealthy.

Executives can also take steps to minimize their state income tax liability by moving after

retirement to a state with low or no state income taxes (e.g., Florida), depriving the state where

the income was earned of the revenue it would have been entitled to, had deferred comp rules

not been in place. The funds in these accounts can be passed on to the executive’s heirs,

allowing our country’s extreme wealth concentration to be passed onto future generations.

In the event of a company bankruptcy, executives are not guaranteed the full value of these

deferred accounts. However, a 2020 GAO report found mixed outcomes in a review of Chapter

11 filings. Executives who stayed with the company through a reorganization were particularly

likely to maintain all or most of their deferred compensation. GAO also noted that in two of

three liquidation cases they studied, executives withdrew their deferred compensation shortly

before their company filed for bankruptcy.

The GAO report also found that the IRS and Department of Labor lacked adequate oversight

standards to determine whether existing eligibility rules were being correctly applied. GAO

noted that the IRS lacked auditing standards to review executive retirement plans when

conducting audits of corporate tax returns. The report also documented the various ways

existing rules provide federal subsidies to corporate executives and the companies that employ

them that are not available to other taxpayers.

These deferred compensation accounts come on top of the massive compensation corporate

executives pocket every year. In 2021, S&P 500 CEOs received, on average, $18.3 million in total

compensation. An early Equilar analysis of 2022 CEO pay levels at 100 large corporations found

a median of $22.3 million. Many large U.S. corporations also offer their top brass a

Supplemental Executive Retirement Plan, which can be designed as defined benefit plans that

guarantee a monthly check after retirement or as defined contribution plans, which may include

variable or performance-based features.

“Top Hat” plans are widespread – and growing

Industry experts are reporting rapid growth of non-qualified deferred plans as executives

demand more and more opportunities to pad their pockets and lower their tax bills. In

September 2022, Voya Financial Inc. saw a 33 percent increase over the previous year in the

number of clients offering non-qualified plans, according to the trade publication Pensions &

Investments. Willis Towers Watson reported helping clients implement more new non-qualified

plans in the preceding 12 to 18 months than in the past six years.

6

We analyzed S&P 500 deferred compensation accounts as of the end of 2021. We looked at

balances for all named executive officers (the CEO, the CFO, and the top three other highest-

paid executives). Companies with mid-year turnover provide data for more than five executives

in their proxy statements.

S&P 500

2021 year-end

Nonqualified deferred compensation accounts:

Total deferred compensation, including withdrawals made during the year – all

named executive officers

$8,856,362,558

Share of CEOs with balances in their nonqualified deferred compensation accounts

64%

Average non-qualified deferred compensation balance – CEOs

$14,572,388

Average non-qualified deferred compensation balance – all named exec officers

$5,573,544

Defined benefit pension funds:

Total value of defined benefit pension funds – all named executive officers

$5,286,270,405

Average pension fund - CEOs

$12,672.631

Deferred compensation and defined benefit pensions:

Total retirement assets (deferred comp + pension value) – all named executive

officers

$14,142,632,963

Average retirement assets (deferred comp + pension value) - CEOs

$19,372,841

Source: Institute for Policy Studies analysis of company proxy statements.

Among the 64 percent of S&P 500 CEOs with tax-deferred accounts, the average balance at the

end of 2021 was $14.6 million. That’s 113 times the average 401(k) balance of $129,157 at

Vanguard, a major provider of such plans. Vanguard’s median 401(k) balance is far lower, at

just $33,472.

Nationwide, just 35 percent of working-age adults have tax-deferred 401(k)-type defined

contribution plans through their employer and another 13 percent have defined benefit or cash

balance plans. Of Americans ages 56-64, fully 42 percent have zero retirement account savings,

according to the U.S. Census Bureau. Americans who are unable to save for retirement need to

rely on Social Security, which as of March 2023 pays an average monthly benefit of $1,784 —

slightly less than average U.S. monthly apartment rent.

Among S&P 500 CEOs with company-provided retirement assets — a “top hat” plan and/or a

pension — the average balance at the end of 2021 was $19.4 million.

7

Low-wage employers

Top executives of low-wage employers are sitting on some of the largest deferred compensation

accounts. The table below lists executives whose “top hat” account balances are large enough to

generate a monthly retirement check that exceeds their workers’ 2022 median annual pay.

