August 14 draft

Author: Sarah Anderson directs the Global Economy Project and co-edits Inequality.org at the

Institute for Policy Studies. She has co-authored the more than 20 previous IPS annual Executive

Excess reports and testified before the Senate Budget Committee on this issue in 2021 and 2012.

Research and editorial assistance: Jasmine Corazon, Kufre McIver, and Sam Pizzigati.

Cover design: Sarah Gertler.

Acknowledgements: Thanks to Scott Klinger of Jobs With Justice, Bart Naylor of Public Citizen,

Jessica Church of Take on Wall Street, and Natalia Renta of Americans for Financial Reform for

expert comments on this report.

The Institute for Policy Studies (IPS-DC.org), a multi-issue research center, has been conducting path-

breaking research on executive compensation for nearly three decades.

The IPS Inequality.org website (Inequality.org) provides an online portal into all things related to the

income and wealth gaps that so divide us, in the United States and throughout the world. Sign up for

our weekly newsletter at: Inequality.org/subscribe.

Twitter and Facebook: @inequalityorg

Institute for Policy Studies

1301 Connecticut Ave. NW, Suite 600

Washington, DC 20036

202 234-9382

www.ips-dc.org, Twitter: @IPS_DC

Facebook: http://www.facebook.com/InstituteforPolicyStudies

Email: sarah@ips-dc.org

© 2023 Institute for Policy Studies

Contents

Key findings………………………………………………………………………………..…………….…….… 1

Introduction …………………………………………….…………………………………………………….….. 4

The Low-Wage 100: CEO pay, median worker pay, and pay ratios ………………………….…………… 5

The Low-Wage 100: Stock buybacks and CEO stock ownership ………………………………………..... 6

The Low-Wage 100: Federal contracts and subsidies……………………………………………………..…. 8

Policy recommendations …………………………………………………………………...………….………. 10

Methodology and sources…………….………………....…………….……………….…...…….………..….. 12

Appendix 1: The 100 S&P 500 companies with the lowest median worker wages ..…..……………..… 13

Appendix 2: Our annual menu of CEO pay reforms ……………………………..………..………......…... 17

1

Key findings

This 29

th

annual Executive Excess report takes an in-depth look at the 100 S&P 500 corporations that had the

lowest median worker pay levels in 2022, a group we’ve dubbed the “Low-Wage 100.” We analyze, for

each of these firms, the total compensation and personal stock holdings of CEOs, the CEO-worker pay gap,

and the overall outlays for stock buybacks. We also reveal how taxpayers are enriching ― through federal

contracts ― the majority of the Low-Wage 100.

1. The CEO-worker pay gap at the Low-Wage 100 averaged 603 to 1 in 2022

Low-Wage 100 CEO pay averaged $15.3 million and median worker pay averaged $31,672 in 2022.

Live Nation Entertainment sported the fattest CEO paycheck and the widest pay gap. Michael

Rapino hauled in $139 million, 5,414 times as much as his firm’s $25,673 median pay.

Aptiv, a vehicle parts maker with federal government contracts, had the lowest median pay, just

$8,139 for a full-time manufacturing worker in Mexico. Stanley Black & Decker reported the

highest, $47,651, but did not disclose details about the location or status of its median worker.

2. The Low-Wage 100 have spent more than $340 billion on stock buybacks since 2020

Between January 1, 2020 and May 31, 2023, 90 of the Low-Wage 100 reported combined stock

buyback expenditures of $341.2 billion. This financial maneuvering artificially inflates executive

stock-based pay and siphons funds from worker wages and other productive investments.

Lowe’s led the buybacks list, with $34.9 billion over the past three and a half years. In 2022 alone,

Lowe’s spent $14.1 billion on buybacks, enough to give every one of its 301,000 U.S. employees a

$46,923 bonus. In 2022, Lowe’s CEO Marvin Ellison enjoyed annual compensation of $17.5 million.

The retailer’s median annual worker pay: a mere $29,584.

Home Depot came in second in our buyback rankings, with $28.9 billion in stock buybacks over the

course of our study period. CEO Edward Decker kept the spigot flowing furiously after taking

Home Depot’s helm in 2022. The company’s repurchases have totaled over $5.7 billion since last

October. In 2022, Decker made 491 times Home Depot’s median pay of $30,100.

Walmart ranks third on the buybacks list, with nearly $23.9 billion. CEO Doug McMillon took in

$25.3 million in 2022 while half of his employees earned less than $27,136.

2

3. During their stock buyback spree, Low-Wage 100 CEOs’ personal stock holdings

increased more than three times as fast as their firms’ median worker pay

The CEOs of the 90 Low-Wage 100 companies that have spent funds on buybacks own

approximately $14.9 billion worth of their company stock.

At the 65 buyback companies where the same person held the top job between 2019 and 2022, the

CEOs’ personal stock holdings soared 33 percent to an average of $184.7 million. Median pay at

these firms rose only 10 percent to an average of $31,972. These figures do not reflect inflation

because the median pay figures cover a global workforce.

Dollar Tree CEO Michael Witynski reaped the single largest stock gain. During his three-year stint

at the helm, his stock holdings ballooned 2,393 percent to $30.5 million while Dollar Tree’s median

pay fell 4.4 percent to just $14,702. Over this three-year span, the retailer spent over $2 billion in

company resources on buybacks.

FedEx CEO Frederick Smith has the largest stockpile in the Low-Wage 100. His personal holdings

have grown 65 percent to more than $5 billion since January 2020. By contrast, FedEx median

worker pay fell by 20 percent to $39,177, a total that includes $9,267 in health benefits, between 2019

and 2022. See more FedEx details below in the contractor section.

4. Over half of the Low-Wage 100 receive taxpayer-funded federal contracts

Of the 100 companies in our sample, 51 received federal contracts worth a combined $24.1 billion

during fiscal years 2020-2023. These contractors spent nearly $160 billion on stock buybacks over

the course of these years.

In 2022, the average CEO pay in this low-wage contractor group stood at $12.7 million, 56 times as

much as the salary of a Biden administration cabinet secretary. This group’s CEOs averaged 438

times their $34,550 median worker pay.

Amazon, the largest contractor in the Low-Wage 100, amassed at least $10.4 billion in federal deals,

with most of that haul coming from a National Security Agency web services contract. The

company has reportedly received additional classified defense contracts. Under CEO Andy Jassy’s

two years at the helm, Amazon has spent $5.9 billion on stock buybacks, an outlay that has helped

inflate Jassy’s personal stock holdings to $265 million. These millions do not include the bulk of his

2021 mega-grant, a reward that will vest over 10 years.

FedEx, the second-largest contractor on our list, pocketed $6.2 billion from Uncle Sam in fiscal years

2020-2023. FedEx spent $3.6 billion on buybacks during this period, a maneuver that helped prop

up the value of Smith’s more than $5 billion in personal stock holdings, the largest stash held by

any CEO in the Low-Wage 100. In 2022, his last year before transitioning to the FedEx executive

chair slot, Smith made $10.6 million, 271 times FedEx median worker pay and 47 times the salary of

the U.S. secretary of veterans affairs. Unlike competitor UPS, where more than 70 percent of

employees are unionized, FedEx has been and continues to be notoriously anti-union.

3

5. Policy solutions for runaway CEO pay are gaining support

Policymakers have begun taking serious steps to respond to public outrage — across the political

spectrum — over executive excess.

Stock buybacks taxes and restrictions: In the 2022 Inflation Reduction Act, Congress passed a 1

percent excise tax on CEO pay-inflating stock buybacks. President Biden proposed quadrupling this

tax in his 2023 State of the Union address. Biden has also included a proposal in his federal budget

plan that would ban top executives from selling their personal stock for a multi-year period after a

buyback, preventing CEOs from timing share repurchases to cash in personally on a short-term

price pop they themselves artificially created. A Senate bill, the ALIGN Act, would do just that.

Federal contractor incentives: In 2022, the Department of Commerce announced plans to give

priority in the awarding of new CHIPS subsidies for domestic semiconductor manufacturing to

firms that do not engage in any stock buybacks. The administration has applied a number of other

pro-worker conditions on federal contracts, but federal agencies could go much further to wield the

power of the public purse against inequality. The Patriotic Corporations Act could serve as a

model. This bill would grant preferential treatment in contracting to firms with pay ratios of 100 to

1 or less, among other benchmarks, including neutrality in union organizing campaigns.

Excessive CEO pay tax: Laws to hike corporate taxes on companies with wide CEO-worker pay

gap are now raising revenue in two major cities, San Francisco and Portland, Oregon. The more

recent of the two taxes, San Francisco’s “Overpaid Executive Tax,” became effective on January 1,

2022. In May 2023, city officials announced that they now expect the tax to bring in about $125

million per year, a higher return than originally expected. San Francisco’s executive tax has also

proved more resilient than other local revenue sources. Legislation similar to San Francisco’s has

been introduced in the U.S. House and Senate and came into play during the Build Back Better

negotiations. Higher tax rates on companies with wide CEO-worker pay gaps create an incentive to

both rein in executive pay and lift up worker wages, all while generating significant new capital for

vital public investments.

4

Introduction

In response to strikes and union organizing drives, corporate leaders routinely insist that they simply lack

the wherewithal to raise employee pay. And yet top executives seem to have little trouble finding

resources for enriching themselves and wealthy shareholders.

In 2021 and 2022, S&P 500 corporations spent record sums on stock buybacks, a maneuver that artificially

inflates the value of a company’s stock — and CEOs’ stock-based pay. All employees contribute to

company profits. But instead of broadly sharing the wealth, companies are using a once-illegal form of

market manipulation to make those at the top of the corporate ladder even richer. This report examines the

buyback activities of the 100 S&P 500 companies that pay the lowest median wages, the “Low-Wage 100.”

Why do stock buybacks pose a problem for both workers and the economy?

Every dollar spent on stock buybacks is a dollar not spent on worker wages, R&D, and other productive

investments that would stimulate long-term growth. Analysts have well documented the association

between buybacks and reduced capital investment and innovation, wage stagnation, and even layoffs.

By artificially inflating CEO pay, buybacks also significantly drive today’s staggering economic inequality.

In 2022, the CEO-to-worker pay ratio stood at 272-to-1 for S&P 500 companies, according to the latest AFL-

CIO analysis. Study after study has shown that such extreme gaps actually undermine the corporate

bottom line by reducing employee morale and productivity and raising turnover rates. We have compiled

a bibliography of such studies from business schools, management consulting firms, and Treasury

Secretary Yellen’s academic work.

Extreme pay disparities also widen gender and racial disparities, since women and people of color make

up a disproportionately large share of low-wage workers and a tiny share of corporate leaders. In 2022,

women held only slightly more than 10 percent of Fortune 500 CEO positions while making up 63.5 percent

of workers earning the federal minimum wage. Black CEOs currently lead just 8 percent of Fortune 500

corporations.

The vast majority of Americans — no matter their political party affiliation — see these disparities as

unacceptable. One 2022 poll shows 87 percent of our nation viewing the growing gap between CEO and

worker pay as a definite problem.

What can we do about these obscene divides? This annual Executive Excess report ends with the most

comprehensive available policy menu for achieving a fair corporate compensation system. Recent steps

forward, particularly those that discourage CEO pay-inflating stock buybacks, are encouraging. But much

more needs to be done to ensure that the fruits of everyone’s labor are equitably shared.

5

The Low-Wage 100

CEO pay, median worker pay, and pay ratios

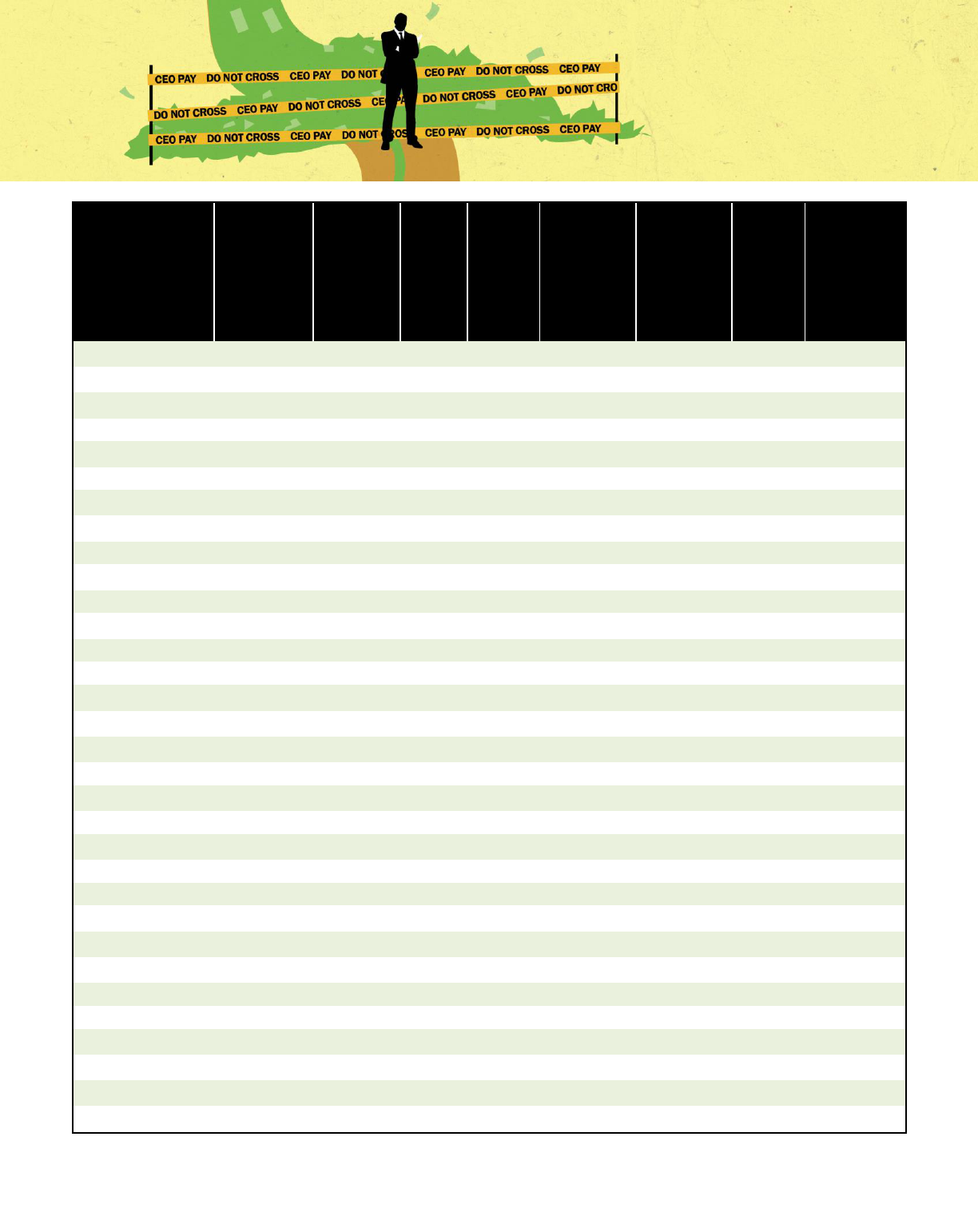

Since 2018, the Securities and Exchange Commission has required publicly held firms to annually report

both median worker pay — the middle value on a company’s pay scale — and the ratio between CEO pay

and that median. These median pay numbers offer a revealing look at how well or poorly firms are sharing

their rewards.

