© 1993-2013 National Association of Insurance Commissioners

MORTGAGE EXPERIENCE ADJUSTMENT

LR003

Under the new RBC and AVR methodology for Commercial and Farm Mortgages this value will no longer be used and its determination is not necessary.

© 1993-2013 National Association of Insurance Commissioners

MORTGAGES

LR004

Basis of Factors

Mortgages in Good Standing

The pre-tax factors for commercial mortgages were developed based on analysis using the Commercial Mortgage Metrics model of Moody’s Analytics and documented in a

report from the American Council of Life Insurers on March 27, 2013. The factors provide for differing levels of risk, the levels determined by a contemporaneous debt

service coverage ratio and the contemporaneous loan-to-value. The 0.14 percent pre-tax factor on insured and guaranteed mortgages represents approximately 30-60 days interest

lost due to possible delay in recovery on default. The pre-tax factor of 0.68 percent for residential mortgages reflects a significantly lower risk than commercial mortgages. The pre-tax

factors were developed by dividing the post-tax factor by 0.7375 (0.7375 is calculated by taking 1.0 less the result of 0.75 multiplied by 0.35).

Mortgages 90 Days Overdue, Not in Process of Foreclosure

The category pre-tax factor for commercial and farm mortgages of 18 percent is based on data taken from the Society of Actuaries “Commercial Mortgage Credit Risk Study.” For

insured and guaranteed or residential mortgages, factors are set at twice the level for those “in good standing” to reflect the increased likelihood of default losses.

Mortgages in Process of Foreclosure

Mortgages in process of foreclosure are considered to be as risky as NAIC 5 bonds and are assigned the same category pre-tax factor of 23 percent for commercial and farm mortgages.

Due and Unpaid Taxes on Overdue Mortgages and Mortgages in Foreclosure

The factor for due and unpaid taxes on overdue mortgages and mortgages in foreclosure is 100 percent.

Specific Instructions for Application of the Formula

Column (1)

Insured or guaranteed mortgages should be reported separately from residential and commercial mortgages. Insured or guaranteed loans include only those mortgage loans insured or

guaranteed by the Federal Housing Administration, under the National Housing Act (Canada) or by the Veterans Administration (exclusive of any portion insured by FHA). Mortgage

loans guaranteed by another company (affiliated or unaffiliated) are not to be included in the insured or guaranteed category.

Except for Lines (1) through (3), (26) and (27), calculations are done on an individual mortgage basis and then the summary amounts are entered in this column for each class of

mortgage investment. Refer to the mortgage calculation worksheet A (Figure 1) for how the individual mortgage calculations are completed for Other Than In Good Standing

mortgages on Lines (16) through (25). Refer to the mortgage calculation worksheet – company developed (Figure 3) for how the individual mortgage calculations are

completed for In Good Standing - Commercial mortgages on Lines (4) through (8) and for In Good Standing - Farm mortgages on Lines (10) through (14). Line (28) should

equal Page 2, Column 3, Lines 3.1 plus 3.2, plus Schedule B, Part 1 Footnotes 3 and 4, first of the two amounts in the footnotes.

© 1993-2013 National Association of Insurance Commissioners

Column (2)

Companies are permitted to reduce the book/adjusted carrying value of mortgage loans reported in Schedule B by any involuntary reserves. Involuntary reserves are equivalent to

valuation allowances specified in SSAP No. 37 paragraph 16. These reserves are held as an offset for a particular troubled mortgage loan that would be required to be written down if

the impairment was permanent.

Column (3)

Column (3) is calculated as the net of Column (1) less Column (2).

Column (4)

Summary amounts of the individual mortgage calculations are entered in this column for each class of mortgage investments. Refer to the mortgage calculation worksheet (Figure 1).

Cumulative writedowns include the total amount of writedowns, amounts non-admitted and involuntary reserves that have been taken or established with respect to a particular

mortgage.

Column (5)

For Lines (4) and (10), the pre-tax factor is equal to 0.0090

For Lines (5) and (11), the pre-tax factor is equal to 0.0175

For Lines (6) and (12), the pre-tax factor is equal to 0.0300

For Lines (7) and (13), the pre-tax factor is equal to 0.0500

For Lines (8) and (14), the pre-tax factor is equal to 0.0750

For Lines (26) and (27), the pre-tax factor is 1.0. For Lines (16) through (25), the average factor column is calculated as Column (6) divided by Column (3).

Column (6)

For Lines (4) through (8), (10) through (14) and (16) through (25), summary amounts are entered for Column (6) based on calculations done on an individual mortgage basis. Refer

to the mortgage calculation worksheets (Figure 1) and (Figure 3). For Lines (1) through (3), (26) and (27), the RBC subtotal is multiplied by the factor to calculate Column (6).