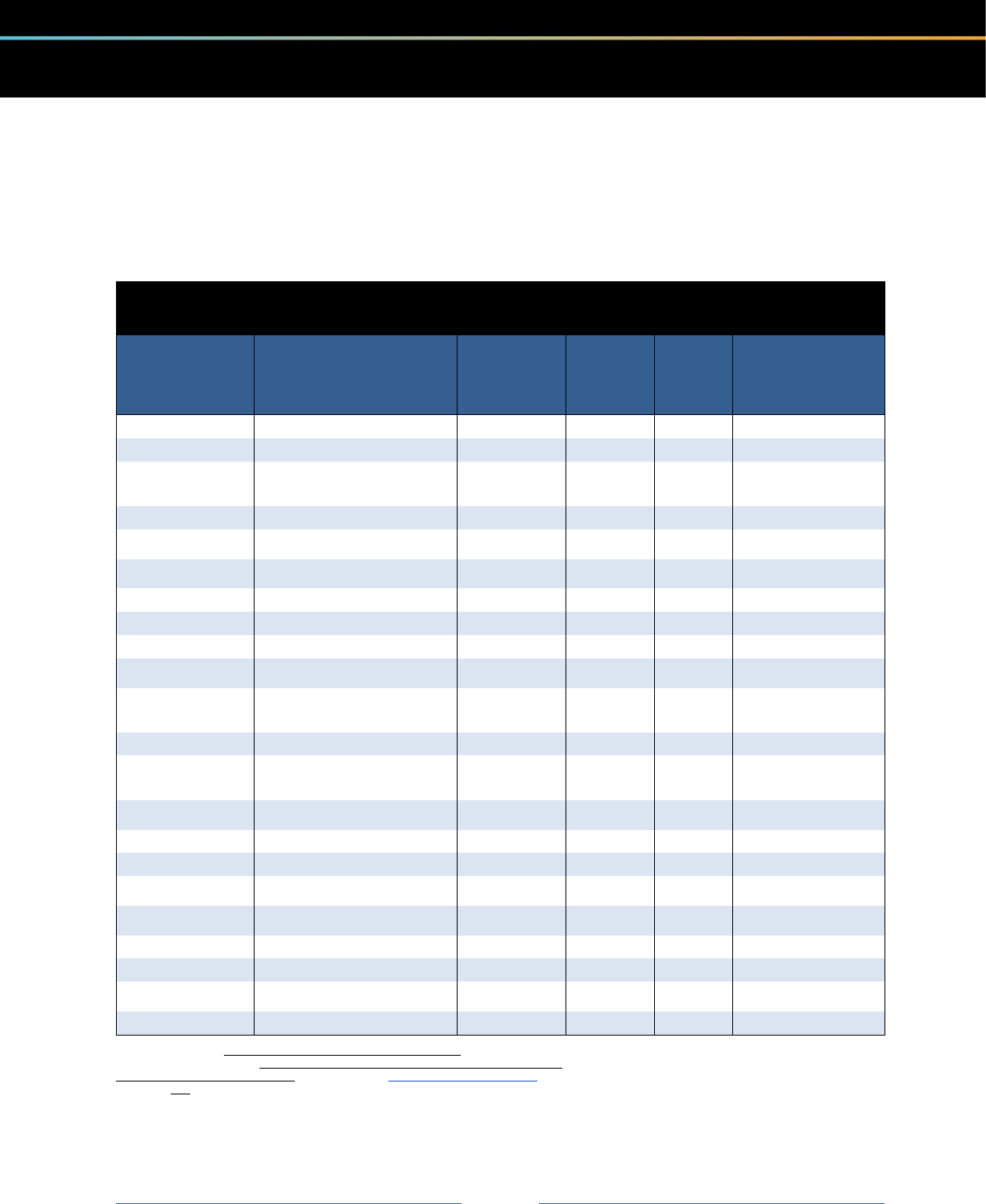

Executives Set to Receive More in Monthly Retirement Checks from Their Deferred

Compensation Accounts Than Their Typical Workers Make in a Year

Company

Executive with the largest

deferred compensation

account/title

Total deferred

compensation,

end of FY2022

Estimated

executive

monthly

retirement

check

Median

annual

worker

pay,

FY2022

Share of eligible

401(k) plan

participants who

have zero balances,

2021 year-end

WALMART

C. Douglas McMillon, CEO

$169,008,390

$1,042,300

$27,136

46%

HYATT HOTELS

Thomas J. Pritzker, Board Chair

$91,217,077

$562,600

$40,395

36%

SERVICE

CORPORATION

INTL

Thomas L. Ryan, CEO

$65,262,950

$402,500

$40,227

Non-union: 6%

Union: 39%

RALPH LAUREN

Ralph Lauren, CEO

$54,360,276

$335,300

$26,670

41%

DISNEY (WALT)