This report zeroes in on the 100 S&P 500 companies with the lowest median wages in 2022, a figure based

on a company’s global workforce, including part- and full-time employees. Last year, median worker pay

at these Low-Wage 100 companies averaged $31,672, and the gap between CEO and median worker pay at

these enterprises averaged 603 to 1.

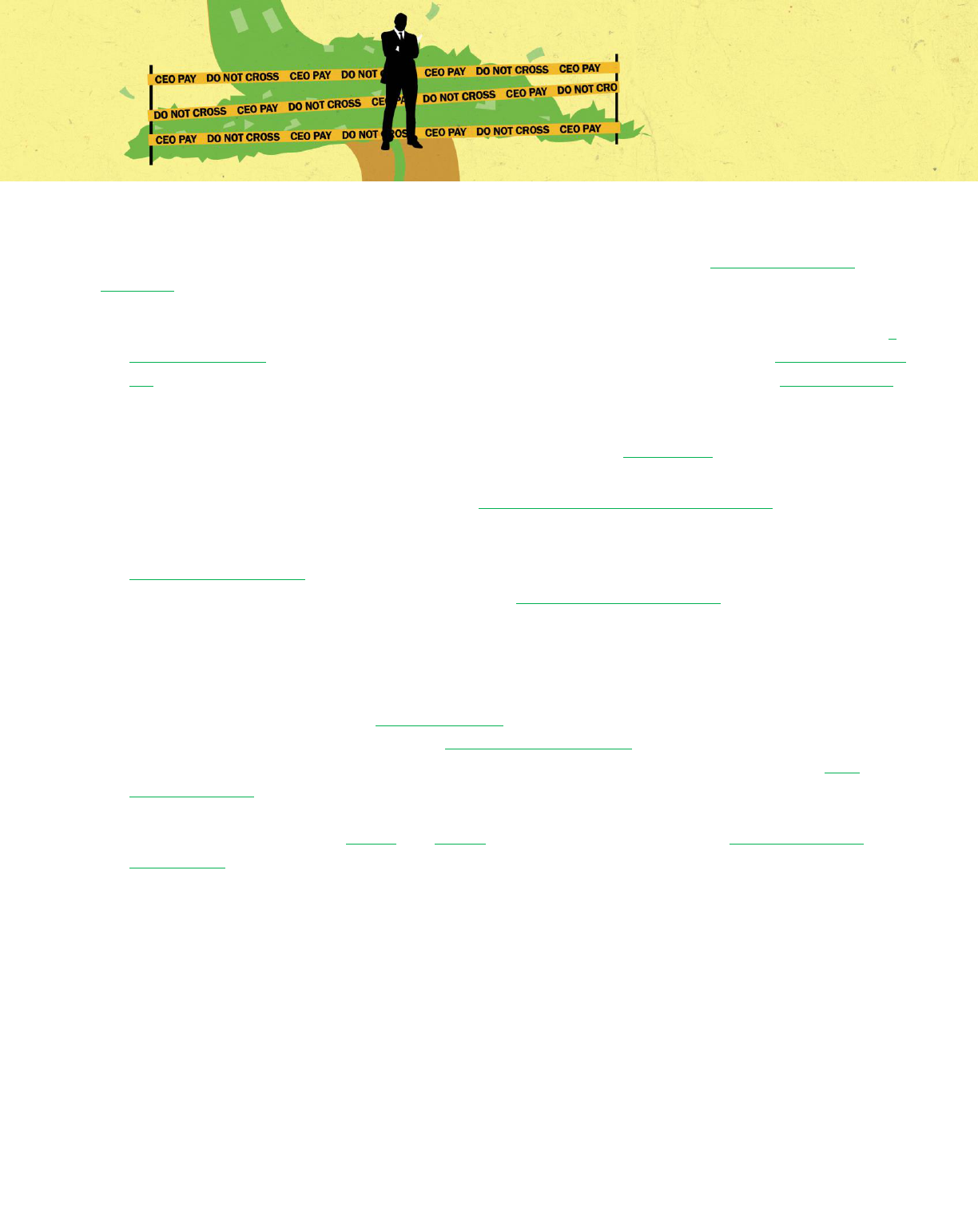

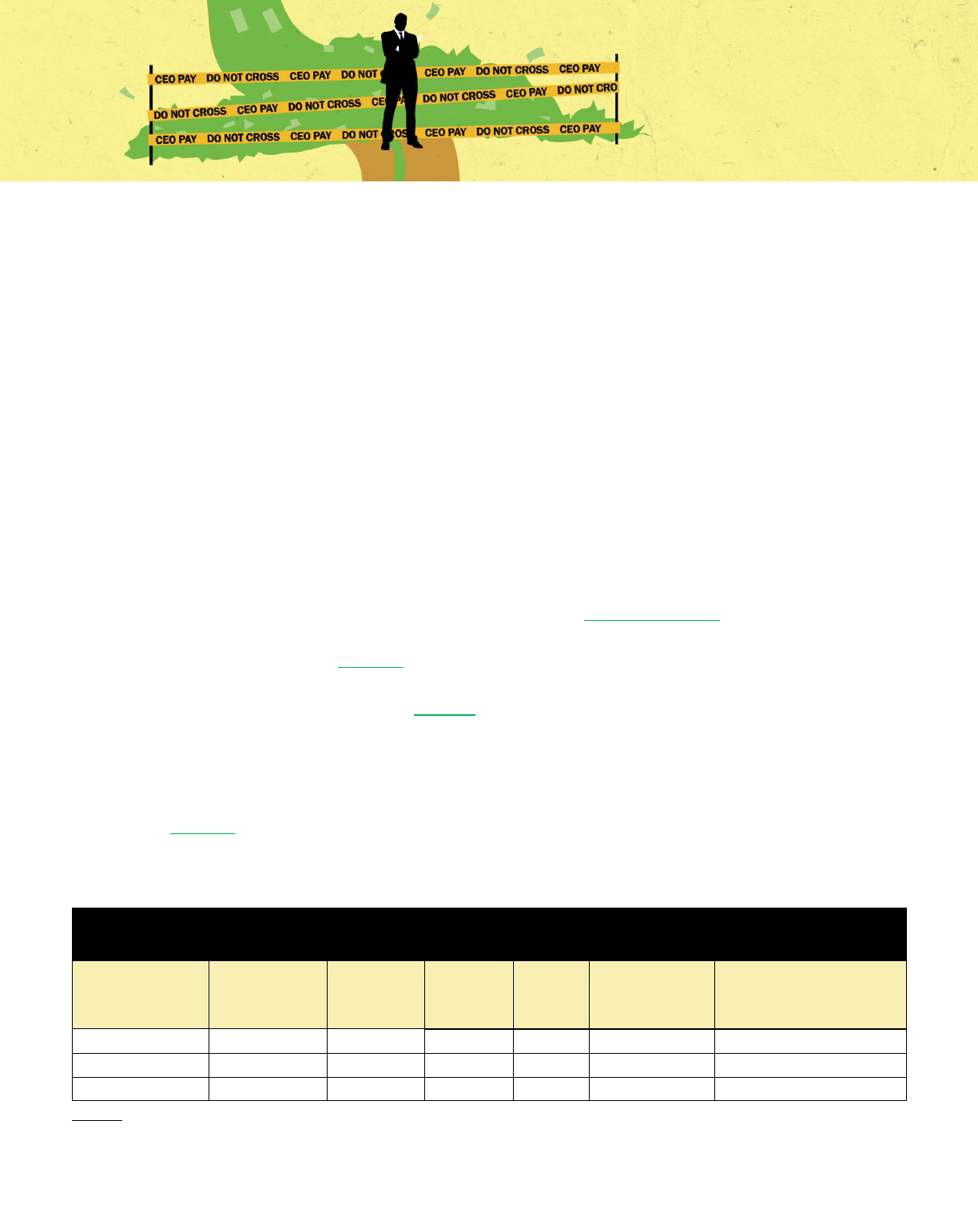

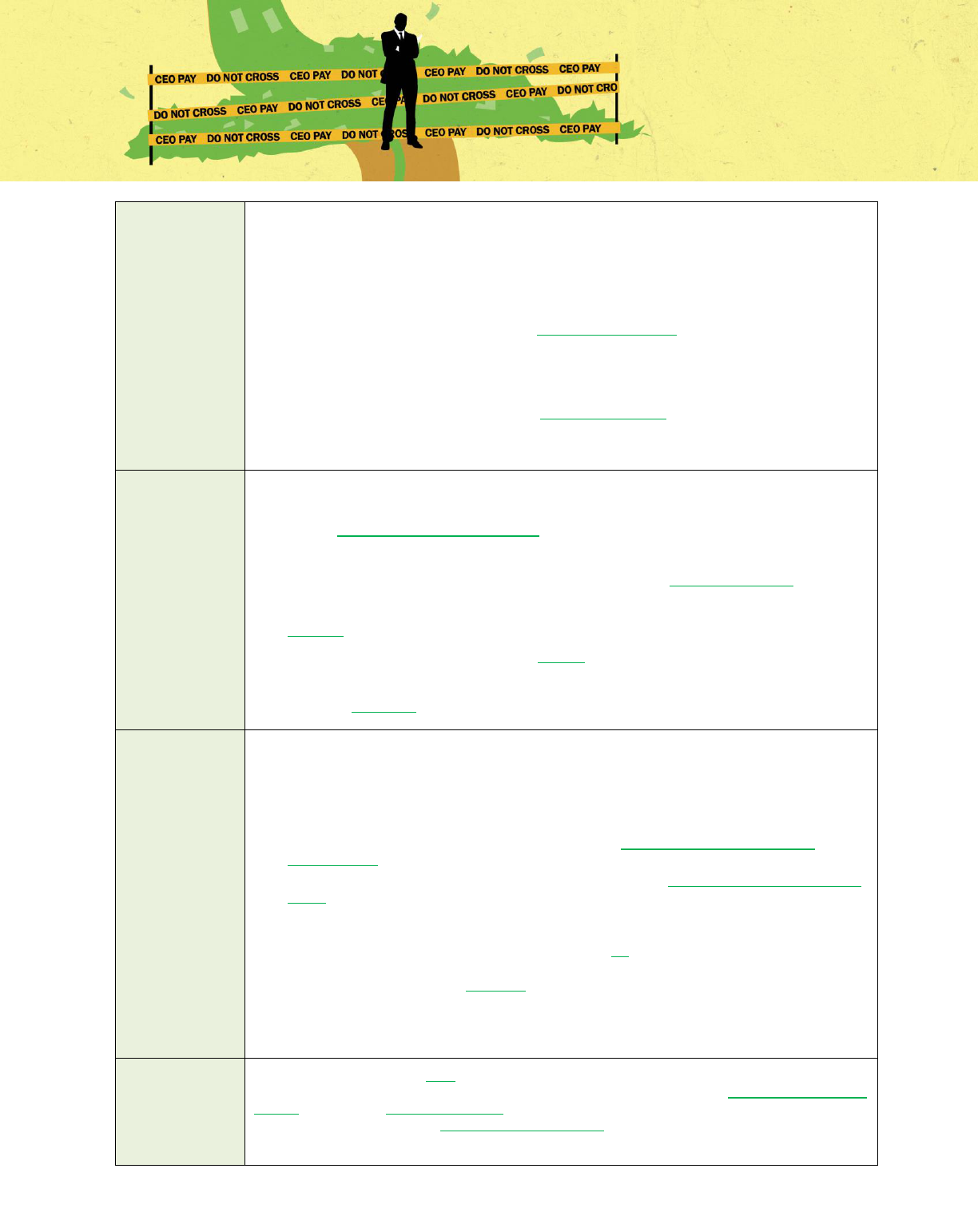

Pay Disparities in 2022

CEO pay, $million

Median worker pay

CEO-worker pay ratio

Low-Wage 100 Average

$15.3

$31,672

603

The 5 S&P 500 firms with the lowest median pay

Aptiv

$16.21

$8,139

1,991

Western Digital

$32.14

$9,644

3,332

Ross Stores

$11.34

$9,968

1,137

Yum Brands

$16.67

$10,398

1,603

Bath & Body Works

$6.91

$10,669

934

Source: Corporate proxy statements filed with the SEC. See Appendix 1 for details on the full Low-Wage 100.