© 1993-2013 National Association of Insurance Commissioners

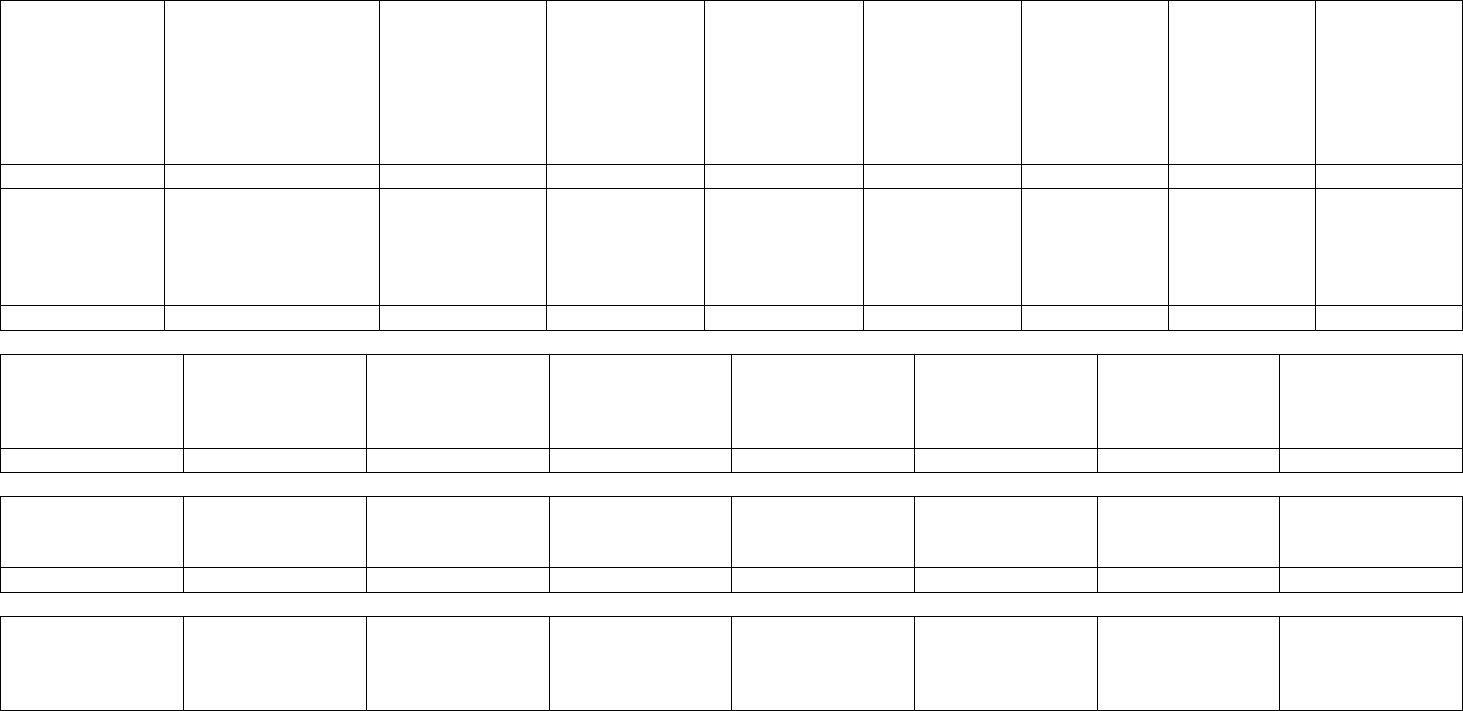

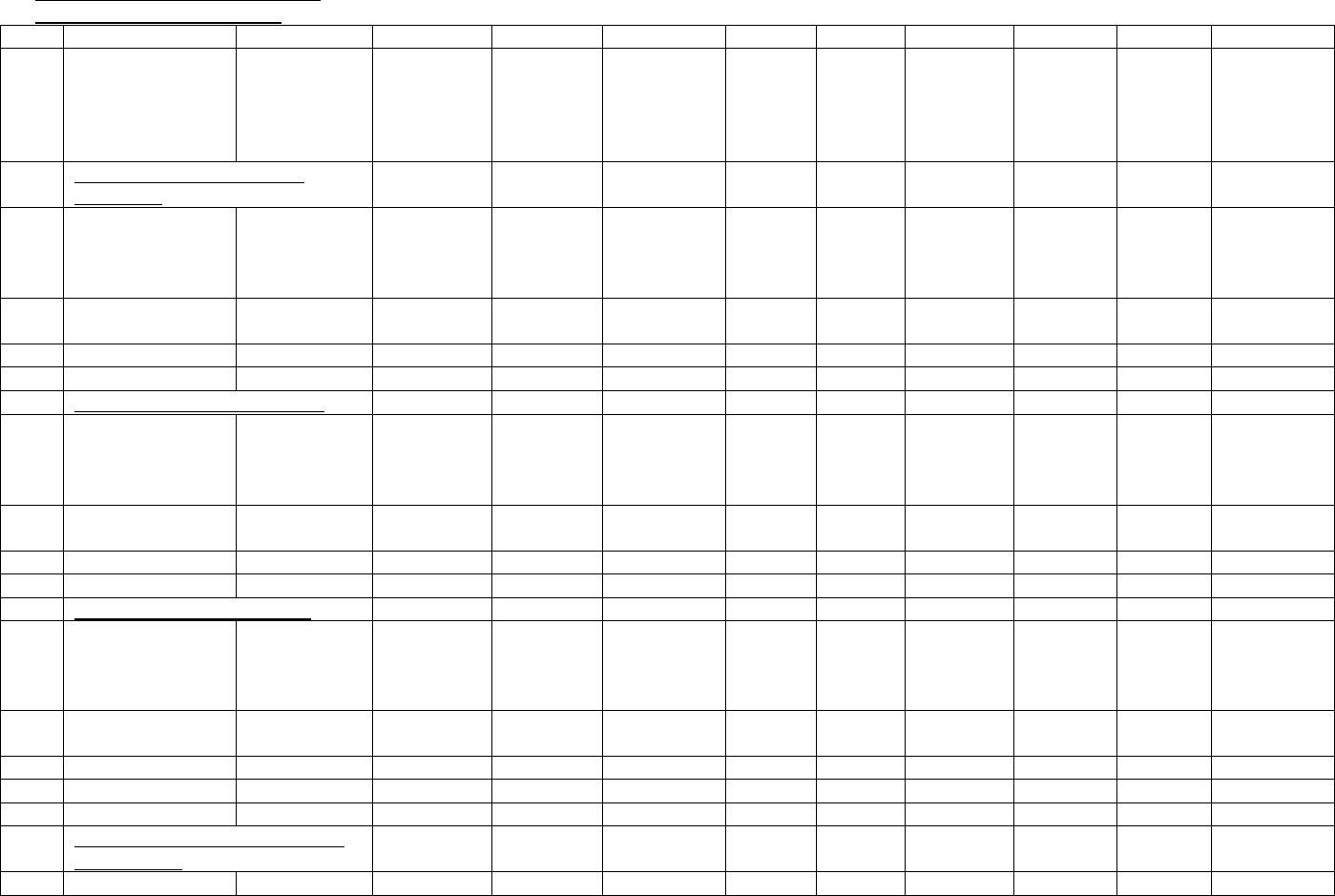

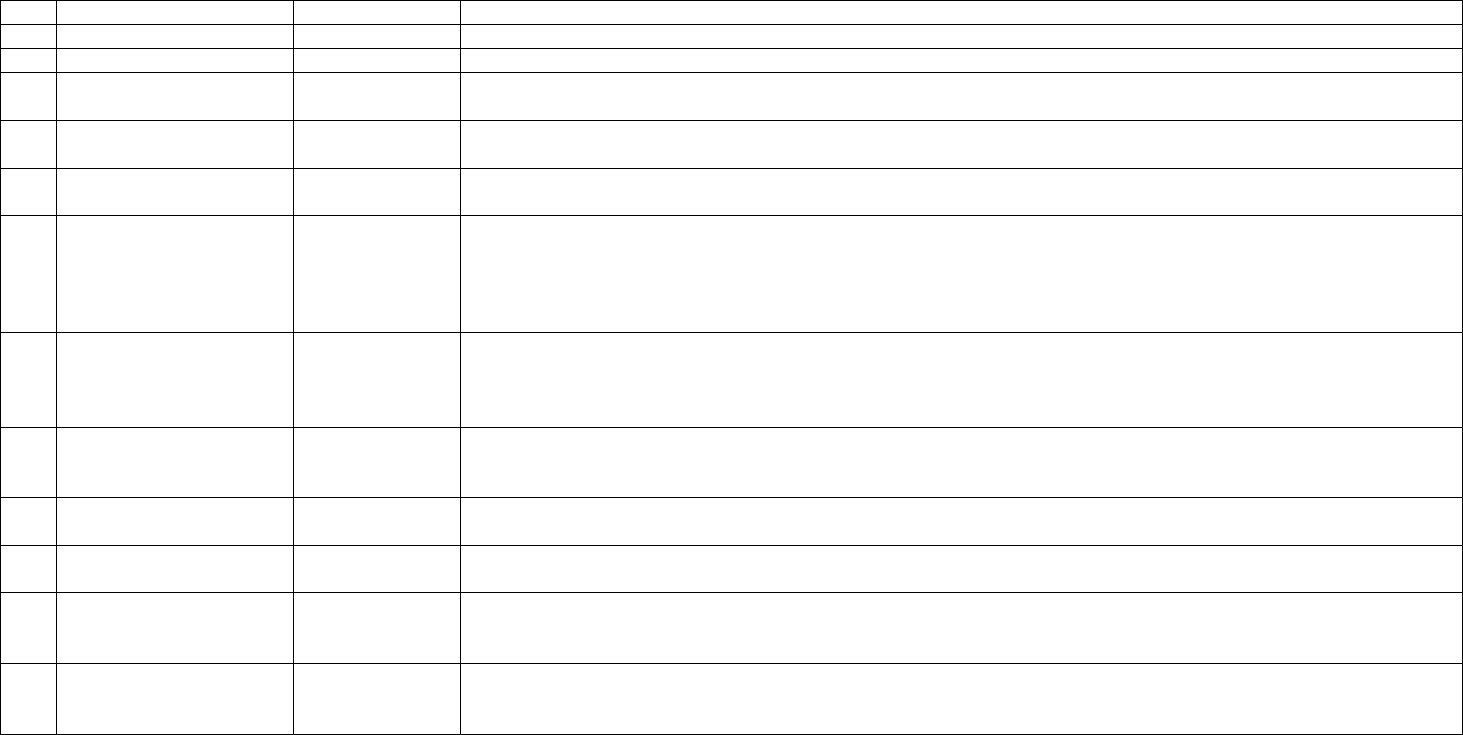

(Figure 1)

Mortgage Worksheet

Other Than In Good Standing

(1)

(2)

(3)

(4)

(5)

(6)

(7)

(7a)

(8)

(9)

(10)

Name / ID

Book/Adjusted

Carrying Value

Involuntary

Reserve

Adjustment

§

RBC

Subtotal

£

Cumulative

Writedowns*

Category

Factor

In Good

Standing

Factor

In Good

Standing

Category

Col (6) X

[Col

(4)+(5)]

- Col (5)

Col (4) X

Col (7)

RBC

Requirement

‡

(1)

All Mortgages Without

Cumulative Writedowns

XXX

†

†

†

All Mortgages With

Cumulative Writedowns:

(2)

†

†

†

(3)

†

†

†

(4)

†

†

†

(5)

†

†

†

(6)

†

†

†

(7)

†

†

†

(8)

†

†

†

(9)

†

†

†

(10)

†

†

†

(11)

†

†

†

(12)

†

†

†

(13)

†

†

†

(14)

†

†

†

(15)

†

†

†

Total Mortgages

This worksheet is prepared on a loan-by-loan basis for each of the mortgage categories listed in (Figure 2) that are applicable. The Column (2), (3), (5) and (10) subtotals for each

category are carried over and entered in Columns (1), (2), (4) and (6) of the Mortgages (LR004) in the risk-based capital formula. Small mortgages aggregated into one line on

Schedule B can be treated as one mortgage on this worksheet. NOTE: This worksheet will be available in the risk-based capital filing software.

†

See (Figure 2) for factors to use in the calculation. The In Good Standing Factor will be based on the CM category developed in the company’s Worksheet and reported in

Column 7a for Commercial or Farm Mortgages.

‡

The RBC Requirement column is calculated as the greater of Column (8) or Column (9), but not less than zero.

§

Involuntary reserves are reserves held as an offset to a particular asset that is clearly a troubled asset and are included on Page 3, Line 25 of the annual statement.

£

Column (4) is calculated as Column (2) less Column (3).

* Cumulative writedowns include the total amount of writedowns, amounts non-admitted and involuntary reserves that have been taken or established with respect to a particular

mortgage.

© 1993-2013 National Association of Insurance Commissioners

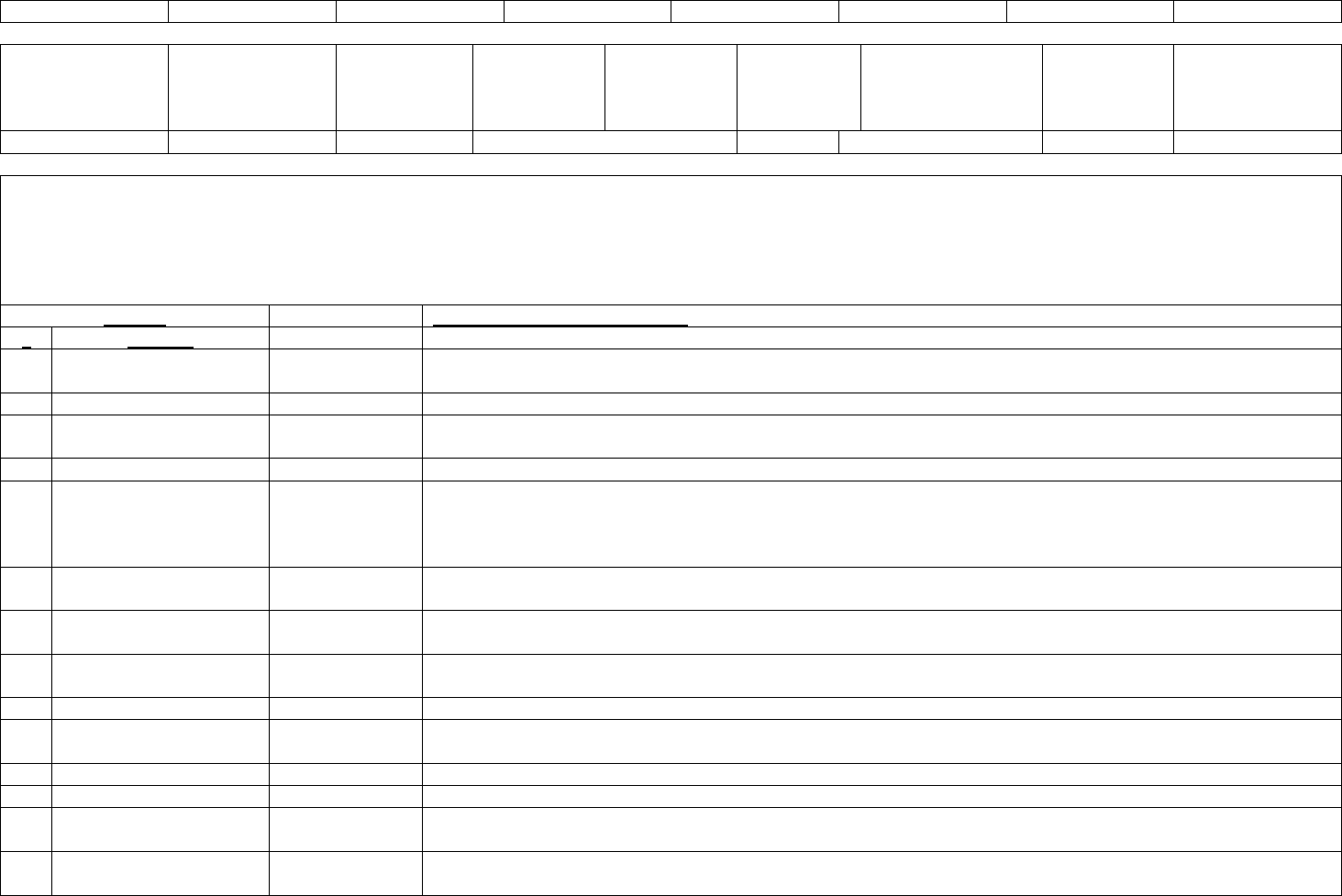

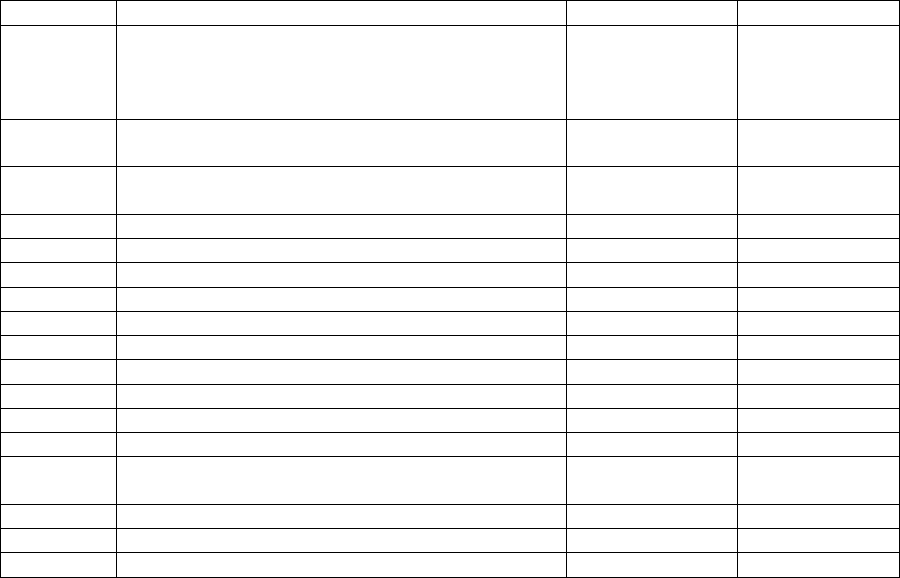

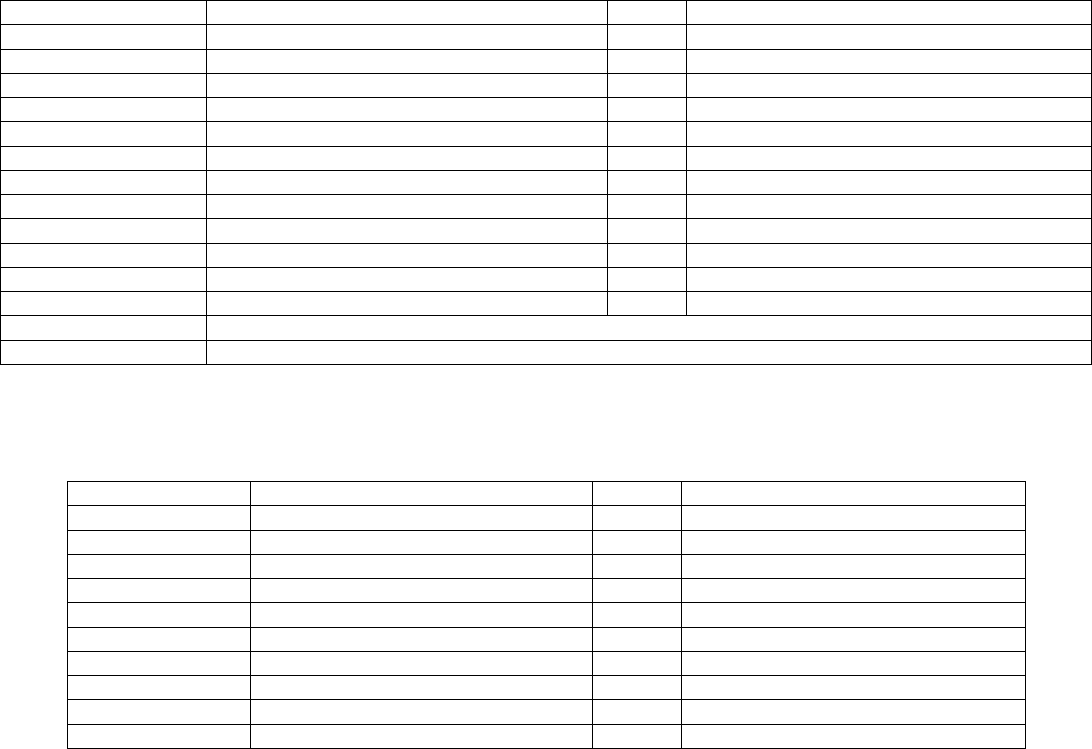

(Figure 2)

