© 2019-2020 National Association of Insurance Commissioners 1 109/254/201920

MORTGAGES

LR004

Basis of Factors

Mortgages in Good Standing

The pre-tax factors for commercial mortgages were developed based on analysis using the Commercial Mortgage Metrics model of Moody’s Analytics and documented in a report

from the American Council of Life Insurers on March 27, 2013. The factors provide for differing levels of risk, the levels determined by a contemporaneous debt service coverage

ratio and the contemporaneous loan-to-value. The 0.14 percent pre-tax factor on insured and guaranteed mortgages represents approximately 30-60 days interest lost due to possible

delay in recovery on default. The pre-tax factor of 0.68 percent for residential mortgages reflects a significantly lower risk than commercial mortgages. The pre-tax factors were

developed by dividing the post-tax factor by 0.7375 (0.7375 is calculated by taking 1.0 less the result of 0.75 multiplied by 0.35). The pre-tax factors are not changing for 2018 due to

tax reform.

Mortgages 90 Days Overdue, Not in Process of Foreclosure

The category pre-tax factor for commercial and farm mortgages of 18 percent is based on data taken from the Society of Actuaries “Commercial Mortgage Credit Risk Study.” For

insured and guaranteed or residential mortgages, factors are set at twice the level for those “in good standing” to reflect the increased likelihood of default losses.

Mortgages in Process of Foreclosure

Mortgages in process of foreclosure are considered to be as risky as NAIC 5 bonds and are assigned the same category pre-tax factor of 23 percent for commercial and farm

mortgages.

Due and Unpaid Taxes on Overdue Mortgages and Mortgages in Foreclosure

The factor for due and unpaid taxes on overdue mortgages and mortgages in foreclosure is 100 percent.

Specific Instructions for Application of the Formula

Column (1)

Insured or guaranteed mortgages should be reported separately from residential and commercial mortgages. Insured or guaranteed loans include only those mortgage loans insured or

guaranteed by the Federal Housing Administration, under the National Housing Act (Canada) or by the Veterans Administration (exclusive of any portion insured by FHA). Mortgage

loans guaranteed by another company (affiliated or unaffiliated) are not to be included in the insured or guaranteed category.

Except for Lines (1) through (3), (26) and (27), calculations are done on an individual mortgage basis and then the summary amounts are entered in this column for each class of

mortgage investment. Refer to the mortgage calculation worksheet A (Figure 1) for how the individual mortgage calculations are completed for Other Than In Good Standing

mortgages on Lines (16) through (25). Refer to the mortgage calculation worksheet – company developed (Figure 3) for how the individual mortgage calculations are completed for

In Good Standing - Commercial mortgages on Lines (4) through (8) and for In Good Standing - Farm mortgages on Lines (10) through (14). Line (28) should equal Page 2, Column 3,

Lines 3.1 plus 3.2, plus Schedule B, Part 1 Footnotes 3 and 4, first of the two amounts in the footnotes.

Column (2)

Companies are permitted to reduce the book/adjusted carrying value of mortgage loans reported in Schedule B by any involuntary reserves. Involuntary reserves are equivalent to

valuation allowances specified in SSAP No. 37 paragraph 16. These reserves are held as an offset for a particular troubled mortgage loan that would be required to be written down if

the impairment was permanent.

© 2019-2020 National Association of Insurance Commissioners 2 109/254/201920

Column (3)

Column (3) is calculated as the net of Column (1) less Column (2).

Column (4)

Summary amounts of the individual mortgage calculations are entered in this column for each class of mortgage investments. Refer to the mortgage calculation worksheet (Figure 1).

Cumulative writedowns include the total amount of writedowns, amounts non-admitted and involuntary reserves that have been taken or established with respect to a particular

mortgage.

Column (5)

For Lines (4) and (10), the pre-tax factor is equal to 0.0090

For Lines (5) and (11), the pre-tax factor is equal to 0.0175

For Lines (6) and (12), the pre-tax factor is equal to 0.0300

For Lines (7) and (13), the pre-tax factor is equal to 0.0500

For Lines (8) and (14), the pre-tax factor is equal to 0.0750

For Lines (26) and (27), the pre-tax factor is 1.0. For Lines (16) through (25), the average factor column is calculated as Column (6) divided by Column (3).

Column (6)

For Lines (4) through (8), (10) through (14) and (16) through (25), summary amounts are entered for Column (6) based on calculations done on an individual mortgage basis. Refer to

the mortgage calculation worksheets (Figure 1) and (Figure 3). For Lines (1) through (3), (26) and (27), the RBC subtotal is multiplied by the factor to calculate Column (6).