The SEC requires firms to calculate median worker pay based on their global workforce. Given this

requirement, we might assume that the companies with the lowest wage levels must have most of their

employees in developing countries. But this is definitely not the case. Three companies that operate

primarily in the United States ― Ross Stores, Yum Brands (owner of KFC, Pizza Hut, Taco Bell), and Bath

& Body Works ― rank among the top five firms that dominate the lowest-wage list. These retail and fast

food firms have chosen a business model that relies overwhelmingly on part-time employees with few

benefits.

Another U.S.-based firm, Live Nation Entertainment, ranks first on our list for the largest CEO paycheck

and the widest pay gap. Michael Rapino hauled in $139 million, 5,414 times as much as the concert giant’s

median pay of $25,673 in 2022. In its proxy statement, the company takes great pains to point out that if

you nix the CEO’s $109 million stock grant and all of the company’s primarily part-time employees from

the calculation, the Live Nation pay ratio would be merely 353 to 1.

6

The Low-Wage 100

Stock buybacks and CEO stock ownership

Stock buybacks were considered stock manipulation and largely banned until 1982, when President

Reagan's SEC legalized them, allowing executives with stock-based pay to create huge windfalls for

themselves and shareholders at the expense of workers and productive investments. We reviewed

quarterly reports filed by the Low-Wage 100 between January 1, 2020 and May 31, 2023 and found that 90

of the firms had spent profits on buybacks at a combined cost of $341.2 billion.

How have CEOs personally benefited from this stock buyback spree? We poured through the footnotes in

company proxy statements to determine that the CEOs in the Low-Wage 100 that have spent funds on

buybacks since 2020 now own approximately $14.9 billion worth of their company stock. That would be

enough to double the pay of nearly a half million workers earning $30,000 per year.

We zeroed in on the 65 buyback companies where the same person held the top job between 2019 and 2022.

Since 2020, these CEOs’ personal stock holdings have increased 33 percent ― to an average of $184.7

million ― while median pay at these firms rose only 10 percent to a $31,972 average. These figures do not

take inflation into account because the median must reflect a global workforce.