The mortgage factors are used in conjunction with the mortgage worksheets (Figures 1 and 3) to calculate the RBC Requirement for each individual mortgage. The factors are used in

Columns (6), (7) and (7a) of the mortgage worksheet and are dependent on which of the 25 mortgage categories below the mortgage falls into. The following factors are used for each

category of mortgages:

Mortgage Factors

LR004

Line

Number

Category

Factor

†

In Good

Standing

Factor

MEA

Factor

In Good Standing

(1)

Residential Mortgages-Insured or Guaranteed

N/A

‡

0.0014

N/A

(2)

Residential Mortgages-All Other

N/A

‡

0.0068

N/A

(3)

Commercial Mortgages-Insured or Guaranteed

N/A

‡

0.0014

N/A

(4)

Commercial Mortgages-All Other – Category CM1

N/A

‡

0.0090

N/A

‡

(5)

Commercial Mortgages – Category CM2

N/A‡

0.0175

N/A‡

(6)

Commercial Mortgages – Category CM3

N/A‡

0.0300

N/A‡

(7)

Commercial Mortgages – Category CM4

N/A‡

0.0500

N/A‡

(8)

Commercial Mortgages – Category CM5

N/A‡

0.0750

N/A‡

(10)

Farm Mortgages - Category CM1

N/A‡

0.0090

N/A‡

(11)

Farm Mortgages – Category CM2

N/A‡

0.0175

N/A‡

(12)

Farm Mortgages – Category CM3

N/A‡

0.0300

N/A‡

(13)

Farm Mortgages – Category CM4

N/A‡

0.0500

N/A‡

(14)

Farm Mortgages – Category CM5

N/A‡

0.0750

N/A‡

90 Days Overdue, Not in Process of Foreclosure

(16)

Farm Mortgages – Category CM6

0.1800

‡

N/A‡

(17)

Residential Mortgages-Insured or Guaranteed

0.0027

0.0014

1.0 N/A

(18)

Residential Mortgages-All Other

0.0140

0.0068

1.0 N/A

(19)

Commercial Mortgages-Insured or Guaranteed

0.0027

0.0014

1.0 N/A

(20)

Commercial Mortgages-All Other – Category CM6

0.1800

‡

N/A‡

In Process of Foreclosure

(21)

Farm Mortgages – Category CM7

0.2300

‡

N/A‡

(22)

Residential Mortgages-Insured or Guaranteed

0.0054

0.0014

1.0 N/A

(23)

Residential Mortgages-All Other

0.0270

0.0068

1.0 N/A

(24)

Commercial Mortgages-Insured or Guaranteed

0.0054

0.0014

1.0 N/A

(25)

Commercial Mortgages-All Other – Category CM7

0.2300

0.0260

N/A‡

© 1993-2013 National Association of Insurance Commissioners

†

The category factor is a factor used for a particular category of mortgage loans that are not in good standing.

‡

The RBC Requirement for mortgage loans in good standing or restructured are not calculated on Figure (1). These requirements are calculated on Mortgage Worksheet company

developed (Figure 3) and transferred to LR004 Mortgage Loans Lines (4) through (8) and (10) through (14). In addition, for Commercial and Farm mortgage loans 90 days

past due or In Process of Foreclosure, the CM category is determined in Mortgage Worksheet company developed and transferred to Worksheet A.

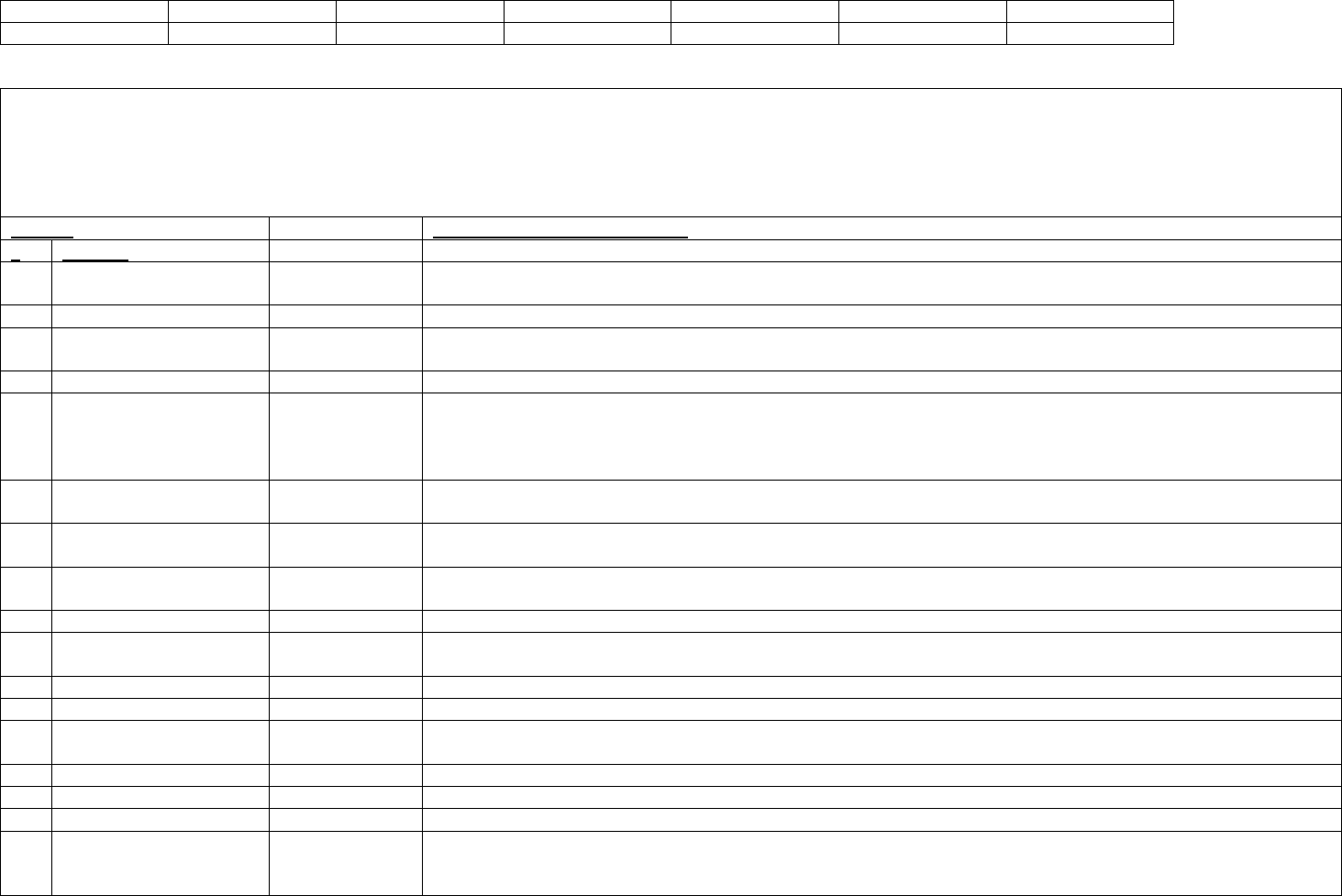

(Figure 3)

Mortgage Worksheet (Company developed)

In Good Standing – Commercial Mortgages and Farm Mortgages

Price Index

current (year

end calculations

to be based off

of 3

rd

Quarter

index of the

given year)}

{input Price Index as

of September 30}

Name / ID / Line

(1)

Date of Origination

(2)

Maturity Date

(3)

Property Type

(4)

Farm Loan

sub-property

type

(5)

Postal Code

(6)

Book /

Adjusted

Carrying

Value

(7)

Statutory

Write-downs

(8)

Statutory

Involuntary

Reserve

(9)

Original Loan

Balance

(10)

Principal Loan

balance to

company

(11)

Balloon Payment

at maturity

(12)

Principal Balance

total

(13)

NOI Second Prior

year

(14)

NOI Prior Year

(15)

NOI

(16)

Interest Rate

(17)

Trailing 12 month

debt service

(18)

Original Property

Value

(19)

Property Value

(20)

Year of valuation

(21)

Calendar Quarter

of Valuation

(22)

Credit

Enhancement?

(23)

(24) Senior Debt?

(25) Construction

Loan?

Construction

Loan out of

Balance?

(26)

Construction

Loan Issues? (27)

Land Loan?

(28)

90 Days Past Due?

(29)

In Process of

Foreclosure?

(30)

Current payment

lower than based

on Loan Interest?

(31)

Is loan interest a

floating rate?

(32)

Is fixed rate reset

during term?

(33)

© 1993-2013 National Association of Insurance Commissioners

Is negative

amortization

allowed?

(34)

Amortization

Type

(35)

Rolling

Average NOI

(36)

RBC Debt

Service

(37)

RBC DCR

(38)

Price Index

at valuation

(39)

Contemporaneous

Property Value

(40)

RBC LTV

(41)

CM Category

(42)

The Company should develop this worksheet on a loan-by-loan basis for each commercial mortgage – other or farm loan held in Annual Statement Schedule B. This

worksheet column (7), and (9) subtotals for each category are to be carried over and entered in Columns (1) and (2) of the Mortgages (LR004) in the risk-based capital

formula lines (4) – (8) and (10) – (14). Small mortgages aggregated into one line on Schedule B can be treated as one mortgage on this worksheet. Amounts in Columns

(7), (9), (42) are carried individually to Worksheet A columns (2), (3) and (7a) for loans that are 90 Days Past Due and In Process of Foreclosure. NOTE: This worksheet

will not be available in the risk-based capital filing software and needs to be developed by the company.

Column

Description / explanation of item

#

Heading

Price Index current is the value on 9/30 of the current year for the National Council of Real Estate Investor

Fiduciaries Price Index for the United States.

(1)

Name / ID

Input

Name / ID / Line – identify each mortgage included as in good standing

(2)

Date of Origination

Input

Enter the year and month that the loan was originated. If the loan has been restructured, extended, or otherwise

re-written, enter that new date.

(3)

Maturity date

Input

Enter earlier of maturity of the loan, or the date the lender can call the loan.

(4)

Property Type

Input

Property Type – Enter 1 for mortgages with an Office, Industrial, Retail or multifamily property as collateral.

Enter 2 for mortgages with a Hotel and Specialty Commercial as property type. For properties that are multiple

use, use the property type with the greatest square footage in the property.

Enter 3 for Farm Loans.

(5)

Farm sub-type

Input

Sub-category – If Property Type=3 (Farm Loans), then you must enter a Sub Category: 1=Timber, 2=Farm and

Ranch, 3=Agribusiness Single Purpose, 4=Agribusiness All Other (See Note 8.)

(6)

Postal Code

Input

Enter zip code of property for US. If multiple properties or zip codes, enter multiple codes. If foreign address,

use postal code. If not available, N/A

(7)

Book / Adjusted

Carrying Value

Input

Enter the value that the loan is carried on the company ledger.

(8)

Statutory write-downs

Input

Enter the value of any write-downs taken on this loan due to permanent impairment.

(9)

Involuntary Reserve

Input

Enter the amount of any involuntary reserve amount. Involuntary reserves are reserves that are held as an offset

to a particular asset that is clearly a troubled asset and are included on Page 3 Line 25 of the Annual Statement.

(10)

Original Loan Balance?