© 2019-2020 National Association of Insurance Commissioners 3 109/254/201920

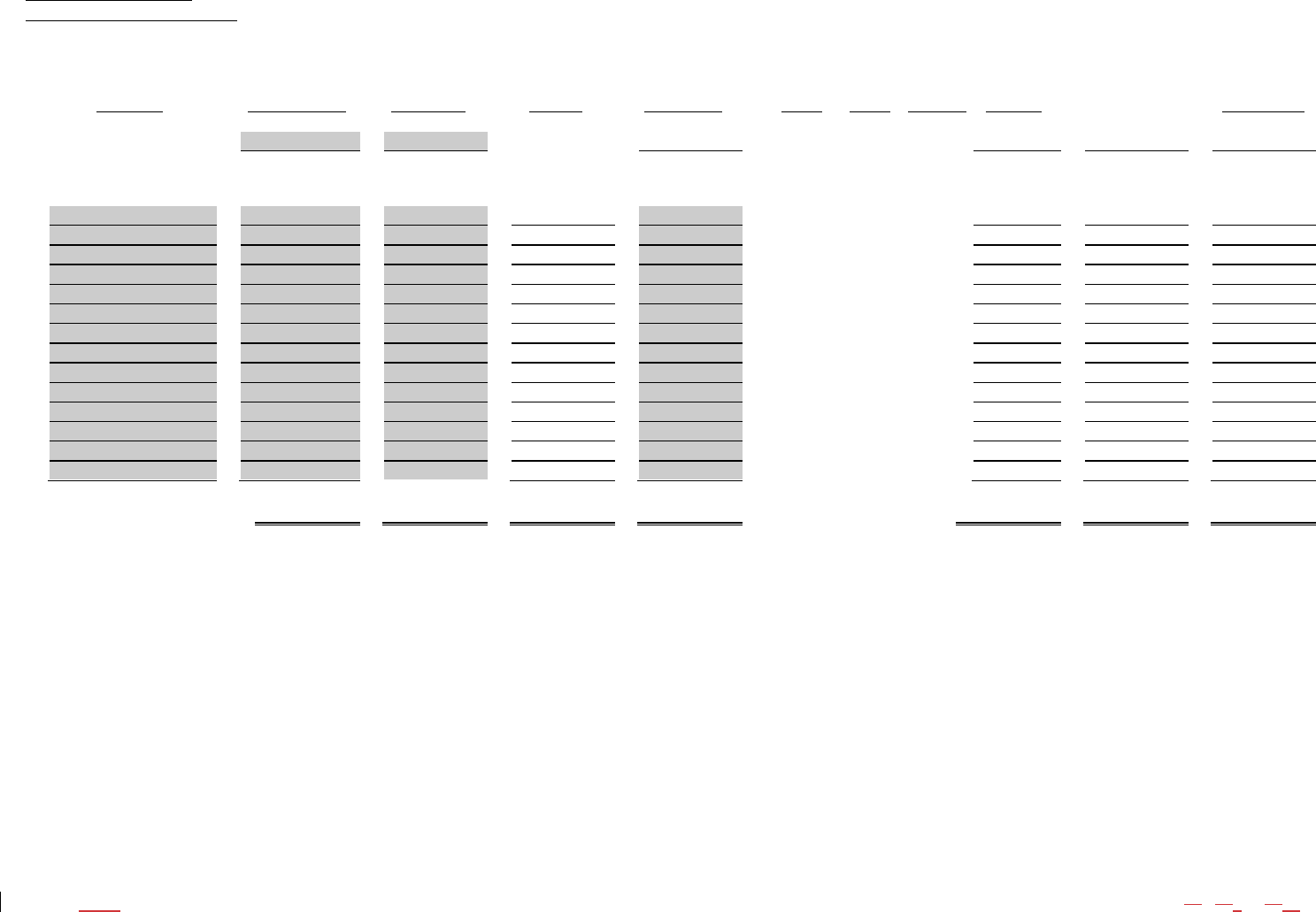

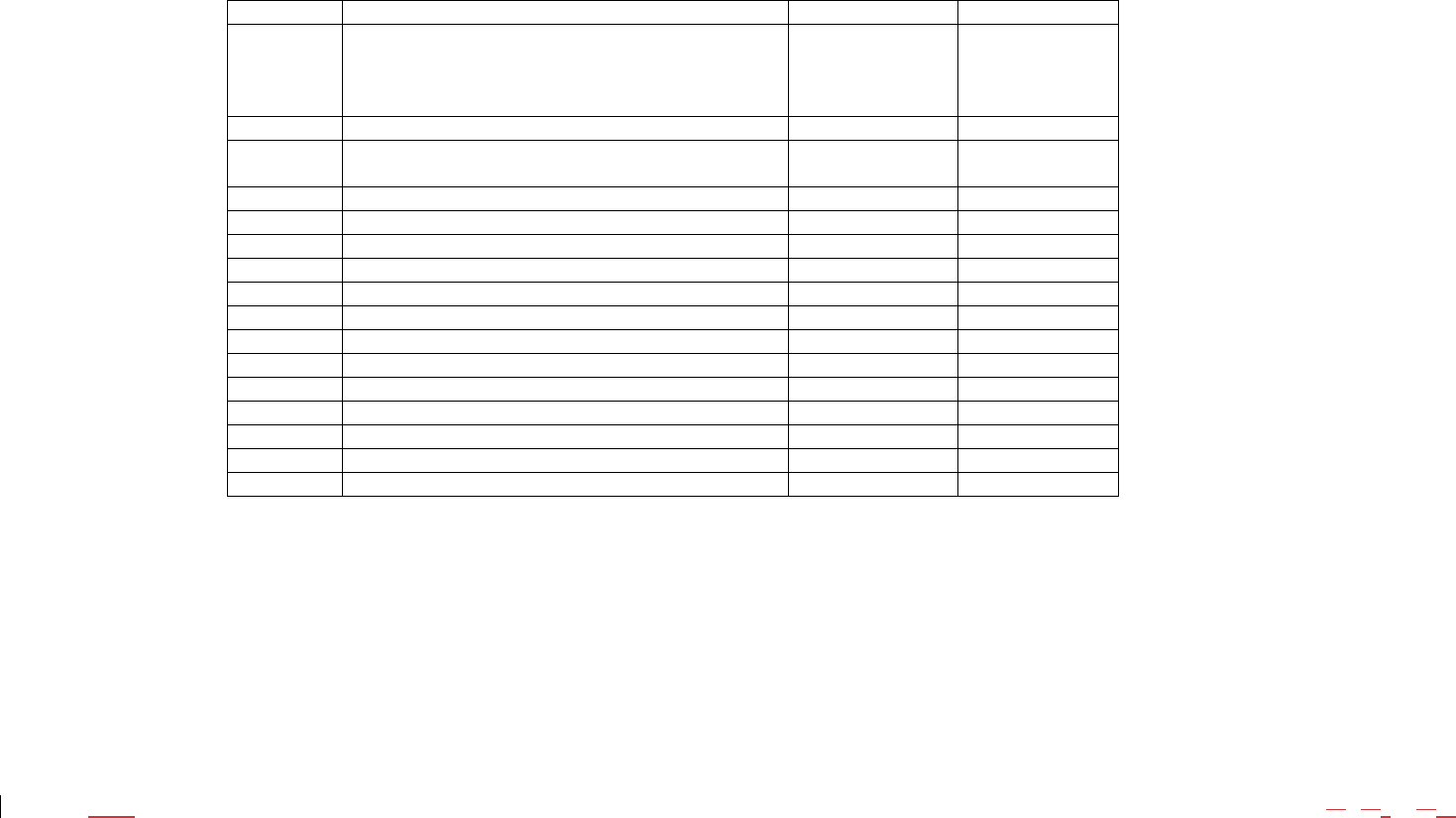

(Figure 1)

Mortgage Worksheet A

Other Than In Good Standing

(

1

)

(

2

)

(

3

)

(

4

)

(

5

)

(

6

)

(

7

)

(

7a

)

(

8

)

(

9

)

(

10

)

Name / ID

Book/Adjusted

Carr

y

in

g

Value

Involuntary

Reserve

Ad

j

ustment

§

RBC

Subtotal

£

Cumulative

Writedowns*

Category

Facto

r

In Good

Standing

Facto

r

In Good

Standing

Cate

g

or

y

Col (6) X

[Col

(4)+(5)]

- Col

(

5

)

Col (4) X

Col

(

7

)

RBC

Re

q

uirement

‡

(1) All Mortgages Without

Cumulative Writedowns

XXX

†

†

†

All Mortgages With

Cumulative W

r

itedowns:

(2)

†

†

†

(3)

†

†

†

(4)

†

†

†

(5)

†

†

†

(6)

†

†

†

(7)

†

†

†

(8)

†

†

†

(9)

†

†

†

(10)

†

†

†

(

11

)

†

†

†

(

12

)

†

†

†

(

13

)

†

†

†

(

14

)

†

†

†

(

15

)

†

†

†

Total Mort

g

a

g

es

This worksheet is prepared on a loan-by-loan basis for each of the mortgage categories listed in (Figure 2) that are applicable. The Column (2), (3), (5) and (10) subtotals for each

category are carried over and entered in Columns (1), (2), (4) and (6) of the Mortgages (LR004) in the risk-based capital formula. Small mortgages aggregated into one line on

Schedule B can be treated as one mortgage on this worksheet. NOTE: This worksheet will be available in the risk-based capital filing software.

†

See (Figure 2) for factors to use in the calculation. The In Good Standing Factor will be based on the CM category developed in the company generated worksheet (Figure 3) and

reported in Column 7a for Commercial or Farm Mortgages.

‡

The RBC Requirement column is calculated as the greater of Column (8) or Column (9), but not less than zero.

§

Involuntary reserves are reserves held as an offset to a particular asset that is clearly a troubled asset and are included on Page 3, Line 25 of the annual statement.

£

Column (4) is calculated as Column (2) less Column (3).

* Cumulative writedowns include the total amount of writedowns, amounts non-admitted and involuntary reserves that have been taken or established with respect to a particular

mortgage.