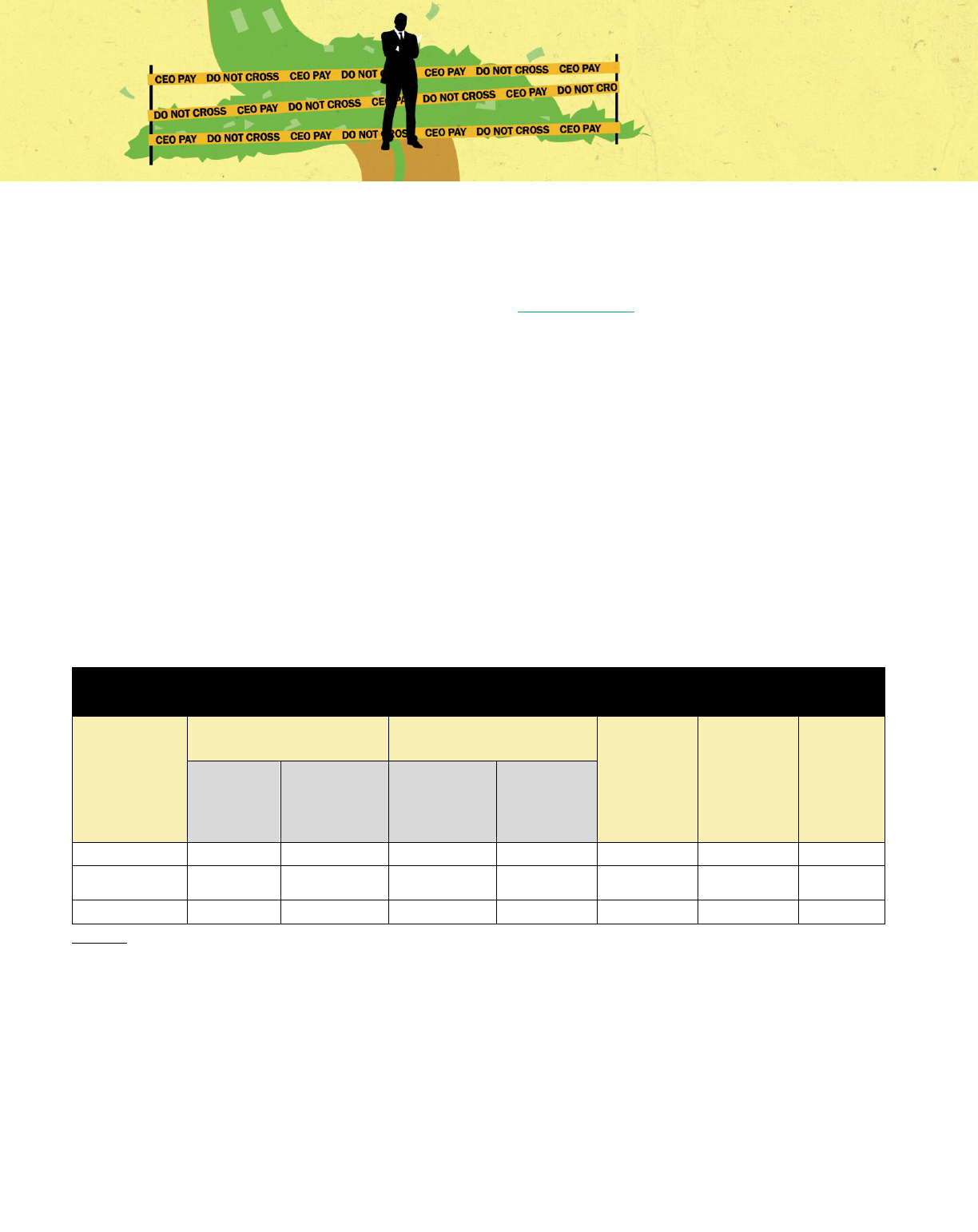

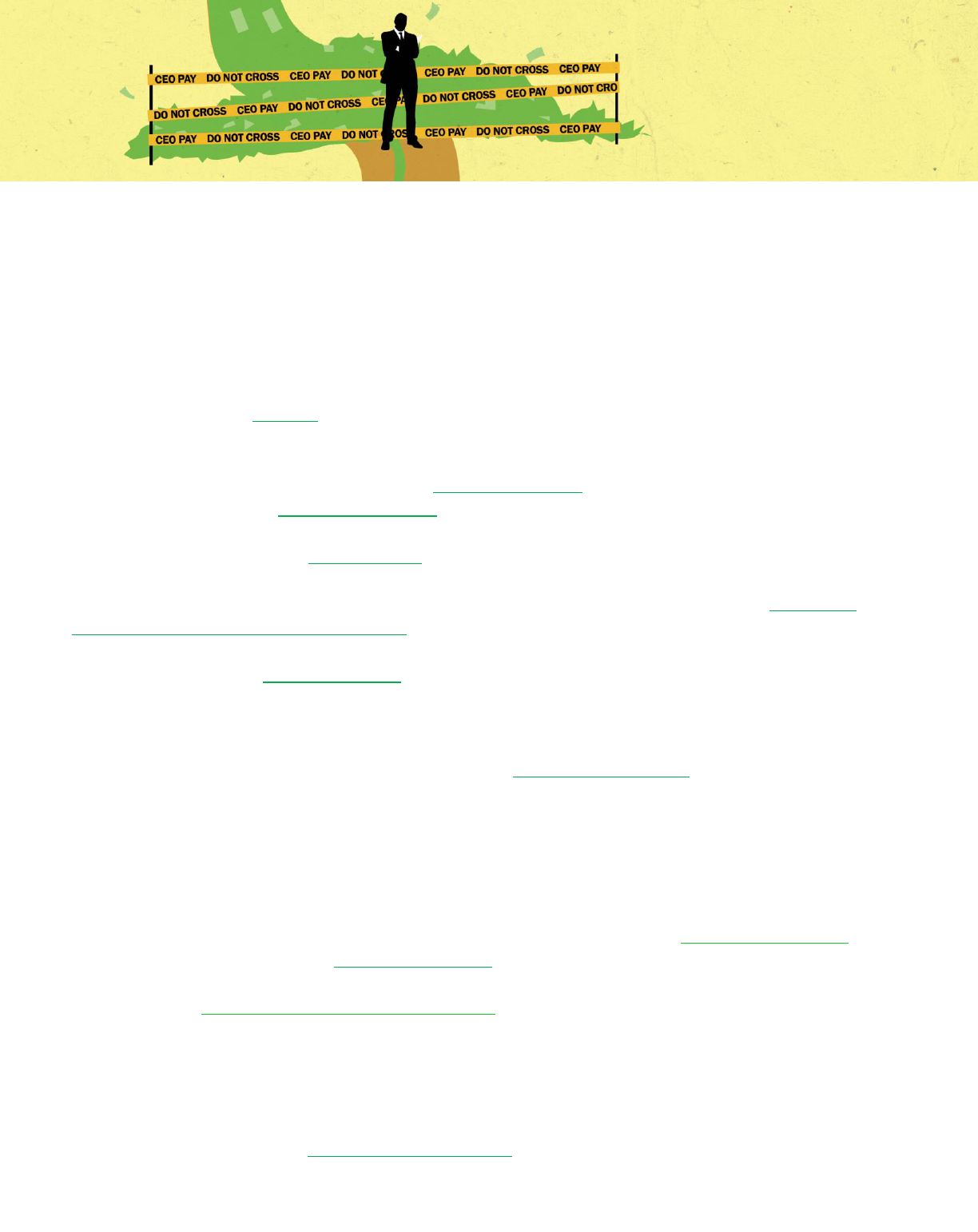

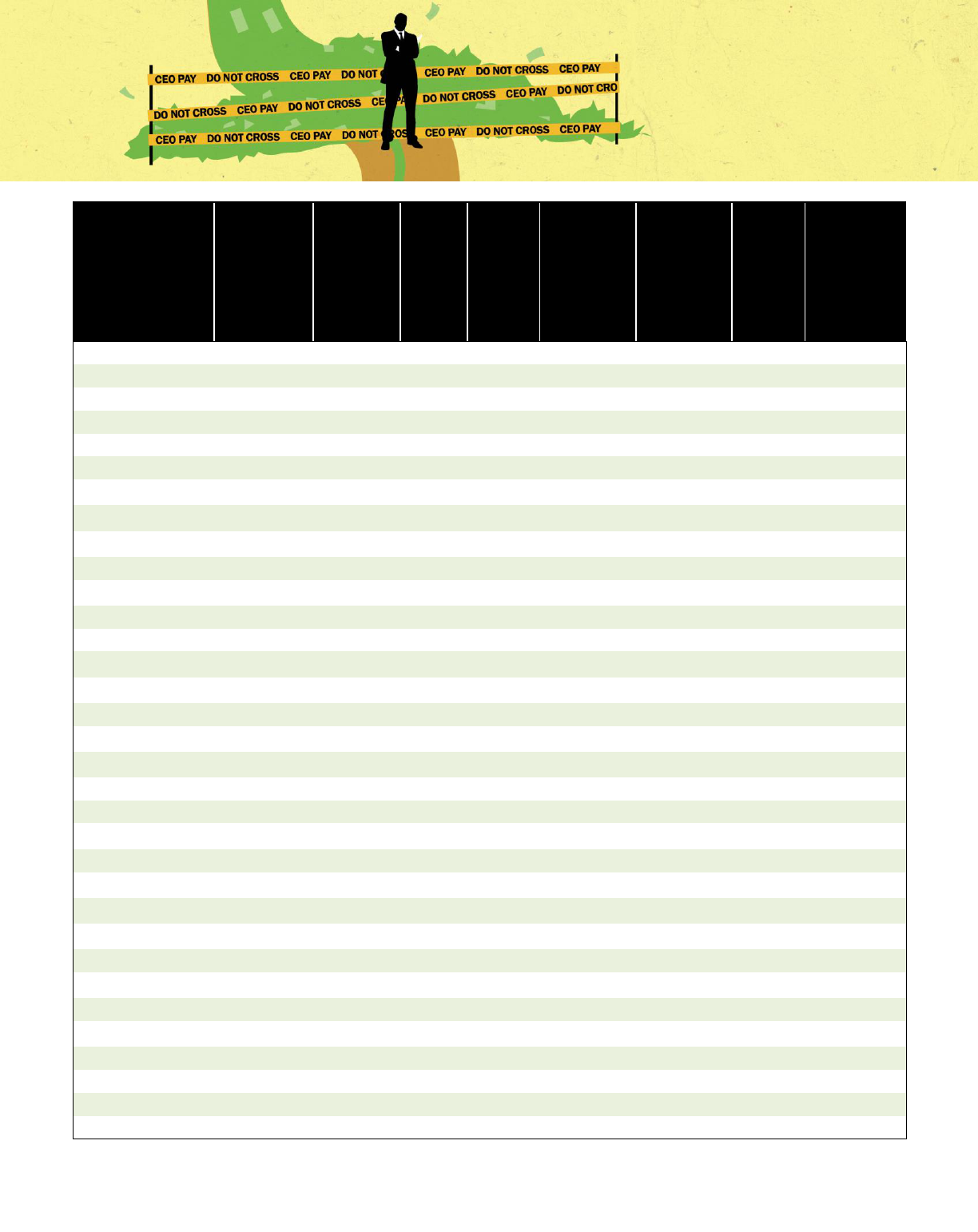

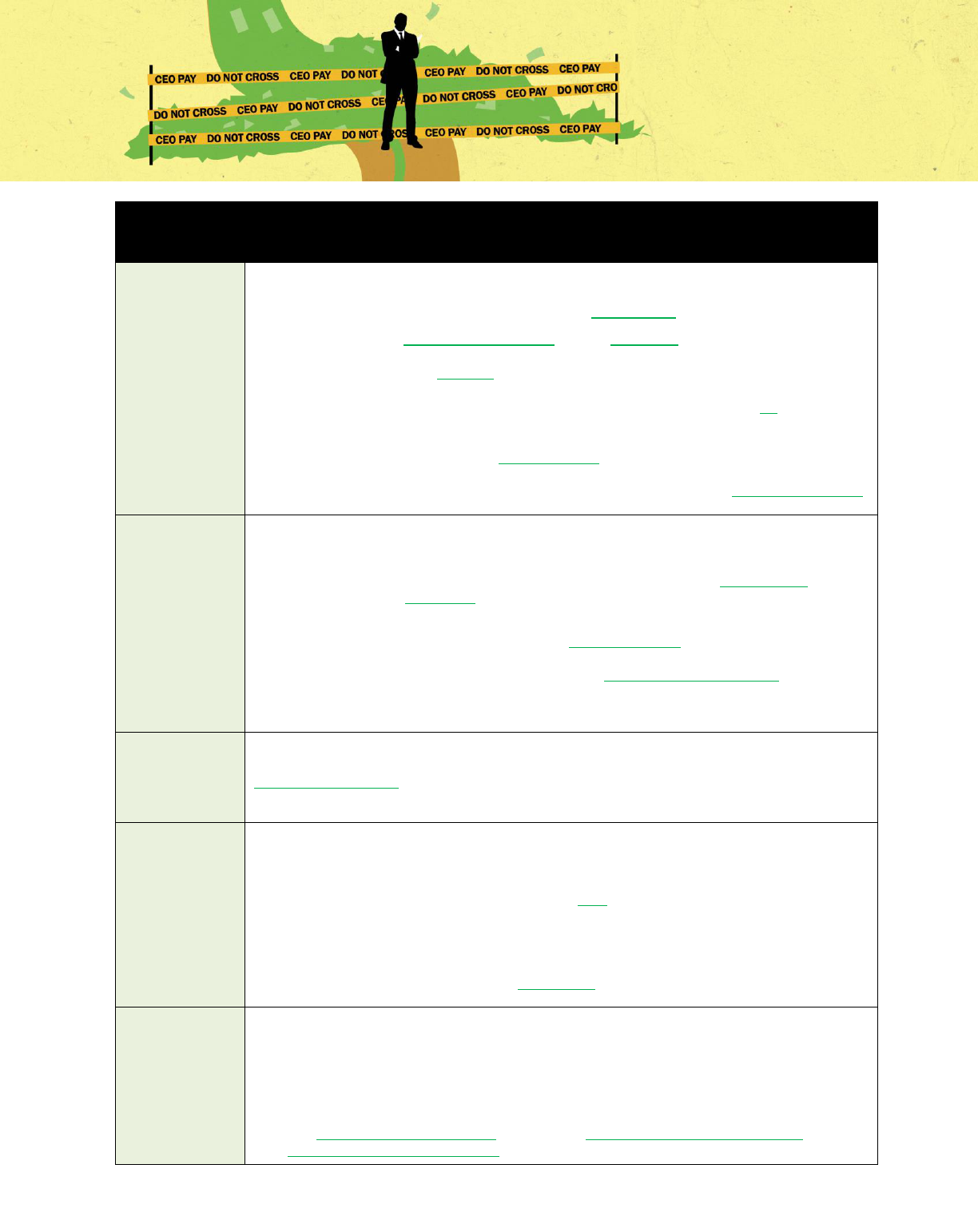

The Low-Wage 100 Corporations That Spent the Most on Stock Buybacks

Value of CEO

stock holdings

Stock buyback

expenditures ($million)

Total U.S.

employees,

2022

2022

buyback

expenditure

per U.S.

employee

Median

worker

pay, 2022

As of July

7, 2023

($million)

% change,

January 6,

2020-July 7,

2023

Reported

January 1,

2020-May 31,

2023

2022 only

Lowe’s

$108.3

754%

$34,949

$14,123

301,000

$46,923

$29,584

Home Depot

$50.3

n/a – new

CEO

$28,857

$6,633

418,900

$15,833

$30,100

Walmart

$284.6

35%

$23,861

$9,866

1,600,000

$6,166

$27,136

Sources: Corporate proxy statements and 10-K and 10-Q reports. See Appendix 1 for details on the full Low-Wage 100.

Lowe’s: This home improvement chain has spent $34.9 billion repurchasing its own stock over the past

three and a half years. In 2022 alone, Lowe’s spent more than $14.1 billion on stock buybacks. If those

funds had instead been divided among the company’s 301,000 U.S. employees, the retailer could have

given each worker a $46,923 bonus. Instead, Lowe’s median worker pay remains below $30,000 while CEO

Marvin Ellison is sitting on over $108 million in company stock, up 754 percent since the start of 2020.

Home Depot: Lowe’s and Home Depot compete vigorously in both the home improvement industry and

in buyback spending. The company blew $6.6 billion on buybacks in 2022, enough to give all 418,900 U.S.

7

Home Depot employees a $15,833 bonus. The company chose instead to manipulate its share price to create

windfalls for executives and wealthy shareholders. Edward Decker, who took the company’s helm in 2022,

holds more than $50 million in company stock. His firm’s typical employee earns just $30,100.

Walmart: The country’s largest employer last year spent $9.9 billion repurchasing company stock, enough

for a $6,166 bonus for each of Walmart’s 1.6 million U.S. employees. Half of the giant retailer’s employees

made less than $27,136 in 2022. CEO Doug McMillon, meanwhile, has amassed nearly $285 million in

Walmart stock, up an estimated 35 percent in value since the beginning of 2020.

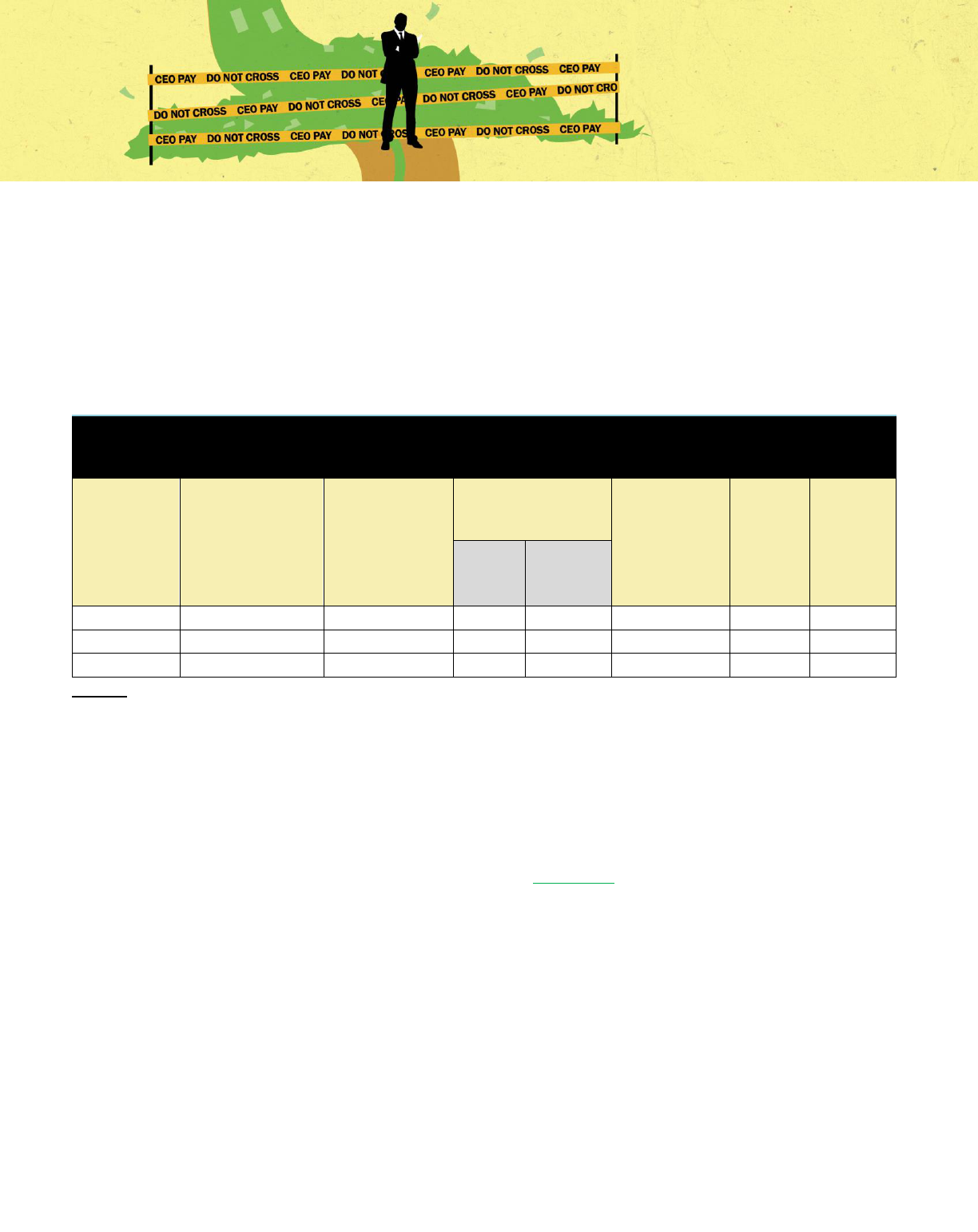

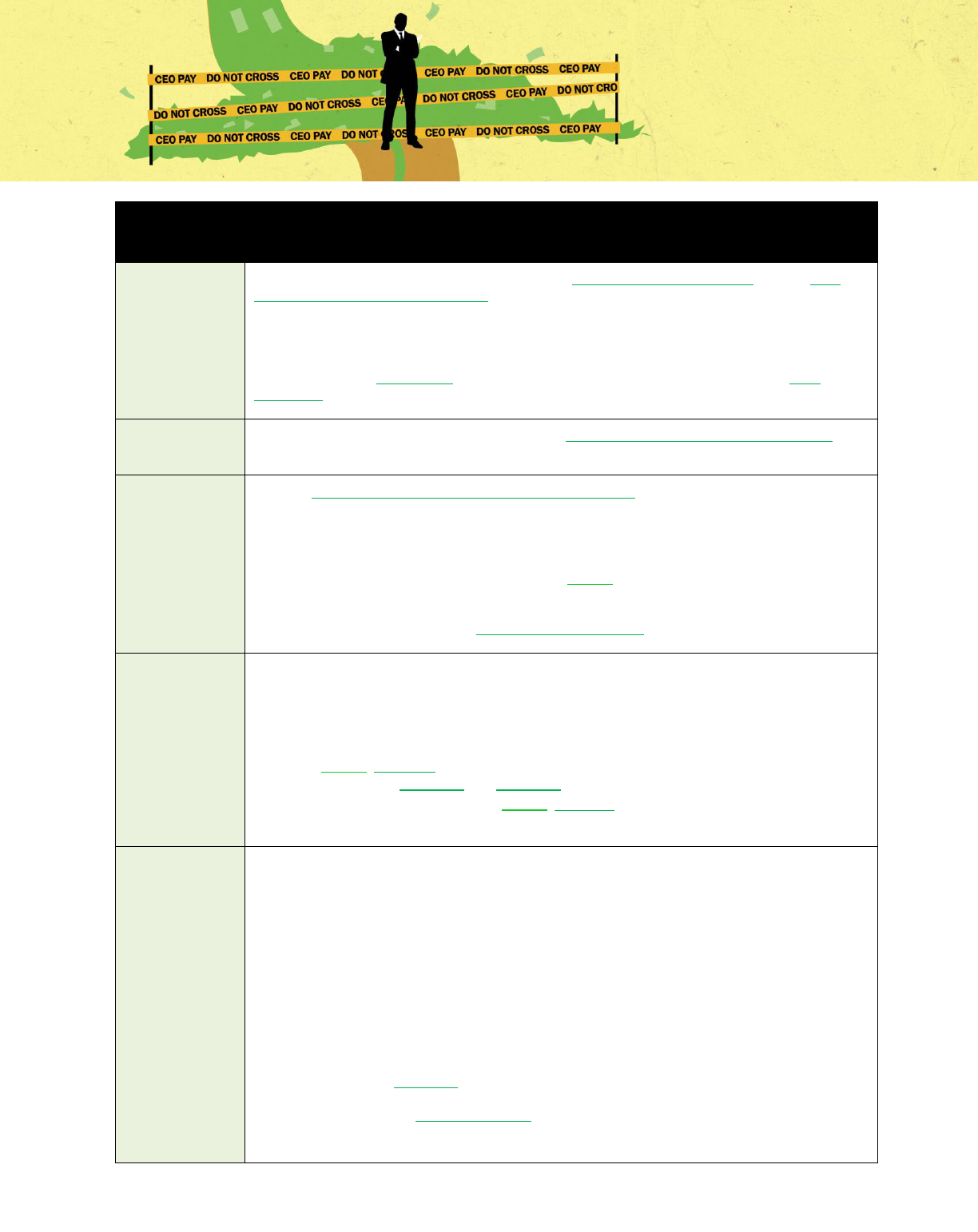

The CEOs of Low-Wage 100 Corporations With the Largest Increases in Their Stock Holdings

CEO in 2022

Stock buyback

expenditures,

reported

January 1, 2020-

May 31, 2023

($million)

Value of CEO

stock holdings

($million)

CEO total

compensation,

2022 ($million)

Median

worker

pay,

2022

CEO-

worker

pay ratio,

2022

As of

July 7,

2023

% change,

January 6,

2020-July

7, 2023

Dollar Tree

Michael Witynski

$2,149

$30.5

2,393%

$13.98

$14,702

951

Tapestry

Joanne Crevoiserat

$2,100

$10.9

1,482%

$13.74

$29,147

471

Nike

John Donahoe II

$8,920

$18.6

769%

$28.84

$37,410

771

Sources: Corporate proxy statements and 10-K and 10-Q reports. See Appendix 1 for details on the full Low-Wage 100.