Christine Mary McCarthy, CFO

$43,968,031

$260,510

$54,256

Hourly: 32%

Salaried: 6%

NIKE

Mark G. Parker, Executive

Chairman

$26,861,591

$165,660

$37,410

25%

AUTOZONE

William C. Rhodes, III, CEO

$23,254,376

$143,420

$31,751

N/A

TJX

Ernie Herrman, CEO

$19,684,322

$121,400

$13,884

N/A

MCCORMICK & CO

Lawrence E. Kurzius, CEO

$15,580,469

$96,090

$38,724

N/A

HOME DEPOT

Craig A. Menear, former

CEO/current Board Chair

$14,776,934

$91,130

$30,100

53%

ROBERT HALF

INTERNATIONAL

Keith Waddell, CEO

$14,637,506

$90,270

$33,912

Temporary (78% of

total employees): 83%

Non-temporary: 9%

COSTCO

Richard A. Galanti, CFO

$13,867,501

$85,530

$45,450

3%

1-800-

FLOWERS.COM

James F. McCann, Exec

Chairman

$13,031,023

$80,370

$36,640

Temporary and/or

seasonal: 57%

Non-temporary: 18%

TARGET

John J. Mulligan, Exec VP and

COO

$10,629,778

$65,560

$25,993

58%

CHIPOTLE

John Hartung, CFO

$9,592,952

$59,160

$16,010

91%

TYSON FOODS

John Tyson, Board Chair

$7,322,733

$45,160

$41,967

44%

DICK’S SPORTING

GOODS

Edward W. Stack, Executive

Chairman

$7,136,821

$44,010

$10,585

62%

CHURCHILL

DOWNS

William C. Carstanjen, CEO

$6,344,734

$39,130

$21,988

48%

MCDONALD’S

Kevin Ozan, Senior Exec VP

$6,086,247

$37,540

$14,521

36%

PETCO

Ronald Coughlin, Jr., CEO

$5,542,731

$34,180

$28,016

70%

DARDEN

Eugene Lee, former

CEO/current Board Chair

$4,863,050

$29,992

$21,931

79%

YUM BRANDS

David Gibbs, CEO

$4,278,300

$26,386

$10,398

73%

Sources and notes: Deferred compensation and median worker pay: proxy statements filed with the SEC. Deferred compensation includes

withdrawals during the year. Active participants and employees with zero 401(k) balances: Form 5500 reports filed with the U.S. Department of Labor.

Estimated monthly retirement check: Calculated using www.immediateannuities.com, assuming immediate retirement, male, age 65, New York

residence. N/A: 401(k) plan participants make up less than half of the company’s total U.S. employees. All companies listed have a majority of their

employees in the United States.

8

Corporations often offer 401(k) plans with matching funds. But these benefits are virtually

meaningless to a significant share of low-wage workers because they cannot afford to set aside

any wages for their retirement.

We analyzed Form 5500 reports filed with the Department of Labor by the companies in the

table to determine the share of employees with zero balances. In most cases, more than a third

of eligible participants had zero funds in their accounts. At all of these companies, a majority of

workers are U.S.-based. We did not include 401(k) balance information for three companies

where plan participants make up less than half of the company’s total U.S. employees.

Among workers nationwide who do contribute to their 401(k) plan, 17.5 million (12 percent) do

not set aside enough money to receive their employer’s full match, according to a 2021 Magnify

Money survey.

Walmart

CEO Doug McMillon held more than $169 million in his non-qualified deferred compensation

account at the end of 2022. That’s 8,556 times as much as the average Walmart 401(k) plan

balance of $19,753 at the end of 2021 (most recent available). Using an annuities calculator, we

estimate that if McMillon were to retire now, he could expect a monthly retirement check of

more than $1 million from his tax-deferred account.

Walmart offers a 401(k) plan to all employees with immediate vesting and matching funds up to

6 percent of an employee’s wages after their first year. But that benefit is only meaningful if

workers can afford to set aside funds in these accounts. According to Walmart’s Form 5500 filed

with the U.S. Department of Labor, 46 percent of eligible participants in the company’s 401(k)

plan have not been able to set aside any money in their account. Median pay at Walmart:

$27,136 (half of their 2.1 million employees, 1.6 million of whom are U.S.-based, make less).