© 2019-2020 National Association of Insurance Commissioners 4 109/254/201920

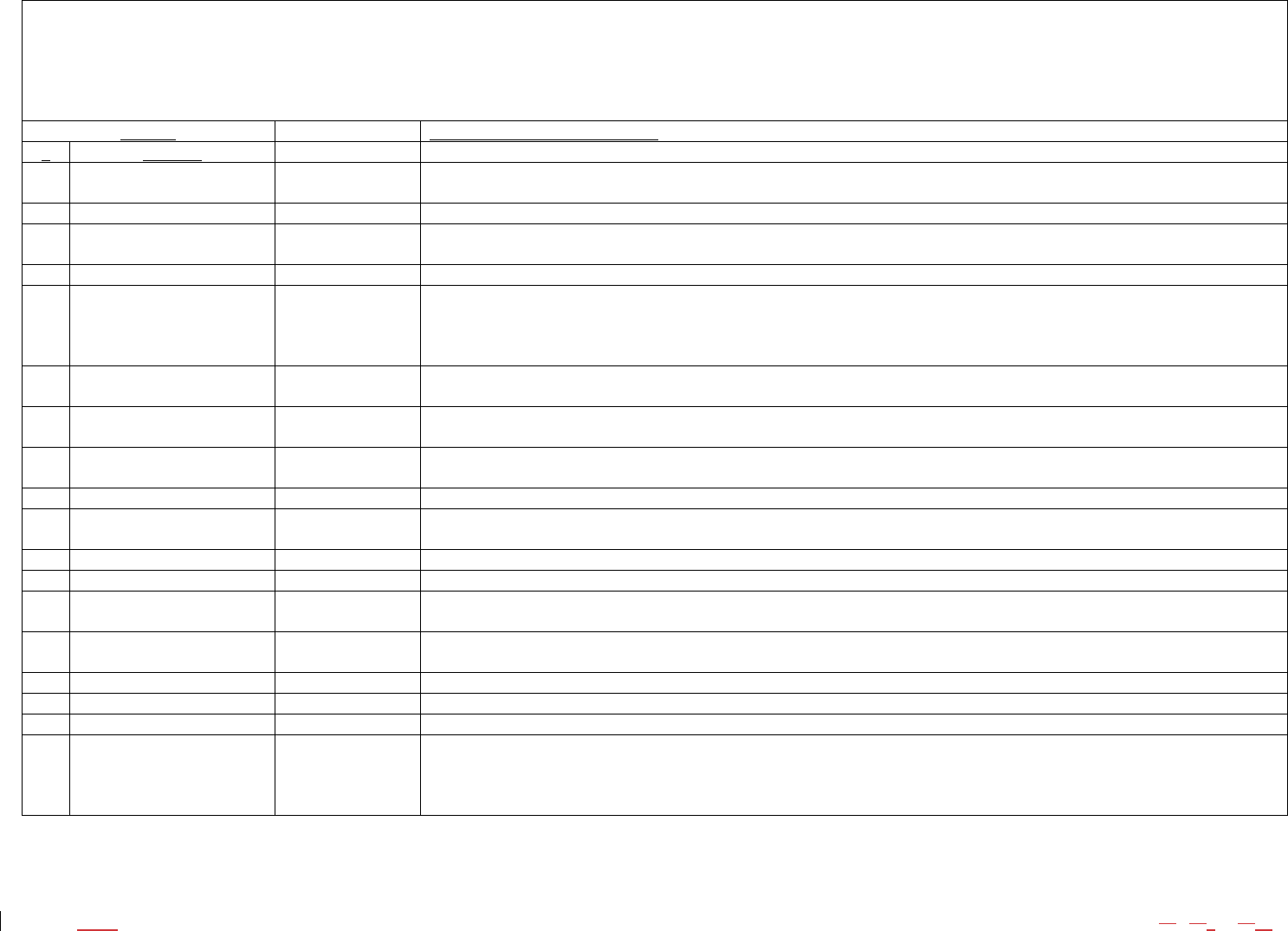

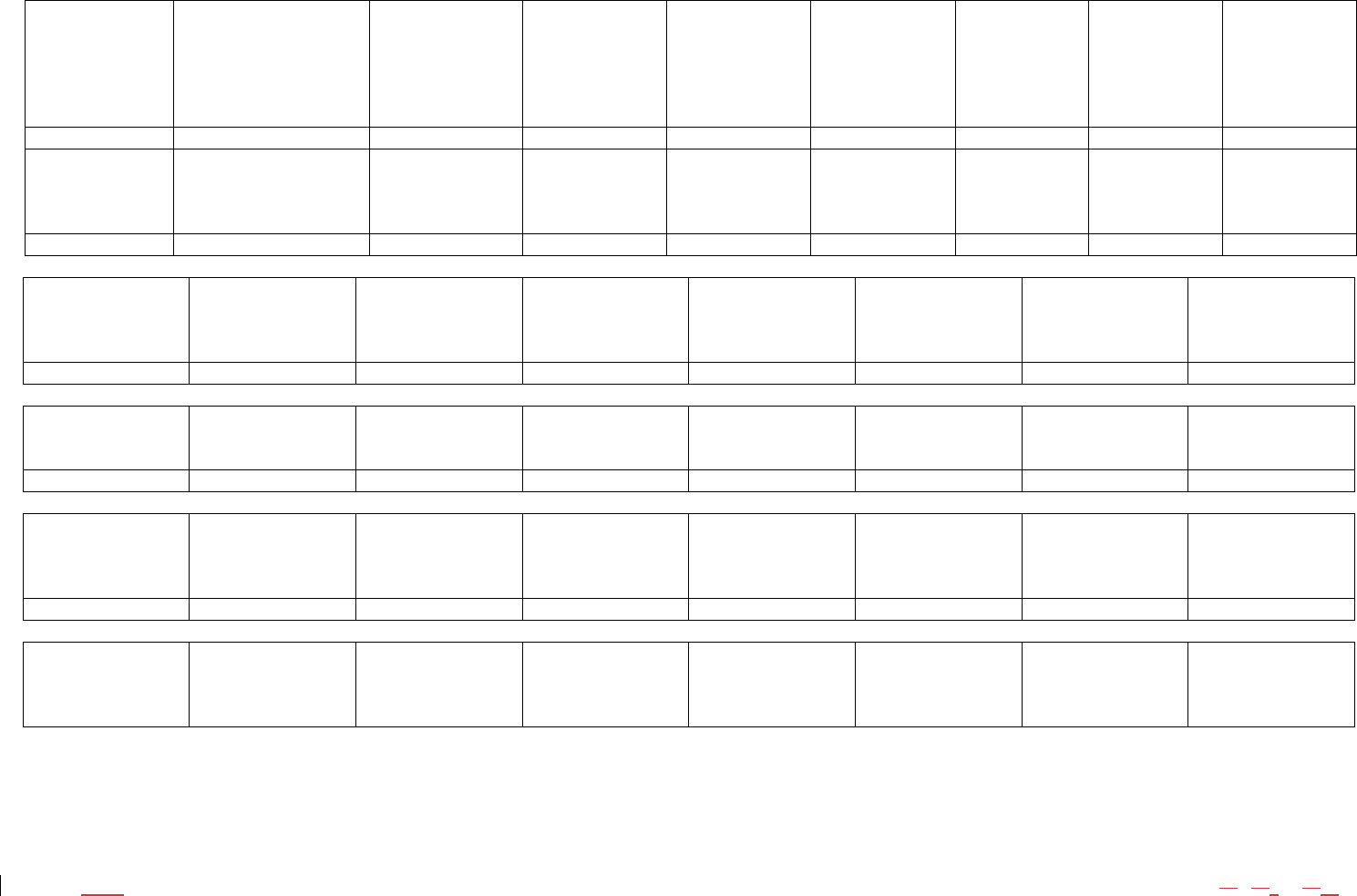

(Figure 2)

The mortgage factors are used in conjunction with the mortgage worksheets (Figures 1 and 3) to calculate the RBC Requirement for each individual mortgage. The factors are used in

Columns (6), (7) and (7a) of the mortgage worksheet and are dependent on which of the 25 mortgage categories below the mortgage falls into. The following factors are used for each

category of mortgages:

Mor

t

g

a

g

e Facto

r

s

LR004 Line

N

umbe

r

Cate

g

or

y

Facto

r

†

In Good

Standin

g

Facto

r

MEA Facto

r

In Good Standin

g

(1) Residential Mort

g

a

g

es-Insured o

r

Guarantee

d

N

/A

‡

0.0014

N

/A

(2) Residential Mort

g

a

g

es-All Othe

r

N

/A

‡

0.0068

N

/A

(3) Commercial Mort

g

a

g

es-Insured or Guarantee

d

N

/A

‡

0.0014

N

/A

(4) Commercial Mo

r

t

g

a

g

es-All Othe

r

–

Cate

g

or

y

CM1

N

/A

‡

0.0090

N

/A

‡

(5) Commercial Mort

g

a

g

es

–

Cate

g

or

y

CM2

N

/A

‡

0.0175

N

/A

‡

(6) Commercial Mort

g

a

g

es

–

Cate

g

or

y

CM3

N

/A

‡

0.0300

N

/A

‡

(7) Commercial Mort

g

a

g

es

–

Cate

g

or

y

CM4

N

/A

‡

0.0500

N

/A

‡

(8) Commercial Mort

g

a

g

es

–

Cate

g

or

y

CM5

N

/A

‡

0.0750

N

/A

‡

(10) Farm Mort

g

a

g

es – Cate

g

or

y

CM1

N

/A

‡

0.0090

N

/A

‡

(11) Far

m

Mort

g

a

g

es

–

Cate

g

or

y

CM2

N

/A

‡

0.0175

N

/A

‡

(12) Farm Mort

g

a

g

es

–

Cate

g

or

y

CM3

N

/A

‡

0.0300

N

/A

‡

(13) Fa

r

m

Mort

g

a

g

es

–

Cate

g

or

y

CM4

N

/A

‡

0.0500

N

/A

‡

(14) Farm Mo

r

t

g

a

g

es

–

Cate

g

or

y

CM5

N

/A

‡

0.0750

N

/A

‡

90 Da

y

s Overdue, Not in P

r

ocess of Fo

r

eclosure

(16) Farm Mort

g

a

g

es

–

Cate

g

or

y

CM6 0.1800

‡

N

/A

‡

(17) Residential Mort

g

a

g

es-Insured or Guarantee

d

0.0027 0.0014 1.0

N

/A

(18) Residential Mort

g

a

g

es-All Othe

r

0.0140 0.0068 1.0

N

/A

(19) Commercial Mort

g

a

g

es-Insured or Gua

r

antee

d

0.0027 0.0014 1.0

N

/A

(20) Comme

r

cial Mort

g

a

g

es-All Othe

r

–

Cate

g

or

y

CM6 0.1800

‡

N

/A

‡

In Process of Foreclosure

(21) Farm Mort

g

a

g

es

–

Cate

g

or

y

CM7 0.2300

‡

N

/A

‡

(22) Residential Mor

t

g

a

g

es-Insured or Guarantee

d

0.0054 0.0014 1.0

N

/A

(23) Residential Mort

g

a

g

es-All Othe

r

0.0270 0.0068 1.0

N

/A

(24) Commercial Mort

g

a

g

es-Insured or Guarantee

d

0.0054 0.0014 1.0

N

/A

(25) Commercial Mort

g

a

g

es-All Othe

r

–

Cate

g

or

y

CM7 0.2300

‡

N

/A

‡

†

The category factor is a factor used for a particular category of mortgage loans that are not in good standing.

‡

The RBC Requirement for mortgage loans in good standing or restructured are not calculated on Figure (1). These requirements are calculated on Mortgage Worksheet (company

developed) (Figure 3) and transferred to LR004 Mortgage Loans Lines (4) through (8) and (10) through (14). In addition, for Commercial and Farm mortgage loans 90 days past

due or In Process of Foreclosure, the CM category is determined in Mortgage Worksheet (company developed) and transferred to Worksheet A.