The CEOs with the largest increases in their stock holdings, all relatively new chief execs, have quickly

amassed large stockpiles amid widespread low pay among their most typical workers.

Dollar Tree: CEO Michael Witynski reaped the biggest stock gain in the Low-Wage 100. During his three-

year stint before resigning in early 2023, his personal stock holdings ballooned 2,393 percent to $30.5

million. Dollar Tree’s median pay fell 4.4 percent to just $14,702 in the same time period, while the

retailers’ customers saw an increase in most products from $1 to $1.25. The retailer has spent over $2 billion

on buybacks since 2020.

Tapestry: Joanne Crevoiserat, after moving from CFO to CEO status in 2020, has amassed nearly $11

million in company stock, a holding up 1,482 percent in value since 2020. Half of the luxury brand’s

employees annually make less than $29,147, a reality that leaves them unlikely to ever carry one of the

company’s high-end Coach handbags. Tapestry median pay increased only 2 percent between 2019 and

2022, not accounting for inflation.

Nike: The athletic wear giant has spent, since John Donahoe II took the CEO job in January 2020, nearly $9

billion on buybacks. That outlay contributed to a 769 percent hike in Donohoe’s stock holdings to nearly

$19 million last month. Meanwhile, half of the company’s 77,239 global employees make less than $37,410.

8

The Low-Wage 100

Federal contracts and subsidies

Ordinary U.S. taxpayers are supporting our inequitable corporate economic order through the hundreds of

billions of federal contracts and subsidies that flow every year to for-profit businesses.

Among the Low-Wage 100, 51 received federal contracts worth a combined $24.1 billion during fiscal years

2020-2023. These low-wage federal contractors spent nearly $160 billion on stock buybacks during this

period. In 2022, the average CEO pay at these low-wage contractors stood at $12.7 million while the

group’s average CEO-worker pay ratio hit 438-to-1. The median worker pay: $34,550.

CEO pay apologists regularly argue that corporate leaders deserve their massive compensation packages

because they bear enormous responsibilities and must take extraordinary risks. This argument quickly falls

apart when we compare CEOs at major contractors with the government officials ultimately responsible for

their contracts.

The U.S. secretary of defense, for instance, manages the country’s largest workforce — more than 2 million

employees — and makes life-and-death decisions on a daily basis. And yet this defense secretary and other

Biden cabinet members make just $226,300 per year. The average $12.7-million CEO compensation in our

low-wage contractor group runs 56 times higher than the current take-home of our cabinet secretaries. The

ratio between cabinet secretary pay and the $80,320 average federal employee pay now runs less than three

to one.

The only current restraint on top-level federal contractor pay remains a cap on how much contactors can

expect the federal government to directly reimburse them for chief executive compensation. In 2022, that

cap stood at $589,000 per executive. But this regulation in no way curbs the windfalls that contracts can

generate for companies and their top executives. Lucrative government deals boost corporate earnings and

share prices, and those increases, in turn, inflate CEO pay.

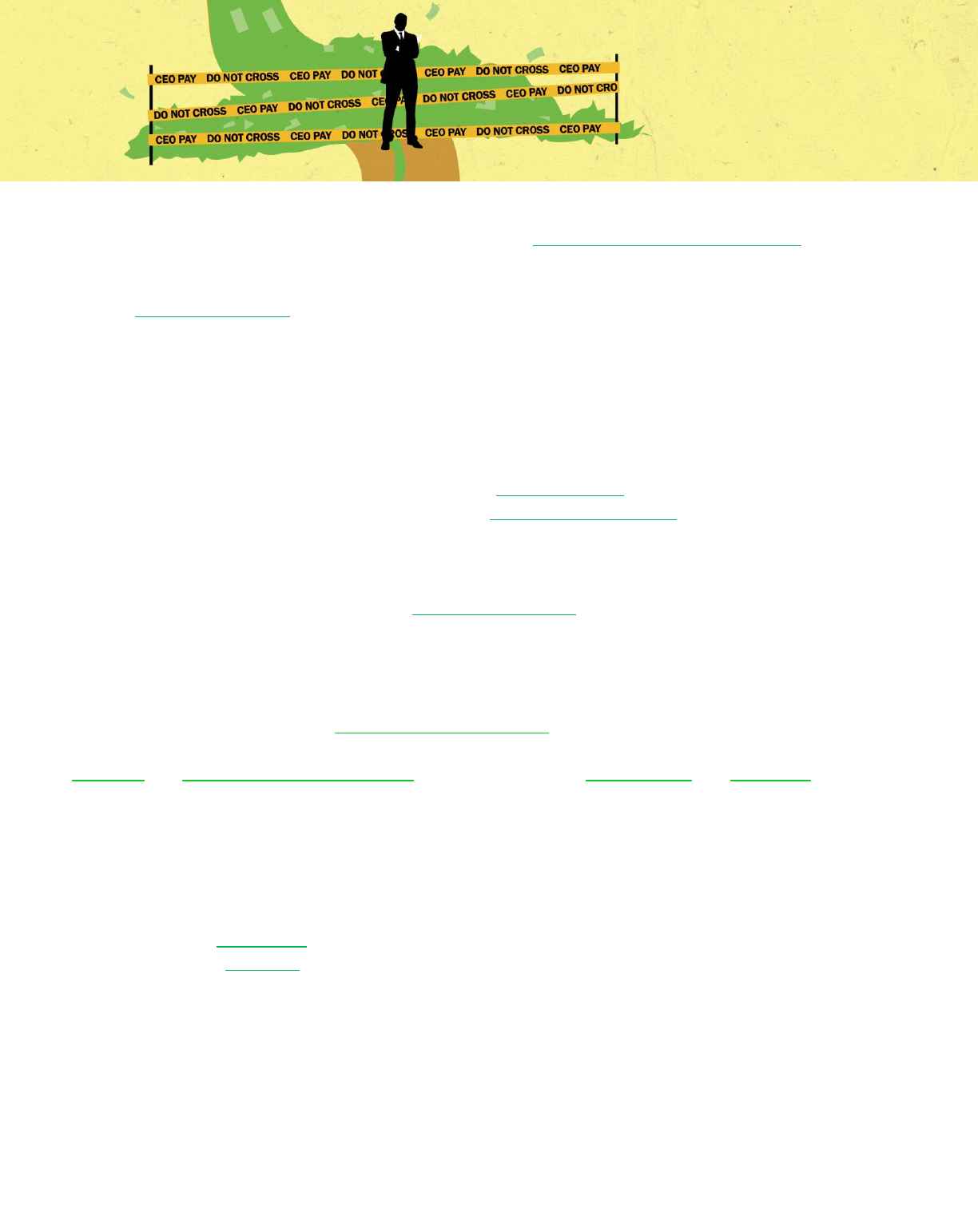

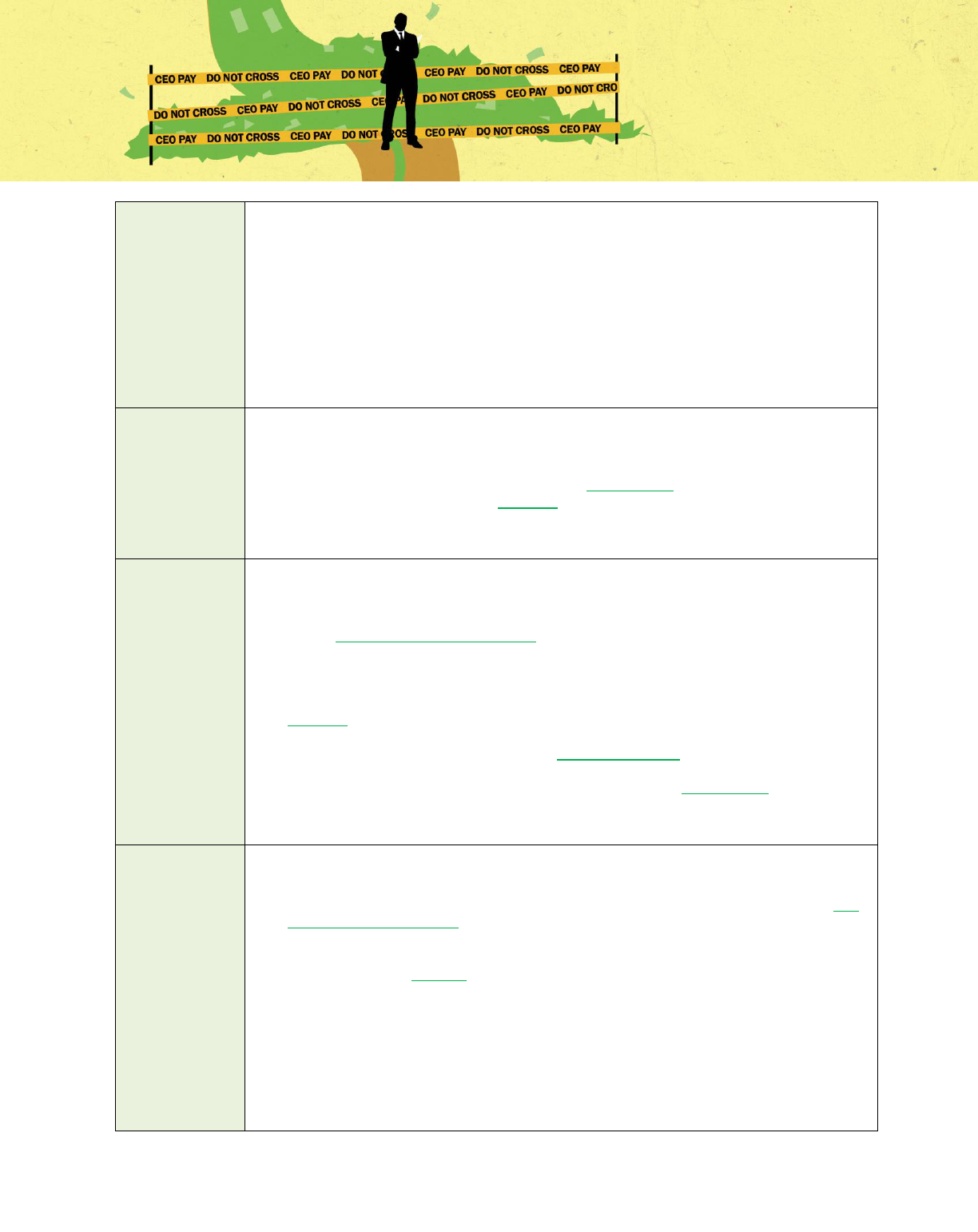

The Low-Wage Corporations with the Largest Federal Contracts

Company

CEO

CEO pay,

2022

Median

worker

pay, 2022

Pay

ratio,

2022

Federal

contracts,

FY20-23

Primary purpose of

contracts

Amazon.com

Andy Jassy

$1,298,723*

$34,195

38*

$10,403,985,746

Web services

FedEx

Frederick Smith

$10,596,150

$39,177

271

$6,162,738,757

Mail services

Johnson Controls

George Oliver

$14,929,350

$47,588

314

$1,960,631,899

Energy systems

Sources: Corporate proxy statements and USAspending.gov. See Appendix 1 for details on the full Low-Wage 100.

*Jassy accepted modest pay in 2022 after receiving a 2021 stock grant valued at $212 million.

9

Amazon: We were able to gather information on $10.4 billion in Amazon contracts during the FY2020-2023

period, including $10 billion to provide web services for the National Security Agency. But the full extent

of Amazon’s taxpayer-funded contracts remains unknown. The company reportedly also received a

lucrative share of a multi-billion-dollar CIA contract for cloud services. The details and exact value of this

contract continue to be classified. Amazon is also in the running for a share of another $9 billion Defense

Department cloud services contract.

In his first year at the helm in 2021, Amazon CEO Andrew Jassy raked in compensation valued at $212.7

million, nearly all of it in stock-based awards that will vest over a decade. That sum is 6,474 times the

company’s median pay and 961 times the salary for the U.S. secretary of defense. In 2022, the company

bumped up its spending on anti-union consultants to more than $14 million to fight campaigns at several

warehouses, including the State Island site where management is still refusing to negotiate a contract, more

than a year after workers voted in the first U.S.-based Amazon union.

FedEx: During FY2020-2023, FedEx raked in nearly $6.2 billion in federal contracts to provide mail

services that included pharmaceutical deliveries for the Veterans Administration. The FedEx deals with

Uncle Sam dwarf the $1.4 billion their leading competitor, United Parcel Service, received in federal

business during this period. Both UPS and the public Postal Service have heavily unionized workforces.

FedEx management, by contrast, has opposed organizing efforts, and the firm currently has a minimal

union presence outside its pilot crew.

CEO Fred Smith spent $3.6 billion on buybacks between 2020 and July 2023, a maneuver that helped prop

up the value of his personal stock holdings — the largest of any CEO in the Low-Wage 100. His personal

holdings have grown 65 percent, to more than $5 billion, over the past three and a half years. By contrast,

FedEx median worker pay fell by 20 percent to $39,177, including $9,267 in health benefits, between 2019

and 2022. Smith made $10.6 million in 2022, his last year before transitioning to the company’s executive

chair position. That $10.6 million rates as 271 times the FedEx median worker pay and 47 times the salary

of the U.S. cabinet secretary of veterans affairs.