The Walmart CEOs who immediately preceded McMillon, Michael Duke and Lee Scott, also

stuffed massive sums in their “top hat” accounts. Duke retired with $178 million and Scott with

$65 million in tax-deferred comp, adjusted to 2022 dollars. In other words, these three men

sheltered more than $411 million from the IRS while paying their workers so little that a

significant share over the years have had to rely on public assistance.

Former Walmart CEO Scott’s experience demonstrates how executives can enjoy huge tax

windfalls through fortuitous timing of their deferred compensation withdrawals. He began

contributing to a deferred plan in 1996, when the top marginal tax rate was 39.6 percent. He

owed taxes on these funds after he retired in 2009. By that time, the top tax rate had been

pushed down to just 35 percent.

9

Hyatt Hotels

Hyatt Board Chair Thomas Pritzker is sheltering $91 million from taxes in his deferred account,

the second-largest stash among major low-wage employers. The son of the Hyatt Hotels

founder, Pritzker has an estimated net worth of $5.5 billion. By contrast, half of Hyatt

employees earn less than $40,395 and 36 percent of those eligible to participate in the hotel

chain’s 401(k) plan have not been able to set aside any funds in their accounts. Ninety percent of

Hyatt employees work in the United States.

Home Depot

A majority (53 percent) of eligible participants in Home Depot’s 401(k) plan have zero balances.

Meanwhile, former CEO and current Board Chair Craig Menear is sitting on $14.8 million in

deferred compensation — enough to generate a monthly retirement check three times larger

than the company’s median worker pay of just $30,100. The value of his deferred comp balance

has nearly doubled since 2019 as his firm has enjoyed a pandemic-related home improvement

spending boom. Over 89 percent of Home Depot’s 490,600 employees work in the United States.

Darden and YUM Brands

The leaders of these restaurant industry giants can look forward to monthly retirement checks

larger than their workers’ median annual pay and more than 70 percent of eligible participants

in their 401(k) plans have zero balances.

Both companies have long been major players in the National Restaurant Association, which

opposes raising the federal minimum wage and has been the leading force in keeping the

federal tipped minimum wage stuck at $2.13 since 1991. The Iowa affiliate of the association

was also reportedly a driver of that state’s new law weakening child labor protections.

David Gibbs has only been at the helm of YUM Brands, the owner of Taco Bell, KFC, and Pizza

Hut, since 2020. The company’s low-wage model generated enormous wealth for former YUM

CEO David Novak, who retired in January 2016 with $239 million in his “top hat” plan. Darden

is the country’s largest full-service restaurant company as the parent of Olive Garden,

LongHorn Steakhouse, Capital Grille, and several other chains.

10

Real estate executives

With rents soaring and the median U.S. home price rising by 42 percent between 2019 and the

end of 2022, ordinary families are finding it hard to set aside money for retirement. By contrast,

several housing industry CEOs are at the top of the list of S&P 500 executives with the largest

deferred compensation funds.

NVR (owner of Ryan Homes)

Paul Saville, who transitioned in 2022 from CEO to Executive Chairman of NVR, has the fattest

“top hat” account in the S&P 500. NVR is a leading home construction corporation and also

provides mortgage services.

The $488 million in Saville’s deferred account at the end of 2022 is enough to generate

retirement checks of more than $3 million every month for the rest of his life. That’s 1,514 times

as much as a typical American retiree can expect to receive every month, based on the average

U.S. Social Security benefit of $1,784 plus a monthly retirement check of $206 generated by the

median Vanguard 401(k) account balance of $33,472.

Of course Saville, whose personal net worth is around $1.7 billion, won’t have to rely solely on

these $3 million monthly retirement checks. Just one indicator of his vast wealth: In 2017, he

sold his Palm Beach home to fellow billionaire Ken Griffin for $85 million.

Camden Property Trust

Executives of Camden Property Trust have profited handsomely from skyrocketing rental rates.

The company has more than 60,000 apartment homes across the country. At the end of 2022, the

real estate investment trust’s top five officers were sheltering from taxes a combined total of

more than $200 million in their “top hat” accounts. CEO Richard Campo had more than $81

million and Executive Vice Board Chair Keith Oden had more than $86 million in their

accounts.

A 2021 Jobs With Justice/Private Equity Stakeholder Project report found that Camden had

pocketed more than $1 million in federal Covid relief subsidies while continuing to file eviction

notices against tenants.

AvalonBay Communities, Inc.