© 2019-2020 National Association of Insurance Commissioners 5 109/254/201920

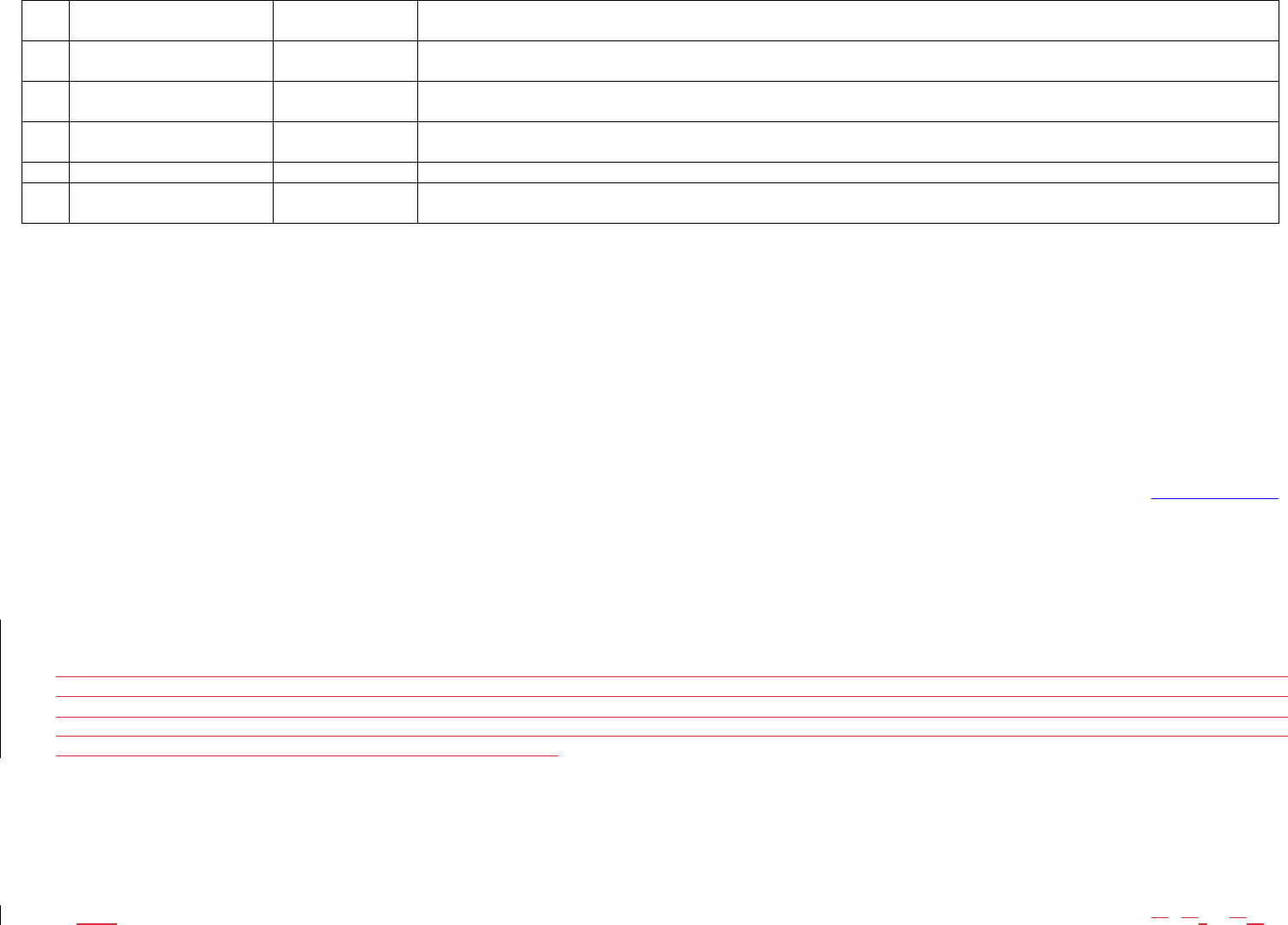

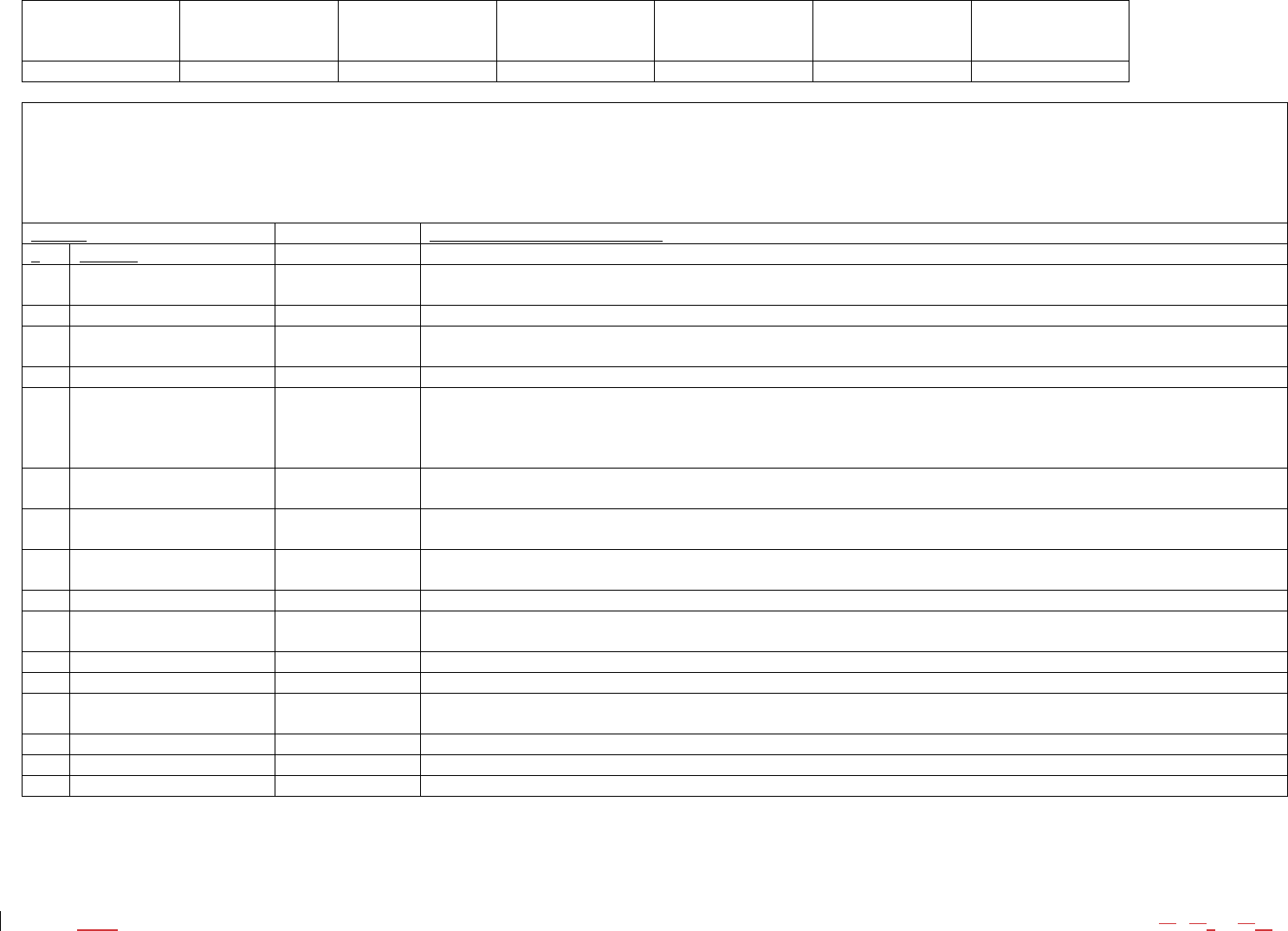

(Figure 3)

Mortgage Worksheet (company developed)

In Good Standing – Commercial Mortgages and Farm Mortgages

Price Index

current (year-end

calculations to be

based off of 3

rd

Quarter index of

the

g

iven

y

ear)

}

{input Price Index as of

September 30}

Name / ID

(1)

Date of Origination

(2)

Maturity Date

(3)

Property Type

(4)

Farm Loan Sub-

property type

(5)

Postal Code

(6)

Book /

Adjusted

Carrying Value

(7)

Statutory

Write-downs

(8)

Statutory

Involuntary

Reserve

(9)

Original Loan

Balance

(10)

Principal Loan

Balance to

Company

(11)

Balloon Payment at

Maturity

(12)

Principal Balance

Total

(13)

NOI Second Prior

Year

(14)

NOI Prior Year

(15)

NOI

(16)

Interest Rate

(17)

Trailing 12 Month

Debt Service

(18)

Original Property

Value

(19)

Property Value

(20)

Year of Valuation

(21)

Calendar Quarter of

Valuation

(22)

Credit

Enhancement?

(23)

Senior Debt?

(24)

Construction Loan?

(25)

Construction Loan

out of Balance?

(26)

Construction Loan

Issues?

(27)

Land Loan?

(28)

90 Days Past Due?

(29)

In Process of

Foreclosure?

(30)

Current payment

lower than based on

Loan Interest?

(31)

Is loan interest a

floating rate?

(32)

Is fixed rate reset

during term?

(33)

Is negative

amortization

allowed?

(34)

Amortization Type

(35)

Rolling

Average NOI

(36)

RBC Debt

Service

(37)

RBC DCR

(38)

Price Index at

Valuation

(39)

Contemporaneous

Property Value

(40)

RBC LTV

(41)

CM Category

(42)

© 2019-2020 National Association of Insurance Commissioners 6 109/254/201920

The Company should develop this worksheet on a loan-by-loan basis for each commercial mortgage – other or farm loan held in Annual Statement Schedule B. This worksheet

columns (7) and (9) subtotals for each category are to be carried over and entered in Columns (1) and (2) of Mortgages (LR004) in the risk-based capital formula lines (4) – (8) and

(10) – (14). Small mortgages aggregated into one line on Schedule B can be treated as one mortgage on this worksheet. Amounts in Columns (7), (9) and (42) are carried

individually to Worksheet A columns (2), (3) and (7a) for loans that are 90 Days Past Due and In Process of Foreclosure. NOTE: This worksheet will not be available in the risk-

based capital filing software and needs to be developed by the company.

Column Description / explanation of item

# Headin

g

Price Index current is the value on 9/30 of the current year for the National Council of Real Estate Investor Fiduciaries

Price Index for the United States.

(1)

N

ame / ID Inpu

t

Identif

y

each mort

g

a

g

e included as in

g

ood standin

g

.

(2) Date of Origination Input Enter the year and month that the loan was originated. If the loan has been restructured, extended, or otherwise re-

written, enter

t

hat new date.

(3) Maturit

y

Date Inpu

t

Enter earlier of maturit

y

of the loan, or the date the lender can call the loan.

(4) Property Type Input Enter 1 for mortgages with an Office, Industrial, Retail or multifamily property as collateral.

Enter 2 for mortgages with a Hotel and Specialty Commercial as property type. For properties that are multiple use, use

the property type with the greatest square footage in the property.

Enter 3 for Farm Loans.

(5) Farm Sub-type Input If Property Type=3 (Farm Loans), then you must enter a Sub Category: 1=Timber, 2=Farm and Ranch, 3=Agribusiness

Sin

g

le Purpose, 4=A

g

ribusiness All Other (See Note 8.)

(6) Postal Code Input Enter zip code of property for US. If multiple properties or zip codes, enter multiple codes. If foreign address, use postal

code. If not available, N/A.

(7) Book / Adjusted Carrying

Value

Input Enter the value that the loan is carried at on the company ledger.

(8) Statutor

y

W

r

ite-downs In

p

u

t

Enter the value of an

y

wri

t

e-

d

owns taken on this loan due to pe

r

manent impairment.

(9) Involuntary Reserve Input Enter the amount of any involuntary reserve amount. Involuntary reserves are reserves that are held as an offset to a

p

articular asset

t

hat is clearl

y

a troubled asse

t

an

d

are included on Pa

g

e 3 Line 25 of the Annual Statement.

(10) Ori

g

inal Loan Balance? Inpu

t

Ente

r

the loan balance at

t

he time of ori

g

ination of the loan.