Johnson Controls: Originally based in Milwaukee, Johnson Controls moved its headquarters to Ireland in

2016 to lower its U.S. tax bill. But the company continues to receive major taxpayer-funded federal

contracts, a haul worth nearly $2 billion in FY2020-2023, primarily for upgrading federal buildings to a

more energy-efficient status. The firm could receive considerably more over coming years, thanks to new

infrastructure and energy legislation. Under CEO George Oliver’s leadership, the firm has spent $4.5

billion on stock buybacks since 2020. That contributed to a 139 percent increase in his personal

stockholdings, to $131.7 million. In 2022 Oliver made 314 times as much as his typical employee.

10

Policy Recommendations

We highlight here three areas of CEO pay policy reforms that have gained traction in recent years.

Appendix 2 catalogs a much more extensive menu of options.

Stock buybacks taxes and restrictions

Before 1982, federal rules generally treated buybacks as illegal stock manipulation. Several bills, including

the Reward Work Act (HR 3694) championed by Rep. Chuy Garcia (D-IL), have been introduced to

reinstate that ban. Recent reforms move the ball in that direction.

The 2022 Inflation Reduction Act introduces a 1 percent excise tax on CEO pay-inflating stock buybacks.

President Biden proposed quadrupling this tax in his 2023 State of the Union address.

Biden has also included in his federal budget proposals restrictions on the sale of executives’ personal

stock after a buyback to prevent CEOs from timing share repurchases to cash in personally on a short-term

price pop they themselves artificially created. A Senate bill introduced in March 2023, the Advancing

Long-term Incentives for Governance Now (ALIGN) Act, would require executives to hold stock-based

compensation for at least three years and to hold their stock for 12 months following the announcement of

a stock buyback. A 2019 SEC investigation revealed that in the eight days following a buyback

announcement top executives sold five times as much stock on average as they had on ordinary days.

In France, where companies are also hitting buybacks records, President Emmanuel Macron has proposed

requiring companies with more than 5,000 employees to increase profit-sharing with workers if they

engage in buybacks.

Federal contractor incentives

President Biden has flexed his executive powers in numerous ways to help working families. He has, for

instance, lifted the wage floor for certain federal contract workers to $15 per hour. And he has ordered

large construction firms involved in public infrastructure projects to negotiate collective agreements with

their workers, a requirement that should be expanded to contractors that provide goods and other services.

In 2022, the U.S. Department of Commerce announced that the agency would give priority in the awarding

of new CHIPS subsidies for domestic semiconductor manufacturing to firms that do not engage in any

stock buybacks. This important step should be expanded to all corporate recipients of federal contracts,

grants, and subsidies.

The administration could also do much more to leverage the power of the public purse against extreme

pay disparities. The proposed Patriotic Corporations Act could serve as a model. This bill would grant

11

preferential treatment in contracting to firms with CEO-worker pay ratios of 100 to 1 or less, among other

benchmarks, including neutrality in union organizing. The Congressional Progressive Caucus has called

on Biden to introduce such incentives. By encouraging big companies to narrow their pay gaps, the

administration would also help ensure that taxpayers get the biggest bang for the buck for federal contract

dollars. Studies have shown that companies with narrow gaps tend to perform better.

Excessive CEO pay taxes

Higher tax rates on companies with wide CEO-worker pay gaps create an incentive to both rein in

executive pay and raise worker wages, all while generating significant new capital for vital public

investments.

Laws to do just that are already generating revenue in two major cities, San Francisco and Portland,

Oregon. The more recent of the two, San Francisco’s “Overpaid Executive Tax,” became effective on

January 1, 2022 after receiving strong support in a 2020 ballot referendum. This new law imposes an

additional gross receipts tax on businesses where the highest-paid employee earns over 100 times the

median pay of the firm’s San Francisco-based employees. In May 2023, San Francisco officials announced

that the tax appears likely to bring in about $125 million per year. The tax has also proved more resilient

than other local revenue sources.

At the federal level, Senate Finance Committee Chair Ron Wyden floated the idea of an excise tax on

corporations with big gaps between CEO and worker pay in the Build Back Better negotiations. His

proposal, loosely modeled on the Tax Excessive CEO Pay Act, a bill championed by Senators Bernie

Sanders and Elizabeth Warren and Representatives Barbara Lee and Rashida Tlaib, has the support of the

AFL-CIO, the Center for American Progress, and numerous other organizations and academics.

Under this Tax Excessive CEO Pay Act, the wider a company’s gap between CEO and median worker pay,

the higher the company’s federal corporate tax rate. Tax penalties would begin at 0.5 percentage points for

companies that pay their top executives between 50 and 100 times more than their median workers. The

highest penalty would apply to companies that pay top executives over 500 times worker pay. Companies

with pay gaps of less than 50 to 1 would not owe an extra dime. The Tax Excessive CEO Pay Act would

raise an estimated $150 billion over 10 years. Rep. Mark DeSaulnier’s CEO Accountability and

Responsibility Act (H.R. 3301) would impose similar tax penalties for large pay ratios.

12

Methodology and Sources

S&P 500 corporations with the lowest median worker pay: Data reported by companies in annual

corporate proxy statements, drawn from the AFL-CIO Paywatch database.

CEO compensation, median worker pay, and pay ratio calculations: The 2010 Dodd-Frank Wall Street

Reform and Consumer Protection Act requires large U.S. publicly traded corporations to report the ratio

between their CEO and median worker pay to the SEC on a yearly basis. Under the SEC rule, companies

key their ratios to two numbers:

CEO compensation: includes salary, bonuses, the grant date estimated value of stock and stock option

awards, changes in pension value, and perks.

Median employee compensation: based on a firm’s global workforce, including part-time,

temporary, and full-time employees, but not subcontracted workers. Companies can exempt non-U.S.

employees from their ratio calculations only if these employees make up 5 percent or less of the total

workforce. They cannot convert part-time and temporary employees into full-time equivalents.

CEO stock holdings: In their annual proxy statements, companies must disclose their top executives’

“beneficial ownership” of company shares. Under SEC rules, this includes shares they already possess as

well as the shares executives have the right to acquire within 60 days of the report date, including through

the exercise of stock options. To estimate the value of unexercised stock options, IPS analyzed the strike

prices and vesting schedules of all options in the “outstanding equity” table that were either already

exercisable or set to become exercisable within 60 days. We excluded grants that at the time of our focus

dates were “under water,” meaning they have no value because their exercise price is higher than the

current price. In analyzing the change in the value of total CEO stock holdings, we did not account for

possible sales of stock during our focus period.

Stock buybacks: We based our figures on share repurchase data for 14 quarters, as reported in

companies’ 10-Q reports filed with the SEC between January 1, 2020 and May 31, 2023.

Federal contracts and grants: We used data from USASpending.gov, as of July 14, 2023. We used the

advanced search, using the parent company UEI number as the keyword and covering fiscal years 2020-

2023. The federal government’s fiscal year begins October 1. Results include contracts begun before this

period that had their latest related action during this period. The figures represent net amounts, adjusting

for loan repayments or other funds paid to the government. Our figures do not include contracts classified

for security purposes, with one exception. Thanks to media coverage, we were able to include a $10 billion

contract from the National Security Agency to Amazon for web services. The NSA has confirmed the

contract to media, thanks to a Microsoft challenge against the deal.

13

Appendix 1: The 100 S&P 500 companies with the

lowest median worker wages in 2022

Company, ranked by

stock buybacks

CEO in 2022

Stock

buyback

expenditures

reported

between

January 1,

2020-May 31,

2023

($million)

Value of

CEO

stock

holdings

as of

July 7,

2023

($million)

% change

in stock

holdings

value,

January

6, 2020-

July 7,

2023

CEO total

compensation,

2022 ($million)

Median worker

pay, 2022

CEO-

worker

pay ratio,

2022

Federal

contracts,

FY20-FY23

Lowe's

Marvin R.

Ellison

$34,949

$108.3

754%

$17.47

$29,584

591

$0

Home Depot

Edward P.

Decker

$28,857

$50.3

(a)

$14.62

$30,100

491

$2,030,452

Walmart

C. Douglas

McMillon

$23,861

$284.6

35%

$25.31

$27,136

933

$0

S&P Global

Douglas L.

Peterson

$15,496

$83.5

31%

$28.64

$35,926

797

$104,164,630

Linde Plc

Sanjiv Lamba

$13,099

$46.4

(a)

$14.60

$45,654

326

$99,581,916

Autozone

William C.

Rhodes III

$10,932

$302.7

130%

$14.33

$31,751

451

$10,500

O'Reilly Automotive

Gregory D.

Johnson

$8,957

$27.1

3%

$5.48

$34,835

157

$33,954

Nike

John Donahoe II

$8,920

$18.6

769%

$28.84

$37,410

771

$0

Target

Brian C. Cornell

$8,868

$55.9

-20%

$17.66

$25,993

680

$0

Dollar General

Jeffery C. Owen

$8,179

$23.5

(a)

$12.03

$18,352

702

$0

Analog Devices

Vincent Roche

$7,599

$39.5

384%

$22.10

$40,596

544

$0

Sherwin-Williams

John G. Morikis

$6,494

$129.8

503%

$12.75

$44,211

288

$24,612,086

McDonald's

Christopher

Kempczinski

$6,200

$84.1

335%

$17.77

$14,521

1,224

$0

Mondelez Intl

Dirk Van de Put

$6,042

$78.5

84%

$17.93

$35,707

502

$0

Amazon.com

Andrew R.

Jassy

$5,911

$264.7

(a)

$1.30

$34,195

38

$10,403,985,746

TJX

Ernie Herrman

$5,487

$41.2

86%

$20.53

$34,084

2,249

$0

MGM Resorts Intl

William

Hornbuckle

$5,365

$10.5

-23%

$16.24

$39,171

415

$0

Best Buy

Corie Barry

$5,206

$25.8

102%

$12.84

$32,197

399

$0

Starbucks

Howard Schultz

$5,075

$2,083.8

(a)

$0.37

$12,254

31

$66,871

Kroger

W. Rodney

McMullen

$4,635

$241.7

144%

$19.21

$28,644

671

$0

Johnson Controls

George R.

Oliver

$4,547

$131.7

139%

$14.93

$47,588

314

$1,960,631,899

Seagate Technology

William D.

Mosley

$4,536

$53.9

59%

$13.21

$10,763

1,227

$0

Colgate-Palmolive

Noel R. Wallace

$4,314

$26.4

57%

$14.46

$39,370

367

$10,908,698

Philip Morris Intl

Jacek Olczak

$3,962

$27.0

(a)

$15.78

$19,411

158

$0

Marriott Intl

Anthony G.

Capuano

$3,851

$34.9

(a)

$18.69

$39,203

477

$31,969,454

Cognizant Tech

Solutions

Brian

Humphries

$3,793

$21.1

3%

$17.94

$31,450

571

$679,929

Fleetcor Technologies

Ronald F.

Clarke

$3,674

$734.9

-31%

$3.99

$42,985

93

$312,130,455

FedEx

Frederick W.

Smith

$3,654

$5,012.3

65%

$10.60

$39,177

271

$6,162,738,757

Estee Lauder

Fabrizio Freda

$3,379

$75.7

-20%

$25.48

$29,236

872

$0

14

Company, ranked by

stock buybacks

CEO in 2022

Stock

buyback

expenditures

reported

between

January 1,

2020-May 31,

2023

($million)

Value of

CEO

stock

holdings

as of

July 7,

2023

($million)

% change

in stock

holdings

value,

January

6, 2020-

July 7,

2023

CEO total

compensation,

2022 ($million)

Median worker

pay, 2022

CEO-

worker

pay ratio,

2022

Federal

contracts,

FY20-FY23

TE Connectivity

Terrence R.

Curtin

$3,190

$57.4

130%

$15.93

$28,757

554

$11,312,602

Domino's Pizza

Russell J.

Weiner

$3,118

$18.1

(a)

$6.64

$31,638

210

$0

Constellation Brands

William A.

Newlands

$3,091

$19.6

243%

$12.04

$34,821

461

$0

YUM Brands

David Gibbs

$3,080

$70.6

-50%

$16.67

$10,398

1,603

$0

Ulta Beauty

David C.

Kimbell

$3,044

$20.1

(a)

$13.51

$14,998

901

$0

Coca-Cola

James Quincey

$2,716

$77.3

112%

$22.82

$12,122

1,883

$12,706,458

Stanley Black &

Decker

Donald Allan Jr.

$2,506

$16.3

(a)

$8.09

$47,651

227

$143,836,872

Mosaic

James C.

O'Rourke

$2,478

$28.9

647%

$12.06

$27,625

437

$0

Ross Stores

Barbara Rentler

$2,469

$40.6

-23%

$11.34

$9,968

1,137

$0

Hilton Worldwide

Christopher

Nassetta

$2,333

$561.4

60%

$23.53

$43,702

539

$114,024

Bath & Body Works

Gina Boswell

$2,314

$0.0

(a)

$6.91

$10,669

934

$0

Corning

Wendell P.

Weeks

$2,258

$51.4

77%

$16.17

$36,485

443

$267,639,441

Becton Dickinson & Co

Tom Polen

$2,253

$60.1

(a)

$16.71

$37,748

443

$718,473,001

Amphenol

R. Adam Norwitt

$2,200

$262.1

610%

$13.96

$16,726

834

$534,089,665

Dollar Tree

Michael A.