Input

Enter the loan balance at the time of origination of the loan.

(11)

Principal balance to Co.

Input

Enter the value of the loan balance owed by the borrower.

(12)

Balloon payment at

maturity

Input

Enter the amount of any balloon or principal payment due at maturity.

(13)

Principal balance total

Input

Enter the total amount of mortgage outstanding including debt that is senior to or pari passu with the company’s

mortgage (Note 2)

© 1993-2013 National Association of Insurance Commissioners

(14)

NOI second prior

Input

Enter the NOI from the year prior to the value in (15) See Note 1.

(15)

NOI prior

Input

Enter the NOI from the prior year to the value in (16) See Note 1.

(16)

NOI

Input

Enter the Net Operating Income for the most recent 12 month fiscal period with an end-date between July1 of the

year prior to this report and June 30 of the year of this report. The NOI should be reported following the

guidance of the Commercial Real Estate Finance Council Investor Reporting Profile v.5.0. Section VII. See Notes

1, 3, 4, 5, and 6 below.

(17)

Interest rate

Input

Enter the Annual interest rate at which the loan is accruing.

- If the rate is floating, enter the larger of the current month rate or the average rate of interest for the prior 12

months, or

- If the rate is fixed by the contract, not level over the year, but level for the next 12 months, use current rate.

If the ‘Total Loan Balance’ consists of multiple loans, use an average loan interest rate weighted by principal

balance.

(18)

Trailing 12 month debt

service

Input

Enter actual 12 months debt service for prior 12 months

(19)

Original Property Value

Input

Enter the Property Value at the time of origination of the loan. (Note 9.)

(20)

Property Value

Input

Property Value is the value of the Property at time of loan origination, or at time of revaluation due to impairment

underwriting, restructure, extension, or other re-writing. (Note 9.)

(21)

Year of valuation

Input

Year of the valuation date defining the value in (20). This will be either the date of origination, or time of

restructure, refinance, or other event which precipitates a new valuation.

(22)

Quarter of valuation

Input

Calendar quarter of the valuation date defining the value in (20).

(23)

Credit Enhancement

Input

Enter the full dollar amount of any credit enhancement. (see Note 5.)

(24)

Senior Debt?

Input

Enter yes if the senior position, no if not. (see Note 7.)

(25)

Construction Loan?

Input

Enter ‘Yes’ if this is a construction loan. (see Note 4.)

(26)

Construction – not in

balance?

Input

Enter ‘Yes” if his is a construction loan that is not in balance. (see Note 4.)

(27)

Construction – Issues?

Input

Enter ‘Yes” if this is a construction loan with issues. (see Note 4.)

(28)

Land Loan?

Input

Enter ‘Yes’ if this is a loan on non-income producing land. (see Note 6.)

(29)

90 days past due?

Input

Enter ‘Yes’ if payments are 90 days past due.

(30)

In process of

foreclosure?

Input

Enter ‘Yes’ if the loan is in process of foreclosure.

(31)

Is current payment

lower than a payment

based on the Loan

Interest?

Input

Yes / No

(32)

Is loan interest a floating

rate?

Input

Yes / No

(33)

If not floating, does loan

reset during term?

Input

Yes / No - Some fixed rate loans define in the loan document a change to a new rate during the life of the loan,

which may be a pre-determined rate or may be the then current market rate. Generally any such changes are less

frequent than annual. .

(34)

Is negative amortization

allowed?

Input

Yes / No

© 1993-2013 National Association of Insurance Commissioners

(35)

Amortization type?

Input

1 = fully amortizing

2 = amortizing with balloon,

3 = full I/O

4 = partial I/O, then amortizing

(36)

Rolling Average NOI

Computation

For 2013 – 100% of NOI

For 2014 – 65% NOI + 35% NOI Prior

For 2015 – 50% NOI + 30% NOI Prior + 20% NOI 2

nd

Prior

For loans originated or valued within the current year use 100% NOI.

For loans originated 2013 or later and within 2 years, use 65% NOI and 35% NOI Prior

(37)

RBC Debt Service

Computation

RBC Debt Service Amount is the amount of 12 monthly principal and interest payments required to amortize the

Total Loan Balance (13) using a Standardized Amortization period of 300 months and the Annual Loan Interest

Rate (17).

(38)

RBC DCR

Computation

Debt Coverage Ratio is the ratio of the Net Operating Income (36) divided by the RBC Debt Service (37) rounded

down to 2 decimal places. See Note 3 below for special circumstances.

(39)

NCREIF Price Index at

Valuation

Computation

Price index is the value of the NCREIF Price Index on the last day of the calendar quarter that includes the date

defined in (21) and (22).

(40)

Contemporaneous

Property Value

Computation

Contemporaneous Value is the Property Value (20) times the ratio (rounded to 4 decimal places) of the Price Index

current to the Price Index at valuation (39).

(41)

RBC LTV

Computation

The Loan to Value ratio is the Total Loan Value (13) divided by the Contemporaneous Value (40) rounded to the

nearest percent.

(42)

CM category

Computation

Commercial Mortgage Risk category is the risk category determined by applying the DCR (38) and the LTV (41)

to the criteria in Figure (4), Figure (5) or Figure (6). See Notes 2, 3, 4, 5, and 6 below for special circumstances.

Note 1: Net Operating Income (NOI): The majority of commercial mortgage loans require the borrower to provide the lender with at least annual financial statements.

The NOI would be determined at the RBC calculation date based on the most recent annual period from financial statements provided by the borrower and analyzed

based on accepted industry standards. The most recent annual period is determined as follows:

If the borrower reports on a calendar year basis, the statements for the calendar year ending December 31 of the year prior to the RBC calculation date will be

used. For example, if the RBC calculation date is 12/31/2012, the most recent annual period is the calendar year that ends 12/31/2011.

If the borrower reports on a fiscal year basis, the statements for the fiscal year that ends after June 30 of the prior calendar year and no later than June 30 of the

year of the RBC calculation date will be used. For example, if the RBC calculation date is 12/31/2012, the most recent annual period is the fiscal year that ends

after 6/30/2011 and no later than 6/30/2012.

The foregoing time periods are used to provide sufficient time for the borrower to prepare the financial statements and provide them to the lender, and for the

lender to calculate the NOI.

The accepted industry standards for determining NOI were developed by the Commercial Mortgage Standards Association now known as CRE Financial Council

(CREFC). The company must develop the NOI using the standards provided by the CREFC Methodology for Analyzing and Reporting Property Income Statements

v.5.1. (www.crefc.org/irp). These standards are part of the CREFC Investor Reporting Package (CREFC IRP Section VII.) developed to support consistent reporting

for commercial real estate loans owned by third party investors. This guidance would be a standardized basis for determining NOI for RBC.

© 1993-2013 National Association of Insurance Commissioners

The NOI will be adjusted to use a 3 year rolling average for the DSC calculation. For 2013, a single year of NOI will be used. For 2014, 2 years will be used, weighted

65% most recent year and 35% prior year. Thereafter, 3 years will be used weighted 50% most recent year, 30% prior year, and 20% 2

nd

prior year. This will apply

when there is a history of NOI values. For new originations, including refinancing, the above schedule would apply by duration from origination. For the special

circumstances listed below, the specific instructions below will produce the NOI to be used, without further averaging.

Note 2: The calculation of debt service coverage and loan to value will include all debt secured by the property that is (1) senior to or pari passu with the insurer's

investment; and (2) any debt subordinate to the insurer's investment that is not (a) subject to an intercreditor, standstill or subordination agreement with the insurer

provided that the agreement does not grant the subordinate debt holder any rights that would materially affect the rights of the insurer and provided that the

subordinate debt holder is prohibited from taking any action against the borrower that would materially affect the insurer’s priority lien position with respect to the

property without the prior written consent of the insurer, or (b) subject to governing laws that provide that the insurer’s investment holds a senior position to the

subordinated debt holder and provide substantially similar protections to the insurer as in (2)(a) above.

Note 3: Unavailable Operating Statements

There are a variety of situations where the most recent annual period’s operating statement may not be available to assist in determining NOI. These situations will occur in

distinct categories and each category requires special consideration. The categories are:

1. Loans on owner occupied properties

a. For properties where the owner is the sole or primary tenant (50% or more of the rentable space), property level operating statements may not be available

or meaningful. If the property is occupied and the loan, taxes and insurance are current, it will be acceptable to derive income and a reasonable estimate

of expenses from the most recent appraisal or equivalent and additional known actual expenses (e.g., real estate taxes and insurance).

b. For properties where the owner is a minority tenant (49% of less of the rentable space), the owner-occupied space should be underwritten at the average

rent per square foot of the arm’s length tenant leases. This income estimate should be added to the other tenant leases and combined with a reasonable

estimate of expenses based on the most recent appraisal or equivalent and additional known actual expenses (e.g., real estate taxes and insurance).

2. Borrower does not provide the annual operating statement

a. Borrower refuses to provide the annual operating statements

i. If the leases are in place and evidenced by estoppels and inspections, NOI would be derived from normalized underwriting in accordance with the

CREFC Methodology for Analyzing and Reporting Property Income Statements.

ii. If there is evidence from inspection that the property is occupied, but there is no evidence of in place leases (e.g., lease documents or estoppels),

NOI would be set equal to the lesser of calculated debt service (DSC=1.0) or the NOI from the normalized underwriting.

iii. If there is no evidence from inspection that the property is occupied and no evidence of in place leases (e.g., lease documents or estoppels), assume

NOI = $0.

b. If the borrower does not have access to a complete previous year operating statement, determine NOI based on the CREFC guidelines for analyzing a

partial year income statement.

Note 4: Construction loans

© 1993-2013 National Association of Insurance Commissioners

Construction loans would be categorized as follows, based on a determination by the loan servicer whether the loan is in balance and whether construction issues

exist:

a. In balance, no construction issues: DSC = 1.0, LTV determined as usual

b. Not in Balance, no construction issues: CM4

c. Construction issues: CM5

A loan is “in balance” if the committed amount of the construction loan plus any lender held reserves and unfunded borrower equity is sufficient to cover the

remaining costs of the development project, including debt service not anticipated to be paid from property operations.

A “construction issue” is a problem that may reasonably jeopardize the completion of the project. Examples of construction issues include the abandonment of

construction and construction defects that are not being addressed.

Note 5: Credit enhancements: Where the loan payments are secured by a letter of credit from an investment grade financial institution or an escrow account held at an

investment grade financial institution, NOI less than the debt service may be increased by these amounts until it is equal to but not exceeding the debt service. These

situations are typically short term in nature, and are intended to bridge the lease-up following renovation or loss of a major tenant.

Note 6: Non-income-producing land: NOI = $0

Note 7: Non-senior financing

a. The company should first calculate DSC and LTV for non-senior financing using the standardized debt service and aggregate LTV of all financing pari

passu and senior to the position held by the company.

b. The non-senior piece should than be assigned to the next riskier RBC category. For example, if the DSC and LTV metrics determined in (a) indicate a

category of CM2, the non-senior piece would be assigned to category CM3. However, it would not be required to assign a riskier category than CM5 if the

loan is not at least 90-days delinquent or in foreclosure.

Note 8: Definitions of each type of Farm Mortgage:

Timber: A loan is classified as a timber loan if more than 50% of the collateral market value (land and timber) of the security is attributable to land supporting a

timber crop that is or will be of commercial value.

Farm & Ranch: Farm and ranch land utilized in the production of agricultural commodities of all kinds, including grains, cotton, sugar, nuts, fruits, vegetables,

forage crops and livestock of all kinds, including, beef, swine, poultry, fowl and fish. Loans included in this category are those in which agricultural land accounts

for more than 50% of total collateral market value.

Agribusiness Single Purpose: Specialized collateral utilized in the production, further processing, adding value or manufacturing of an agricultural commodity or

forest product. In order for a loan to be classified as such, the market value of the single-purpose (special use) collateral would account for more than 50% of total

collateral market value.

© 1993-2013 National Association of Insurance Commissioners

This collateral is generally not multi-functional and can only be used for a specific production, manufacturing and/or processing function within a specific sub-

sector of the food or agribusiness industry and whereby such assets are not strategically important in nature to the overall industry capacity. These assets can be

shut down or replicated easily in other locations, or existing plants can be expanded to absorb shuttered capacity. The assets are not generally limited in nature by

environmental or operational permits and/or regulatory requirements. An example would be a poultry processing plant located in the Southeast of the United

States where there is excess capacity inherent to the industry and production capacity is easily replaceable.