AvalonBay Communities Executive Chairman Timothy Naughton had more than $23 million in

his deferred compensation account at the end of 2022. The company, which wholly or partially

owns more than 82,000 apartment homes in 12 states, has a long history of opposition to rent

11

control and other tenants’ rights. In 2020, they donated more than $8 million to a successful

campaign to block California’s Prop 21 initiative aimed at limiting unfair rent increases and

preserving affordable housing.

Jobs With Justice and the Private Equity Stakeholder Project found that AvalonBay also

continued to file eviction notices during the pandemic while pocketing state and local subsidies.

Health care executives

Centene

Centene CEO Michael Neidorff died in 2022, leaving his heirs a “top hat” plan valued at the end

of last year at $328 million – the second largest in the S&P 500. Neidorff made his enormous

fortune by providing government-funded insurance for seniors and low-income families

through Medicare and Medicaid. Centene is the nation’s largest insurer for Medicaid, which the

federal government expanded significantly during the first few years of the pandemic. As of

February 2023, Centene had paid $939 million to settle cases brought by at least 17 states over

claims of overcharging for pharmacy services.

Pfizer

Fueled by Covid vaccine profits, Pfizer CEO Albert Bourla enjoyed a 37 percent increase in the

value of his deferred compensation account over the past year, from $29 million to $44 million

at the end of 2022. Bourla’s tax windfalls from deferred comp come on top of the windfalls from

his company’s mastery of corporate tax avoidance schemes. According to a landmark 2017

Institute on Taxation and Economic Policy report, the drug maker operated 157 subsidiaries in

tax havens and held $199 billion in profits offshore for tax purposes, the second highest among

the Fortune 500. Pfizer currently has 76 lobbyists working to keep pharmaceutical prices high

and tax bills low.

CVS

Former CVS CEO Larry Merlo ended his career on a high note. Buoyed by government-

subsidized Covid vaccines and tests, the pharmacy chain enjoyed record profits and a soaring

share price in 2021. That helped bump up the value of his deferred compensation from $87

million in 2019 to more than $122 million at the end of 2021. That sum is enough to generate a

$753,000 monthly retirement check for the rest of Merlo’s life.

12

Narrowing the Retirement Divide

Ensuring a dignified retirement for all will require action on many fronts. A web of tax and

labor policies, inter-woven with racial and gender discrimination, has protected and favored the

wealthy white men who run most our country’s large corporations. Here, we highlight just four

steps towards fixing our retirement system so it provides for the rest of us.

1. End the double standard in government retirement benefits

Corporate executives should be subject to the same rules that govern the retirement assets of the

people they employ. Over the years, diverse political leaders have embraced this basic

principle. Some examples of legislation that could reduce inequality in deferred compensation

plans:

2020 CEO and Worker Pension Fairness Act: This bill (S.3341) revises Section 409A of the tax

code, which currently allows executives to shelter unlimited amounts in accounts where their

money can grow tax-free for years and years until they withdraw the funds. Under this bill,

executives would owe taxes on their compensation when it vests.

The bill includes exceptions for deferred compensation at “substantial risk of forfeiture,”

defined as compensation conditioned on performance targets for future services. To protect

rank-and-file employees at start-up companies who often receive equity-based pay, it also

exempts qualified and incentive stock options, but only for those who are not “highly

compensated” (i.e., individuals who own 5 percent or more of the company or whose income in

the previous year exceeded a certain threshold, currently $150,000).

Revenue from the bill, estimated at $15 billion over 10 years, would be transferred to the

Pension Benefit Guaranty Corporation to shore up multiemployer pensions, plans negotiated by

two or more employers with one or more labor unions.

2017 Republican Tax Reform: The CEO and Worker Pension Fairness Act described above is

largely based on a similar provision (Section 3801) in the original mark of the Tax Cuts and Jobs

Act, prepared by Republican House Ways and Means Committee Chair Kevin Brady. The

revenue estimate on this proposal was $16.2 billion over 10 years. The provision failed to pass

out of the committee.

2013 Senate Finance Committee staff report: This report on tax reform options includes

several potential changes to nonqualified deferred compensation, including repealing the IRS

code section related to such plans (409A) and taxing employees on this compensation on a

current basis or when it is earned or vested. It also cites a proposal by then-Senator Hillary

Clinton to impose a $1 million annual limit on deferrals. The Senate passed a similar proposal in

a 2007 minimum wage bill but the provision was dropped in conference committee.