Witynski

$2,149

$30.5

2,393%

$13.98

$14,702

951

$0

Tractor Supply

Harry A. Lawton

III

$2,112

$24.5

(a)

$10.48

$13,884

352

$0

Tapestry

Joanne

Crevoiserat

$2,100

$10.9

1,482%

$13.74

$29,147

471

$0

Whirlpool

Marc R. Bitzer

$2,064

$41.4

91%

$11.95

$28,540

419

$24,782

LKQ

Dominick

Zarcone

$2,044

$23.9

198%

$10.74

$34,099

315

$327,283

Skyworks Solutions

Liam K. Griffin

$2,014

$11.4

7%

$16.67

$30,180

552

$0

Advance Auto Parts

Thomas R.

Greco

$2,008

$12.3

-35%

$8.38

$24,415

343

$0

Carrier Global

David Gitlin

$1,971

$105.5

(b)

$13.22

$43,209

306

$160,899,628

Amcor Plc

Ron Delia

$1,841

$17.2

43%

$9.87

$41,332

239

$0

Assurant

Keith W.

Demmings

$1,712

$4.8

(a)

$8.37

$43,451

193

$67,008,804

Darden Restaurants

Eugene L. Lee

Jr.

$1,570

$48.6

-1%

$11.89

$21,931

542

$0

Walgreens Boots

Alliance

Rosalind G.

Brewer

$1,564

$1.4

(a)

$17.29

$24,530

705

$1,115,754,713

Costco Wholesale

W. Craig Jelinek

$1,552

$190.9

105%

$9.91

$45,450

218

$0

Chipotle Mexican Grill

Brian Niccol

$1,487

$160.0

140%

$17.19

$16,010

1,073

$0

Mohawk Industries

Jeffrey S.

Lorberbaum

$1,397

$1,054.7

-22%

$4.26

$37,483

114

$0

Microchip Technology

Ganesh

moorthy

$1,375

$67.4

277%

$12.76

$46,326

275

$143,836,872

DXC Technology

Michael J.

Salvino

$1,313

$22.4

(a)

$28.72

$39,684

512

$277,412,790

ON Semiconductor

Hassance El-

Khoury

$1,301

$31.6

(a)

$16.52

$16,050

1,029

$0

15

Company, ranked by

stock buybacks

CEO in 2022

Stock

buyback

expenditures

reported

between

January 1,

2020-May 31,

2023

($million)

Value of

CEO

stock

holdings

as of

July 7,

2023

($million)

% change

in stock

holdings

value,

January

6, 2020-

July 7,

2023

CEO total

compensation,

2022 ($million)

Median worker

pay, 2022

CEO-

worker

pay ratio,

2022

Federal

contracts,

FY20-FY23

Hershey

Michele Buck

$1,283

$66.3

248%

$13.55

$39,579

342

$1,080,116

Kimberly-Clark

Michael D. Hsu

$1,234

$43.7

66%

$14.56

$42,734

341

$249,255

Ralph Lauren

Patrice Louvet

$1,171

$6.8

-61%

$18.55

$31,187

464

$0

Tyson Foods

Donnie King

$1,169

$9.9

(a)

$12.01

$41,967

286

$818,828,824

Wabtec

Rafael Santana

$1,157

$15.2

230%

$11.69

$45,760

255

$2,515,633

Baxter Intl

Jose E. Almeida

$1,133

$24.3

-40%

$13.59

$46,830

290

$108,201,268

Align Technology

Joseph M.

Hogan

$1,100

$65.8

14%

$18.68

$18,215

1,026

$0

Smith (A.O.)

Kevin J.

Wheeler

$880

$13.6

229%

$6.64

$45,640

145

$0

VF

Steven E.

Rendle

$835

$9.1

-93%

$15.42

$28,679

136

$0

Robert Half Intl

Keith Waddell

$824

$103.6

30%

$9.39

$33,912

277

$605,506

Genuine Parts

Paul D.

Donahue

$810

$24.6

52%

$10.38

$43,046

241

$24,171,159

Avery Dennison

Mitch Butier

$715

$71.9

95%

$9.11

$13,688

665

$283,453

Kraft Heinz

Miguel Patricio

$658

$42.6

72%

$7.10

$43,160

164

$1,123,640

Borgwarner

Frédéric B.

Lissalde

$527

$12.6

32%

$17.86

$32,960

542

$10,908,698

Factset Research

Systems

F. Phillip Snow

$424

$33.0

142%

$6.60

$18,958

348

$2,604,691

PPG Industries

T. M. Knavish

$400

$7.1

(a)

$2.86

$35,600

249

$143,836,872

Newell Brands

Ravichandra

Saligram

$361

$0.8

(a)

$10.30

$37,644

274

$0

Fastenal

Daniel L.

Florness

$290

$28.5

228%

$5.44

$44,729

122

$49,899,318

Carnival

Josh Weinstein

$258

$1.2

(a)

$8.01

$14,496

553

$5,541,622

Viatris

Michael Goettler

$250

$1.4

(b)

$14.77

$34,858

398

$70,590

Live Nation

Entertainment

Michael Rapino

$226

$360.5

-30%

$139.01

$25,673

5,414

$0

Wynn Resorts

Craig S. Billings

$219

$26.8

(a)

$12.23

$46,164

265

$0

Garmin

Clifton A.

Pemble

$207

$8.9

-43%

$3.68

$39,950

115

$4,253,406

Cooper Cos

Albert G. White

III

$151

$45.3

51%

$11.74

$34,165

344

$422,949

Extra Space Storage

Joseph D.

Margolis

$131

$29.5

85%

$11.63

$46,624

249

$0

Aptiv

Kevin P. Clark

$127

$65.1

-8%

$16.21

$8,139

1,991

$20,203,679

Mccormick & Co

Lawrence E.

Kurzius

$100

$79.9

487%

$10.43

$38,724

269

$0

Epam Systems

Arkadiy Dobkin

$97

$428.3

-2%

$6.45

$33,273

194

$0

Royal Caribbean

Group

Jason T. Liberty

$11

$6.5

(a)

$10.76

$15,264

705

$46,501

Norwegian Cruise Line

Frank J. Del Rio

$0

(c)

$21.21

$24,484

866

$2,774,879

Iron Mountain

William Meeny

$0

(c)

$15.10

$37,882

399

$280,758,478

AES

Andres Gluski

$0

(c)

$12.53

$45,196

277

$66,340,563

Teleflex

Liam Kelly

$0

(c)

$8.19

$32,939

249

$12,199,374

16

Company, ranked by

stock buybacks

CEO in 2022

Stock

buyback

expenditures

reported

between

January 1,

2020-May 31,

2023

($million)

Value of

CEO

stock

holdings

as of July

7, 2023

($million)

% change

in stock

holdings

value,

January

6, 2020-

July 7,

2023

CEO total

compensation,

2022 ($million)

Median worker

pay, 2022

CEO-

worker pay

ratio, 2022

Federal

contracts, FY20-

FY23

Western Digital

David V.

Goeckeler

$0

(c)

$32.14

$9,644

3,332

$0

Caesars Entertainment

Tom Reeg

$0

(c)

$31.35

$36,252

865

$0

Copart

Jeffrey Liaw

$0

(c)

$31.00

$41,662

744

$0

Las Vegas Sands

Robert G.

Goldstein

$0

(c)

$11.41

$34,712

329

$0

Monolithic Power

Systems

Michael Hsing

$0

(c)

$20.66

$44,194

468

$0

Public Storage

Joseph Russell

$0

(c)

$9.20

$33,379

276

$0

TOTAL

$341,214

$14,895.0

$24,123,902,755

AVERAGE

$3,412

$165.5

$15.29

$31,672

603

241,239,028

AVERAGE – 65 firms

with no CEO change

$184.7

33%

(a) not applicable - CEO change (b) not applicable - new corporation (c) not applicable - no buyback expenditures

17

Appendix 2: Our annual menu of CEO pay reforms

Every year, this section of our annual Executive Excess report offers the most comprehensive available menu of policy

options for reining in CEO pay. These options cover reforms in everything from corporate governance to government

contracts and subsidies. Members of Congress have introduced legislation that speaks to some of these options. Other

reforms are pending before legislative bodies in U.S. cities and states — and nations around the world.

How best to evaluate these CEO pay reforms? IPS has developed, as a guide, the following principles for effective and

equitable corporate compensation.

Principles for a Better CEO Pay System

1. Encourage narrower CEO-worker pay

gaps.

As CEOs focus on funneling corporate resources

to shareholders and themselves, workers are not

getting a fair deal for their labor. Extreme pay

gaps also endanger enterprise effectiveness.

Management guru Peter Drucker believed that

pay ratios can run no higher than 25-to-1

without damaging company morale and

productivity. Researchers have documented that

enterprises operate more effectively over the

long term when they tap into — and reward —

the creative contributions of all employees.

2. Eliminate taxpayer subsidies for

excessive pay

Ordinary taxpayers should not have to foot the

bill for excessive executive compensation. And

yet they do. Government contracts and subsidies

routinely make mega millionaires out of

corporate executives, and tax loopholes such as

the preferential treatment of investment fund

managers’ carried interest income and unlimited

tax-deferred retirement accounts perpetuate our

out of control executive pay system.

3. Encourage reasonable compensation

limits and counter short-termism

The greater the annual reward an executive can

receive, the greater the temptation to make

reckless decisions that generate short-term

earnings at the expense of long-term health for

the corporation and the broader economy and

environment. Public policies can encourage

more reasonable compensation levels without

micromanaging pay levels at individual firms.

4. Bolster accountability to shareholders

On paper, the corporate boards that determine

executive pay must answer to shareholders. In

actual practice, top executives typically

dominate corporate boards. Despite some

progress, boards should face stronger

requirements to justify to shareholders the

compensation they award to executives.

5. Extend accountability to broader

stakeholder groups

In 2019, the Business Roundtable declared that

the corporations should aim to not just serve

shareholders ― the group’s official position

since 1997 ― but “to create value for all our

stakeholders.” To go beyond rhetorical urgings

like this, corporate pay practices need to

encourage CEO decisions that take into account

the long-term health of the planet and the

interests of all corporate stakeholders, including

consumers, employees, and their communities.

23

CEO PAY REFORMS RELATED TO TAX POLICY

Raising the

corporate tax

rate on firms

with wide gaps

between CEO

and worker pay

In addition to the two federal bill noted above (the Tax Excessive CEO Pay Act and the CEO

Accountability and Responsibility Act), several cities and states have either adopted or are

considering tax penalties on corporations with large CEO-worker pay gaps. The city of Portland,

Oregon began collecting revenue from the world’s first such tax in 2018. Firms with a business

presence in Portland that pay their CEO more than 100 times their median worker pay owe an

extra 10 percent of their business tax bill. Firms over 250 times face a 25 percent extra tax. San

Francisco adopted a similar tax after a successful 2020 ballot initiative. A number of state

lawmakers have also proposed tying tax rates to CEO-worker pay ratios.

Excise tax on

stock buybacks

The Inflation Reduction Act of 2022 introduced a one percent excise tax on stock buybacks.

Limiting

executive tax-

deferred pay

A recent Institute for Policy Studies-Jobs With Justice report found that the top five executives at

S&P 500 firms held a combined $8.9 billion in special tax-deferred accounts at the end of 2021.

These accounts are unlimited while ordinary taxpayers face strict limits on how much income

they can defer from taxes via 401(k) plans.

The CEO and Worker Pension Fairness Act (S.3341) would revise Section 409A of the tax

code so that executives would owe taxes on their compensation when it vests.

In 2007, the Senate passed a minimum wage bill that would have limited annual executive

pay deferrals to $1 million, but the provision was dropped in conference committee.

Ending the

preferential

capital gains

treatment of

carried interest

Under current rules, managers of private equity, real estate, and hedge funds pay the

discounted capital-gains tax rate on so-called “carried interest” (earnings tied to a percentage of

the fund’s profits). This income actually amounts to compensation for managing other people’s

investments and should be taxed as ordinary income.

Sen. Tammy Baldwin and Rep. Bill Pascrell introduced the Carried Interest Fairness Act of

2021 (S.1598/HR 1068) to eliminate the “carried interest” loophole. This legislation would

generate between $12 billion and $14 billion over 10 years.

The Stop Wall Street Looting Act, (S.3022/HR 5648) would also eliminate this loophole, as

part of a broader plan to end private equity’s predatory practices.

Limiting the

deductibility of

excessive pay

In 1993, Congress amended the tax code to prevent corporations from deducting off their

taxable income the amounts they pay top executives in excess of $1 million per executive —

unless the compensation came as stock options and other forms of “performance” pay. This

huge loophole encouraged corporate boards to hand out massive bonuses that dramatically

widened pay gaps between corporate executives and rank-and-file workers.

The 2017 Republican tax law closed this “performance” pay loophole, but only for compensation

going to a corporation’s CEO, CFO, and three other highest-paid employees. As part of the

American Rescue and Recovery Act, Congress took another step forward by closing the

loophole for compensation going to an additional five executives (10 in total). Pay above $1

million going to other highly paid employees — such as traders at large Wall Street firms —

remains fully deductible.

Sens. Jack Reed (D-RI) and Richard Blumenthal (D-CT) and Rep. Lloyd Doggett (D-TX)

have sponsored legislation that would extend the $1 million deductibility cap to all forms of

compensation for all employees.

Rep. Barbara Lee’s Income Equity Act would deny employers a tax deduction for any

excessive pay that runs greater than 25 times the median compensation paid to full-time

employees or $500,000.

24

Richard Freeman and Douglas Kruse of Harvard University and Joseph Blasi of Rutgers

University have proposed that Congress only allow tax deductions for executive bonuses

when corporations award as much incentive pay “to the bottom 80 percent of their

workforce as they do to the top 5 percent.”