(11) Principal Balance

t

o Co. Inpu

t

Enter the value of the loan

b

alance owed b

y

the borrower.

(12) Balloon Payment at

Maturit

y

Input Enter the amount of any balloon or principal payment due at maturity.

(13) Principal Balance Total Input Enter the total amount of mortgage outstanding including debt that is senior to or pari passu with the company’s mortgage

(Note 2)

(14)

N

OI Second Prio

r

Inpu

t

Enter the NOI from the

y

ear prior

t

o the value in (15). See Note 1.

(15)

N

OI Prio

r

Inpu

t

Enter the NOI from the prior

y

ear to the value in (16). See Note 1.

(16) NOI Input Enter the Net Operating Income for the most recent 12 month fiscal period with an end-date between July 1 of the year

prior to this report and June 30 of the year of this report. The NOI should be reported following the guidance of the

Commercial Real Estate Finance Council Investor Reporting Profile v.5.0. Section VII. See Notes 1, 3, 4, 5, and 6

b

elow.

© 2019-2020 National Association of Insurance Commissioners 7 109/254/201920

(17) Interest Rate Input Enter the annual interest rate at which the loan is accruing.

‐ If the rate is floating, enter the larger of the current month rate or the average rate of interest for the prior 12 months,

or

‐ If the rate is fixed by the contract, not level over the year, but level for the next 12 months, use current rate.

If the ‘Total Loan Balance’ consis

t

s of multiple loans, use an avera

g

e loan interest rate wei

g

hted b

y

p

r

inci

p

al balance.

(18) Trailing 12 Month Debt

Service

Input Enter actual 12 months debt service for prior 12 months

(19) Ori

g

inal Propert

y

Value Inpu

t

Enter the Propert

y

Value at

t

he

t

ime of ori

g

ination of the loan. (No

t

e 9)

(20) Property Value Input Property Value is the value of the Property at time of loan origination, or at time of revaluation due to impairment

underwritin

g

, restructure, extension, or other re-writin

g

. (No

t

e 9)

(21) Year of Valuation Input Year of the valuation date defining the value in (20). This will be either the date of origination, or time of restructure,

refinance, or other event which precipitates a new valuation.

(22) Quarter of Valuation Inpu

t

Calendar quar

t

er of the valuation date definin

g

the value in (20).

(23) C

r

edi

t

Enhancemen

t

Inpu

t

Ente

r

the full dollar amount of an

y

credit enhancement. (see

N

ote 5)

(24) Senior Debt? Inpu

t

En

t

er

y

es if senior position, no if not. (see Note 7.)

(25) Cons

t

r

uc

t

ion Loan? Inpu

t

Enter ‘Yes’ if this is a construction loan. (see Note 4.)

(26) Construction – not in

b

alance?

Input Enter ‘Yes” if his is a construction loan that is not in balance. (see Note 4)

(27) Construction

–

Issues? Inpu

t

Enter ‘Yes” if this is a construction loan with issues. (see Note 4)

(28) Land Loan? Inpu

t

Ente

r

‘Yes’ if this is a loan on non-income producin

g

land. (see No

t

e 6)

(29) 90 da

y

s past due? Inpu

t

Enter ‘Yes’ if

p

a

y

men

t

s are 90 da

y

s past due.

(30) In process of foreclosure? Inpu

t

Enter ‘Yes’ if the loan is in p

r

ocess of foreclosure.

(31) Is current payment lower

than a payment based on

the loan interest?

Input Yes / No

(32) Is loan interest a floating

rate?

Input Yes / No

(33) If not floating, does loan

reset during term?

Input Yes / No - Some fixed rate loans define in the loan document a change to a new rate during the life of the loan, which

may be a pre-determined rate or may be the then current market rate. Generally any such changes are less frequent than

annual.

(34) Is negative amortization

allowed?

Input Yes / No

(35) Amortization type? Input 1 = fully amortizing

2 = amortizing with balloon

3 = full I/O

4 = partial I/O, then amortizin

g

(36) Rolling Average NOI Computation For 2013 – 100% of NOI

For 2014 – 65% NOI + 35% NOI Prior

For 2015 – 50% NOI + 30% NOI Prior + 20% NOI 2

nd

Prior

For loans originated or valued within the current year, use 100% NOI.

For loans ori

g

inated 2013 or later and within 2

y

ears, use 65% NOI and 35% NOI Prio

r

© 2019-2020 National Association of Insurance Commissioners 8 109/254/201920

(37) RBC Debt Service Computation This amount is the amount of 12 monthly principal and interest payments required to amortize the Total Loan Balance

(13) usin

g

a S

t

andardized A

m

ortization period of 300 months and the Annual Loan Interest Rate (17).

(38) RBC DCR Computation This is the ratio of the Net Operating Income (36) divided by the RBC Debt Service (37) rounded down to 2 decimal

p

laces. See Note 3 below for special circumstances.

(39) NCREIF Price Index at

Valuation

Computation The value of the NCREIF Price Index on the last day of the calendar quarter that includes the date defined in (21) and

(22).

(40) Contemporaneous

Prope

r

t

y

Value

Computation The Property Value (20) times the ratio (rounded to 4 decimal places) of the Price Index current to the Price Index at

valuation (39).

(41) RBC LTV Compu

t

ation The Total Loan Value (13) divided

b

y

the Contemporaneous Value (40) rounded to the nearest percent.

(42) CM Category Computation The risk category determined by applying the DCR (38) and the LTV (41) to the criteria in Figure (4), Figure (5) or

Fi

g

ure (6). See Notes 2, 3, 4, 5, and 6

b

elow for special circumstances.

Note 1: Net Operating Income (NOI): The majority of commercial mortgage loans require the borrower to provide the lender with at least annual financial statements. The NOI

would be determined at the RBC calculation date based on the most recent annual period from financial statements provided by the borrower and analyzed based on accepted

industry standards. The most recent annual period is determined as follows:

If the borrower reports on a calendar year basis, the statements for the calendar year ending December 31 of the year prior to the RBC calculation date will be used. For

example, if the RBC calculation date is 12/31/2012, the most recent annual period is the calendar year that ends 12/31/2011.

If the borrower reports on a fiscal year basis, the statements for the fiscal year that ends after June 30 of the prior calendar year and no later than June 30 of the year of the

RBC calculation date will be used. For example, if the RBC calculation date is 12/31/2012, the most recent annual period is the fiscal year that ends after 6/30/2011 and no

later than 6/30/2012.

The foregoing time periods are used to provide sufficient time for the borrower to prepare the financial statements and provide them to the lender, and for the lender to

calculate the NOI.

The accepted industry standards for determining NOI were developed by the Commercial Mortgage Standards Association now known as CRE Financial Council (CREFC). The

company must develop the NOI using the standards provided by the CREFC Methodology for Analyzing and Reporting Property Income Statements v.5.1. (www.crefc.org/irp).

These standards are part of the CREFC Investor Reporting Package (CREFC IRP Section VII.) developed to support consistent reporting for commercial real estate loans owned

by third party investors. This guidance would be a standardized basis for determining NOI for RBC.

The NOI will be adjusted to use a 3 year rolling average for the DSC calculation. For 2013, a single year of NOI will be used. For 2014, 2 years will be used, weighted 65% most

recent year and 35% prior year. Thereafter, 3 years will be used weighted 50% most recent year, 30% prior year, and 20% 2

nd

prior year. This will apply when there is a history

of NOI values. For new originations, including refinancing, the above schedule would apply by duration from origination. For the special circumstances listed below, the specific

instructions below will produce the NOI to be used, without further averaging.

For purposes of the NOI inputs at (14), (15), (16), and the computation of a Rolling Average NOI at (36), an insurer may report 2020 NOI (i.e., NOI for any 12-month fiscal

period ending after June 30, 2020 but not later than June 30, 2021) as the greater of: (1) actual NOI as determined under the CREF-C IRP Standards or (2) 85% of NOI

determined for the immediate preceding fiscal year’s annual report. This guidance with respect to 2020 NOI applies to the application of the 2020 NOI in risk-based capital

reporting for 2021, 2022, and 2023. In cases where an insurer reports 85% of 2019 NOI as the 2020 NOI input, the insurer should retain information about actual 2020 NOI in its

workpapers so that the information can be readily available to regulators.

© 2019-2020 National Association of Insurance Commissioners 9 109/254/201920

SCHEDULE BA MORTGAGES

LR009

Basis of Factors

For Affiliated Mortgages, Line 10999999, the factors used are the same as for commercial mortgages and are defined in Figure 9. Risk categories and factors are determined using a

company generated worksheet for In Good Standing (Figure 10) and (Figure 8) for Past Due or In Process of Foreclosure.

For Unaffiliated Mortgages, Line 0999999, the factors used are the same as for commercial mortgages and are defined in Figure 9. Risk categories and factors are determined as

follows:

1) For Investments that contain covenants whereby factors of maximum LTV and minimum DSC, or equivalent thresholds must be complied with and it can be

determined that the Investments are in compliance, these investments would use the process for directly held mortgages using the maximum LTV and minimum DSC

using the company generated worksheet and transferred to LR009 line (2) for mortgages with covenants that are in compliance.

2) Investments that are defeased with government securities will be assigned to CM1.

3) Other investments comprised primarily of senior debt will be assigned to CM2.

4) All other investments in this category will be assigned CM3. This would include assets such as a mortgage fund that invests in mezzanine or sub debt, or investments

that cannot be determined to be in compliance with the covenants.

Specific Instructions for Application of the Formula

Column (1)

Except for Line (1), calculations are done on an individual mortgage basis and then the summary amounts are entered in this column for each class of mortgage investment. Refer to

the Schedule BA mortgage calculation worksheets (Figure 8) and (Figure 10) for how the individual mortgage calculations are completed. Line (20) should equal Schedule BA Part 1,

Column 12, Line 0999999 plus Line 1099999.