13

2. Expand Social Security and require CEOs to pay their fair share

To narrow the retirement divide, it will not be enough to reduce public subsidies for lavish

executive retirement accounts. We also need stronger labor rights, a federal minimum wage

increase, expanded defined benefit pensions, and other pro-worker policies so that ordinary

Americans can afford to save more to ensure financial security in their golden years.

Perhaps most importantly, we need to expand Social Security, the key pillar for retirement

security for most Americans, particularly low- and moderate-income families who receive little

to no tax benefits. Funding for expansion could come from lifting the wage cap on payroll taxes

so that CEOs and other high earners pay roughly the same share of their total income into the

Social Security fund as ordinary workers. Under the current wage cap of $160,200, people who

make more than $1 million a year stop paying payroll taxes in February, while most working

people pay all year.

In direct contrast to the private sector retirement divide, Social Security’s benefits are

progressive, favoring low- and middle-income workers. A worker retiring now after earning

$45,000 in 2022 would receive a benefit equal to about 34 percent of his or her pay, while a

retiring CEO who earned $9 million last year would receive a benefit that replaced just 0.43

percent of that pay, according to the Social Security Administration’s benefit calculator.

Across-the-board Social Security benefit increases, combined with targeted increases for low-

income workers and other vulnerable groups, would make an enormous difference in American

seniors’ quality of life.

3. Cap retirement benefits for major federal contractors and subsidy

recipients at the level received by the U.S. President

Taxpayer money should not be used to widen the retirement divide. The executive branch

should wield the power of the public purse to demand that companies receiving large federal

contracts and subsidies not provide executives retirement benefits that are worth more than

what the President of the United States receives. Former presidents receive a pension equal to

the salary of a Cabinet secretary, currently set at $235,600.

When Marillyn Hewson retired as CEO of mega-contractor Lockheed Martin in 2020, she had

$63.2 million in her deferred compensation plan and $54.5 million in her pension.

4. Increase retirement benefit transparency

In researching this report, we were frustrated by the lack of publicly available data needed to

get a clearer picture of employer-provided retirement benefits and how much they are actually

helping workers prepare for their golden years. We recommend requirements to disclose:

14

Median 401(k) plan balances: Using companies’ Form 5500 reports, we could calculate the

average balance in their 401(k) plans. But given how top-heavy these accounts are, it would be

much more revealing if corporations were required to report median account balances.

Unclaimed matching funds: Many companies boast of their matching benefits, but these are

virtually meaningless if workers are paid so little they can’t afford to save enough to take

advantage of this perk.

CEO-worker retirement benefit ratio: Publicly held corporations are required to report the

ratio between their CEO and median worker pay. These pay gaps are staggering. But the CEO-

worker retirement divide is no doubt even wider. It would be most revealing if they were

required to report the estimated monthly retirement check the CEO and other named executives

can expect compared to the estimated retirement check for the firm’s median worker.

5. Tax Excessive CEO Pay

One way to reduce executive deferred compensation is to reduce executive compensation. The

Tax Excessive CEO Pay Act would encourage corporations to lower executive pay levels and lift

up worker wages. Under this bill, the wider a company’s gap between CEO and median worker

pay, the higher their federal corporate tax rate. Tax penalties would begin at 0.5 percentage

points for companies that pay their CEO between 50 and 100 times more than their median

worker. The highest penalty would apply to companies that pay top executives over 500 times

worker pay. Companies with pay gaps of less than 50 to 1 would not owe an extra dime. Similar

taxes are already raising revenue in two cities, San Francisco, California and Portland, Oregon.

Appendix: Methodology and Sources

Total non-qualified deferred compensation and median worker pay: Corporate proxy

statements filed with the SEC. To the end of year deferred compensation balance we added any

withdrawals or distributions made during the year, as these were part of the total retirement

package provided to the executives.

Monthly retirement check estimates: We used the annuity calculator found at

www.immediateannuities.com and selected: male, age 65, New York, and immediate payout.

The calculations were performed on May 3, 2023.

401(k) plans: Form 5500 filings with the U.S. Department of Labor. To calculate the share of

eligible participants with zero balances, we used figures for total participants and participants

with account balances as of the end of the plan year. We double-checked these figures against

calculations in the Free ERISA database managed by Benefits Pro. To calculate the average

401(k) plan balance at Walmart, we divided total assets by total participants, based on data from

the company’s Form 5500, “Annual Return/Report of Employee Benefit Plan,” filed with the

U.S. Department of Labor, September 12, 2022.