Financial

transaction tax

Another way to generate much-needed revenue while curbing executive excess would be

through a financial transaction tax on Wall Street trades. Various legislative proposals in the

Senate and the House, including the Wall Street Tax Act and the Wall Street Speculation Tax,

would curb the lucrative short-term speculation that has inflated Wall Street bonuses while

adding no significant value to the real economy.

PAY REFORMS TIED TO CONTRACTS, SUBSIDIES, OTHER PUBLIC SUPPORT

Leveraging

government

procurement

dollars to

encourage

narrower CEO-

worker pay

gaps

By law, the U.S. government denies contracts to companies that discriminate, in their

employment practices, on race or gender. Our public policy sends the clear message that our

tax dollars should not be subsidizing racial or gender inequality. We could also leverage the

public purse to discourage extreme economic inequality.

Rep. Jan Schakowsky introduced the Patriotic Corporations of America Act (H.R. 4186) in

2021 to extend tax breaks and federal contracting preferences to companies that meet

good behavior benchmarks, including CEO-worker pay ratios of 100-1 or less.

Rep. Mark DeSaulnier’s CEO Accountability and Responsibility Act (H.R. 3301) would

provide similar preferences to encourage narrow pay ratios.

Sen. Bernie Sanders released a broad pro-union Workplace Democracy Plan in 2019 that

includes a ban on federal contracts to firms with CEO-worker pay ratios of more than 150

to 1 or that outsource jobs, pay workers less than $15 an hour, or engage in union busting.

At the state level, a Rhode Island bill would give preferential treatment in state contracting

to corporations that pay their CEOs no more than 25 times their median worker pay. A

Connecticut bill would disqualify companies with CEO-worker pay ratios of more than 100

to 1 from gaining state subsidies and grants.

Stock buyback

disincentives

tied to

government

contracts and

subsidies

In 2022, the Department of Commerce announced plans to give priority in the awarding of new

CHIPS subsidies for domestic semiconductor manufacturing to firms that do not engage in any

stock buybacks. This important precedent could be extended to all forms of taxpayer-funded

contracts, grants, and subsidies.

Pay ratio-linked

corporate

subsidies and

bailouts

All forms of federal, state, and local corporate welfare could be required to incorporate CEO-

worker pay ratio guidelines in their qualification standards.

The Congressional Progressive Caucus has called on Biden to introduce such incentives.

In 2015, then-Republican congressman Mick Mulvaney authored an amendment designed

to prevent the U.S. Export-Import Bank from subsidizing any U.S. company with annual

CEO pay over 100 times median worker pay. Mulvaney later directed the Office of

Management and Budget and served as President Trump’s acting chief of staff. Mulvaney’s

proposal did not become law, but does suggest a potential for bipartisan action.

The European Union already applies similar pay ratio standards to state aid for failing

banks. Bailed-out banks operating within the EU have to cap executive pay at no more

than 15 times the national average salary or 10 times their average employee wage.

25

Leveraging

public pension

funds to

encourage

narrower CEO-

worker pay

ratios

Public employee pension fund investments offer a significant opportunity to influence corporate

pay behavior.

In 2023, the Marin County Employees’ Retirement Association adopted a position of voting

against any CEO pay package where the CEO makes more than 100 times the

corporation’s median worker, arguing that such pay is excessive and detrimental to returns

to shareholders.

The city of San Francisco has adopted an advisory resolution urging the San Francisco

Employees Retirement System to consider executive compensation and pay ratios during

decision making on investments and proxy voting. The system holds $21 billion in assets.

The resolution asks the pension board to report CEO-worker pay ratios at firms where the

pension system invests and to set guidelines for what constitutes “excessive” pay.

The New York State Pension Fund has a similar agreement that urges several large

corporations to reexamine their CEO and executive pay and adopt policies that take into

account the compensation of the rest of their workforces.

CEO pay limits

at public (or

publicly

supported)

institutions

In several states and countries, lawmakers and other groups have worked to crack down on

executive excess at firms receiving taxpayer support.

A 2013 New York State executive order prohibited service providers that annually average

over $500,000 in state support and receive at least 30 percent of their annual in-state

revenue from state funds from using more than $199,000 in state funds to pay individual

executive compensation. New York Governor Kathy Hochul rescinded the order in 2022.

Unions pushed ballot initiatives in both Massachusetts and California in 2014 aimed at

limiting CEO pay at hospitals that receive taxpayer subsidies. In both cases, the unions

withdrew the initiatives after popular support helped them win other concessions.

Former French President François Hollande capped executive pay at firms where the

government owns a majority stake at 450,000 euros, or essentially 20 times the minimum wage.

This limit later evaporated after pushback from corporate leaders. Management consultant

Douglas Smith has called for a similar pay ratio limit on U.S. firms receiving taxpayer funds.

Rein in CEO

pay at nonprofit

organizations

Under the 2017 tax law Republican lawmakers adopted, nonprofits may no longer deduct

executive compensation above $1 million on their federal tax filings. This represents a positive

step, but more could be done to ensure that taxpayers are not subsidizing excessive pay at

nonprofits that already receive preferential tax status. Huge paychecks for nonprofit health care

executive executives have motivated actions in several states.

In Washington, the state legislature is considering a new tax on nonprofit executive

compensation in excess of 10 times the state’s average annual salary.

In Los Angeles, the city council has approved a proposal to limit compensation for hospital

CEOs to the salary of the president of the United States: $450,000. The measure will

appear on the March 2024 ballot and has inspired similar efforts in additional California

cities.

In Connecticut, a state lawmaker has introduced a bill that would require nonprofit hospitals

that pay executives more than $500,000 to pay property taxes.

Economist Dean Baker has proposed that paying executives no more than $400,000 per

year — the salary of the U.S. president — should become a condition of keeping nonprofit

status for tax purposes. Another approach would be to set the cap at no more than 20

times the pay of a nonprofit’s lowest-paid worker.

Fannie Mae and

Freddie Mac

executive pay

caps

In 2015, Congress passed a bill to cap CEO paychecks at quasi-public Fannie Mae and Freddie

at no more than $600,000. In subsequent years, Fannie and Freddie have exploited loopholes in

the law to boost pay far above that limit for top executives. Each enterprise shifted duties from

the pay-limited CEO position to the uncapped positions of president and other top executives.

This loophole should be closed.

26

CEO PAY REFORMS LINKED TO CORPORATE GOVERNANCE

Stock buybacks

Since 1982, SEC Rule 10b-18 has allowed corporations to repurchase their shares on the open

market, with certain limitations. Buybacks have become a pervasive form of legal stock market

manipulation. In 2022, S&P 500 firms spent a record $922.7 billion on stock buybacks.

President Biden’s federal budget proposal and the ALIGN Act would ben executives from

selling their personal stock for a certain period after a buyback.

The Reward Work Act (HR 3694) championed by Rep. Chuy Garcia (D-IL) would ban open

market buybacks.

Sen. Bernie Sanders (I-VT) and Rep. Ro Khanna (D-CA) have authored a bill that would

prohibit buybacks where CEO pay exceeds 150 times the compensation that goes to a

company’s median pay.

Sen. Sherrod Brown (D-OH) has introduced a bill requiring publicly traded companies to

issue a worker dividend equal to $1 for every $1 million spent on stock buybacks. Senators

Cory Booker (D-NJ) and Bob Casey (D-PA) have introduced a similar Worker Dividend Act.

Corporate

board diversity

In at least a dozen European countries, workers have the right to representation in their

company’s top administrative and management bodies. This has had a moderating effect on

CEO pay levels. In Germany, a nation with one of the world’s most highly developed systems for

including workers in corporate decision-making, average CEO pay levels run about half as much

as the U.S. average. In a 2018 poll of likely U.S. voters, 52 percent support placing workers on

major corporate boards and only 23 percent stood opposed.

Rep. Chuy Garcia (D-IL) has introduced the Reward Work Act (HR 3694) to require

corporations to allow employees to elect at least one third of board members.

Sen Elizabeth Warren (D-MA) has introduced the Accountable Capitalism Act to require

corporations with annual revenues over $1 billion to allow employees to pick at least 40

percent of board members.

Signing and

merger bonus

ban

“Golden hellos” and merger bonuses give executives a powerful incentive to wheel and deal

instead of working to build enterprises fit for long-term success. In 2013, Swiss voters adopted a

national ballot initiative that, among other provisions, prohibits executive sign-on and merger

bonuses.

‘Skin in the

game’ mandate

Small-scale entrepreneurs seldom behave recklessly because they have their own personal

wealth tied up in their business. Executives of large corporations, on the other hand, face little

downside risk for irresponsible behavior.

In 2019, Rep. Katie Porter (D-CA) introduced a bill requiring publicly held corporations to

disclose whether they have established procedures to recoup compensation from top

executives to cover the cost of fines or penalties against their company.

Investment adviser Vincent Panvini has proposed that executives be required to place a

share of their own financial assets in escrow for five or ten years. If a CEO’s company

loses value over that time, the CEO would forfeit money from that escrow.

A CEO pay limit

for firms in

bankruptcy

Private equity funds have been connected to a rash of bankruptcies in recent years that often

lead to massive loss of jobs and reductions in employee benefits. A significant portion of the

companies that have filed for bankruptcy carried huge debt loads left over from leveraged

buyouts by private equity firms. This trend has sparked increased interest in ensuring that CEOs

and other executives at distressed firms do not enrich themselves while eliminating jobs and

pensions.

The Stop Wall Street Looting Act builds on the Bankruptcy Abuse Prevention and

Consumer Protection Act of 2005 (Sec. 331). This existing law prohibits companies in

27

bankruptcy from giving executives any “retention” bonus or severance pay that runs over

ten times the average bonus or severance awarded to regular employees in the previous

year. The new bill would strengthen this legislation by:

1) closing a loophole that exempts “performance-based pay” and expanding the ban

beyond top executives to the next 20 most highly paid employees, consultants, and

department heads (Sec.304).

2) banning special payments to high-level executives if the company has not paid promised

severance pay to employees or has reduced employee benefits within the year before

declaring bankruptcy (Sec. 305).

3) blocking courts from approving a bankruptcy exit plan if top executives will receive

payments either excessive or not generally applicable to other employees (Sec. 306).

Abolish

executive

performance

pay

At best, stock options and other performance-pay incentives have CEOs thinking more about

their own personal rewards than long-term enterprise sustainability. At their worst, “pay for

performance” deals encourage criminal behavior.

Michael Dorff of the Southwestern Law School has proposed a ban on “performance pay.”

Bart Naylor of Public Citizen has proposed that stock options be banned as a form of

compensation for financial firm employees. Short of that, Naylor argues they should at least

be kept — and not cashed in — for at least two years after retirement.

‘Say on Pay’

with teeth

Under the 2010 Dodd-Frank law, U.S. shareholders gained the right to a non-binding vote on

executive pay packages. Several options could further empower shareholders.

Make say-on-pay votes binding. In the S&P 500, shareholder votes against CEO pay hit a

high of 12.6 percent opposition in 2022 and such votes have had some impact in

discouraging particularly egregious packages. But corporations can also freely ignore

those votes.

The UK already requires public companies to give shareholders a binding vote on

compensation every three years. A former EU internal markets commissioner has

proposed that shareholders should also have the power to vote on the ratio between the

lowest- and highest-paid employees in a firm.

In Australia, shareholders have the power to remove directors if a company's executive pay

report gets a “no” vote from at least 50 percent of shareholders.

Dean Baker of the Center for Economic and Policy Research has proposed that corporate

directors have their compensation denied if a CEO pay package they have approved fails

to gain a majority in a “say on pay” vote.

Claw back

unearned pay

Executives should not get to keep compensation based on unachieved performance goals.

Section 954 of the 2010 Dodd-Frank law requires executives to repay compensation

gained as a result of erroneous data in financial statements. The SEC finally issued a final

rule on this section in 2022, requiring executives to repay “excess” incentive compensation

received during the three-year period preceding an accounting restatement. Clawback

provisions in the earlier Sarbanes-Oxley Act only applied to restatements resulting from

misconduct. Under UK rules, the clawback period runs 10 years.

28

WALL STREET PAY REFORMS

Pay restrictions

on executives

of large

financial

institutions

Executive compensation played a key role in the reckless behavior that led to the 2008 financial

crash. In response, Section 956 of the 2010 Dodd-Frank financial reform law prohibits large

financial institutions from granting incentive-based compensation that “encourages inappropriate

risks.” After dragging their feet for 13 years, federal regulators are currently working on

producing a final rule on this provision.

A coalition led by Americans for Financial Reform and Public Citizen are advocating for three

changes to strengthen the regulators’ 2016 proposal:

Require executives to defer a significant percentage of compensation for 10 years, and

make them forfeit these sums if the financial institution fails or gets hit with misconduct

fines. Rep. Rashida Tlaib has also introduced a bill, the Fostering Accountability in

Remuneration Fund Act, or FAIR Fund Act, along these lines.

Ban stock options for financial executives, since they promise executives all the benefits of

share price increases with none of the risk of share price declines.

Ban executives from hedging bonus pay: Any effort to reduce inappropriate risk-taking will

be ineffective if executives can use hedging strategies to reduce their risk from poor

company performance.

Claw back

executive pay

at failed banks

The failure of several regional banks in early 2023 provoked a wave of demands for

accountability. Senator Sherrod Brown (D-OH) and Senator Tim Scott (R-SC), the leaders of the

Senate Banking Committee, introduced a bipartisan bill, the Recovering Executive

Compensation Obtained from Unaccountable Practices (RECOUP) Act, to claw back

compensation of senior executives at failed banks and penalize them for their misconduct. The

bill quickly passed out of committee but the full Senate has not yet voted on the bill.

Banker bonus

limits

EU rules introduced in 2014 limit banker bonuses to no more than annual salary, or up to

200 percent of annual salary with shareholder approval. The cap applies to bankers in non-