Other loans included in this category are those collateralized by single purpose (special use) confinement livestock production facilities in which the special use

facilities account for more than 50% of total collateral market value.

Agribusiness All Other: Multiple-use collateral utilized in the production, further processing, adding value or manufacturing of an agricultural commodity or

forest product. In order for a loan to be classified as such, the market value of any single use portion may not be greater than 50% of total collateral market value.

This collateral is multi-functional in nature, adaptable to other manufacturing, processing, or servicing food or agribusiness industries or sub-industries. Assets

could also be very strategic in nature and not easily replaceable either due to cost, location, environmental permitting and/or government regulations. These assets

may be single purpose in nature, but so vital to the industry capacity needs that they will be generally purchased by another like processing company or strategic or

financial buyer. An example of these types of assets are strategically located and highly automated cold storage facilities whereby they can be used for dry storage,

distribution centers or converted into warehouse or other type uses. Another example may be a cheese processing plant that is strategically located within the heart

of the dairy industry, limited permits, environmental restrictions that would limit added capacity, or high barriers to entry to build a like facility within the

industry. For example, one of the largest cheese plants in the industry is located in California and it is not easily replicated within the cheese processing industry

due to its location, capacity, costs, access to fluid milk supply and related feed and water, as well as highly regulated environmental and government restrictions.

Other loans included in this category are those in which more than 50% of the collateral market value is accounted for by chattel assets or other assets related to

the business and financial operations of agribusinesses, including inventories, accounts, trade receivables, cash and brokerage accounts, machinery, equipment,

livestock and other assets utilized for or generated by agribusiness operations.

Note 9. The origination value is developed during the underwriting process using appropriate appraisal standards.

a. If values were received from a qualified third party appraiser, those values must be used.

b. If the company performs internal valuations using standards comparable to an external appraisal, then the internal valuation may be used.

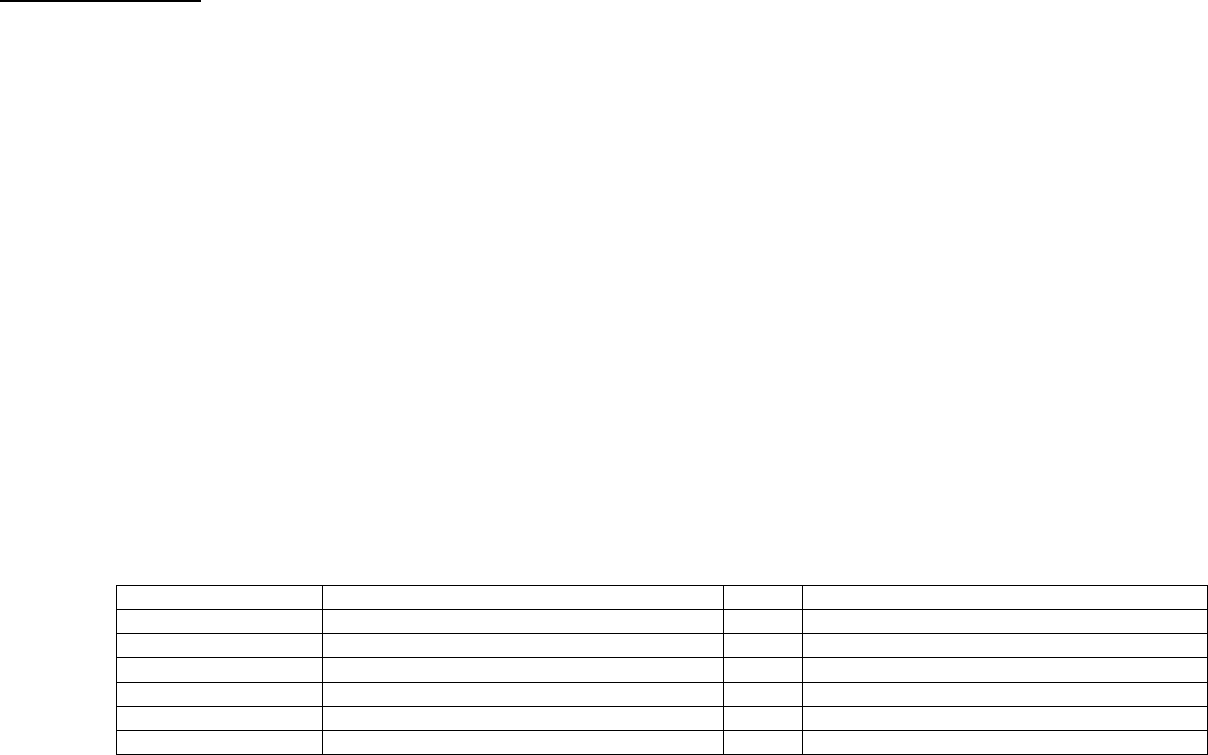

(Figure 4)

For Office, Industrial, Retail and Multi-family

Risk category

DSC limits

LTV limits

CM1

1.50 ≤ DSC

and

LTV < 85%

CM2

DSC < 1.50

and

LTV < 55%

CM2

0.95 ≤ DSC < 1.50

and

55% ≤ LTV < 75%

CM2

1.15 ≤ DSC < 1.50

and

75% ≤ LTV < 100%

CM2

1.50 ≤ DSC

and

85% ≤ LTV < 100%

CM2

1.75 ≤ DSC

and

100% ≤ LTV

© 1993-2013 National Association of Insurance Commissioners

CM3

DSC < 0.95

and

55% ≤ LTV < 85%

CM3

0.95 ≤ DSC < 1.15

and

75% ≤ LTV < 100%

CM3

1.15 ≤ DSC < 1.75

and

100% ≤ LTV

CM4

DSC < 0.95

and

85% ≤ LTV < 105%

CM4

0.95 ≤ DSC < 1.15

and

100% ≤ LTV

CM5

DSC < 0.95

and

105% ≤ LTV

(Figure 5)

For Hotels and Specialty Commercial

Risk category

DSC limits

LTV limits

CM1

1.85 ≤ DSC

and

LTV < 60%

CM2

1.45 ≤ DSC < 1.85

and

LTV < 70%

CM2

1.85 ≤ DSC

and

60% ≤ LTV < 115%

CM3

0.90 ≤ DSC < 1.45

and

≤ LTV < 80%

CM3

1.45 ≤ DSC < 1.85

and

70% ≤ LTV

CM3

1.85 ≤ DSC

and

115% ≤ LTV

CM4

DSC < 0. 90

and

LTV < 90%

CM4

0.90 ≤ DSC < 1.10

and

80% ≤ LTV < 90%

CM4

1.10 ≤ DSC < 1.45

and

80% ≤ LTV

CM5

1.10 ≤ DSC

and

90% ≤ LTV

(Figure 6)

Farm Mortgages (Agricultural Loans)

Timber

Farm & Ranch

Agribusiness

Single Purpose

Agribusiness

All Other

CM1

LTV <= 55%

LTV <= 60%

LTV <= 60%

CM2

55% < LTV <= 65%

60% < LTV <= 70%

LTV <= 60%

60% < LTV <= 70%

CM3

65% < LTV <= 85%

70% < LTV <= 90%

60% < LTV <= 70%

70% < LTV <= 90%

CM4

85% < LTV <= 105%

90% < LTV <= 110%

70% < LTV <= 90%

90% < LTV <= 110%

CM5

105% < LTV

110% < LTV

90% < LTV

110% < LTV

© 1993-2013 National Association of Insurance Commissioners

SCHEDULE BA MORTGAGES

LR009

Basis of Factors

For Affiliated Mortgages (Line 10999999), the factors used are the same as for commercial mortgages and are defined in Figure 9. Risk categories and factors are determined

using a company generated worksheet for In Good Standing (Figure 10) and (Figure 8) for Past Due or In Process of Foreclosure.

For Unaffiliated Mortgages, (Line 0999999), the factors used are the same as for commercial mortgages and are defined in Figure 9. Risk categories and factors are

determined as follows:

1) For Investments that contain covenants whereby factors of maximum LTV and minimum DSC, or equivalent thresholds must be complied with and it can be

determined that the Investments are in compliance, these investments would use the process for directly held mortgages using the maximum LTV and minimum

DSC using the company generated worksheet and transferred to LR009 line (2) for mortgages with covenants that are in compliance.

2) Investments that are defeased with government securities will be assigned to CM1.

3) Other investments comprised primarily of senior debt will be assigned to CM2.

4) All other investments in this category will be assigned CM3. This would include assets such as a mortgage fund that invests in mezzanine or sub debt, or

investments that cannot be determined to be in compliance with the covenants.

Specific Instructions for Application of the Formula

Column (1)

Except for Line (1), calculations are done on an individual mortgage basis and then the summary amounts are entered in this column for each class of mortgage investment. Refer to the

Schedule BA mortgage calculation worksheets (Figure 8) and (Figure 10) for how the individual mortgage calculations are completed. Line (20) should equal Schedule BA Part 1,

Column 12, Line 0999999 plus Line 1099999.

Column (2)

Companies are permitted to reduce the book/adjusted carrying value of mortgage loans reported in Schedule BA by any involuntary reserves. Involuntary reserves are equivalent to

valuation allowances specified in the codification of statutory accounting principles. They are non-AVR reserves reported on Annual Statement Page 3, Line 25. These reserves are

held as an offset for a particular troubled Schedule BA mortgage loan that would be required to be written down if the impairment was permanent.

Column (3)

Column (3) is calculated as the net of Column (1) less Column (2).

Column (4)

For Lines (12) through (14) and Lines (16) through (18), summary amounts of the individual mortgage calculations are entered in this column for each class of mortgage investments.

Refer to the Schedule BA mortgage calculation worksheet (Figure 8).

Column (5)

For Line (1), the pre-tax factor is 0.0014.

© 1993-2013 National Association of Insurance Commissioners

See Figure 9 for computation of appropriate factors.

Column (6)

For Lines (1) through (10) the RBC subtotal is multiplied by the average factor to calculate Column (6). The categories and subtotals will be determined in the company

developed worksheet Figure (10).

For Lines (12) through (14) and Lines (16) through (18), summary amounts are entered for Column (6) based on calculations done on an individual mortgage basis. Refer to the

Schedule BA mortgage calculation worksheet (Figure 8).