Column (2)

Companies are permitted to reduce the book/adjusted carrying value of mortgage loans reported in Schedule BA by any involuntary reserves. Involuntary reserves are equivalent to

valuation allowances specified in the codification of statutory accounting principles. They are non-AVR reserves reported on Annual Statement Page 3, Line 25. These reserves are

held as an offset for a particular troubled Schedule BA mortgage loan that would be required to be written down if the impairment was permanent.

Column (3)

Column (3) is calculated as the net of Column (1) less Column (2).

Column (4)

For Lines (12) through (14) and Lines (16) through (18), summary amounts of the individual mortgage calculations are entered in this column for each class of mortgage investments.

Refer to the Schedule BA mortgage calculation worksheet (Figure 8).

Column (5)

For Line (1), the pre-tax factor is 0.0014.

See Figure 9 for computation of appropriate factors.

© 2019-2020 National Association of Insurance Commissioners 10 109/254/201920

Column (6)

For Lines (1) through (10) the RBC subtotal is multiplied by the average factor to calculate Column (6). The categories and subtotals will be determined in the company developed

worksheet Figure (10).

For Lines (12) through (14) and Lines (16) through (18), summary amounts are entered for Column (6) based on calculations done on an individual mortgage basis. Refer to the

Schedule BA mortgage calculation worksheet (Figure 8).

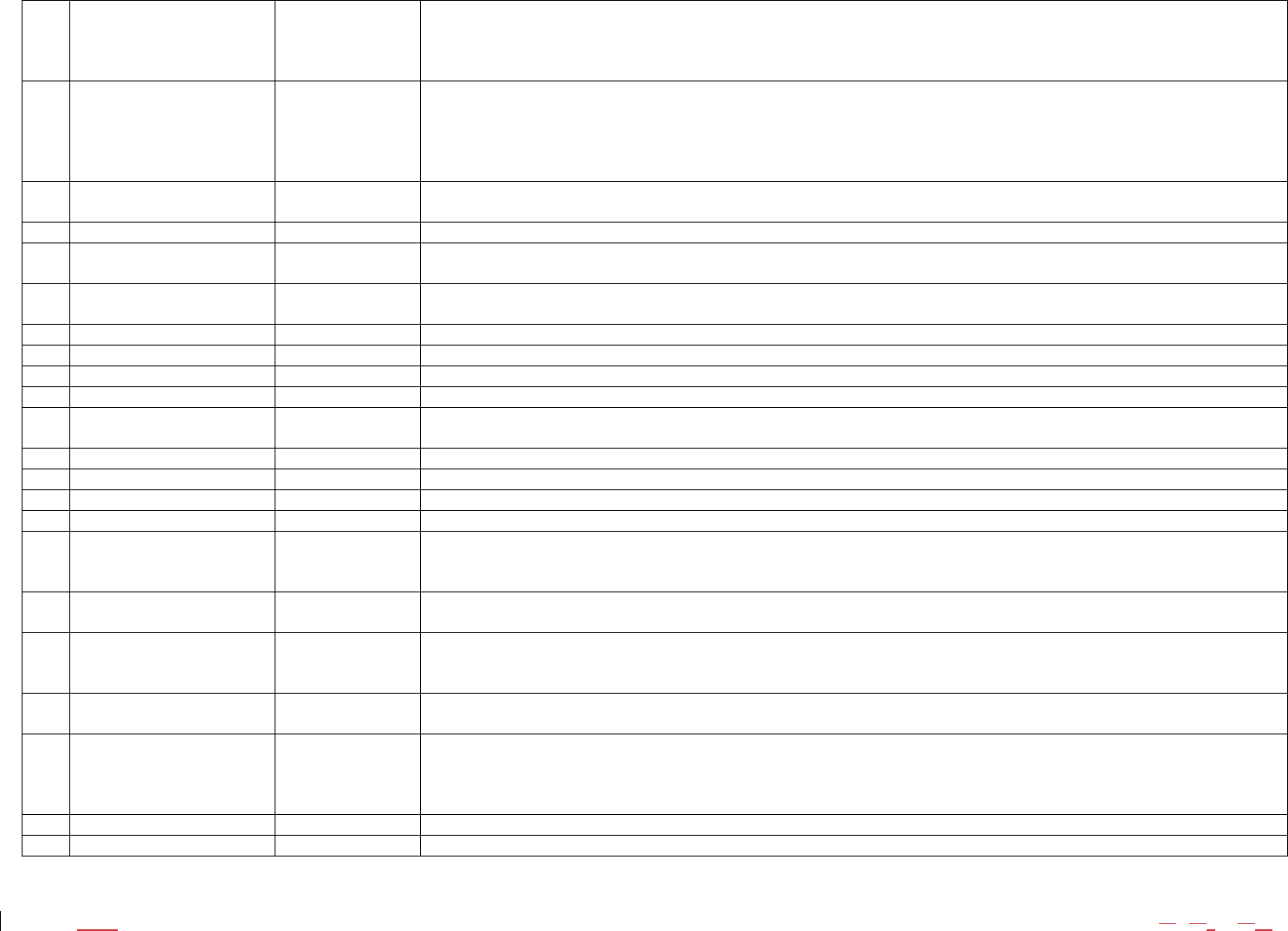

(Figure 8)

Schedule BA Mortgage Worksheet A

Other Than In Good Standing

(1) (2) (3) (4) (5) (6) (7) (7a) (8) (9) (10)

Name / ID

Book/Adjusted

Carrying

Value

Involuntary

Reserve

Adjustment§

RBC

Subtotal £

Cumulative

Writedowns

*

Category

Factor

In Good

Standing

Factor

In Good

Standing

Category

Col (6) X

[Col

(4)+(5)]

- Col (5)

Col (4) X

Col (7)

RBC

Requirement

‡

90 Days Overdue – Insured or

Guarantee

d

† †

†

(1) All Mortgages

Without

Cumulative

Writedowns

XXX 0.0027 0.0014 N/A

(2) With Cumulative

Writedowns:

0.0027 0.0014 N/A

(3) 0.0027 0.0014

N

/A

Total

90 Da

y

s Over

d

ue

–

Unaffiliate

d

(1) All Mortgages

Without

Cumulative

Writedowns

XXX 0.1800 † †

(2) With Cumulative

Writedowns:

0.1800 † †

(3) 0.1800 † †

Total

90 Da

y

s Ove

r

due

–

Affiliated

(1) All Mortgages

Without

Cumulative

Writedowns

XXX 0.1800 † †

(2) With Cumulative

Writedowns:

0.1800 † †

© 2019-2020 National Association of Insurance Commissioners 11 109/254/201920

(3) 0.1800 † †

Total

In Process of Foreclosure – Insured

or Guarantee

d

(1) All Mortgages

Without

Cumulative

Wri

t

edowns

XXX 0.0054 0.0014 N/A

(2) With Cumulative

Writedowns:

0.0054 0.0014 N/A

(3) 0.0054 0.0014

N

/A

Total

In Process of Foreclosure –

Unaffiliate

d

(1) All Mortgages

Without

Cumulative

Wri

t

e

d

owns

XXX 0.2300 † †

(2) With Cumulative

Writedowns:

0.2300 † †

(3) 0.2300 † †

Total

In Process of Foreclosure

–

Affiliate

d

(1) All Mortgages

Without

Cumulative

Writedowns

XXX 0.2300 † †

(2) With Cumulative

Writedowns:

0.2300 † †

(3) 0.2300 † †

To

t

al

(99) Total Schedule BA

Mortgages

This worksheet is prepared on a loan-by-loan basis for each of the mortgage categories listed in (Figure 9) that are applicable. The Column (2), (3), (5) and (10) subtotals for each

category are carried over and entered in Columns (1), (2), (4) and (6) of the Schedule BA Mortgages (LR009) Lines (12) through (14) and Lines (16) through (18) in the risk-based

capital formula. NOTE: This worksheet will be available in the risk-based capital filing software.

†

See (Figure 9) for factors to use in the calculation. The In Good Standing Factor will be based on the CM category developed in the company generated worksheet (Figure 10) and

reported in Column 7a.

‡ The RBC Requirement column (10) is calculated as the greater of Column (8) or Column (9), but not less than zero.

© 2019-2020 National Association of Insurance Commissioners 12 109/254/201920

§ Involuntary reserves are reserves held as an offset to a particular asset that is clearly a troubled asset and are included on Page 3, Line 25 of the annual statement.

£ Column (4) is calculated as Column (2) less Column (3).

* Cumulative writedowns include the total amount of writedowns, amounts non-admitted and involuntary reserves that have been taken or established with respect to a particular

mortgage.

(Figure 9)

The mortgage factors are used in conjunction with the mortgage worksheets (Figures 8 and 10) to calculate the RBC Requirement for each individual mortgage in an affiliated

structure. The factors are used in Columns (6) and (7) of the mortgage worksheet (Figure 8) and are dependent on which of the 14 mortgage categories below the mortgage falls into.