© 1993-2013 National Association of Insurance Commissioners

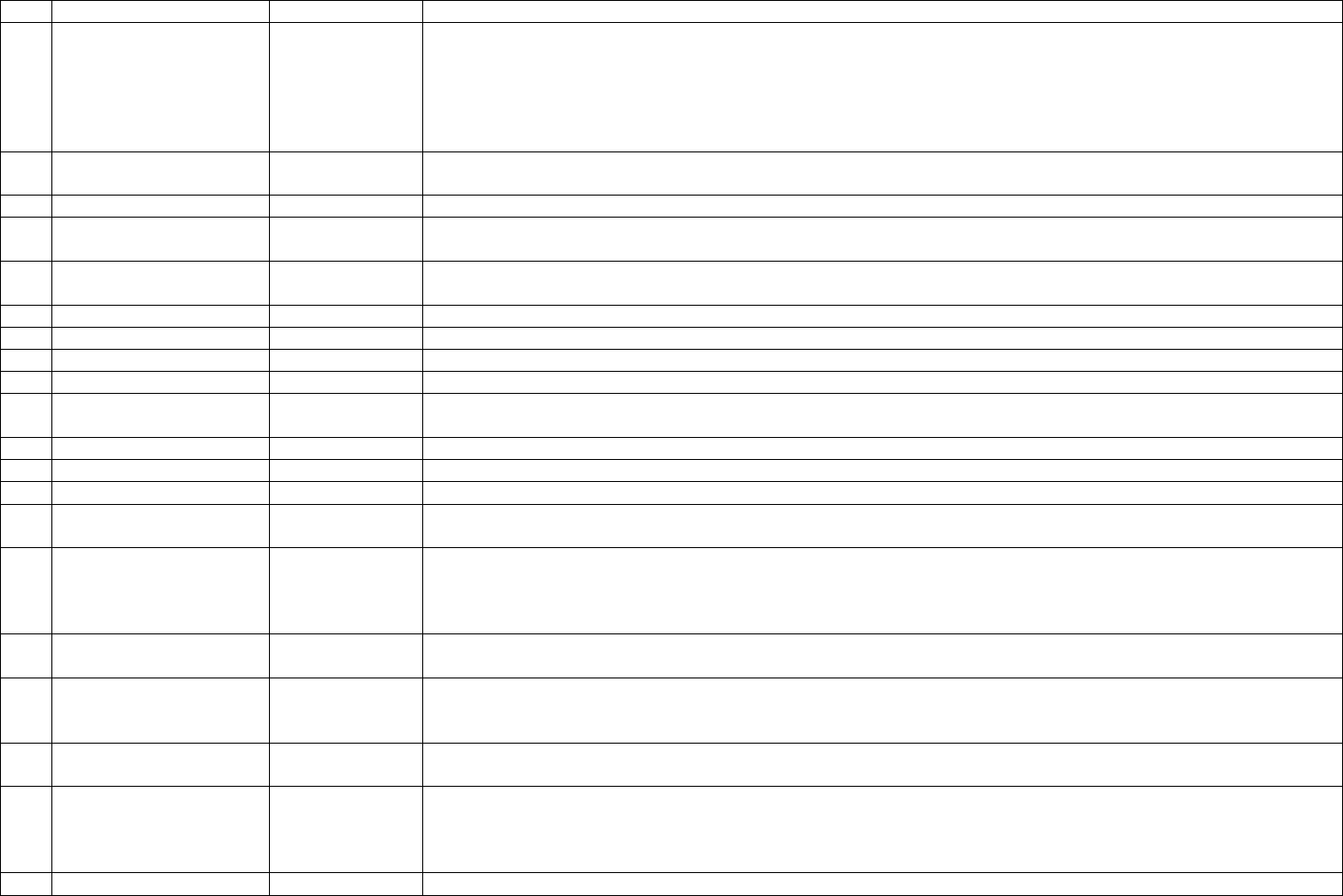

(Figure 8)

Schedule BA Mortgage Worksheet A

Other Than In Good Standing

(1)

(2)

(3)

(4)

(5)

(6)

(7)

(7a)

(8)

(9)

(10)

Name / ID

Book/Adjusted

Carrying

Value

Involuntary

Reserve

Adjustment§

RBC

Subtotal

Cumulative

Writedowns

*

Category

Factor

In Good

Standing

Factor

In Good

Standing

Category

Col (6) X

[Col

(4)+(5)]

- Col (5)

Col (4) X

Col (7)

RBC

Requirement

‡

90 Days Overdue – Insured or

Guaranteed

†

†

†

(1)

All Mortgages

Without

Cumulative

Writedowns

XXX

0.0027

0.0014

N/A

(2)

With Cumulative

Writedowns:

0.0027

0.0014

N/A

(3)

0.0027

0.0014

N/A

Total

90 Days Overdue – Unaffiliated

(1)

All Mortgages

Without

Cumulative

Writedowns

XXX

0.1800

†

†

(2)

With Cumulative

Writedowns:

0.1800

†

†

(3)

0.1800

†

†

Total

90 Days Overdue – Affiliated

(1)

All Mortgages

Without

Cumulative

Writedowns

XXX

0.1800

†

†

(2)

With Cumulative

Writedowns:

0.1800

†

†

(3)

0.1800

†

†

Total

In Process of Foreclosure – Insured

or Guaranteed

(1)

All Mortgages

XXX

0.0054

0.0014

N/A

© 1993-2013 National Association of Insurance Commissioners

Without

Cumulative

Writedowns

(2)

With Cumulative

Writedowns:

0.0054

0.0014

N/A

(3)

0.0054

0.0014

N/A

Total

In Process of Foreclosure –

Unaffiliated

(1)

All Mortgages

Without

Cumulative

Writedowns

XXX

0.2300

†

†

(2)

With Cumulative

Writedowns:

0.2300

†

†

(3)

0.2300

†

†

Total

In Process of Foreclosure –

Affiliated

(1)

All Mortgages

Without

Cumulative

Writedowns

XXX

0.2300

†

†

(2)

With Cumulative

Writedowns:

0.2300

†

†

(3)

0.2300

†

†

Total

(99)

Total Schedule BA

Mortgages

This worksheet is prepared on a loan-by-loan basis for each of the mortgage categories listed in (Figure 9) that are applicable. The Column (2), (3), (5) and (10) subtotals for each

category are carried over and entered in Columns (1), (2), (4) and (6) of the Schedule BA Mortgages (LR009) Lines (12) through (14) and Lines (16) through (18) in the risk-based capital formula.

NOTE: This worksheet will be available in the risk-based capital filing software.

†

See (Figure 9) for factors to use in the calculation. The In Good Standing Factor will be based on the CM category developed in the company generated worksheet (Figure 10) and reported

in Column 7a.

‡ The RBC Requirement column (10) is calculated as the greater of Column (8) or Column (9), but not less than zero.

§ Involuntary reserves are reserves held as an offset to a particular asset that is clearly a troubled asset and are included on Page 3, Line 25 of the annual statement.

£ Column (4) is calculated as Column (2) less Column (3).

© 1993-2013 National Association of Insurance Commissioners

* Cumulative writedowns include the total amount of writedowns, amounts non-admitted and involuntary reserves that have been taken or established with respect to a

particular mortgage.

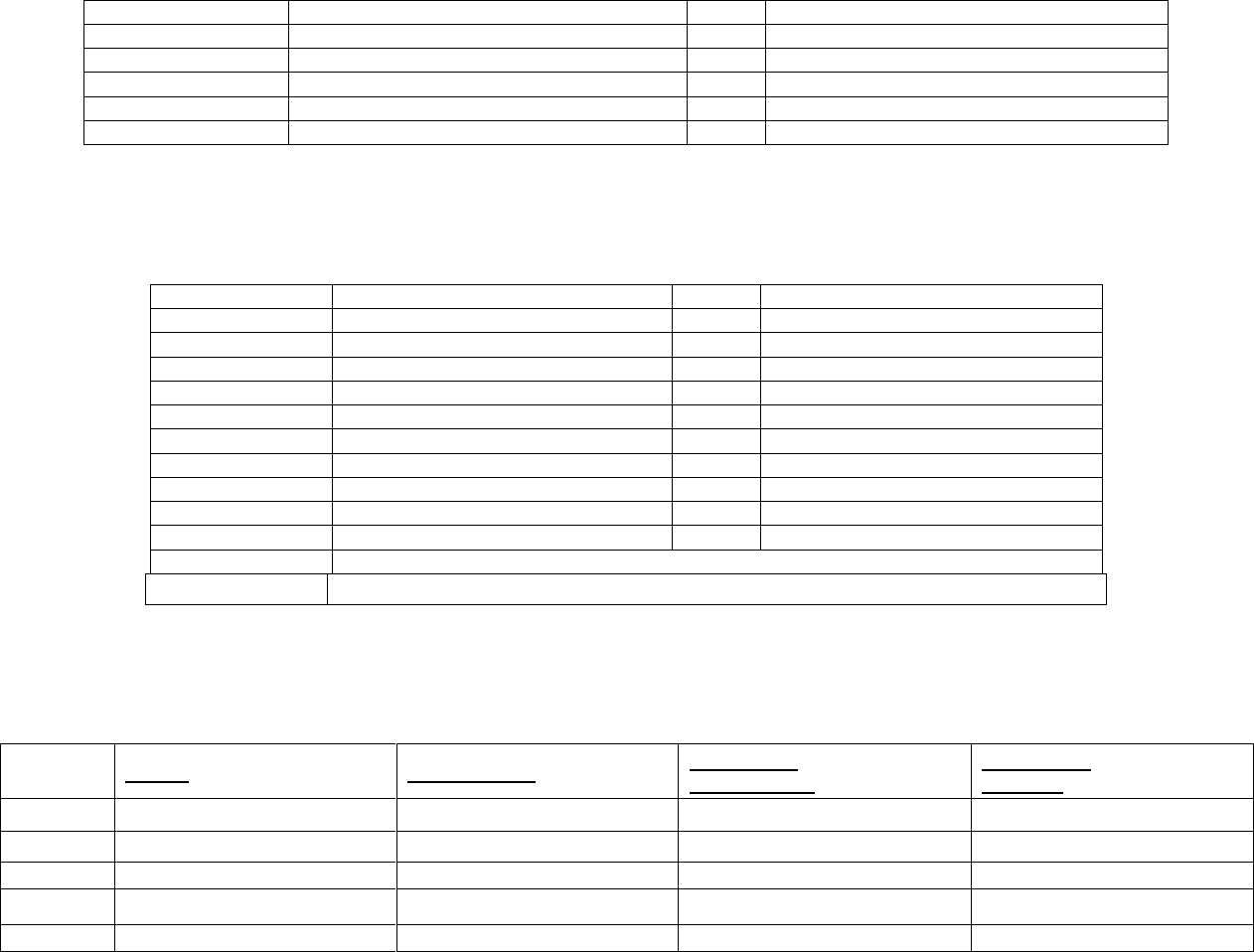

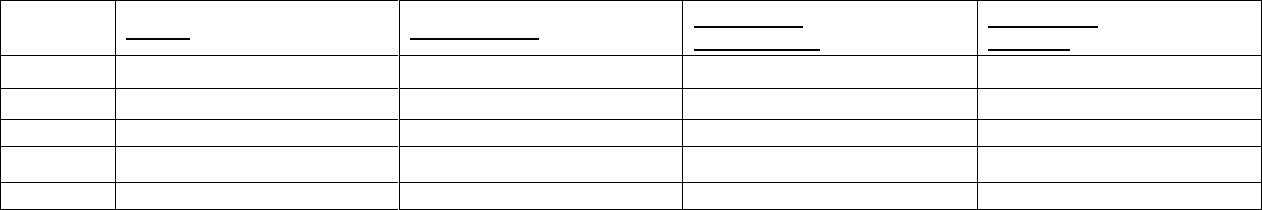

(Figure 9)

The mortgage factors are used in conjunction with the mortgage worksheets (Figures 8 and 10) to calculate the RBC Requirement for each individual mortgage in an

affiliated structure. The factors are used in Columns (6) and (7) of the mortgage worksheet (Figure 8) and are dependent on which of the 14 mortgage categories below the

mortgage falls into. Residential Mortgages and Commercial Mortgages Insured or Guaranteed are classified as Category CM1. The following factors are used for each

category of mortgages:

Schedule BA Mortgage Factors

LR009

Line

Number

Category

Factor†

In Good

Standing

Factor

(2)

Unaffiliated – defeased with government

securities

N/A‡

0.0090

(3)

Unaffiliated investments comprised primarily of

Senior Debt

N/A‡

0.0175

(4)

Unaffiliated – all other unaffiliated mortgages

N/A‡

0.0300

(5)

Affiliated Mortgages – Category CM1

N/A‡

0.0090

(6)

Affiliated Mortgages – Category CM2

N/A‡

0.0175

(7)

Affiliated Mortgages – Category CM3

N/A‡

0.0300

(9)

Affiliated Mortgages – Category CM4

N/A‡

0.0500

(10)

Affiliated Mortgages – Category CM5

N/A‡

0.0750

(12)

90 Days Past Due - Insured or Guaranteed

0.0027

.0014

(13)

90 Days Past Due - Unaffiliated

0.1800

‡

(14)

90 Days Past Due – Affiliated

0.1800

‡

(16)

In Process of Foreclosure - Insured or

Guaranteed

0.0054

.0014

(17)

In Process of Foreclosure - Unaffiliated

0.2300

‡

(18)

In Process of Foreclosure – Affiliated

0.2300

‡

† The category factor is a factor used for a particular category of mortgage loans that are not in good standing.

‡ The RBC Requirement for mortgage loans in good standing are not calculated on Figure (8). These requirements are calculated on the company’s Schedule BA Mortgage

Worksheet and transferred to LR009 Schedule BA Mortgage Loans Lines (12) – (14) and (16) – (18).

(Figure 10)

© 1993-2013 National Association of Insurance Commissioners

Mortgage Worksheet (Company developed)

In Good Standing - Commercial

Price Index

current (year

end calculations

to be based off

of 3

rd

Quarter

index of the

given year)}

{input Price Index as

of September 30}

Name / ID / Line

(1)

Date of Origination

(2)

Maturity Date

(3)

Property Type

(4)

Farm Loan

sub-property

type

(5)

Postal Code

(6)

Book/Adjusted

Carrying

Value

(7)

Statutory

Write-downs

(8)

Statutory

Involuntary

Reserve

(9)

Original Loan

Balance

(10)

Principal Loan

balance to

company

(11)

Balloon Payment

at maturity

(12)

Principal Balance

total

(13)

NOI Second Prior

year

(14)

NOI Prior Year

(15)

NOI

(16)

Interest Rate

(17)

Trailing 12 month

debt service

(18)

Original Property

Value

(19)

Property Value

(20)

Year of valuation

(21)

Calendar Quarter

of Valuation

(22)

Credit

Enhancement?

(23)

(24) Senior Debt

(25) Construction

Loan

Construction

Loan out of

Balance

(26)

Construction

Loan Issues (27)

Land Loan

(28)

90 Days Past Due

(29)

In Process of

Foreclosure?

(30)

Current payment

lower than based

on Loan Interest?

(31)

Is loan interest

floating?

(32)

Is fixed rate reset

during term?

(33)

Is negative

amortization

allowed?

(34)

Amortization

Type

(35)

Schedule BA

mortgage?

(36)

Affiliated

Mortgage

(37)

Covenant – Max

LTV

(39)

Covenant – Min

DCR

(40)

Loan Covenants in

compliance?

(41)

Defeased with

government

securities?

(42)

Primarily Senior

positions?

Rolling Average

NOI

RBC DCR

(45)

Price Index at

valuation

Contemporaneous

Property Value

RBC - Loan to

Value ratio

RBC Risk

Category

© 1993-2013 National Association of Insurance Commissioners

(43)

(44)

(46)

(47)

(48)

(49)

This worksheet is prepared on a loan-by-loan basis for each commercial mortgage – other or farm loan held in Schedule BA. The Column (5), and (6) subtotals for each

category are carried over and entered in Columns (1) and (2) of the Mortgages (LR009) in the risk-based capital formula lines (2) – (10). Small mortgages aggregated

into one line on Schedule BA can be treated as one mortgage on this worksheet. Amounts in Columns (7), (9), (49) are carried individually to Worksheet A columns (2),

(3) and (7a) for loans that are 90 Days Past Due and In Process of Foreclosure. NOTE: This worksheet will not be available in the risk-based capital filing software and

must be developed by the Company.

Column

Description / explanation of item

#

Heading

Price Index current is the value on 9/30 of the current year for the National Council of Real Estate Investor

Fiduciaries Price Index for the United States.

(1)

Name / ID

Input

Name / ID / Line – identify each mortgage included as in good standing

(2)

Date of Origination

Input

Enter the year and month that the loan was originated. If the loan has been restructured, extended, or otherwise

re-written, enter that new date.

(3)

Maturity date

Input

Enter earlier of maturity of the loan, or the date the lender can call the loan.

(4)

Property Type

Input

Property Type – Enter 1 for mortgages with an Office, Industrial, Retail or multifamily property as collateral.

Enter 2 for mortgages with a Hotel and Specialty Commercial as property type. For properties that are multiple

use, use the property type with the greatest square footage in the property.

Enter 3 for Farm Loans.

(5)

Farm sub-type

Input

Sub-category – If Property Type=3 (Farm Loans), then you must enter a Sub Category: 1=Timber, 2=Farm and

Ranch, 3=Agribusiness Single Purpose, 4=Agribusiness All Other (See Note 8.)

(6)

Postal Code

Input

Enter zip code of property for US properties. If multiple properties or zip codes, enter multiple codes. If foreign,

enter postal code. If not available, N/A

(7)

Book / Adjusted

Carrying Value

Input

Enter the value that the loan is carried on the company ledger.

(8)

Statutory writedowns

Input

Enter the value of any writedowns taken on this loan due to permanent impairment.

(9)

Involuntary Reserve

Input

Enter the amount of any involuntary reserve amount. Involuntary reserves are reserves that are held as an offset

to a particular asset that is clearly a troubled asset and are included on Page 3 Line 25 of the Annual Statement.

(10)

Original Loan Balance?

Input

Enter the loan balance at the time of origination of the loan.

(11)

Principal balance to Co.

Input

Enter the value of the loan balance owed by the borrower.

(12)

Balloon payment at

maturity

Input

Enter the amount of any balloon or principal payment due at maturity.

(13)

Principal balance total

Input

Enter the total amount of mortgage outstanding that is senior to or pari passu with the company’s mortgage

(14)

NOI second prior

Input

Enter the NOI from the year prior to the value in (15) See Note 1.

(15)

NOI prior

Input

Enter the NOI from the prior year to the value in (16) See Note 1.

(16)

NOI

Input

Enter the Net Operating Income for the most recent 12 month fiscal period with an end-date between July1 of the

year prior to this report and June 30 of the year of this report. The NOI should be reported following the

guidance of the Commercial Real Estate Finance Council Investor Reporting Profile v.5.0. Section VII. See Notes

© 1993-2013 National Association of Insurance Commissioners

1, 2, 3, 4, 5 and 6 below.

(17)

Interest rate

Input

Enter the Annual interest rate at which the loan is accruing.

- If the rate is floating, enter the larger of the current month rate or the average rate of interest for the prior 12

months, or

- If the rate is fixed by the contract, not level over the year, but level for the next 12 months, use current rate.

If the ‘Total Loan Balance’ consists of multiple loans, use an average loan interest rate weighted by principal

balance.

(18)

Trailing 12 month debt

service

Input

Enter actual 12 months debt service for prior 12 months

(19)

Original Property Value

Input

Enter the loan balance at the time of origination of the loan.

(20)

Property Value

Input

Property Value is the value of the Property at time of loan origination, or at time of revaluation due to impairment

underwriting, restructure, extension, or other re-writing.

(21)

Year of valuation

Input

Year of the valuation date defining the value in (20). This will be either the date of origination, or time of

restructure, refinance, or other event which precipitates a new valuation.

(22)

Quarter of valuation

Input

Calendar quarter of the valuation date defining the value in (20).

(23)

Credit Enhancement

Input

Enter the full dollar amount of any credit enhancement. (see Note 5.)

(24)

Senior Loan?

Input

Enter yes if the senior position, no if not. (see Note 7.)

(25)

Construction Loan?

Input

Enter ‘Yes’ if this is a construction loan. (see Note 4.)

(26)

Construction – not in

balance

Input

Enter ‘Yes” if his is a construction loan that is not in balance. (see Note 4.)

(27)

Construction – Issues

Input

Enter ‘Yes” if this is a construction loan with issues. (see Note 4.)

(28)

Land Loan?

Input

Enter ‘Yes’ if this is a loan on non-income producing land. (see Note 6.)

(29)

90 days past due?

Input

Enter ‘Yes’ if payments are 90 days past due.

(30)

In process of

foreclosure?

Input

Enter ‘Yes’ if the loan is in process of foreclosure.

(31)

Is current payment

lower than a payment

based on the Loan

Interest?

Input

Yes / No

(32)

Is loan interest a floating

rate?

Input

Yes / No

(33)

If not floating, does loan

reset during term?

Input

Yes / No - Some fixed rate loans define in the loan document a change to a new rate during the life of the loan,

which may be a pre=determined rate or may be the then current market rate. Generally any such changes are less

frequent than annual. .

(34)

Is negative amortization

allowed?

Input

Yes / No

(35)

Amortization type?

Input

1 = fully amortizing

2 = amortizing with balloon,

3 = full I/O

4 = partial I/O, then amortizing

(36)

Schedule BA mortgage?

Input

Yes / no

© 1993-2013 National Association of Insurance Commissioners

(37)

Affiliated Mortgage?

Input

Yes / no

(38)

Covenant Max LTV

Input

For mortgage investments with covenants, what is the maximum LTV allowed?

(39)

Covenant Min DCR

Input

For mortgage investments with covenants, what is the minimum DCR allowed?

(40)

Covenants in

compliance?

Input

Yes / no – for mortgage investments with covenants, is the investment in compliance with the covenants?

(41)

Defeased with

government securities

Input

Yes/no – has the mortgage loan been defeased using government securities?

(42)

Primarily senior

mortgages

Input

Is the mortgage pool primarily senior mortgage instruments? {If yes, assigned to CM2}

(43)

Rolling Average NOI

Computation

For 2012 – 100% of NOI

For 2014 – 65% NOI + 35% NOI Prior

For 2015 – 50% NOI + 30% NOI Prior + 20% NOI 2

nd

Prior

For loans originated or valued within the current year use 100% NOI.

For loans originated 2012 or later and within 2 years, use 65% NOI and 35% NOI Prior

(44)

RBC Debt Service

Computation

RBC Debt Service Amount is the amount of 12 monthly principal and interest payments required to amortize the

Total Loan Balance (13) using a Standardized Amortization period of 300 months and the Annual Loan Interest

Rate (17).

(45)

RBC - DCR

Computation

Debt Coverage Ratio is the ratio of the Net Operating Income (43) divided by the RBC Debt Service (44) rounded

down to 2 decimal places. See Note 3 below for special circumstances. For loan pools with covenants, this will be

the minimum DCR by covenant.

(46)

NCREIF Index at

Valuation

Computation

Price index is the value of the NCREIF Price Index on the last day of the calendar quarter that includes the date

defined in (21) and (22).

(47)

Contemporaneous

Property Value

Computation

Contemporaneous Value is the Property Value (11) times the ratio (rounded to 4 decimal places) of the Price Index

current to the Price Index (46).

(48)

RBC - LTV

Computation

The Loan to Value ratio is the Loan Value (13) divided by the Contemporaneous Value (47) rounded to the nearest

percent.

For Loan Pools with covenants, this will be the max LTV by covenant.

(49)

CM category

Computation

Commercial Mortgage Risk category is the risk category determined by applying the DCR (45) and the LTV (48)

to the criteria in Figure (11), Figure (12) or Figure (13). See Notes 2, 3, 4, 5, and 6 below for special circumstances.

If (41) = yes, CM1. If (42) = yes, CM2. If no LTV and DCR, and (41) = no and (42) = no, CM3.

Note 1: Net Operating Income (NOI): The majority of commercial mortgage loans require the borrower to provide the lender with at least annual financial statements.

The NOI would be determined at the RBC calculation date based on the most recent annual period from financial statements provided by the borrower and analyzed based

on accepted industry standards. The most recent annual period is determined as follows:

If the borrower reports on a calendar year basis, the statements for the calendar year ending December 31 of the year prior to the RBC calculation date will be

used. For example, if the RBC calculation date is 12/31/2012, the most recent annual period is the calendar year that ends 12/31/2011.

If the borrower reports on a fiscal year basis, the statements for the fiscal year that ends after June 30 of the prior calendar year and no later than June 30 of the

year of the RBC calculation date will be used. For example, if the RBC calculation date is 12/31/2012, the most recent annual period is the fiscal year that ends

after 6/30/2011 and no later than 6/30/2012.

The foregoing time periods are used to provide sufficient time for the borrower to prepare the financial statements and provide them to the lender, and for the

lender to calculate the NOI.

© 1993-2013 National Association of Insurance Commissioners

The accepted industry standards for determining NOI were developed by the Commercial Mortgage Standards Association now known as CRE Financial Council

(CREFC). The company must develop the NOI using the standards provided by the CREFC Methodology for Analyzing and Reporting Property Income Statements v.

5.1(www.crefc.org/irp) . These standards are part of the CREFC Investor Reporting Package (CREFC IRP Section VII.) developed to support consistent reporting for

commercial real estate loans owned by third party investors. This guidance is a standardized basis for determining NOI for RBC.

The NOI will be adjusted to use a 3 year rolling average for the DSC calculation. For 2013, a single year of NOI will be used. For 2014, 2 years will be used, weighted 65%

most recent year and 35% prior year. Thereafter, 3 years will be used weighted 50% most recent year, 30% prior year, and 20% 2

nd

prior year. This will apply when there

is a history of NOI values. For new originations, including refinancing, the above schedule would apply by duration from origination. For the special circumstances listed

below, the specific instructions below will produce the NOI to be used, without further averaging.