Residential Mortgages and Commercial Mortgages Insured or Guaranteed are classified as Category CM1. The following factors are used for each category of mortgages:

Schedule BA Mort

g

a

g

e Factors

LR009

Line

Number

Category

Factor†

In Good

Standing

Factor

(3) Unaffiliated

–

defeased with

g

overnment securities

N

/A

‡

0.0090

(4) Unaffiliated investments comprised primarily of

Senior Deb

t

N/A‡ 0.0175

(5) Unaffiliated

–

all other unaffiliated mort

g

a

g

es

N

/A

‡

0.0300

(6) Affiliated Mort

g

a

g

es

–

Cate

g

or

y

CM1

N

/A

‡

0.0090

(7) Affiliated Mo

r

t

g

a

g

es

–

Cate

g

or

y

CM2

N

/A

‡

0.0175

(8) Affiliated Mort

g

a

g

es

–

Ca

t

e

g

o

r

y

CM3

N

/A

‡

0.0300

(9) Affiliated Mort

g

a

g

es

–

Cate

g

or

y

CM4

N

/A

‡

0.0500

(10) Affiliated Mort

g

a

g

es

–

Cate

g

or

y

CM5

N

/A

‡

0.0750

(12) 90 Da

y

s Past Due - Insured or Guaranteed 0.0027 .0014

(13) 90 Da

y

s Past Due - Unaffiliated 0.1800

‡

(14) 90 Da

y

s Past Due

–

Affiliate

d

0.1800

‡

(16) In P

r

ocess of Foreclosure - Insured o

r

Guaranteed 0.0054 .0014

(17) In Process of Foreclosure - Unaffiliated 0.2300

‡

(18) In Process of Foreclosure

–

Affiliate

d

0.2300

‡

† The category factor is a factor used for a particular category of mortgage loans that are not in good standing.

‡ The RBC Requirement for mortgage loans in good standing are not calculated on Figure (8). These requirements are calculated on the company’s Schedule BA Mortgage Worksheet

and transferred to LR009 Schedule BA Mortgage Loans Lines (12) – (14) and (16) – (18).

© 2019-2020 National Association of Insurance Commissioners 13 109/254/201920

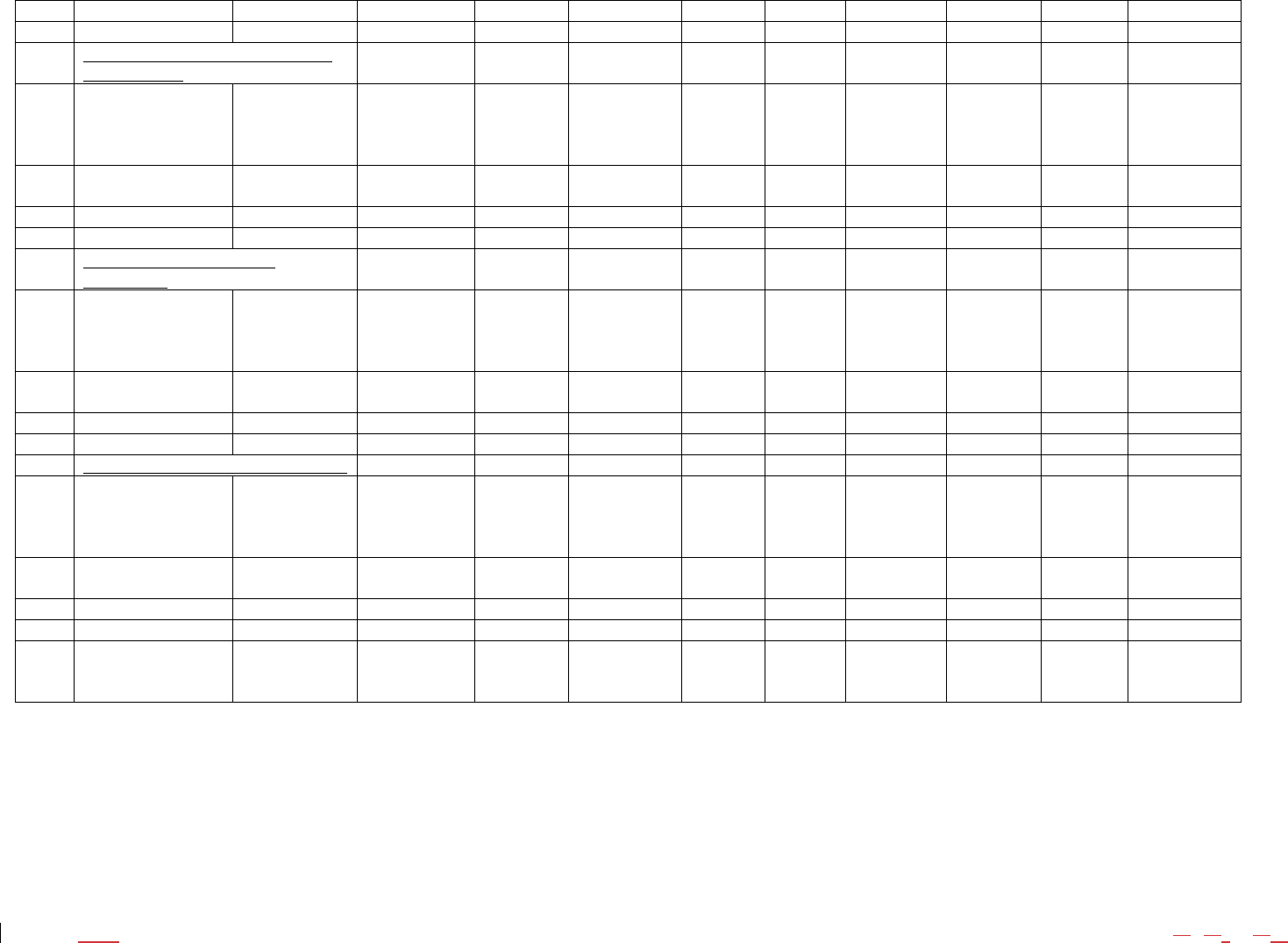

(Figure 10)

Mortgage Worksheet (company developed)

In Good Standing - Commercial

Price Index

current (year-end

calculations to be

based off of 3

rd

Quarter index of

the

g

iven

y

ear)

}

{input Price Index as of

September 30}

Name / ID

(1)

Date of Origination

(2)

Maturity Date

(3)

Property Type

(4)

Farm Loan Sub-

property Type

(5)

Postal Code

(6)

Book/Adjusted

Carrying Value

(7)

Statutory

Write-downs

(8)

Statutory

Involuntary

Reserve

(9)

Original Loan

Balance

(10)

Principal Loan

Balance to

Company

(11)

Balloon Payment at

Maturity

(12)

Principal Balance

Total

(13)

NOI Second Prior

Year

(14)

NOI Prior Year

(15)

NOI

(16)

Interest Rate

(17)

Trailing 12 Month

Debt Service

(18)

Original Property

Value

(19)

Property Value

(20)

Year of Valuation

(21)

Calendar Quarter of

Valuation

(22)

Credit

Enhancement?

(23)

Senior Debt

(24)

Construction Loan

(25)

Construction Loan

out of Balance

(26)

Construction Loan

Issues

(27)

Land Loan

(28)

90 Days Past Due

(29)

In Process of

Foreclosure?

(30)

Current payment

lower than based on

Loan Interest?

(31)

Is loan interest

floating?

(32)

Is fixed rate reset

during term?

(33)

Is negative

amortization

allowed?

(34)

Amortization Type

(35)

Schedule BA

mortgage?

(36)

Affiliated Mortgage

(37)

Covenant – Max

LTV

(39)

Covenant – Min

DCR

(40)

Loan Covenants in

compliance?

(41)

Defeased with

government

securities?

(42)

© 2019-2020 National Association of Insurance Commissioners 14 109/254/201920

Primarily Senior

positions?

(43)

Rolling Average

NOI

(44)

RBC DCR

(45)

Price Index at

Valuation

(46)

Contemporaneous

Property Value

(47)

RBC - Loan to

Value Ratio

(48)

RBC Risk Category

(49)

This worksheet is prepared on a loan-by-loan basis for each commercial mortgage – other or farm loan held in Schedule BA. The Column (7) and (9) subtotals for each category

are carried over and entered in Columns (1) and (2) of the Mortgages (LR009) in the risk-based capital formula lines (2) – (10). Small mortgages aggregated into one line on

Schedule BA can be treated as one mortgage on this worksheet. Amounts in Columns (7), (9) and (49) are carried individually to Worksheet A columns (2), (3) and (7a) for loans

that are 90 Days Past Due and In Process of Foreclosure. NOTE: This worksheet will not be available in the risk-based capital filing software and must be developed by the

Company.

Column Description / Explanation of Item

# Headin

g

Price Index current is the value on 9/30 of the current year for the National Council of Real Estate Investor Fiduciaries

Price Index for the United States.

(1)

N

ame / ID Inpu

t

Identif

y

each mort

g

a

g

e included as in

g

ood standin

g

.

(2) Date of Origination Input Enter the year and month that the loan was originated. If the loan has been restructured, extended, or otherwise re-

writ

t

en, enter that new date.

(3) Maturi

t

y

Date Inpu

t

Enter earlier of maturit

y

of the loan, or the date the lender can call the loan.

(4) Property Type Input Enter 1 for mortgages with an Office, Industrial, Retail or multifamily property as collateral.

Enter 2 for mortgages with a Hotel and Specialty Commercial as property type. For properties that are multiple use, use

the property type with the greatest square footage in the property.

Enter 3 fo

r

Fa

r

m Loans.

(5) Farm Sub-type Input Sub-category – If Property Type=3 (Farm Loans), then you must enter a Sub Category: 1=Timber, 2=Farm and Ranch,

3=A

g

ribusiness Sin

g

le Purpose, 4=A

g

ribusiness All Othe

r

. (See Note 8)

(6) Postal Code Input Enter zip code of property for US properties. If multiple properties or zip codes, enter multiple codes. If foreign, enter

p

ostal code. If not available, N/A.

(7) Book / Adjusted Carrying

Value

Input Enter the value that the loan is carried at on the company ledger.

(8) Statutor

y

Writedowns Inpu

t

Enter

t

he value of an

y

writedowns taken on this loan due

t

o permanent i

m

p

airment.

(9) Involuntary Reserve Input Enter the amount of any involuntary reserve amount. Involuntary reserves are reserves that are held as an offset to a

p

articular asset that is clea

r

l

y

a troubled asset and are included on Pa

g

e 3 Line 25 of the Annual Statement.