Note 2: The calculation of debt service coverage and loan to value will include all debt secured by the property that is (1) senior to or pari passu with the insurer's

investment; and (2) any debt subordinate to the insurer's investment that is not (a) subject to an intercreditor, standstill or subordination agreement with the insurer

provided that the agreement does not grant the subordinate debt holder any rights that would materially affect the rights of the insurer and provided that the subordinate

debt holder is prohibited from taking any action against the borrower that would materially affect the insurer’s priority lien position with respect to the property without

the prior written consent of the insurer, or (b) subject to governing laws that provide that the insurer’s investment holds a senior position to the subordinated debt holder

and provide substantially similar protections to the insurer as in (2)(a) above.

Note 3: Unavailable Operating Statements

There are a variety of situations where the most recent annual period’s operating statement may not be available to assist in determining NOI. These situations will occur in

distinct categories and each category requires special consideration. The categories are:

1. Loans on owner occupied properties

a. For properties where the owner is the sole or primary tenant (50% or more of the rentable space), property level operating statements may not be available

or meaningful. If the property is occupied and the loan, taxes and insurance are current, it will be acceptable to derive income and a reasonable estimate

of expenses from the most recent appraisal or equivalent and additional known actual expenses (e.g., real estate taxes and insurance).

b. For properties where the owner is a minority tenant (49% of less of the rentable space), the owner-occupied space should be underwritten at the average

rent per square foot of the arm’s length tenant leases. This income estimate should be added to the other tenant leases and combined with a reasonable

estimate of expenses based on the most recent appraisal or equivalent and additional known actual expenses (e.g., real estate taxes and insurance).

2. Borrower does not provide the annual operating statement

a. Borrower refuses to provide the annual operating statements

i. If the leases are in place and evidenced by estoppels and inspections, NOI would be derived from normalized underwriting in accordance with the

CREFC Methodology for Analyzing and Reporting Property Income Statements.

ii. If there is evidence from inspection that the property is occupied, but there is no evidence of in place leases (e.g., lease documents or estoppels),

NOI would be set equal to the lesser of calculated debt service (DSC=1.0) or the NOI from the normalized underwriting.

iii. If there is no evidence from inspection that the property is occupied and no evidence of in place leases (e.g., lease documents or estoppels), assume

NOI = $0.

© 1993-2013 National Association of Insurance Commissioners

b. If the borrower does not have access to a complete previous year operating statement, determine NOI based on the CREFC guidelines for analyzing a

partial year income statement.

Note 4: Construction loans

Construction loans would be categorized as follows, based on a determination by the loan servicer whether the loan is in balance and whether construction issues exist:

d. In balance, no construction issues: DSC = 1.0, LTV determined as usual

e. Not in Balance, no construction issues: CM4

f. Construction issues: CM5

A loan is “in balance” if the committed amount of the construction loan plus any lender held reserves and unfunded borrower equity is sufficient to cover the remaining

costs of the development project, including debt service not anticipated to be paid from property operations.

A “construction issue” is a problem that may reasonably jeopardize the completion of the project. Examples of construction issues include the abandonment of construction

and construction defects that are not being addressed.

Note 5: Credit enhancements: Where the loan payments are secured by a letter of credit from an investment grade financial institution or an escrow account held at an

investment grade financial institution, NOI less than the debt service may be increased by these amounts until it is equal to but not exceeding the debt service. These

situations are typically short term in nature, and are intended to bridge the lease-up following renovation or loss of a major tenant.

Note 6: Non-income-producing land: NOI = $0

Note 7: Non-senior financing

c. The company should first calculate DSC and LTV for non-senior financing using the standardized debt service and aggregate LTV of all financing pari

passu and senior to the position held by the company.

d. The non-senior piece should than be assigned to the next riskier RBC category. For example, if the DSC and LTV metrics determined in (a) indicate a

category of CM2, the non-senior piece would be assigned to category CM3. However, it would not be required to assign a riskier category than CM5 if the

loan is not at least 90-days delinquent or in foreclosure.

Note 8: Definitions of each type of Farm Mortgage:

Timber: A loan is classified as a timber loan if more than 50% of the collateral market value (land and timber) of the security is attributable to land supporting a timber

crop that is or will be of commercial value.

Farm & Ranch: Farm and ranch land utilized in the production of agricultural commodities of all kinds, including grains, cotton, sugar, nuts, fruits, vegetables, forage

crops and livestock of all kinds, including, beef, swine, poultry, fowl and fish. Loans included in this category are those in which agricultural land accounts for more than

50% of total collateral market value.

© 1993-2013 National Association of Insurance Commissioners

Agribusiness Single Purpose: Specialized collateral utilized in the production, further processing, adding value or manufacturing of an agricultural commodity or forest

product. In order for a loan to be classified as such, the market value of the single-purpose (special use) collateral would account for more than 50% of total collateral

market value.

This collateral is generally not multi-functional and can only be used for a specific production, manufacturing and/or processing function within a specific sub-sector of the

food or agribusiness industry and whereby such assets are not strategically important in nature to the overall industry capacity. These assets can be shut down or

replicated easily in other locations, or existing plants can be expanded to absorb shuttered capacity. The assets are not generally limited in nature by environmental or

operational permits and/or regulatory requirements. An example would be a poultry processing plant located in the Southeast of the United States where there is excess

capacity inherent to the industry and production capacity is easily replaceable.

Other loans included in this category are those collateralized by single purpose (special use) confinement livestock production facilities in which the special use facilities

account for more than 50% of total collateral market value.

Agribusiness All Other: Multiple-use collateral utilized in the production, further processing, adding value or manufacturing of an agricultural commodity or forest

product. In order for a loan to be classified as such, the market value of any single use portion may not be greater than 50% of total collateral market value.

This collateral is multi-functional in nature, adaptable to other manufacturing, processing, or servicing food or agribusiness industries or sub-industries. Assets could also

be very strategic in nature and not easily replaceable either due to cost, location, environmental permitting and/or government regulations. These assets may be single

purpose in nature, but so vital to the industry capacity needs that they will be generally purchased by another like processing company or strategic or financial buyer. An

example of these types of assets are strategically located and highly automated cold storage facilities whereby they can be used for dry storage, distribution centers or

converted into warehouse or other type uses. Another example may be a cheese processing plant that is strategically located within the heart of the dairy industry, limited

permits, environmental restrictions that would limit added capacity, or high barriers to entry to build a like facility within the industry. For example, one of the largest

cheese plants in the industry is located in California and it is not easily replicated within the cheese processing industry due to its location, capacity, costs, access to fluid

milk supply and related feed and water, as well as highly regulated environmental and government restrictions.

Other loans included in this category are those in which more than 50% of the collateral market value is accounted for by chattel assets or other assets related to the

business and financial operations of agribusinesses, including inventories, accounts, trade receivables, cash and brokerage accounts, machinery, equipment, livestock and

other assets utilized for or generated by agribusiness operations.

© 1993-2013 National Association of Insurance Commissioners

(Figure 11)

For Office, Industrial, Retail and Multi-family

Risk category

DSC limits

LTV limits

CM1

1.50 ≤ DSC

and

LTV < 85%

CM2

DSC < 1.50

and

LTV < 55%

CM2

0.95 ≤ DSC < 1.50

and

55% ≤ LTV < 75%

CM2

1.15 ≤ DSC < 1.50

and

75% ≤ LTV < 100%

CM2

1.50 ≤ DSC

and

85% ≤ LTV < 100%

CM2

1.75 ≤ DSC

and

100% ≤ LTV

CM3

DSC < 0.95

and

55% ≤ LTV < 85%

CM3

0.95 ≤ DSC < 1.15

and

75% ≤ LTV < 100%

CM3

1.15 ≤ DSC < 1.75

and

100% ≤ LTV

CM4

DSC < 0.95

and

85% ≤ LTV < 105%

CM4

0.95 ≤ DSC < 1.15

and

100% ≤ LTV

CM5

DSC < 0.95

and

105% ≤ LTV

(Figure 12)

For Hotels and Specialty Commercial

Risk category

DSC limits

LTV limits

CM1

1.85 ≤ DSC

and

LTV < 60%

CM2

1.45 ≤ DSC < 1.85

and

LTV < 70%

CM2

1.85 ≤ DSC

and

60% ≤ LTV < 115%

CM3

0.90 ≤ DSC < 1.45

and

≤ LTV < 80%

CM3

1.45 ≤ DSC < 1.85

and

70% ≤ LTV

CM3

1.85 ≤ DSC

and

115% ≤ LTV

CM4

DSC < 0. 90

and

LTV < 90%

CM4

0.90 ≤ DSC < 1.10

and

80% ≤ LTV < 90%

CM4

1.10 ≤ DSC < 1.45

and

80% ≤ LTV

CM5

1.10 ≤ DSC

and

90% ≤ LTV

(Figure 13)

© 1993-2013 National Association of Insurance Commissioners

For Farm Loans:

Timber

Farm & Ranch

Agribusiness

Single Purpose

Agribusiness

All Other

CM1

LTV <= 55%

LTV <= 60%

LTV <= 60%

CM2

55% < LTV <= 65%

60% < LTV <= 70%

LTV <= 60%

60% < LTV <= 70%

CM3

65% < LTV <= 85%

70% < LTV <= 90%

60% < LTV <= 70%

70% < LTV <= 90%

CM4

85% < LTV <= 105%

90% < LTV <= 110%

70% < LTV <= 90%

90% < LTV <= 110%

CM5

105% < LTV

110% < LTV

90% < LTV

110% < LTV

© 1993-2013 National Association of Insurance Commissioners

ASSET CONCENTRATION FACTOR

LR010

Basis of Factors

The purpose of the concentration factor is to reflect the additional risk of high concentrations in single exposures (represented by an individual issuer of a security or a holder of a

mortgage, etc.) The concentration factor doubles the risk-based capital pre-tax factor (with a maximum of 45 percent pre-tax) of the 10 largest asset exposures excluding various low-

risk categories or categories that already have a maximum factor. Since the risk-based capital of the assets included in the concentration factor has already been counted once in the

basic formula, the asset concentration factor only serves to add in the additional risk-based capital required. The calculation is completed on a consolidated basis; however, the

concentration factor is reduced by amounts already included in the concentration factors of subsidiaries to avoid double-counting.

Specific Instructions for Application of the Formula

The 10 largest asset exposures should be developed by consolidating the assets of the parent with the assets of the company’s insurance and investment subsidiaries. The concentration

factor component on any asset already reflected in the subsidiary’s RBC for the concentration factor should be deducted from Column (4). This consolidation process affects higher

tiered companies only. Companies on the lowest tier of the organizational chart will prepare the asset concentration on a “stand alone” basis.

The 10 largest exposures should exclude the following: affiliated and non-affiliated common stock, affiliated preferred stock, home office properties, policy loans, bonds for which

AVR and RBC are zero, NAIC 1 bonds, NAIC 1 unaffiliated preferred stock, NAIC 1 Hybrids, CM 1 Commercial and Farm Mortgages and any other asset categories with RBC

factors less than 0.8 percent post-tax (this includes residential mortgages in good standing, insured or guaranteed mortgages, and cash and short-term investments).

In determining the assets subject to the concentration factor for both C1o and C1cs, the ceding company should exclude any asset whose performance inures primarily (>50 percent) to

one reinsurer under modified coinsurance or funds withheld arrangements. The reinsurer should include 100 percent of such asset. Any asset where no one reinsurer receives more than

50 percent of its performance should remain with the ceding company.

Assets should be aggregated by issuer before determining the 10 largest exposures. Aggregations should be done separately for bonds and preferred stock (the first six digits of the

CUSIP number can be used as a starting point) (please note that the same issuer may have more than one unique series of the first six digits of the CUSIP), mortgages and real estate.

Securities held within Schedule BA partnerships should be aggregated by issuer as if the securities are held directly. Likewise, where joint venture real estate is mortgaged by the

insurer, both the mortgage and the joint venture real estate should be considered as part of a single exposure. Tenant exposure is not included. For bonds and unaffiliated preferred

stock, aggregations should be done first for classes 2 through 6. After the 10 largest issuer exposures are chosen, any NAIC 1 bonds, NAIC 1 unaffiliated preferred stock or NAIC 1

Hybrids from any of these issuers should be included before doubling the risk-based capital. For some companies, following the above steps may generate less than 10 “issuer”

exposures. These companies should list all available exposures.

Replicated assets other than synthetically created indices should be included in the asset concentration calculation in the same manner as other assets.

The book/adjusted carrying value of each asset is listed in Column (2).