(10) Ori

g

inal Loan Balance? Inpu

t

Enter the loan balance at the time of ori

g

ination of the loan.

(11) Principal Balance to Co. Inpu

t

Enter the value of the loan balance owed

by

the borrowe

r

.

(12) Balloon Payment at

Maturi

t

y

Input Enter the amount of any balloon or principal payment due at maturity.

(13) Principal Balance Total Inpu

t

Enter the total amount of mort

g

a

g

e outs

t

andin

g

t

ha

t

is senior to or pari passu with the com

p

an

y

’s mort

g

a

g

e

(14)

N

OI Second Prio

r

Inpu

t

Enter the NOI from

t

he

y

ear prior to the value in (15). See Note 1.

(15)

N

OI P

r

io

r

Inpu

t

Enter the NOI from the

p

rior

y

ea

r

to the value in (16). See Note 1.

© 2019-2020 National Association of Insurance Commissioners 15 109/254/201920

(16) NOI Input Enter the Net Operating Income for the most recent 12 month fiscal period with an end-date between July 1 of the year

prior to this report and June 30 of the year of this report. The NOI should be reported following the guidance of the

Commercial Real Estate Finance Council Investor Reporting Profile v.5.0. Section VII. See Notes 1, 2, 3, 4, 5 and 6

b

elow.

(17) Interest Rate Input Enter the annual interest rate at which the loan is accruing.

‐ If the rate is floating, enter the larger of the current month rate or the average rate of interest for the prior 12 months,

or

‐ If the rate is fixed by the contract, not level over the year, but level for the next 12 months, use current rate.

If the ‘Total Loan Balance’ consists of multi

p

le loans, use an avera

g

e loan interest rate wei

g

hted b

y

princi

p

al balance.

(18) Trailing 12 Month Debt

Service

Input Enter actual 12 months debt service for prior 12 months.

(19) Ori

g

inal Propert

y

Value Inpu

t

Enter the loan balance at the time of ori

g

ination of the loan.

(20) Property Value Input The value of the Property at time of loan origination, or at time of revaluation due to impairment underwriting,

restructure, extension, or other re-writin

g

.

(21) Year of Valuation Input Year of the valuation date defining the value in (20). This will be either the date of origination, or time of restructure,

r

efinance, or other event which precipitates a new valuation.

(22) Quarter of Valuation Inpu

t

Calendar quarter of

t

he valuation date definin

g

the value in (20).

(23) C

r

edi

t

Enhancemen

t

Inpu

t

Enter the full dollar amount of an

y

credit enhancemen

t

. (see Note 5)

(24) Senior Loan? Inpu

t

Enter ’Yes’ if senior position, ‘No’ if not. (see

N

ote 7)

(25) Construction Loan? Inpu

t

Enter ‘Yes’ if this is a construction loan. (see

N

o

t

e 4)

(26) Construction – not in

b

alance

Input Enter ‘Yes’ if this is a construction loan that is not in balance. (see Note 4)

(27) Construction

–

Issues Inpu

t

En

t

er ‘Yes’ if this is a construction loan wi

t

h issues. (see Note 4)

(28) Land Loan? In

p

u

t

Enter ‘Yes’ if this is a loan on non-income producin

g

land. (see

N

ote 6)

(29) 90 da

y

s past due? Inpu

t

Enter ‘Yes’ if pa

y

ments are 90 da

y

s past due.

(30) In process of foreclosure? Inpu

t

Enter ‘Yes’ if the loan is in process of foreclosure.

(31) Is current payment lower

than a payment based on

the Loan In

t

erest?

Input Yes / No

(32) Is loan interest a floating

rate?

Input Yes / No

(33) If not floating, does loan

reset during term?

Input Yes / No - Some fixed rate loans define in the loan document a change to a new rate during the life of the loan, which

may be a predetermined rate or may be the then current market rate. Generally any such changes are less frequent than

annual.

(34) Is negative amortization

allowed?

Input Yes / No

(35) Amortization type? Input 1 = fully amortizing

2 = amortizing with balloon

3 = full I/O

4 = pa

r

tial I/O, then amortizin

g

(36) Schedule BA mort

g

a

g

e? Inpu

t

Yes /

N

o

(37) Affiliated Mort

g

a

g

e? Inpu

t

Yes /

N

o

© 2019-2020 National Association of Insurance Commissioners 16 109/254/201920

(38) Covenan

t

Max LTV Inpu

t

For mort

g

a

g

e investmen

t

s with covenants, what is the maximum LTV allowed?

(39) Covenan

t

Min DCR In

p

u

t

Fo

r

mort

g

a

g

e investments with covenants, what is the minimum DCR allowed?

(40) Covenants in compliance? Inpu

t

Yes /

N

o

–

for mort

g

a

g

e investments with covenants, is the inves

t

men

t

in co

m

p

liance with the covenants?

(41) Defeased with

g

ove

r

nment securities

Input Yes / No – has the mortgage loan been defeased using government securities?

(42) Primarily Senior

Mort

g

a

g

es

Input Is the mortgage pool primarily senior mortgage instruments? {If yes, assign to CM2}

(43) Rolling Average NOI Computation For 2012 – 100% of NOI

For 2014 – 65% NOI + 35% NOI Prior

For 2015 – 50% NOI + 30% NOI Prior + 20% NOI 2

nd

Prior

For loans originated or valued within the current year, use 100% NOI.

Fo

r

loans o

r

i

g

inated 2012 or later and within 2

y

ea

r

s, use 65% NOI and 35% NOI Prio

r

.

(44) RBC Debt Service Computation RBC Debt Service Amount is the amount of 12 monthly principal and interest payments required to amortize the Total

Loan Balance (13) using a Standardized Amortization period of 300 months and the Annual Loan Interest Rate (17).

(45) RBC - DCR Computation Debt Coverage Ratio is the ratio of the Net Operating Income (43) divided by the RBC Debt Service (44) rounded down

to 2 decimal places. See Note 3 below for special circumstances. For loan pools with covenants, this will be the minimum

DCR b

y

covenant.

(46) NCREIF Index at

Valuation

Computation Price index is the value of the NCREIF Price Index on the last day of the calendar quarter that includes the date defined in

(21) and (22).

(47) Contemporaneous

Proper

t

y

Value

Computation Contemporaneous Value is the Property Value (11) times the ratio (rounded to 4 decimal places) of the Price Index

current to the Price Index (46).

(48) RBC - LTV Computation The Loan to Value ratio is the Loan Value (13) divided by the Contemporaneous Value (47) rounded to the nearest

percent.

For Loan Pools with covenants, this will be the max LTV b

y

covenant.

(49) CM Category Computation Commercial Mortgage Risk category is the risk category determined by applying the DCR (45) and the LTV (48) to the

criteria in Figure (11), Figure (12) or Figure (13). See Notes 2, 3, 4, 5, and 6 below for special circumstances.

If (41) =

y

es, CM1. If (42) =

y

es, CM2. If no LTV and DCR, and (41) = no and (42) = no, CM3.

Note 1: Net Operating Income (NOI): The majority of commercial mortgage loans require the borrower to provide the lender with at least annual financial statements. The NOI

would be determined at the RBC calculation date based on the most recent annual period from financial statements provided by the borrower and analyzed based on accepted industry

standards. The most recent annual period is determined as follows:

If the borrower reports on a calendar year basis, the statements for the calendar year ending December 31 of the year prior to the RBC calculation date will be used. For

example, if the RBC calculation date is 12/31/2012, the most recent annual period is the calendar year that ends 12/31/2011.

If the borrower reports on a fiscal year basis, the statements for the fiscal year that ends after June 30 of the prior calendar year and no later than June 30 of the year of the

RBC calculation date will be used. For example, if the RBC calculation date is 12/31/2012, the most recent annual period is the fiscal year that ends after 6/30/2011 and no

later than 6/30/2012.

The foregoing time periods are used to provide sufficient time for the borrower to prepare the financial statements and provide them to the lender, and for the lender to

calculate the NOI.

The accepted industry standards for determining NOI were developed by the Commercial Mortgage Standards Association now known as CRE Financial Council (CREFC). The

company must develop the NOI using the standards provided by the CREFC Methodology for Analyzing and Reporting Property Income Statements v. 5.1 (www.crefc.org/irp).

© 2019-2020 National Association of Insurance Commissioners 17 109/254/201920

These standards are part of the CREFC Investor Reporting Package (CREFC IRP Section VII.) developed to support consistent reporting for commercial real estate loans owned by

third party investors. This guidance is a standardized basis for determining NOI for RBC.

The NOI will be adjusted to use a 3-year rolling average for the DSC calculation. For 2013, a single year of NOI will be used. For 2014, 2 years will be used, weighted 65% most

recent year and 35% prior year. Thereafter, 3 years will be used weighted 50% most recent year, 30% prior year, and 20% 2

nd

prior year. This will apply when there is a history of

NOI values. For new originations, including refinancing, the above schedule would apply by duration from origination. For the special circumstances listed below, the specific

instructions below will produce the NOI to be used, without further averaging.

For purposes of the NOI inputs at (14), (15), (16), and the computation of a Rolling Average NOI at (43), an insurer may report 2020 NOI (i.e., NOI for any 12-month fiscal period

ending after June 30, 2020 but not later than June 30, 2021) as the greater of: (1) actual NOI as determined under the CREF-C IRP Standards or (2) 85% of NOI determined for the

immediate preceding fiscal year’s annual report. This guidance with respect to 2020 NOI applies to the application of the 2020 NOI in risk-based capital reporting for 2021, 2022, and

2023. In cases where an insurer reports 85% of 2019 NOI as the 2020 NOI input, the insurer should retain information about actual 2020 NOI in its workpapers so that the information

can be readily available to regulators.